Authored by Andrew Moran via The Epoch Times,

The federal government completed the sale of 1 million barrels of gasoline from the Northeast Gasoline Supply Reserve (NGSR), the White House said in a statement shared with The Epoch Times on Tuesday.

Last month, the government announced it would release 42 million gallons of gas from storage facilities in Maine and New Jersey to help lower pump prices heading into the typically busy summer driving season.

After receiving 19 proposals from five companies since May 21, the federal government awarded contracts to all the firms: BP (500,000 barrels), Vitol (200,000 barrels), Freepoint Commodities (100,000 barrels), George E. Warren (100,000 barrels), and Irving Oil (98,824 barrels).

Gas reserves were sold at an average $2.34 per gallon.

Senior administration officials touted the news as another victory for the federal government’s inflation-fighting efforts.

“The Biden-Harris Administration continues to take strategic action to lower prices for American consumers in every aspect of their lives—especially as summer driving season ramps up,” said Energy Secretary Jennifer Granholm.

“By releasing this reserve ahead of July 4th, we are ensuring sufficient supply flows to the northeast at a time hardworking Americans need it the most.”

But while gasoline prices have not rocketed this summer, the White House is trying to build on the plethora of measures to reduce energy costs, says National Economic Advisor Lael Brainard.

“Gas prices have come down nearly 20 cents in the last two months, but we know there is more to do,” said Ms. Brainard.

“This release will help lower prices at the pump, building on other actions by President Biden, including historic releases from the Strategic Petroleum Reserve, record energy production, and the largest-ever investment in clean energy.”

[ZH: Yeah Ms. Brainard, but prices are surging again now.]

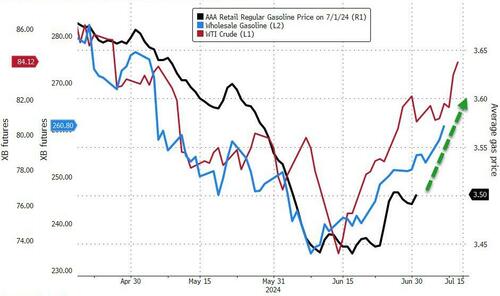

According to the American Automobile Association (AAA), gas prices are around $3.49 per gallon, down 5 cents from a year ago.

The cost of gas could start ticking higher because of the jump in crude oil prices.

U.S. crude topped $83 a barrel on the New York Mercantile Exchange during the July 1 trading session. Year-to-date, the West Texas Intermediate crude oil benchmark is up about 17 percent.

Oil prices had cooled since the end of April, but the revival of geopolitical tensions, investors bracing for the Federal Reserve to cut interest rates, an active hurricane season, and tight international energy markets have bolstered oil prices in recent sessions.

“Summer got off to a slow start last week with low gas demand,” said AAA spokesperson Andrew Gross.

“But with a record 60 million travelers forecast to hit the road for the July 4th holiday, that number could pop over the next 10 days. But will oil stay above $80 a barrel, or will it sag again? Stay tuned.”

The latest Energy Information Administration (EIA) data show that gasoline demand was 8.96 million barrels last week, down 240,000 barrels from the same period a year ago.

Since January 2021, gas prices have soared cumulatively 55 percent, and oil has surged 66 percent.

Tapping Into Reserves

In 2012, President Barack Obama created the Northeast Gasoline Supply Reserve following Hurricane Sandy, which destroyed refineries in the region.

Recent EIA figures revealed domestic gas inventories totaled 233.886 million barrels for the week ending June 21, down more than 3 percent from the same period three years ago.

Additionally, following Russian President Vladimir Putin’s invasion of Ukraine, President Biden tapped into the nation’s emergency oil stockpiles to curb prices, drawing down 180 million barrels of oil. The White House estimates this trimmed gas prices by about 80 cents.

The SPR is approximately 40 percent lower than in January 2021. Since hitting a bottom of 346.758 million barrels in July 2023, the U.S. government has been gradually refilling reserves. As of June 21, the SPR was 372.197 million barrels, the highest since December 2022.

The White House has repeatedly shifted its position to replenish the SPR.

In April, the Department of Energy abruptly canceled a 2.8-million-barrel offer to refill a significant storage facility in Louisiana. This decision occurred one month after issuing a solicitation for August and September deliveries.

However, Ms. Granholm told Reuters in a June 28 interview that the administration could rush offers to replenish U.S. reserves beyond a 3-million-barrel-a-month pace.

“It could pick up more than that,” she said, adding that two SPR locations in Louisiana and Texas have been in maintenance.

“All four sites will be back up by the end of the year, so one could imagine that pace would pick up, depending on the market.”

The federal government established the Strategic Petroleum Reserve in 1975 in response to the 1973–1974 oil embargo. The purpose was to limit the impact of disruptions in global petroleum markets. Officials could withdraw from the SPR during emergencies, energy interruptions, or supply troubles.

