–>

November 1, 2022

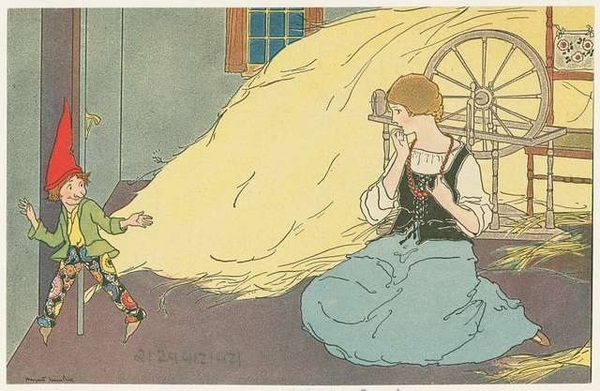

In the October 21, 2022 Editorial in the Wall Street Journal, “President Rumpelstiltskin: The White House tries to spin economic straw into political gold,” the Journal’s Editorial Board compares President Biden to the Grimm Brothers’ Fairy tale character Rumpelstiltskin.

‘); googletag.cmd.push(function () { googletag.display(‘div-gpt-ad-1609268089992-0’); }); }

While I do not disagree with the content of the editorial per say — the analysis and insight into the administration’s positions are cogent and on point — I do take issue with the premise of the editorial. The comparison of President Biden to Rumpelstiltskin is an inept equivalence. It maligns the Grimm Brother’s magical “little man” who spins straw into gold.

The editorial states ““The White House… pretends that the straw it’s selling is really gold.” But Rumpelstiltskin, a mischievous nature-spirit akin to hobgoblins and sprites, does not pretend the straw he spins is gold, he actually transforms the straw into gold. There’s no pretense about it.

In Rumpelstiltskin’s fairy-tale world, supernatural creatures can perform such magic.

‘); googletag.cmd.push(function () { googletag.display(‘div-gpt-ad-1609270365559-0’); }); }

However, Washington D.C. is not a fairy-tale world. The politicians, administrators, and power brokers there cannot, no matter how hard they try, spin straw into gold. Yet they pretend they can. And they pretend they do. And they dissemble to cover up the fact that they can’t.

But I digress.

The editorial board’s assertion that it is not possible for straw to be turned into gold misses the analogical core of the “Rumpelstiltskin” fable. The fundamental metaphor of “Rumpelstiltskin” is that straw — representing the products of agriculture — is turned into gold (wealth) through the ineffable “magic” of nature and diligent labor.

Raw materials are the modern equivalent of the straw Rumpelstiltskin spins; goods and services produced from these raw materials are the gold the straw becomes. Goods and services — made possible by plentiful and inexpensive energy, by the way — are the wealth of the modern economy. This wealth allows human beings to live richer and more comfortable lives.

For example, bauxite is mined in Australia and turned into, among other things, aluminum foil that is sold in a supermarkets. The final point of purchase marks the end of a long and convoluted “magical” process. The price paid at the counter sends money back down the line all the way to the mine in Australia allowing all the persons involved in the chain of production and distribution to purchase the things they need to survive.

While it would be impossible for the modern economy to function if the bauxite miner demanded sheep and corn for his (or her) raw ore, or if the supermarket demanded buckets of bauxite in exchange for its goods, the use of money allows the miner to purchase lamb from the supermarket and aluminum foil to make sure the leftovers stay fresh.

‘); googletag.cmd.push(function () { googletag.display(‘div-gpt-ad-1609268078422-0’); }); } if (publir_show_ads) { document.write(“

Money is the magic of our economy.

