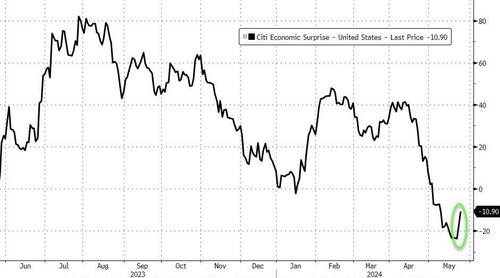

After six straight weeks of 'weakness', US Macro Surprise data surged higher this week (Good News) - it's biggest positive weekly shift since January.

Source: Bloomberg

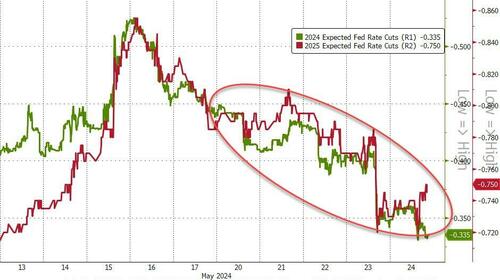

And that 'good news' sent rate-cut expectations tumbling (hawkishly) lower

Source: Bloomberg

Nasdaq dramatically outperformed on the week while the S&P managed to rally today to get green for the week (both up for five straight weeks). Small Caps and The Dow were both down notably on the week. Hawkish Fed Minutes spooked stocks mid-week but NVDA's earnings saved the tech-heavy indices...

After four straight weeks of gains, The Dow suffered its worst week since March 2023.

The Russell 2000 also saw its first weekly loss in the last five.

This was Nasdaq's best week relative to Russell 2000 since Nov 2023...

Source: Bloomberg

...which pulled the Nasdaq/Russell pair up to critical resistance...

Source: Bloomberg

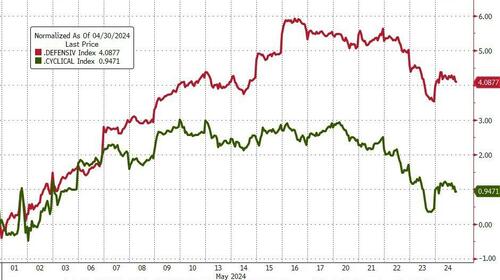

Defensives have been leading in May so far and while both fell this week, Cyclicals underperformed...

Source: Bloomberg

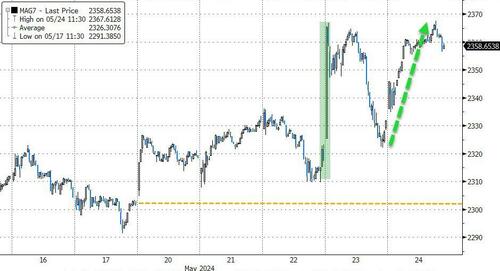

The basket of 'Magnificent 7' stocks rallied for the fifth straight week to a new record high (obviously helped generously by NVDA).

Source: Bloomberg

NVDA refuses to dance to CSCO's historical pattern and is headed to the moon...

Source: Bloomberg

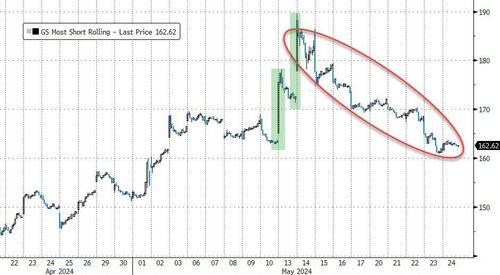

Interestingly, 'most shorted' stocks suffered their worst week since Nov 2023...

Source: Bloomberg

Treasury yields were all higher on the week, but it was the short-end that notably lagged (2Y +12bps, 30Y +1bps)...

Source: Bloomberg

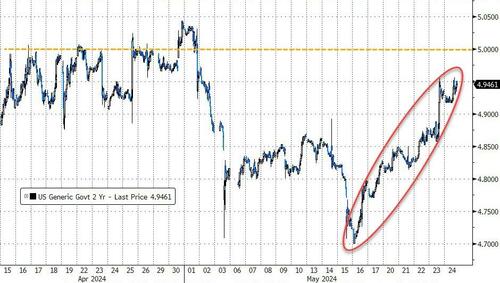

The 2Y yield rallied up toward the 5.00% danger-zone (its biggest weekly yield increase in six weeks)...

Source: Bloomberg

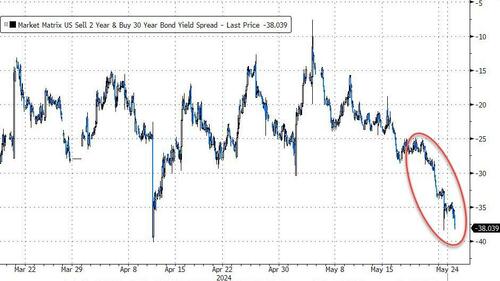

The yield curve (2s30s) flattened bigly this week (-12bps - the biggest weekly flattening since February)

Source: Bloomberg

The dollar continued to flip-flop, rallying this week after last week's decline

Source: Bloomberg

Gold's worst week in 8 months (since Sept 2023)

