The White House continues playing up the positives regarding the economy, including its role in creating those positives, but risks coming across as out of touch by downplaying and ignoring the negatives.

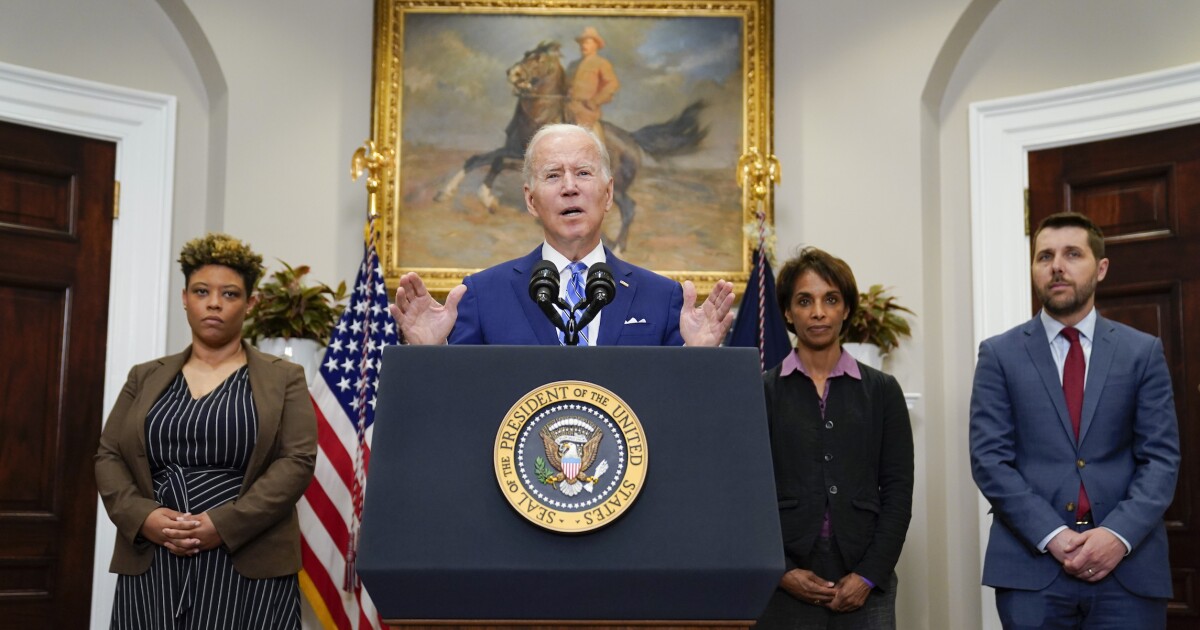

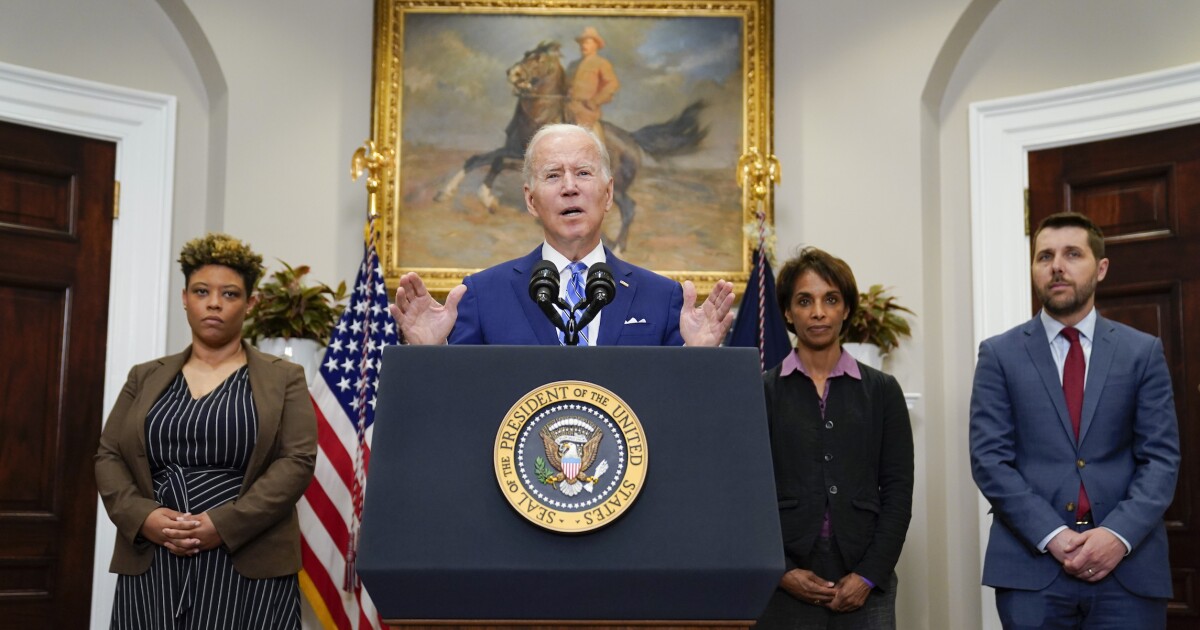

President Joe Biden met with his economic team on Wednesday, including the secretaries of treasury, energy, and labor, along with the chairwoman of the Council of Economic Advisers, and released a statement afterward indicating the American economy is in strong shape.

WHITE HOUSE DRAWS RIDICULE FOR STUDENT DEBT SPIN

“They reported that the United States economy remains resilient in the face of global challenges, thanks in part to the president’s economic plan, which has helped spur a historic recovery,” the statement reads. “The team discussed the need to continue making progress in reducing prices and implementing the administration’s once-in-a-generation fiscally responsible public investment plan in our infrastructure, manufacturing, and the clean energy transition.”

There are many positive aspects to the economy for the White House to promote, including low numbers of jobless claims, millions of jobs added to the economy since Biden took office, and new investments in infrastructure, manufacturing, and energy, thanks to bills passed by Congress.

The problem is that there are negative factors that tend to be more noticeable to consumers. Inflation has been above 8% since March, with prices rising on everyday items like meat, eggs, and gas. The Federal Reserve has responded by hiking interest rates, making it harder to obtain credit. The stock market is lower today than it was a year ago, and gross domestic product has fallen for two straight quarters, putting the United States on the verge of a recession.

When asked about the negatives, Biden administration officials often respond with the positives.

“This is one of the strongest job markets that we have seen on record,” White House press secretary Karine Jean-Pierre told reporters last Friday when asked about falling stock markets.

But voters may not be buying the administration’s talking points. Biden’s approval rating for the economy is just 38.1%, per the RealClearPolitics average, with 59% disapproving, which is lower than his overall job approval.