But money is merely the medium of exchange for goods and services: it is neither the straw nor the gold, the lamb or the foil. Money holds no nutritional value in and of itself. One can’t eat paper. Money is purely symbolic, a way of assigning and assessing value. And since the symbolic value of money directly affects the quality of life for the people the government officials claim to represent,  maintaining confidence in the currency is one of the primary responsibilities of the government. By instituting policies and regulations that burden industry with additional costs, overspending, and raising taxes, the Biden administration (certainly not the only administration to behave this way) is not helping the real economy (the straw turned to gold). In fact, the opposite is true. The administration is kneecapping the real economy and destabilizing the dollar by allowing (or actively effectuating) the loss of value to the medium of exchange (inflation).

maintaining confidence in the currency is one of the primary responsibilities of the government. By instituting policies and regulations that burden industry with additional costs, overspending, and raising taxes, the Biden administration (certainly not the only administration to behave this way) is not helping the real economy (the straw turned to gold). In fact, the opposite is true. The administration is kneecapping the real economy and destabilizing the dollar by allowing (or actively effectuating) the loss of value to the medium of exchange (inflation).

As an extreme punishment for units guilty of cowardice or mutiny, Roman Legions would decimate the unit — execute one in ten soldiers. Ten percent is a significant and debilitating percentage of any whole. It only takes ten years of decimation to reduce any whole to nothing. Losing 8.2 percent of the purchasing power of a dollar each year (the current rate of inflation) is not insignificant. Twelve years of the current rate and the current value of a dollar is whittled down to nothing when compared to its representative value today.

Perhaps the only thing worse than allowing (or actively effectuating) the value of the dollar to diminish is to deny that it’s happening or to suggest that inflation is no big deal. So when the Editorial Board of the Wall Street Journal states “…President Biden and his economic advisers claimed that a $1.4 trillion budget deficit for fiscal 2022 was a great fiscal and economic success” they make a salient point.

And normal folk grow skeptical of the government’s truthfulness and worried about their and their children’s future.

And they grow angry.

Those who have to pay off their mortgage or credit cards find borrowing (printing) 1.4 trillion dollars a year both irresponsible and reprehensible; especially since the national debt is more than thirty trillion dollars already. Thirty trillion dollars, in any real sense, is an unpayable sum. To make matters worse, the debt is not collateralized by any real property, product, or good. It is only the ability of the government to collect taxes to service the debt that gives any legitimacy to the bonds the government issues. The fact that the national debt does not include any of the many unfunded liabilities the government is obligated to pay over the coming years only augments the problem.

By putting lipstick on the proverbial pig, the administration plays a game that will have disastrous consequences in the long run. After all, money only has value when the people using it believe in the relative value the money represents to goods and services. If the stewards of the financial system are seen as untruthful (or actually are untruthful), faith in the currency evaporates.

People need to believe in the magician or the magic show is over.

If one wants to use a Fairy Tale analogy to describe the White House’s behavior, I would suggest that “The Boy who Cried Wolf” is a far better match than “Rumpelstiltskin.” In “The Boy who Cried Wolf” a shepherd boy is tasked with watching over the village’s herd of sheep. Twice he calls the town to rush from their work to save the herd from predatory wolves. But there were no wolves to be found. The shepherd boy’s cries for help were a cynical prank to amuse his perverse sense of humor. So when an actual wolf stalked the flock, the villagers did not heed the boy’s cries for help because they did not trust his word. The wolf, unopposed, devoured the village’s precious sheep and disaster befell the village.

The moral of “The Boy who Cried Wolf” is that liars, once recognized, are not believed, even when they tell the truth.

Biden is no Rumpelstiltskin. He, and his administration, are more like a bunch of boys who cry wolf.

All that’s left is to see the extent of the wolf’s predations.

Image: New York Public Library

<!– if(page_width_onload <= 479) { document.write("

“); googletag.cmd.push(function() { googletag.display(‘div-gpt-ad-1345489840937-4’); }); } –> If you experience technical problems, please write to [email protected]

FOLLOW US ON

<!–

–>

<!– _qoptions={ qacct:”p-9bKF-NgTuSFM6″ }; ![]() –> <!—-> <!– var addthis_share = { email_template: “new_template” } –>

–> <!—-> <!– var addthis_share = { email_template: “new_template” } –>