There wasn't too much excitement in the latest Fed Beige Book report which was based on information collected on or before February 27, 2023: it found that overall economic activity increased slightly since the previous, Jan 18, 2023 report: Six Districts reported little or no change in economic activity since the last report, while six indicated economic activity expanded at a modest pace. Looking ahead, the mood remained listless with contacts "not expecting economic conditions to improve much in the months ahead."

That said, if one reads between the lines, the impression on gets is of consumers who are once again maxing out their credit cards just to keep pace with inflation; meanwhile even thought the Beige Book did not dwell on housing weakness, it noted growing weakness in the office market.

- On balance, supply chain disruptions continued to ease. Consumer spending generally held steady, though a few Districts reported moderate to strong growth in retail sales during what is typically a slow period.

- Auto sales were little changed, though inventory levels continued to improve.

- Several Districts indicated that high inflation and higher interest rates continued to reduce consumers’ discretionary income and purchasing power, and some concern was expressed about rising credit card debt.

- Travel and tourism activity remained fairly strong in most Districts. Manufacturing activity stabilized following a period of contraction.

- While housing markets remained subdued, restrained by exceptionally low inventory, an unexpected uptick in activity beyond the seasonal norm was seen in some Districts along the eastern seaboard.

- Commercial real estate activity was steady, with some growth in the industrial market but ongoing weakness in the office market.

- Demand for nonfinancial services was steady overall but picked up in a few Districts. On balance, loan demand declined, credit standards tightened, and delinquency rates edged up.

- Energy activity was flat to down slightly, and agricultural conditions were mixed.

And, as noted above, "amid heightened uncertainty, contacts did not expect economic conditions to improve much in the months ahead."

Turning to labor markets we find a far stronger underlying picture, although one wonders how much of this is still a kneejerk response to the chaos in the immediate aftermath of the covid lockdowns:

- Labor market conditions remained solid. Employment continued to increase at a modest to moderate pace in most

- Districts despite hiring freezes by some firms and scattered reports of layoffs.

- Labor availability improved slightly, though finding workers with desired skills or experience remained challenging.

- Several Districts indicated that a lack of available childcare continued to impede labor force participation.

- While labor markets generally remained tight, a few Districts noted that firms are becoming less flexible with employees and beginning to reduce remote work options.

- Wages generally increased at a moderate pace, though some Districts noted that wage pressures had eased somewhat.

And some good news for watchers of the wage-price spiral: "Wage increases are expected to moderate further in the coming year."

- Or maybe not because when turning to prices, the Beige Book found that "Inflationary pressures remained widespread, though price increases moderated in many Districts."

- Several Districts reported input costs rose further, particularly for energy and raw materials, though there was some relief reported for freight and shipping costs.

- Some Districts noted that firms were finding it more difficult to pass on cost increases to their consumers.

- Selling prices increased moderately in most Districts, with several Districts noting a deceleration.

- Home prices were generally flat or down slightly, while rents were reported to be steady or higher. Still, home prices and rents remained high, contributing to ongoing concerns about housing affordability.

As with labor, there was optimism when looking ahead, as respondents said they "expected price increases to continue to moderate over the year."

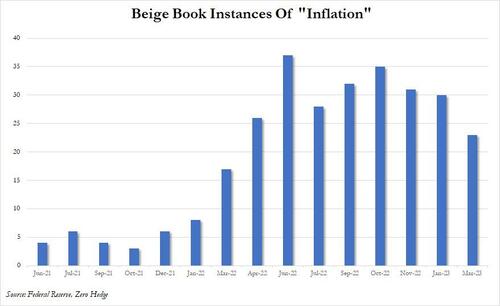

Two charts to end with: first, peak inflation is now comfortably in the rearview mirror - with the fewest mentions in one year - and anyone betting that the Fed is freaking out about inflation may be surprised in two weeks...

