The last time we looked at the senior loan officer survey (SLOOS) several months ago, we found "tighter standards and weaker demand for commercial and industrial (C&I) loans to firms of all sizes over the third quarter" in addition to tighter standards and less demand for most other loan categories.

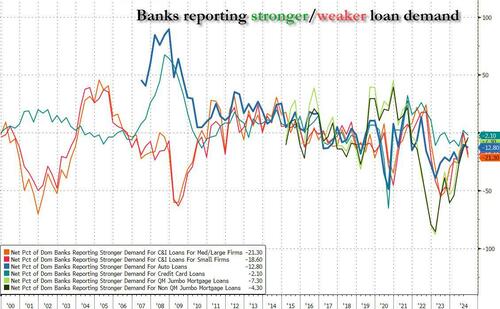

So fast forward to today when the latest closely watched SLOOS report for Q3 was published, and which found that there has been little change because regarding loans to businesses during the third quarter, survey respondents reported, "basically unchanged lending standards for commercial and industrial (C&I) loans to large and middle-market firms and tighter standards for loans to small firms. Meanwhile, banks reported weaker demand for C&I loans to firms of all sizes. Furthermore, banks reported tighter standards and weaker demand for all commercial real estate (CRE) loan categories."

For loans to households, banks "unchanged lending standards and weaker demand across most categories of residential real estate (RRE) loans."

In addition, banks reported basically unchanged lending standards and demand for home equity lines of credit (HELOCs). Moreover, standards reportedly tightened for credit card loans and remained basically unchanged for auto and other consumer loans, while demand weakened for auto and other consumer loans and remained basically unchanged for credit card loans.

In short, less demand, tighter supply.

Separately, the October SLOOS looked at that demand for credit card loans across borrowers with different credit scores. Banks reported that they were more likely to approve credit card loans to prime or super-prime borrowers and less likely to approve credit cards for near-prime and subprime borrowers, compared with the beginning of the year.

The survey also found that banks reported that the level of demand for credit card loans was stronger in the third quarter of 2024 than before the pandemic (end of 2019) across most credit score categories and all dimensions of credit card demand (that is, demand for new cards, requests for increased credit limits, and utilization of existing credit).

Banks forecast further strengthening in demand over the next six months, with an expected increase in borrower spending, as the most cited reason for their outlook. Which makes sense now that virtually all consumer savings have been wiped out.

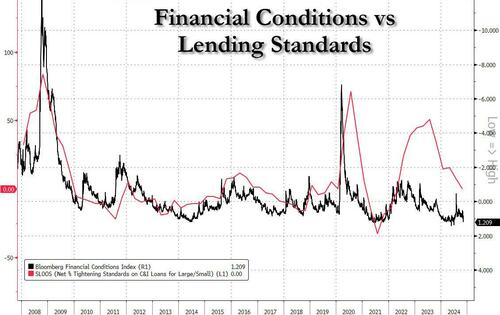

And yes, for those wondering, loan tightness is almost entirely a function of financial conditions: as the next chart shows, financial conditions have become far less tight in the past two quarter, tracking the sharp easing in financial conditions.

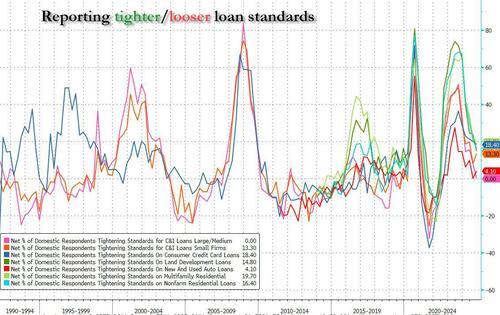

Putting it all together, banks anticipate further tightening lending standards across most categories, even as consumer fight with each other for what little loan availability exists while scrambling to load up their credit cards with as much debt as possible before the next bust.

Source: Fed

The last time we looked at the senior loan officer survey (SLOOS) several months ago, we found “tighter standards and weaker demand for commercial and industrial (C&I) loans to firms of all sizes over the third quarter” in addition to tighter standards and less demand for most other loan categories.

So fast forward to today when the latest closely watched SLOOS report for Q3 was published, and which found that there has been little change because regarding loans to businesses during the third quarter, survey respondents reported, “basically unchanged lending standards for commercial and industrial (C&I) loans to large and middle-market firms and tighter standards for loans to small firms. Meanwhile, banks reported weaker demand for C&I loans to firms of all sizes. Furthermore, banks reported tighter standards and weaker demand for all commercial real estate (CRE) loan categories.”

For loans to households, banks “unchanged lending standards and weaker demand across most categories of residential real estate (RRE) loans.”

In addition, banks reported basically unchanged lending standards and demand for home equity lines of credit (HELOCs). Moreover, standards reportedly tightened for credit card loans and remained basically unchanged for auto and other consumer loans, while demand weakened for auto and other consumer loans and remained basically unchanged for credit card loans.

In short, less demand, tighter supply.

Separately, the October SLOOS looked at that demand for credit card loans across borrowers with different credit scores. Banks reported that they were more likely to approve credit card loans to prime or super-prime borrowers and less likely to approve credit cards for near-prime and subprime borrowers, compared with the beginning of the year.

The survey also found that banks reported that the level of demand for credit card loans was stronger in the third quarter of 2024 than before the pandemic (end of 2019) across most credit score categories and all dimensions of credit card demand (that is, demand for new cards, requests for increased credit limits, and utilization of existing credit).

Banks forecast further strengthening in demand over the next six months, with an expected increase in borrower spending, as the most cited reason for their outlook. Which makes sense now that virtually all consumer savings have been wiped out.

And yes, for those wondering, loan tightness is almost entirely a function of financial conditions: as the next chart shows, financial conditions have become far less tight in the past two quarter, tracking the sharp easing in financial conditions.

Putting it all together, banks anticipate further tightening lending standards across most categories, even as consumer fight with each other for what little loan availability exists while scrambling to load up their credit cards with as much debt as possible before the next bust.

Source: Fed

Loading…