Authored by Simon White, Bloomberg macro strategist,

The dollar is at risk from further deterioration in the Fed’s balance sheet as it moves to stabilize the US banking system.

Markets are taking a breather this morning after the histrionics of last week. Nonetheless, problems remain, with several smaller US banks still at risk after the decimation of sentiment in the wake of SVB’s collapse.

The calm is being aided by reports that one particularly beleaguered lender, First Republic, will receive more support from the Fed. The central bank is expected to extend its lending programs to help banks in First’s position.

There are two principal ways the Fed can use its balance sheet to ease:

-

through expanding it (QE and lending programs);

-

and by deteriorating it (credit easing).

How it eases depends on the securities the banking system uses to “make position”. Ultimately, to ensure there are no crunch points, the Fed has to deal in these securities in times of difficulty.

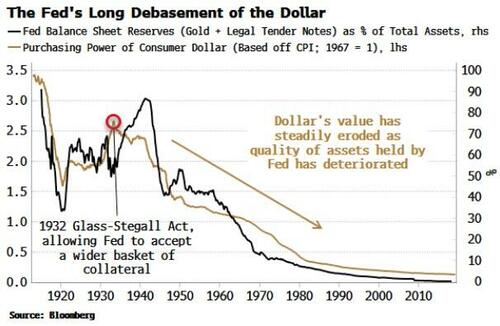

The poorer the quality of the assets on the banking-sector’s balance sheet exposes the Fed’s balance sheet to greater deterioration. As the dollar is a liability of the Fed, its value is debased the more the Fed takes on poorer quality collateral.

The chart below elegantly shows the long-term decline in the dollar’s real value.

There is almost a 1-1 relationship between the degradation in the Fed’s balance sheet - as captured by the percentage of high-quality assets - and the real value of the dollar, i.e. its purchasing power.

The Fed is has already expanded its balance sheet, and any new lending programs will almost certainly involve a balance-sheet deterioration as it takes on poorer-quality collateral. SVB happened to have a lot of USTs and MBS, but other banks do not, with e.g. the smaller-bank sector having a much higher exposure to commercial real-estate loans, accounting for 70% of the market according to JP Morgan. (One important caveat is some loans counted as real-estate loans are business loans collateralized by commercial real estate.)

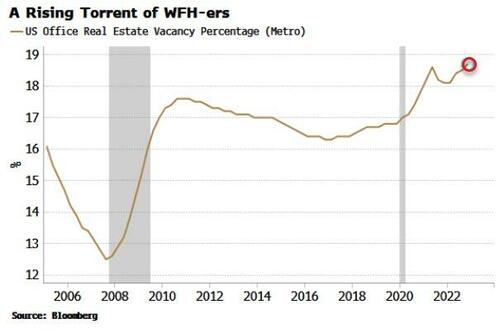

CRE prices are dropping fast, exacerbated by recent banking troubles, but are also facing structural challenges as office vacancy-rates hit near 20-year highs, driven primarily by changing worker habits.

As well as the longer-term threat to the dollar’s purchasing power, the dollar’s FX value is also cyclically exposed. Demand for US assets is low while hedging costs are so high, while reliable leading indicators such as the real yield curve continue to flatten.

Authored by Simon White, Bloomberg macro strategist,

The dollar is at risk from further deterioration in the Fed’s balance sheet as it moves to stabilize the US banking system.

Markets are taking a breather this morning after the histrionics of last week. Nonetheless, problems remain, with several smaller US banks still at risk after the decimation of sentiment in the wake of SVB’s collapse.

The calm is being aided by reports that one particularly beleaguered lender, First Republic, will receive more support from the Fed. The central bank is expected to extend its lending programs to help banks in First’s position.

There are two principal ways the Fed can use its balance sheet to ease:

-

through expanding it (QE and lending programs);

-

and by deteriorating it (credit easing).

How it eases depends on the securities the banking system uses to “make position”. Ultimately, to ensure there are no crunch points, the Fed has to deal in these securities in times of difficulty.

The poorer the quality of the assets on the banking-sector’s balance sheet exposes the Fed’s balance sheet to greater deterioration. As the dollar is a liability of the Fed, its value is debased the more the Fed takes on poorer quality collateral.

The chart below elegantly shows the long-term decline in the dollar’s real value.

There is almost a 1-1 relationship between the degradation in the Fed’s balance sheet – as captured by the percentage of high-quality assets – and the real value of the dollar, i.e. its purchasing power.

The Fed is has already expanded its balance sheet, and any new lending programs will almost certainly involve a balance-sheet deterioration as it takes on poorer-quality collateral. SVB happened to have a lot of USTs and MBS, but other banks do not, with e.g. the smaller-bank sector having a much higher exposure to commercial real-estate loans, accounting for 70% of the market according to JP Morgan. (One important caveat is some loans counted as real-estate loans are business loans collateralized by commercial real estate.)

CRE prices are dropping fast, exacerbated by recent banking troubles, but are also facing structural challenges as office vacancy-rates hit near 20-year highs, driven primarily by changing worker habits.

As well as the longer-term threat to the dollar’s purchasing power, the dollar’s FX value is also cyclically exposed. Demand for US assets is low while hedging costs are so high, while reliable leading indicators such as the real yield curve continue to flatten.

Loading…