The Biden administration's fight against homelessness is faltering ahead of the 2024 presidential election cycle.

A new Wall Street Journal report reveals the number of Americans ending up on the streets is happening at a "record rate" despite 'Bidenomics' being touted as an economic savior for the middle class. Every working-class folk understands Biden's policies have been absolutely horrendous -- two years of negative real wages forced many to rack up insurmountable credit card debt during the highest interest rate environment in a generation while draining personal savings -- all to make ends meet, like putting food on the table and paying rent. Compound this with the worst housing affordability period in decades (maybe relief in 2H24 or '25), and it's not hard to understand why the homelessness crisis is beginning to spiral out of control for Democrats.

WSJ's Jon Kamp and Shannon Najmabadi analyzed data from more than 300 entities that track homeless people across metro areas, counties, and states. They noted the data accounted for 80% of the homeless people counted nationwide last year.

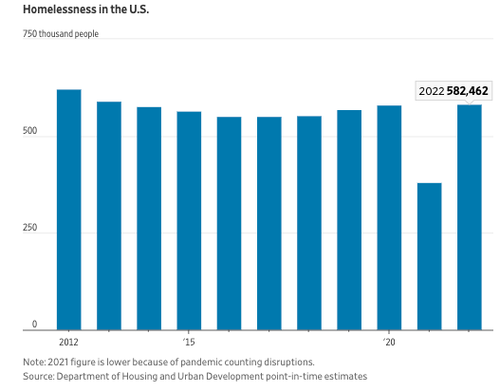

So far this year, the data shows the number of homeless people has soared by 11% compared with 2022. WSJ said the jump "represents by far the biggest recorded increase since the government started tracking comparable numbers in 2007." They pointed out the second-highest increase was in 2019, at a 2.7% increase, "excluding an artificially high increase last year caused by pandemic counting interruptions."

The surge in homelessness has now pushed the number of folks living on the streets to nearly 600,000.

Besides overleveraged and broke consumers, many can't afford shelter costs. The national housing crisis has been exacerbated due to limited supply and the 30-year fixed-rate mortgage rate above 7%.

Nevertheless, consumers have used their credit cards too much during this high-rate environment. They're tapped out: Consumers Finally Crack: Shocking Drop In June Credit Card Debt Marks End Of Spending Binge. And with a personal savings rate at ultra-low levels, folks have no financial cushion in hard times.

The situation worsens for the more than 40 million Americans with student loan debt who will see their payments restart in the next 2.5 weeks.

On top of this, all the Covid-relief funds have run out. Jamie Rife, executive director of the Metro Denver Homeless Initiative, explained:

"We are beginning to feel the full economic fallout of the Covid-19 era."

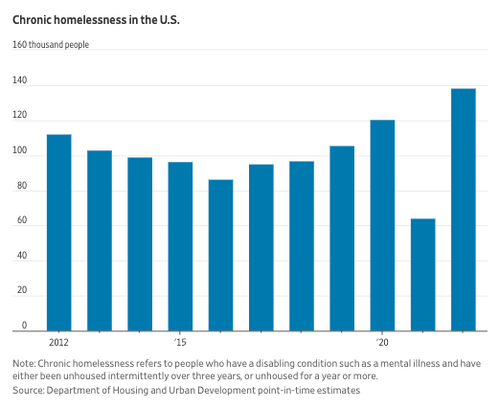

Meanwhile, chronic homelessness has soared to a new high.

Not to mention Biden is also dealing with a "twin crisis": Suicides and drug overdoses climbed to a record high in 2022. Let's not forget there's still a border crisis.

Crisis after crisis, crushing the working poor while "Rich Men North Of Richmond" care more about giving billions of dollars to Ukraine instead of helping the working class, might be why Biden's polling numbers are at ultra-low levels.

The Biden administration’s fight against homelessness is faltering ahead of the 2024 presidential election cycle.

A new Wall Street Journal report reveals the number of Americans ending up on the streets is happening at a “record rate” despite ‘Bidenomics‘ being touted as an economic savior for the middle class. Every working-class folk understands Biden’s policies have been absolutely horrendous — two years of negative real wages forced many to rack up insurmountable credit card debt during the highest interest rate environment in a generation while draining personal savings — all to make ends meet, like putting food on the table and paying rent. Compound this with the worst housing affordability period in decades (maybe relief in 2H24 or ’25), and it’s not hard to understand why the homelessness crisis is beginning to spiral out of control for Democrats.

WSJ’s Jon Kamp and Shannon Najmabadi analyzed data from more than 300 entities that track homeless people across metro areas, counties, and states. They noted the data accounted for 80% of the homeless people counted nationwide last year.

So far this year, the data shows the number of homeless people has soared by 11% compared with 2022. WSJ said the jump “represents by far the biggest recorded increase since the government started tracking comparable numbers in 2007.” They pointed out the second-highest increase was in 2019, at a 2.7% increase, “excluding an artificially high increase last year caused by pandemic counting interruptions.”

The surge in homelessness has now pushed the number of folks living on the streets to nearly 600,000.

Besides overleveraged and broke consumers, many can’t afford shelter costs. The national housing crisis has been exacerbated due to limited supply and the 30-year fixed-rate mortgage rate above 7%.

Nevertheless, consumers have used their credit cards too much during this high-rate environment. They’re tapped out: Consumers Finally Crack: Shocking Drop In June Credit Card Debt Marks End Of Spending Binge. And with a personal savings rate at ultra-low levels, folks have no financial cushion in hard times.

The situation worsens for the more than 40 million Americans with student loan debt who will see their payments restart in the next 2.5 weeks.

On top of this, all the Covid-relief funds have run out. Jamie Rife, executive director of the Metro Denver Homeless Initiative, explained:

“We are beginning to feel the full economic fallout of the Covid-19 era.”

Meanwhile, chronic homelessness has soared to a new high.

Not to mention Biden is also dealing with a “twin crisis”: Suicides and drug overdoses climbed to a record high in 2022. Let’s not forget there’s still a border crisis.

Crisis after crisis, crushing the working poor while “Rich Men North Of Richmond” care more about giving billions of dollars to Ukraine instead of helping the working class, might be why Biden’s polling numbers are at ultra-low levels.

Loading…