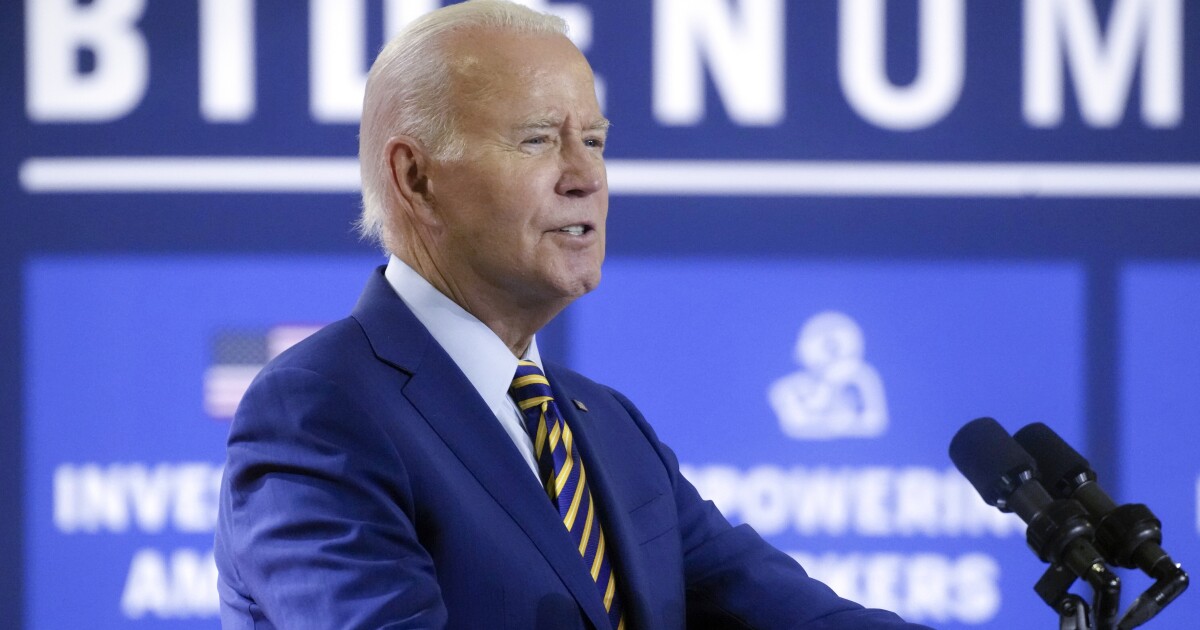

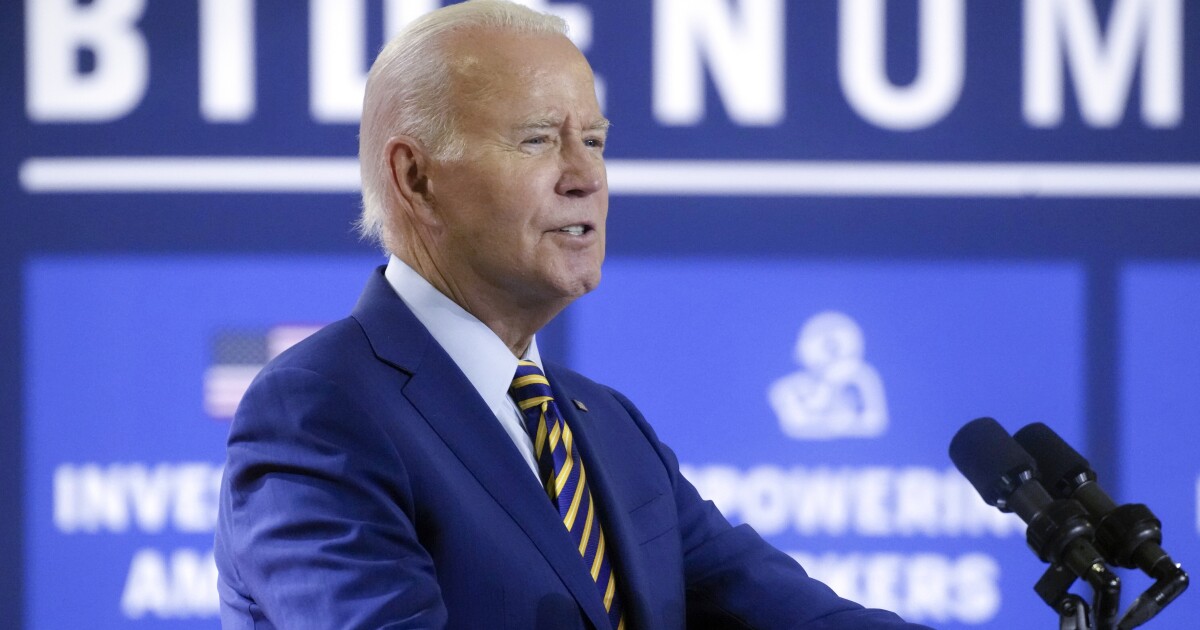

The Biden administration is planning a slew of actions across multiple agencies intended to lower healthcare costs as part of its “Bidenomics” agenda.

