Authored by Mike Shedlock via MishTalk.com,

Biden abandoned the term Bidenomics for over a month. He’s now back at it, with Treasury Secretary Janet Yellen tooting his horn...

Biden Drops the Term Bidenomics

From June through November 1, Biden used the term Bidenomics over 100 times. Then he stopped using it.

On December 6, I commented Biden Drops the Term Bidenomics, Republicans Would Be Wise to Use it Instead

It seems that Biden has lost faith in Bidenomics, but his staff hasn’t. The public had no faith to begin with.

“You say you lost your faith, but that’s not where it’s at

You had no faith to lose and you know it“In case you don’t recognize those lines, they are from Positively 4th Street, written many decades ago by Bod Dylan.

Bidenomics is Back!

Perhaps because he has nothing else, Bidenomics is back.

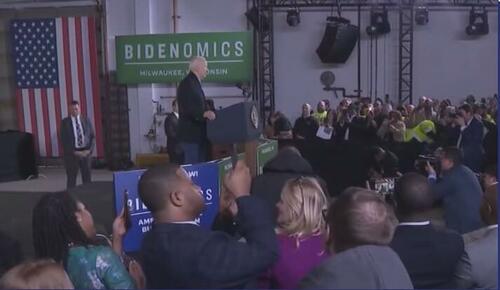

On December 20, Biden Pitched ‘Bidenomics’ to Black voters in Milwaukee

“When you increase the middle-class, the poor have a shot and the wealthy still do very well. The middle-class does well and we all do well. That’s what we call Bidenomics,” the president said, flanked by blue and green signs that read, “Bidenomics: America’s Small Business Boom.”

Some Democrats have wondered whether the White House should continue to use that slogan. A recent Wall Street Journal poll found the majority of those surveyed, 52%, had an unfavorable view of “Bidenomics,” while 29% had a favorable view.

Doubling Down With Janet Yellen

"Why do you think there is this disconnect, and are you concerned about the fact that the administration's message around 'Bidenomics' isn't landing?"

— RNC Research (@RNCResearch) December 12, 2023

Biden Treasury Secretary Janet Yellen: "We're still in the aftermath of [COVID]" pic.twitter.com/EQcYXNRFa9

WSJ: “Why do you think there is this disconnect, and are you concerned about the fact that the administration’s message around ‘Bidenomics’ isn’t landing?”

Yellen: “The pandemic caused an enormous amount of disruption of people’s lives, and we’re still in the aftermath of what’s been a serious shock. And we’ve had serious global shocks. And, although prices are rising at a much slower pace than they were, inflation is substantially off its highs.”

“The level of prices of some things that people buy and are important to them are higher. A good example would be rents. Rents have gone up considerably.”

Bidenomics Is Working for the Middle Class

Yesterday, Janet Yellen had this Op-Ed in the Wall Street Journal: Bidenomics Is Working for the Middle Class

When you have done everything humanly possible to increase inflation and sow the seeds of more inflation, and when the best thing you can come up with is a lie, the fallback strategy of repeating the lie is all you can do.

"What is your message to Americans who think what you've done on the economy is not enough?"

— RNC Research (@RNCResearch) December 21, 2023

KARINE JEAN-PIERRE: "It's going to take some time for them to feel the accomplishments!" pic.twitter.com/ZTuMsZeXIb

Rate Cut Headwinds

-

Global wage arbitrage and just-in-time manufacturing have reversed to inflationary onshoring and just-in-case manufacturing.

-

Neither party will fix deficits and out of control spending.

-

Trump’s tariffs and sanctions were hugely inflationary but Biden is much worse.

-

Biden’s energy policy and regulatory madness is hugely inflationary.

-

Retiring boomers need more medical care services. Their jobs are replaced by unskilled zoomers with a totally different work ethic.

-

Massive wage increases in union contracts over a many year period and ongoing minimum wage hikes in many states.

For years I was one of the biggest deflationistas around.

But many factors supporting lower interest rates and lower inflation have changed 180 degrees from tailwinds to headwinds.

If inflation is transitory, then transitory to what?

For discussion, please see Huge Moves in the Yield Curve This Year, What’s Going On?

Regarding the huge inversion between 1 month and five years then strongly steepening: Could it be the bond market smells a short quick recession followed by a big inflation problem coming down the pike?

