Well, if one new personal finance study is accurate, at least we might be seeing deflation somewhere...

When it comes to retirement, the figure $3 million is often thrown around. For example, this article from Bloomberg states that the answer to the question "how much is enough to retire comfortably?" is "somewhere between $3 million and $5 million".

But online personal finance guide Moneyzine has crunched the numbers on this (on a State-by-State basis) and has figured out that this figure is far, far lower. In a new study, Moneyzine has said that "the average American should be saving $10,178 a year from their earnings to be put into a retirement plan" and will have need to have saved $658,883 to be able to retire with the same standard of living as they're accustomed to.

This should only take the average American 22 years to save with compound interest, the zine says. In extreme circumstances, for those who want to live to the oldest recorded age of 122, one would need $2,963,879 saved the study says.

“Often, the figures thrown around about retirement savings can seem overwhelming. While it's true that the cost of living and future uncertainties require a substantial nest egg, presenting multi-million dollar figures to the average individual is intimidating," Jonathan Merry, personal finance expert and CEO at Moneyzine stated. "It can also be counterproductive as these massive numbers tend to create a mental block for many. Instead of motivating them, it pushes them further away from the idea of financial planning altogether."

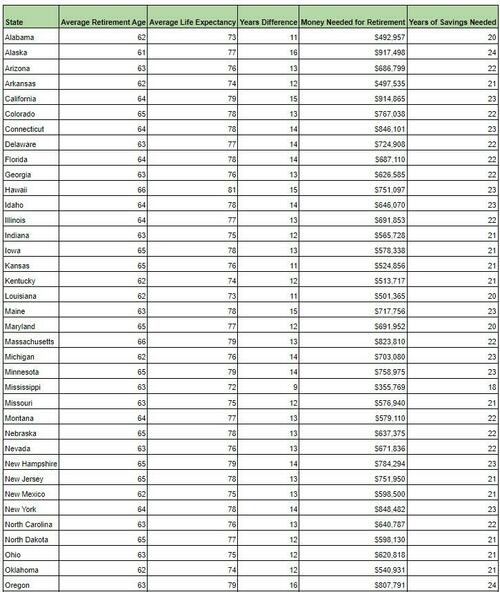

The study outlined a full list of what each state should be saving based on average income after tax.

Merry added: "It's crucial that we frame these discussions in a more approachable and realistic way. To that end, we’ve looked at the average wage in the USA to see what people need to start putting away for a more realistic look at a comfortable retirement.”

The study analyzed average yearly salaries state by state, accounting for taxes to arrive at a potential monthly take-home pay. Following a widely accepted financial guideline, the study suggests allocating your post-tax income in the following way: 50% for necessities, 30% for discretionary expenses, and 20% for savings.

It also looked at money needed for retirement, per state.

Full charts and the full study can be found at Moneyzine.com.

Well, if one new personal finance study is accurate, at least we might be seeing deflation somewhere…

When it comes to retirement, the figure $3 million is often thrown around. For example, this article from Bloomberg states that the answer to the question “how much is enough to retire comfortably?” is “somewhere between $3 million and $5 million”.

But online personal finance guide Moneyzine has crunched the numbers on this (on a State-by-State basis) and has figured out that this figure is far, far lower. In a new study, Moneyzine has said that “the average American should be saving $10,178 a year from their earnings to be put into a retirement plan” and will have need to have saved $658,883 to be able to retire with the same standard of living as they’re accustomed to.

This should only take the average American 22 years to save with compound interest, the zine says. In extreme circumstances, for those who want to live to the oldest recorded age of 122, one would need $2,963,879 saved the study says.

“Often, the figures thrown around about retirement savings can seem overwhelming. While it’s true that the cost of living and future uncertainties require a substantial nest egg, presenting multi-million dollar figures to the average individual is intimidating,” Jonathan Merry, personal finance expert and CEO at Moneyzine stated. “It can also be counterproductive as these massive numbers tend to create a mental block for many. Instead of motivating them, it pushes them further away from the idea of financial planning altogether.”

The study outlined a full list of what each state should be saving based on average income after tax.

Merry added: “It’s crucial that we frame these discussions in a more approachable and realistic way. To that end, we’ve looked at the average wage in the USA to see what people need to start putting away for a more realistic look at a comfortable retirement.”

The study analyzed average yearly salaries state by state, accounting for taxes to arrive at a potential monthly take-home pay. Following a widely accepted financial guideline, the study suggests allocating your post-tax income in the following way: 50% for necessities, 30% for discretionary expenses, and 20% for savings.

It also looked at money needed for retirement, per state.

Full charts and the full study can be found at Moneyzine.com.

Loading…