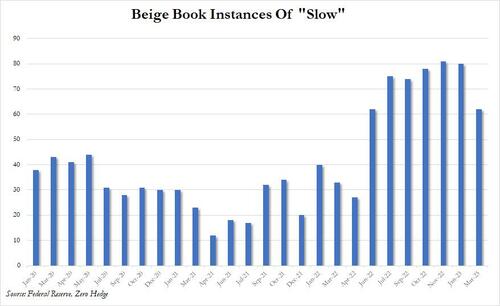

... and while the risk of stagflation remains with mentions of "slow" high, this too saw a notable drop from recent record highs.

Source: Federal Reserve

There wasn’t too much excitement in the latest Fed Beige Book report which was based on information collected on or before February 27, 2023: it found that overall economic activity increased slightly since the previous, Jan 18, 2023 report: Six Districts reported little or no change in economic activity since the last report, while six indicated economic activity expanded at a modest pace. Looking ahead, the mood remained listless with contacts “not expecting economic conditions to improve much in the months ahead.”

That said, if one reads between the lines, the impression on gets is of consumers who are once again maxing out their credit cards just to keep pace with inflation; meanwhile even thought the Beige Book did not dwell on housing weakness, it noted growing weakness in the office market.

- On balance, supply chain disruptions continued to ease. Consumer spending generally held steady, though a few Districts reported moderate to strong growth in retail sales during what is typically a slow period.

- Auto sales were little changed, though inventory levels continued to improve.

- Several Districts indicated that high inflation and higher interest rates continued to reduce consumers’ discretionary income and purchasing power, and some concern was expressed about rising credit card debt.

- Travel and tourism activity remained fairly strong in most Districts. Manufacturing activity stabilized following a period of contraction.

- While housing markets remained subdued, restrained by exceptionally low inventory, an unexpected uptick in activity beyond the seasonal norm was seen in some Districts along the eastern seaboard.

- Commercial real estate activity was steady, with some growth in the industrial market but ongoing weakness in the office market.

- Demand for nonfinancial services was steady overall but picked up in a few Districts. On balance, loan demand declined, credit standards tightened, and delinquency rates edged up.

- Energy activity was flat to down slightly, and agricultural conditions were mixed.

And, as noted above, “amid heightened uncertainty, contacts did not expect economic conditions to improve much in the months ahead.”

Turning to labor markets we find a far stronger underlying picture, although one wonders how much of this is still a kneejerk response to the chaos in the immediate aftermath of the covid lockdowns:

- Labor market conditions remained solid. Employment continued to increase at a modest to moderate pace in most

- Districts despite hiring freezes by some firms and scattered reports of layoffs.

- Labor availability improved slightly, though finding workers with desired skills or experience remained challenging.

- Several Districts indicated that a lack of available childcare continued to impede labor force participation.

- While labor markets generally remained tight, a few Districts noted that firms are becoming less flexible with employees and beginning to reduce remote work options.

- Wages generally increased at a moderate pace, though some Districts noted that wage pressures had eased somewhat.

And some good news for watchers of the wage-price spiral: “Wage increases are expected to moderate further in the coming year.“

- Or maybe not because when turning to prices, the Beige Book found that “Inflationary pressures remained widespread, though price increases moderated in many Districts.”

- Several Districts reported input costs rose further, particularly for energy and raw materials, though there was some relief reported for freight and shipping costs.

- Some Districts noted that firms were finding it more difficult to pass on cost increases to their consumers.

- Selling prices increased moderately in most Districts, with several Districts noting a deceleration.

- Home prices were generally flat or down slightly, while rents were reported to be steady or higher. Still, home prices and rents remained high, contributing to ongoing concerns about housing affordability.

As with labor, there was optimism when looking ahead, as respondents said they “expected price increases to continue to moderate over the year.”

Two charts to end with: first, peak inflation is now comfortably in the rearview mirror – with the fewest mentions in one year – and anyone betting that the Fed is freaking out about inflation may be surprised in two weeks…

… and while the risk of stagflation remains with mentions of “slow” high, this too saw a notable drop from recent record highs.

Source: Federal Reserve

Loading…