By Charles Kennedy of OilPrice.com

The price of the U.S. WTI crude oil has finally stayed in the low $70s per barrel for a sustainable period of time, allowing the Biden Administration to ramp up the refill of the Strategic Petroleum Reserve (SPR), which it had said would do at prices of $79 a barrel or below.

WTI Crude is now at $70 per barrel as of Tuesday morning, after spending days below that threshold.

But the Energy Department has just $841 million left to buy crude for the SPR, Bloomberg reported on Tuesday, citing an estimate by ClearView Energy Partners, a consulting firm. That money would be enough to buy only around 12 million barrels of crude at today’s prices, per Bloomberg’s calculations.

This would be a drop in the ocean, considering that the SPR is only just over half full compared to its capacity of 700 million barrels.

DOE's Office of Petroleum Reserves has recently announced a call for bids to supply up to 1.5 million barrels of oil to the Bayou Choctaw site in January 2025. An additional solicitation will follow on August 12, 2024, for another 2 million barrels destined for the Bryan Mound site, also for delivery in January 2025.

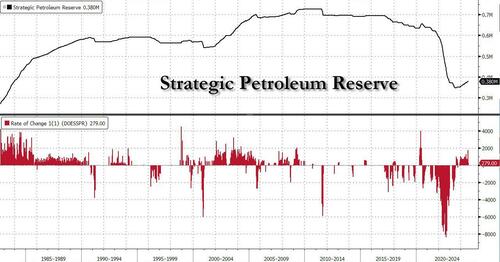

The replenishment strategy comes in the wake of the SPR's critical role in stabilizing the market during global supply disruptions, notably the release of more than 180 million barrels of oil from the SPR starting in 2021, as gasoline prices remained high. The Department of Treasury claims that these releases, along with coordinated international efforts, helped reduce gasoline prices by up to 40 cents per gallon in 2022.

The SPR currently houses 375 million barrels of crude—a figure that is 263 million barrels less than oil in the SPR at the beginning of President Joe Biden’s term in office. The SPR, capable of storing as many as 714 million barrels of crude oil, is kept in underground salt caverns at four sites in Texas and Louisiana and was designed to protect the economy and American livelihoods during oil shortages.

By Charles Kennedy of OilPrice.com

The price of the U.S. WTI crude oil has finally stayed in the low $70s per barrel for a sustainable period of time, allowing the Biden Administration to ramp up the refill of the Strategic Petroleum Reserve (SPR), which it had said would do at prices of $79 a barrel or below.

WTI Crude is now at $70 per barrel as of Tuesday morning, after spending days below that threshold.

But the Energy Department has just $841 million left to buy crude for the SPR, Bloomberg reported on Tuesday, citing an estimate by ClearView Energy Partners, a consulting firm. That money would be enough to buy only around 12 million barrels of crude at today’s prices, per Bloomberg’s calculations.

This would be a drop in the ocean, considering that the SPR is only just over half full compared to its capacity of 700 million barrels.

DOE’s Office of Petroleum Reserves has recently announced a call for bids to supply up to 1.5 million barrels of oil to the Bayou Choctaw site in January 2025. An additional solicitation will follow on August 12, 2024, for another 2 million barrels destined for the Bryan Mound site, also for delivery in January 2025.

The replenishment strategy comes in the wake of the SPR’s critical role in stabilizing the market during global supply disruptions, notably the release of more than 180 million barrels of oil from the SPR starting in 2021, as gasoline prices remained high. The Department of Treasury claims that these releases, along with coordinated international efforts, helped reduce gasoline prices by up to 40 cents per gallon in 2022.

The SPR currently houses 375 million barrels of crude—a figure that is 263 million barrels less than oil in the SPR at the beginning of President Joe Biden’s term in office. The SPR, capable of storing as many as 714 million barrels of crude oil, is kept in underground salt caverns at four sites in Texas and Louisiana and was designed to protect the economy and American livelihoods during oil shortages.

Loading…