Government Accounts for Nearly 25 Percent of All Job Gains in 2023

Finally please note Government Accounts for Nearly 25 Percent of All Job Gains in 2023

That’s hardly a sign of sustainable strength.

Authored by Mike Shedlock via MishTalk.com,

Biden abandoned the term Bidenomics for over a month. He’s now back at it, with Treasury Secretary Janet Yellen tooting his horn…

Biden Drops the Term Bidenomics

From June through November 1, Biden used the term Bidenomics over 100 times. Then he stopped using it.

On December 6, I commented Biden Drops the Term Bidenomics, Republicans Would Be Wise to Use it Instead

It seems that Biden has lost faith in Bidenomics, but his staff hasn’t. The public had no faith to begin with.

“You say you lost your faith, but that’s not where it’s at

You had no faith to lose and you know it“In case you don’t recognize those lines, they are from Positively 4th Street, written many decades ago by Bod Dylan.

Bidenomics is Back!

Perhaps because he has nothing else, Bidenomics is back.

On December 20, Biden Pitched ‘Bidenomics’ to Black voters in Milwaukee

“When you increase the middle-class, the poor have a shot and the wealthy still do very well. The middle-class does well and we all do well. That’s what we call Bidenomics,” the president said, flanked by blue and green signs that read, “Bidenomics: America’s Small Business Boom.”

Some Democrats have wondered whether the White House should continue to use that slogan. A recent Wall Street Journal poll found the majority of those surveyed, 52%, had an unfavorable view of “Bidenomics,” while 29% had a favorable view.

Doubling Down With Janet Yellen

“Why do you think there is this disconnect, and are you concerned about the fact that the administration’s message around ‘Bidenomics’ isn’t landing?”

Biden Treasury Secretary Janet Yellen: “We’re still in the aftermath of [COVID]” pic.twitter.com/EQcYXNRFa9

— RNC Research (@RNCResearch) December 12, 2023

WSJ: “Why do you think there is this disconnect, and are you concerned about the fact that the administration’s message around ‘Bidenomics’ isn’t landing?”

Yellen: “The pandemic caused an enormous amount of disruption of people’s lives, and we’re still in the aftermath of what’s been a serious shock. And we’ve had serious global shocks. And, although prices are rising at a much slower pace than they were, inflation is substantially off its highs.”

“The level of prices of some things that people buy and are important to them are higher. A good example would be rents. Rents have gone up considerably.”

Bidenomics Is Working for the Middle Class

Yesterday, Janet Yellen had this Op-Ed in the Wall Street Journal: Bidenomics Is Working for the Middle Class

When you have done everything humanly possible to increase inflation and sow the seeds of more inflation, and when the best thing you can come up with is a lie, the fallback strategy of repeating the lie is all you can do.

“What is your message to Americans who think what you’ve done on the economy is not enough?”

KARINE JEAN-PIERRE: “It’s going to take some time for them to feel the accomplishments!” pic.twitter.com/ZTuMsZeXIb

— RNC Research (@RNCResearch) December 21, 2023

Rate Cut Headwinds

-

Global wage arbitrage and just-in-time manufacturing have reversed to inflationary onshoring and just-in-case manufacturing.

-

Neither party will fix deficits and out of control spending.

-

Trump’s tariffs and sanctions were hugely inflationary but Biden is much worse.

-

Biden’s energy policy and regulatory madness is hugely inflationary.

-

Retiring boomers need more medical care services. Their jobs are replaced by unskilled zoomers with a totally different work ethic.

-

Massive wage increases in union contracts over a many year period and ongoing minimum wage hikes in many states.

For years I was one of the biggest deflationistas around.

But many factors supporting lower interest rates and lower inflation have changed 180 degrees from tailwinds to headwinds.

If inflation is transitory, then transitory to what?

For discussion, please see Huge Moves in the Yield Curve This Year, What’s Going On?

Regarding the huge inversion between 1 month and five years then strongly steepening: Could it be the bond market smells a short quick recession followed by a big inflation problem coming down the pike?

Government Accounts for Nearly 25 Percent of All Job Gains in 2023

Finally please note Government Accounts for Nearly 25 Percent of All Job Gains in 2023

That’s hardly a sign of sustainable strength.

Loading…