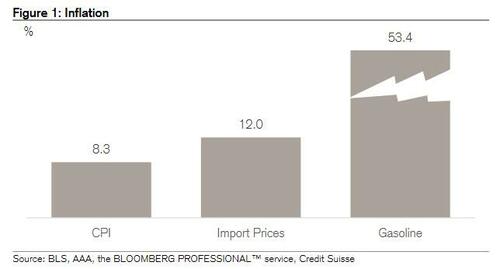

Over the past year, CPI has risen 8%, import prices 12%, and gasoline 53%, and as popular outrage has exploded, it is not surprising that governments around the world and certainly the United States, are enacting policies to "mitigate" inflation and alleviate the burden of higher prices on low- income families.

There is just one problem: as Credit Suisse strategist Jonathan Golub writes, most if not all of these policy prescriptions lower near-term prices but leave longer run inflationary pressures in place. While politically expedient, these efforts encourage additional spending, like what the Biden administration is pursuing right now. They also undermine decision making by obfuscating price signals. In his note (available to pro subs), Golub highlights 2 such examples: the lowering of gasoline taxes and import tariffs, both proposals actively contemplated by the Biden and other western administrations. We excerpt some highlights below:

Reduction of Excise (Gas) Taxes

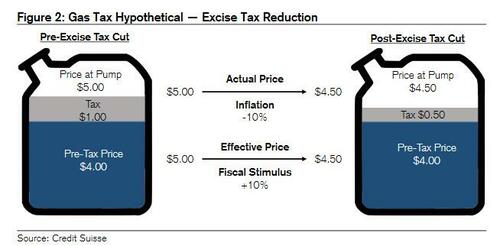

Gas at the pump currently averages $4.67 across the U.S., including federal and state excise taxes of $0.18 and $0.26. While excise taxes are included in inflation calculations, sales tax is not. For this reason, lowering gasoline taxes directly and immediately decreases stated inflation.

Unfortunately, lowering taxes does nothing to reduce the underlying price of oil. Rather, the tax savings simply encourages consumers to spend more freely on lower-priced gasoline or other goods and services.

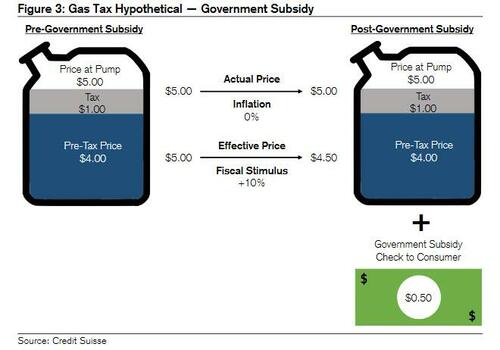

Put differently, lowering excise taxes is a form of fiscal stimulus, similar to writing checks to lower income American families. While providing a subsidy check to offset higher prices would not lower official inflation measures, it would have the exact same economic impact.

Removal of Import Tariffs

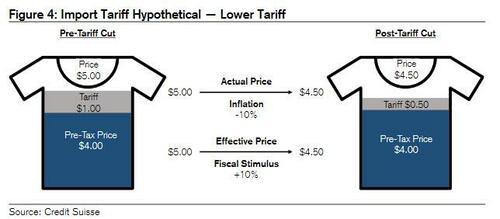

While much attention has been given to the increase in food and energy prices, other areas of the economy are also experiencing above trend inflation, including the price of imported goods (12% YoY).

Generally speaking, tariffs on imported goods are paid for by the end consumer rather than the foreign seller. As such, lowering tariffs would have a similar impact on consumer inflation as cutting gasoline or any other excise taxes. For example, a decrease in the tariff applied to an imported t-shirt would immediately decrease consumer inflation.

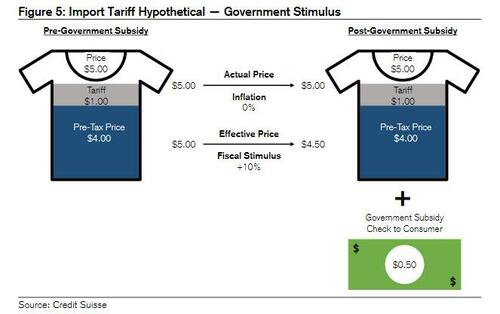

Lowering tariffs would have the same economic effect as writing stimulus checks to lower income families; however, it would not alter official inflation measures.

Impact to GDP

While lowering gasoline taxes and tariffs would have a similar near-term impact on inflation, they would have very different effects on other economic measures, such as GDP. If we assume that gasoline at the pump is a domestic product, then increased demand would translate into higher GDP. By contrast, an increase in imports would lower official GDP measures (GDP = C + I + G + NX). From a stock market perspective, equities are far more sensitive to changes in domestic demand than GDP. Put differently, investors would see both actions in a similar light even though they would alter official growth measures.

Over the past year, CPI has risen 8%, import prices 12%, and gasoline 53%, and as popular outrage has exploded, it is not surprising that governments around the world and certainly the United States, are enacting policies to “mitigate” inflation and alleviate the burden of higher prices on low- income families.

There is just one problem: as Credit Suisse strategist Jonathan Golub writes, most if not all of these policy prescriptions lower near-term prices but leave longer run inflationary pressures in place. While politically expedient, these efforts encourage additional spending, like what the Biden administration is pursuing right now. They also undermine decision making by obfuscating price signals. In his note (available to pro subs), Golub highlights 2 such examples: the lowering of gasoline taxes and import tariffs, both proposals actively contemplated by the Biden and other western administrations. We excerpt some highlights below:

Reduction of Excise (Gas) Taxes

Gas at the pump currently averages $4.67 across the U.S., including federal and state excise taxes of $0.18 and $0.26. While excise taxes are included in inflation calculations, sales tax is not. For this reason, lowering gasoline taxes directly and immediately decreases stated inflation.

Unfortunately, lowering taxes does nothing to reduce the underlying price of oil. Rather, the tax savings simply encourages consumers to spend more freely on lower-priced gasoline or other goods and services.

Put differently, lowering excise taxes is a form of fiscal stimulus, similar to writing checks to lower income American families. While providing a subsidy check to offset higher prices would not lower official inflation measures, it would have the exact same economic impact.

Removal of Import Tariffs

While much attention has been given to the increase in food and energy prices, other areas of the economy are also experiencing above trend inflation, including the price of imported goods (12% YoY).

Generally speaking, tariffs on imported goods are paid for by the end consumer rather than the foreign seller. As such, lowering tariffs would have a similar impact on consumer inflation as cutting gasoline or any other excise taxes. For example, a decrease in the tariff applied to an imported t-shirt would immediately decrease consumer inflation.

Lowering tariffs would have the same economic effect as writing stimulus checks to lower income families; however, it would not alter official inflation measures.

Impact to GDP

While lowering gasoline taxes and tariffs would have a similar near-term impact on inflation, they would have very different effects on other economic measures, such as GDP. If we assume that gasoline at the pump is a domestic product, then increased demand would translate into higher GDP. By contrast, an increase in imports would lower official GDP measures (GDP = C + I + G + NX). From a stock market perspective, equities are far more sensitive to changes in domestic demand than GDP. Put differently, investors would see both actions in a similar light even though they would alter official growth measures.