The White House looks likely to avoid a full-blown recession ahead of the midterm elections, as the Fed projects the economy growing 0.2% this year and 1.2% next year. But such sluggish growth paired with high inflation may not please voters on Election Day.

“Inflation is a big issue for people,” said University of Massachusetts economics professor Gerald Friedman. “People are going to be hit with high heating bills this winter, and that’s going to be a bit of a shock. On the other hand, people have jobs.”

Friedman isn’t a fan of the Fed’s aggressive interest rate hikes, fearing they’ll spur an unnecessary recession. He cites lingering supply chain snags from the pandemic as playing a large role in inflation rates that will eventually level out.

Cato Institute economist Norbert Michel largely agrees.

“It’s good that the growth in the price level (especially, but not exclusively, as measured by the [consumer price index]) seems to have calmed down. If that trend continues, it means that inflation has slowed even though the year-to-year rate changes remain elevated,” he wrote recently. “The Fed does not have to drive the price level back down to the pre-pandemic level for inflation to return to the neighborhood of a 2% target.”

There have been reports in recent days that Biden may replace his top economic advisers after the midterm elections. Council of Economic Advisers Chairwoman Cecilia Rouse will be returning to Princeton next spring, and some reports say Treasury Secretary Janet Yellen and National Economic Council Director Brian Deese could leave as well, depending on the outcome.

Deese has denied the reports, as has the White House.

Friedman argues that whether or not Yellen and Deese leave, the general direction of economic policy within the Biden administration will not change because the ultimate direction-setter, Biden himself, will not change.

CLICK HERE TO READ MORE FROM THE WASHINGTON EXAMINER

When it comes to the midterm elections, Friedman also contends voters may have other things on their minds in the voting booth.

“I’m not sure people will be voting on the economy,” he said. “They may be voting on Donald Trump, and they may be voting on Roe and the Supreme Court.”