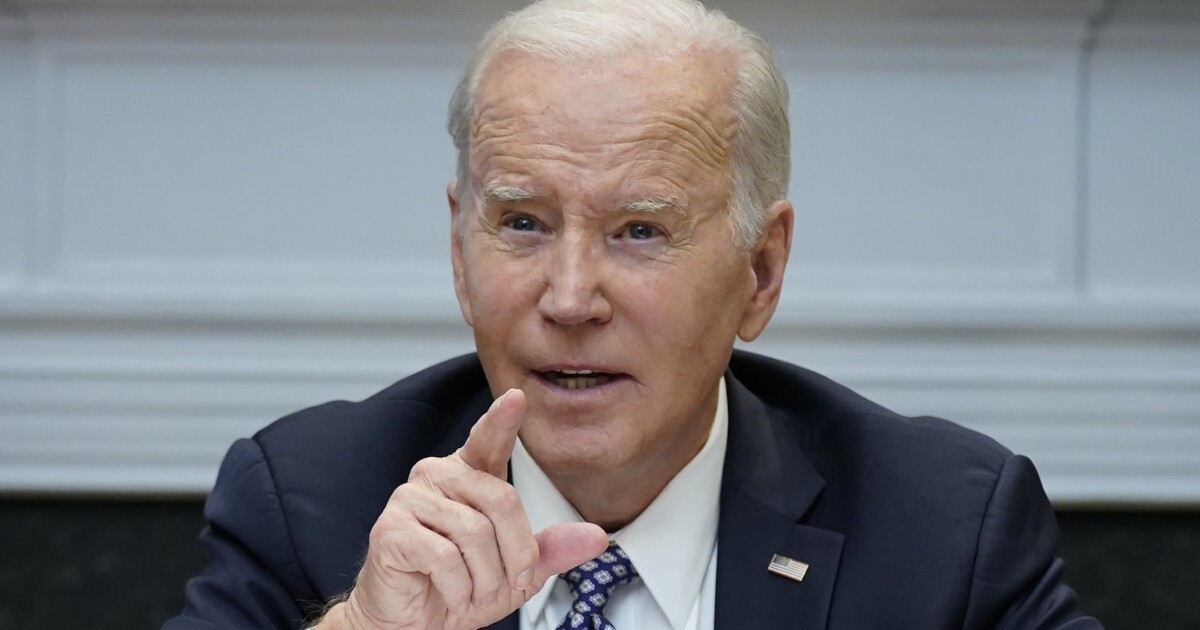

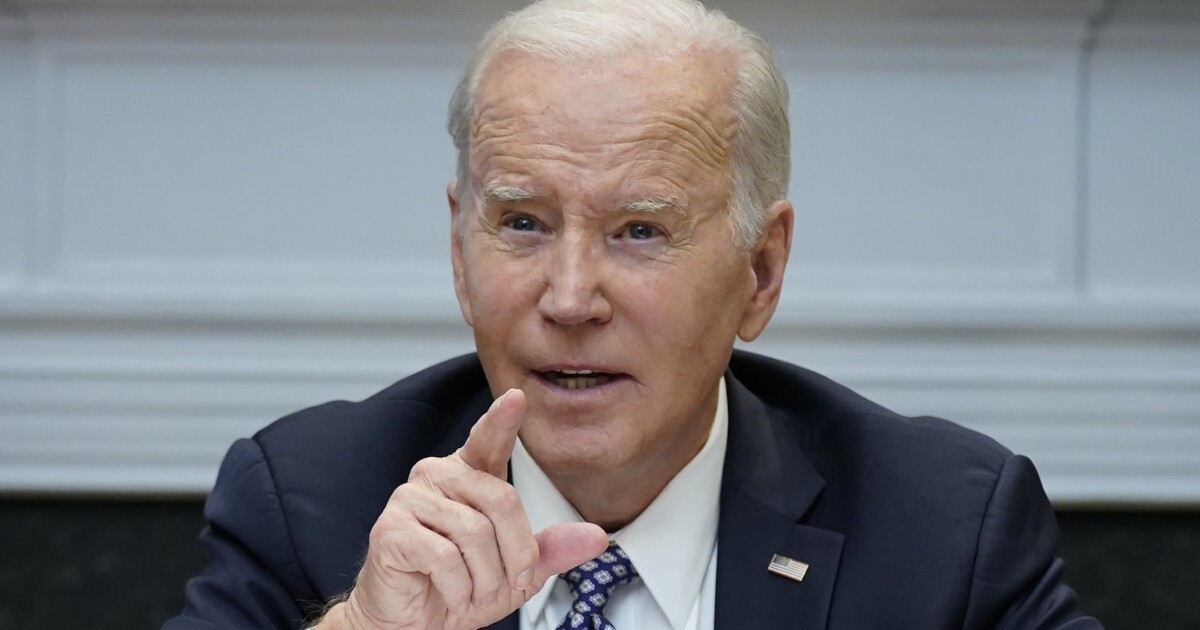

President Joe Biden may have to wield his veto pen again to thwart the wishes of Congress, this time over mortgage rates.

The House of Representatives passed the Middle Class Borrower Protection Act last Friday, with 14 Democrats joining all Republicans in a 230-189 vote to scrap new rules that readjust mortgage rates.

BIDEN TRIES TO SHAKE LOW MARKS ON ECONOMY WITH ‘BIDENOMICS’ PUSH

In the aggregate, the adjustments raise rates for borrowers with credit scores of 680 or above while lowering them for those with lower credit scores and lower down payments. In voting to scrap the rule, which went into effect May 1, House Republicans described the policy as another example of equity and socialism run amok.

Rep. Warren Davidson (R-OH), the legislation’s author, told the Washington Examiner earlier this week that the rule change was an “equity play to redistribute credit scores.”

Other Republican representatives piled on.

“President Biden’s recent mortgage rule is insane!” Rep. Debbie Lesko (R-AZ) tweeted. “This upside-down policy incentivizes people not to be financially responsible. Those with good credit scores should never be forced to subsidize those with bad credit scores.”

But the president threw cold water on the effort by issuing a statement of administration policy firmly stating his opposition.

“The bill would inhibit the Federal Housing Finance Agency’s ability to respond to changing housing market conditions and diminish the agency’s ability to ensure the safety and soundness of the government-sponsored enterprises,” reads the statement, which was released the same day as the House vote.

Rescinding the rule would also make it more difficult for the agency to serve low- and moderate-income households, the statement continues, though it does not include a veto threat.

The bill faces longer odds in the Senate, where Democrats hold a narrow majority, but may still be able to pass. At the beginning of this month, the upper chamber voted to repeal Biden’s student loans plan, with Sens. Joe Manchin (D-WV), Jon Tester (D-MT), and Kyrsten Sinema (I-AZ) joining Republicans to pass the measure.