Source: Bloomberg

Silver was down on the week but outperformed gold, holding above $30

Source: Bloomberg

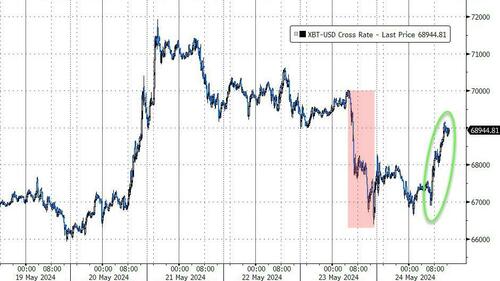

Bitcoin rallied for the second week in a row, rebounding today to $69,000

Source: Bloomberg

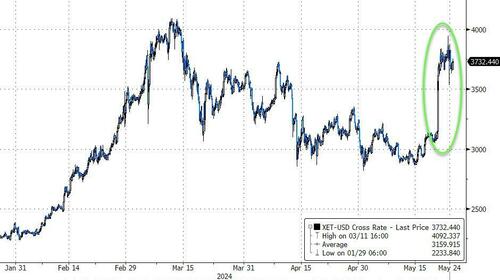

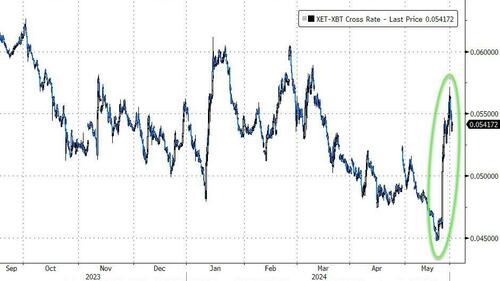

Ethereum dramatically outperformed bitcoin with its best week since July 2021

Source: Bloomberg

It was ETH's best week relative to BTC since May 2021...

Source: Bloomberg

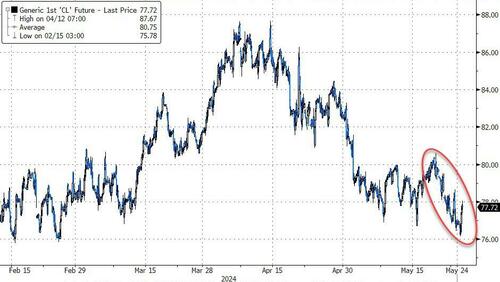

Despite a rebound today, oil prices ended lower on the week with WTI clinging to $78

Source: Bloomberg

Finally, US equity market capitalization remains drastically decoupled from bank reserves at The Fed - a relationship that had held and reverted for much of the last four years...

Source: Bloomberg

Have a great long weekend.

After six straight weeks of ‘weakness’, US Macro Surprise data surged higher this week (Good News) – it’s biggest positive weekly shift since January.

Source: Bloomberg

And that ‘good news’ sent rate-cut expectations tumbling (hawkishly) lower

Source: Bloomberg

Nasdaq dramatically outperformed on the week while the S&P managed to rally today to get green for the week (both up for five straight weeks). Small Caps and The Dow were both down notably on the week. Hawkish Fed Minutes spooked stocks mid-week but NVDA’s earnings saved the tech-heavy indices…

After four straight weeks of gains, The Dow suffered its worst week since March 2023.

The Russell 2000 also saw its first weekly loss in the last five.

This was Nasdaq’s best week relative to Russell 2000 since Nov 2023…

Source: Bloomberg

…which pulled the Nasdaq/Russell pair up to critical resistance…

Source: Bloomberg

Defensives have been leading in May so far and while both fell this week, Cyclicals underperformed…

Source: Bloomberg

The basket of ‘Magnificent 7’ stocks rallied for the fifth straight week to a new record high (obviously helped generously by NVDA).

Source: Bloomberg

NVDA refuses to dance to CSCO’s historical pattern and is headed to the moon…

Source: Bloomberg

Interestingly, ‘most shorted’ stocks suffered their worst week since Nov 2023…

Source: Bloomberg

Treasury yields were all higher on the week, but it was the short-end that notably lagged (2Y +12bps, 30Y +1bps)…

Source: Bloomberg

The 2Y yield rallied up toward the 5.00% danger-zone (its biggest weekly yield increase in six weeks)…

Source: Bloomberg

The yield curve (2s30s) flattened bigly this week (-12bps – the biggest weekly flattening since February)

Source: Bloomberg

The dollar continued to flip-flop, rallying this week after last week’s decline

Source: Bloomberg

Gold’s worst week in 8 months (since Sept 2023)

Source: Bloomberg

Silver was down on the week but outperformed gold, holding above $30

Source: Bloomberg

Bitcoin rallied for the second week in a row, rebounding today to $69,000

Source: Bloomberg

Ethereum dramatically outperformed bitcoin with its best week since July 2021

Source: Bloomberg

It was ETH’s best week relative to BTC since May 2021…

Source: Bloomberg

Despite a rebound today, oil prices ended lower on the week with WTI clinging to $78

Source: Bloomberg

Finally, US equity market capitalization remains drastically decoupled from bank reserves at The Fed – a relationship that had held and reverted for much of the last four years…

Source: Bloomberg

Have a great long weekend.

Loading…