The plan, announced Friday morning, seeks to roll back Trump-era healthcare rules while building on legislation to prevent surprise billing that took effect last year.

PEOPLE ARE UNCOMFORTABLE WITH AI-LED HEALTHCARE

The effort is meant to relieve the “economic stressor” of healthcare costs on families, White House domestic policy adviser Neera Tanden told reporters, through a series of steps to lower costs.

Short-term insurance plans

The first of three actions is the Department of Health and Human Services proposing a new rule restricting short-term insurance plans, which the administration argues are not the “quality and comprehensive coverage” that consumers need.

Under the Trump administration, access to short-term insurance plans that do not need to follow certain Obamacare coverage requirements could be renewed for up to three years. Now, HHS is proposing these so-called junk plans be limited to only three months of coverage, with up to one-month renewal.

The rule stipulates that new plans will be subject to these limitations, while those currently in short-term plans will be able to keep their existing coverage. All short-term plans, however, will be required to disclose fully the benefits that differ from Obamacare-compliant plans.

Administration officials clarified for reporters that although this is not a complete rollback to the Obama-era regulation of short-term plans, the administration’s action is an intentional reversal of Trump-era rules.

The administration’s language of “junk” insurance plans echoes that used on the House floor last month when Democrats argued the CHOICE Act, which would allow more flexibility in choosing healthcare coverage, would be “death by a thousand cuts” to Obamacare.

When asked by reporters what has delayed executive action on this issue, senior administration officials emphasized that President Joe Biden has been “busy on healthcare” issues, including enrollment in Obamacare plans, but that the administration is “delighted” to be taking action now.

Surprise medical billing

The No Surprises Act, which was enacted in 2020 and took effect in January 2022, aims to address unforeseen bills from out-of-network services.

The administration’s new guidance regarding the No Surprises Act clarifies that insurance companies cannot “game the system,” Tanden says, by failing to distinguish between in-network providers and out-of-network providers that have contracts with in-network facilities.

Administration officials told reporters that the new guidance would hold a patient harmless if she, for example, delivered a baby at an in-network facility but was treated by an out-of-network anesthesiologist during her stay. For the patient, this cost would be governed by in-network cost-sharing provisions in the plan, but officials did not clarify how the cost would be recouped by the out-of-network provider.

Medical credit cards and loans

Biden administration officials also told reporters that, for the first time, the Consumer Financial Protection Bureau, HHS, and Treasury Department are collaborating to request information from medical credit card and loan companies regarding specialty products geared toward patients and their families to cover medical expenses.

“Financial firms are partnering with health care players to push products that can drive patients deep into debt,” said CFPB Director Rohit Chopra. “We are opening a public inquiry to better understand how these practices are affecting patients in our country.”

The agencies will probe the nature of the specialty medical payment market, patient experiences, healthcare provider incentives, and the billing or financial assistance issues associated with these products.

“This inquiry builds on the Department’s work to protect patients from unfair billing practices, lower costs, and increase transparency in our healthcare system,” said HHS Secretary Xavier Becerra. “Hearing directly from patients about their experiences will help shape policies that can prevent families from incurring medical debt.”

Inflation Reduction Act changes to Medicare costs

The Office of the Assistant Secretary for Planning and Evaluation at HHS also announced Friday morning its estimate that the Medicare Part D restructuring in the Inflation Reduction Act will reduce enrollee out-of-pocket spending by $7.4 billion annually for nearly 19 million people.

A key feature in the Inflation Reduction Act is the HHS secretary’s ability to set prices for the most costly prescription drugs covered by Medicare. The administration estimates that this, as well as changes to catastrophic Part D coverage, will reduce out-of-pocket costs by an average of $400 per Medicare Part D enrollee.

CLICK HERE TO READ MORE FROM THE WASHINGTON EXAMINER

The Medicare price negotiation of the Inflation Reduction Act has come under intense scrutiny in recent weeks as both pharmaceutical giant Merk and the Pharmaceutical Research Manufacturers of America, or PhRMA, have sued the Biden administration to halt enforcement of the provision.

Both lawsuits argue that the Medicare provision of the Inflation Reduction Act unconstitutionally compels private businesses to comply with federally mandated prices and institutes punitive penalties for noncompliance.