That forced Biden to use another veto, which he’s had to do multiple times this year.

Along with the president, the situation also creates headaches for House Democrats who must go on record over controversial policies. Among the 14 Democrats who crossed party lines to vote against Biden’s mortgage overhaul are Reps. Henry Cuellar (D-TX), who often takes centrist positions, and Abigail Spanberger (D-VA), who narrowly won reelection in November in a swing district.

The Washington Examiner has reached out to Cuellar and Spanberger’s offices for comment.

The White House denies that its mortgage rate overhaul will punish borrowers with high credit scores and especially that the adjustment will result in a subsidy for those with lower credit scores.

FHFA officials also point out that those with exceptionally high credit scores of 780 and above will mostly see their fees go down relative to the old scale.

Despite the defections, the vast majority of Democrats did vote to keep the new policy in place. They defend it as a way to increase housing affordability, especially amid rising average mortgage rates.

“My colleagues on the other side of the aisle appear to be more concerned about protecting the wealthy, even if it comes at the expense of those with less intergenerational wealth,” said Rep. Maxine Waters (D-CA), ranking member of the House Financial Services Committee.

The fight comes as Biden seeks to embrace his economic record, with the administration aggressively promoting the term “Bidenomics” as a good thing. Republicans say they’re ready for that fight, pointing to Biden’s low economic approval ratings.

CLICK HERE TO READ MORE FROM THE WASHINGTON EXAMINER

Mortgage rates could be another area of vulnerability regardless of what happens with the rate overhaul.

According to the Federal Reserve Bank of St. Louis, the average rate for a 30-year mortgage rose from 2.77% the day Biden took office to 6.67% this month.