'Soft' survey data has been a bloodbath this week with regional Fed surveys all slumping and this morning's Chicago PMI uglier than all expectations.

That smashed 'hope' - the spread between hard and soft data - back to cycle lows...

Source: Bloomberg

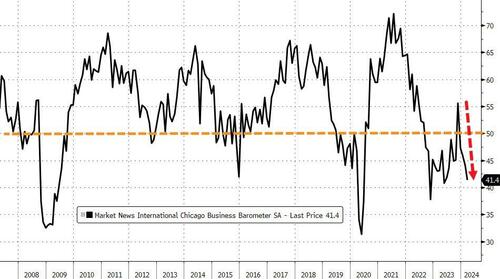

Today's Chicago PMI plunged to 41.4 - its lowest since May 2023 - from 44.0 (and well below the expected bounce to 46.0)...

Source: Bloomberg

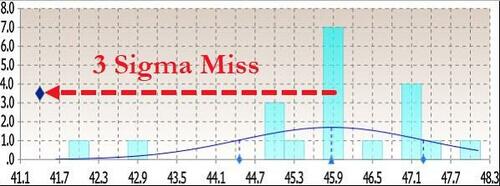

That was below all analysts expectations for the second month in a row...

Source: Bloomberg

Under the hood was even more problematic:

-

New orders fell at a faster pace; signaling contraction

-

Employment fell at a slower pace; signaling contraction

-

Inventories fell at a faster pace; signaling contraction

-

Supplier deliveries fell and a faster pace; signaling contraction

-

Production fell at a faster pace; signaling contraction

-

Order backlogs fell at a slower pace; signaling contraction

Worse still, Prices paid rose again!

So, in summary: slower growth, declining production, shrinking orders, falling employment... and accelerating inflation - is it any wonder that 'soft survey' data is collapsing - not exactly election-winning headlines.

‘Soft’ survey data has been a bloodbath this week with regional Fed surveys all slumping and this morning’s Chicago PMI uglier than all expectations.

That smashed ‘hope’ – the spread between hard and soft data – back to cycle lows…

Source: Bloomberg

Today’s Chicago PMI plunged to 41.4 – its lowest since May 2023 – from 44.0 (and well below the expected bounce to 46.0)…

Source: Bloomberg

That was below all analysts expectations for the second month in a row…

Source: Bloomberg

Under the hood was even more problematic:

-

New orders fell at a faster pace; signaling contraction

-

Employment fell at a slower pace; signaling contraction

-

Inventories fell at a faster pace; signaling contraction

-

Supplier deliveries fell and a faster pace; signaling contraction

-

Production fell at a faster pace; signaling contraction

-

Order backlogs fell at a slower pace; signaling contraction

Worse still, Prices paid rose again!

So, in summary: slower growth, declining production, shrinking orders, falling employment… and accelerating inflation – is it any wonder that ‘soft survey’ data is collapsing – not exactly election-winning headlines.

Loading…