The world’s largest economy consumes about 20 million barrels of oil per day, meaning current reserves would be exhausted in 18 days if production ceased.

Authored by Andrew Moran via The Epoch Times,

The federal government completed the sale of 1 million barrels of gasoline from the Northeast Gasoline Supply Reserve (NGSR), the White House said in a statement shared with The Epoch Times on Tuesday.

Last month, the government announced it would release 42 million gallons of gas from storage facilities in Maine and New Jersey to help lower pump prices heading into the typically busy summer driving season.

After receiving 19 proposals from five companies since May 21, the federal government awarded contracts to all the firms: BP (500,000 barrels), Vitol (200,000 barrels), Freepoint Commodities (100,000 barrels), George E. Warren (100,000 barrels), and Irving Oil (98,824 barrels).

Gas reserves were sold at an average $2.34 per gallon.

Senior administration officials touted the news as another victory for the federal government’s inflation-fighting efforts.

“The Biden-Harris Administration continues to take strategic action to lower prices for American consumers in every aspect of their lives—especially as summer driving season ramps up,” said Energy Secretary Jennifer Granholm.

“By releasing this reserve ahead of July 4th, we are ensuring sufficient supply flows to the northeast at a time hardworking Americans need it the most.”

But while gasoline prices have not rocketed this summer, the White House is trying to build on the plethora of measures to reduce energy costs, says National Economic Advisor Lael Brainard.

“Gas prices have come down nearly 20 cents in the last two months, but we know there is more to do,” said Ms. Brainard.

“This release will help lower prices at the pump, building on other actions by President Biden, including historic releases from the Strategic Petroleum Reserve, record energy production, and the largest-ever investment in clean energy.”

[ZH: Yeah Ms. Brainard, but prices are surging again now.]

According to the American Automobile Association (AAA), gas prices are around $3.49 per gallon, down 5 cents from a year ago.

The cost of gas could start ticking higher because of the jump in crude oil prices.

U.S. crude topped $83 a barrel on the New York Mercantile Exchange during the July 1 trading session. Year-to-date, the West Texas Intermediate crude oil benchmark is up about 17 percent.

Oil prices had cooled since the end of April, but the revival of geopolitical tensions, investors bracing for the Federal Reserve to cut interest rates, an active hurricane season, and tight international energy markets have bolstered oil prices in recent sessions.

“Summer got off to a slow start last week with low gas demand,” said AAA spokesperson Andrew Gross.

“But with a record 60 million travelers forecast to hit the road for the July 4th holiday, that number could pop over the next 10 days. But will oil stay above $80 a barrel, or will it sag again? Stay tuned.”

The latest Energy Information Administration (EIA) data show that gasoline demand was 8.96 million barrels last week, down 240,000 barrels from the same period a year ago.

Since January 2021, gas prices have soared cumulatively 55 percent, and oil has surged 66 percent.

Tapping Into Reserves

In 2012, President Barack Obama created the Northeast Gasoline Supply Reserve following Hurricane Sandy, which destroyed refineries in the region.

Recent EIA figures revealed domestic gas inventories totaled 233.886 million barrels for the week ending June 21, down more than 3 percent from the same period three years ago.

Additionally, following Russian President Vladimir Putin’s invasion of Ukraine, President Biden tapped into the nation’s emergency oil stockpiles to curb prices, drawing down 180 million barrels of oil. The White House estimates this trimmed gas prices by about 80 cents.

The SPR is approximately 40 percent lower than in January 2021. Since hitting a bottom of 346.758 million barrels in July 2023, the U.S. government has been gradually refilling reserves. As of June 21, the SPR was 372.197 million barrels, the highest since December 2022.

The White House has repeatedly shifted its position to replenish the SPR.

In April, the Department of Energy abruptly canceled a 2.8-million-barrel offer to refill a significant storage facility in Louisiana. This decision occurred one month after issuing a solicitation for August and September deliveries.

However, Ms. Granholm told Reuters in a June 28 interview that the administration could rush offers to replenish U.S. reserves beyond a 3-million-barrel-a-month pace.

“It could pick up more than that,” she said, adding that two SPR locations in Louisiana and Texas have been in maintenance.

“All four sites will be back up by the end of the year, so one could imagine that pace would pick up, depending on the market.”

The federal government established the Strategic Petroleum Reserve in 1975 in response to the 1973–1974 oil embargo. The purpose was to limit the impact of disruptions in global petroleum markets. Officials could withdraw from the SPR during emergencies, energy interruptions, or supply troubles.

The world’s largest economy consumes about 20 million barrels of oil per day, meaning current reserves would be exhausted in 18 days if production ceased.

Loading…