By The Committee for A Responsible Federal Budget

The Biden Administration recently announced a new plan to cancel student debt for up to 30 million borrowers and released a preliminary rule this morning detailing parts of this plan. The proposal, which is being introduced through the rule making process, would replace the Administration’s initial proposal to cancel between $10,000 and $20,000 per person of debt, which was struck down by the Supreme Court.

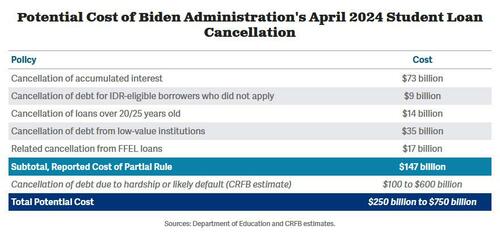

Elements of the plan in today’s proposed rule would cost nearly $150 billion, according to the Department of Education. However, this excludes a proposal to allow the Secretary of Education to cancel debt for those facing hardship or likely to default. Including this provision, we estimate the plan could cost $250 billion to $750 billion, depending on how the additional cancellation is designed.

The plan itself has five major components. It would:

-

Cancel accumulated interest for borrowers with balances higher than what they initially borrowed, capped at $20,000 for those in standard repayment and uncapped but restricted to individuals making less than $120,000 annually or couples making under $240,000 enrolled in an income-driven repayment (IDR) plan.

-

Automatically cancel loans for borrowers in standard repayment who would be eligible for cancellation had they applied for programs such as Public Service Loan Forgiveness (PSLF) or the new IDR program, Saving on a Valuable Education (SAVE).

-

Automatically cancel loans for borrowers who have been repaying undergraduate loans for over 20 years or graduate loans for over 25 years.

-

Cancel debt of those who attended low-financial-value programs, including those that failed accountability measures or were deemed ineligible for federal student aid programs.

-

Forgive debt of borrowers who are “facing hardships” or are likely to default on their loan payments.

The Department of Education has estimated the first four components of the plan would cost $147 billion over a decade, with half the cost stemming from the cancellation of accumulated interest. This is in line with estimates we are currently producing, though well above estimates of $77 billion from the Penn Wharton Budget Model (PWBM). A huge source of uncertainty is how these provisions would interact with existing IDR programs and how much of the debt would otherwise be cancelled under current policy.

Importantly, today’s rule does not include the Administration’s hardship cancellation plan, which would “authorize the automatic forgiveness of loans for borrowers at a high risk of future default as well as those who show hardship due to other indicators.”

This is by far the most unclear and potentially the most costly part of their proposal, since cancellation could be both wide-ranging and ongoing. We estimate this proposal could cost between $100 billion and $600 billion over a decade. However, there’s a tremendous amount of uncertainty, with design choices possibly resulting in much lower costs than our range – for example, PWBM estimates this provision would only cost $7 billion.

It is unclear how the Administration will define hardship, but they discuss 16 possible criteria such as other consumer debt, age, and health care or housing expenses and also declare hardship could be defined based on “any other indicators of hardship identified by the Secretary.” In assessing default risk, the rule allows cancellation for cancellation for those with an 80 percent likelihood of default, as determined by the Secretary. Importantly, over $150 billion of debt is currently in default (and loans in default generally have around a 70 percent recovery rate). We also estimate that a further 6 million borrowers are over 90 days delinquent on their loans, which is another predictor of a high likelihood of default and would further push up the number. The historically high rates of delinquency appear to be related to challenges around restarting student loan repayments last year.

While the default provision would be limited to the next two years under the most recent draft of the proposal, the hardship component has no time limit and thus opens a new venue for a future administration to cancel large amounts of student loan debt. An analysis by FREOPP argues that it could cover over 70 percent of college students.

In total, our $250 billion to $750 billion estimate for the total cost of the plan would be in line with the cost of the Administration’s $400 billion blanket debt cancellation, which was ruled illegal by the Supreme Court. It would be on top of more than $600 billion of debt cancellation already enacted through unilateral executive action. As we have shown before, these policies would put upward pressure on inflation and interest rates by supporting stronger demand, and much of the benefits would accrue to high-income and highly-educated Americans. In the coming weeks, we will produce further analysis of the Administration’s latest proposal and continue to refine our cost estimates as more data is made available. These analyses will be available at our student debt cancellation resources page.

By The Committee for A Responsible Federal Budget

The Biden Administration recently announced a new plan to cancel student debt for up to 30 million borrowers and released a preliminary rule this morning detailing parts of this plan. The proposal, which is being introduced through the rule making process, would replace the Administration’s initial proposal to cancel between $10,000 and $20,000 per person of debt, which was struck down by the Supreme Court.

Elements of the plan in today’s proposed rule would cost nearly $150 billion, according to the Department of Education. However, this excludes a proposal to allow the Secretary of Education to cancel debt for those facing hardship or likely to default. Including this provision, we estimate the plan could cost $250 billion to $750 billion, depending on how the additional cancellation is designed.

The plan itself has five major components. It would:

-

Cancel accumulated interest for borrowers with balances higher than what they initially borrowed, capped at $20,000 for those in standard repayment and uncapped but restricted to individuals making less than $120,000 annually or couples making under $240,000 enrolled in an income-driven repayment (IDR) plan.

-

Automatically cancel loans for borrowers in standard repayment who would be eligible for cancellation had they applied for programs such as Public Service Loan Forgiveness (PSLF) or the new IDR program, Saving on a Valuable Education (SAVE).

-

Automatically cancel loans for borrowers who have been repaying undergraduate loans for over 20 years or graduate loans for over 25 years.

-

Cancel debt of those who attended low-financial-value programs, including those that failed accountability measures or were deemed ineligible for federal student aid programs.

-

Forgive debt of borrowers who are “facing hardships” or are likely to default on their loan payments.

The Department of Education has estimated the first four components of the plan would cost $147 billion over a decade, with half the cost stemming from the cancellation of accumulated interest. This is in line with estimates we are currently producing, though well above estimates of $77 billion from the Penn Wharton Budget Model (PWBM). A huge source of uncertainty is how these provisions would interact with existing IDR programs and how much of the debt would otherwise be cancelled under current policy.

Importantly, today’s rule does not include the Administration’s hardship cancellation plan, which would “authorize the automatic forgiveness of loans for borrowers at a high risk of future default as well as those who show hardship due to other indicators.”

This is by far the most unclear and potentially the most costly part of their proposal, since cancellation could be both wide-ranging and ongoing. We estimate this proposal could cost between $100 billion and $600 billion over a decade. However, there’s a tremendous amount of uncertainty, with design choices possibly resulting in much lower costs than our range – for example, PWBM estimates this provision would only cost $7 billion.

It is unclear how the Administration will define hardship, but they discuss 16 possible criteria such as other consumer debt, age, and health care or housing expenses and also declare hardship could be defined based on “any other indicators of hardship identified by the Secretary.” In assessing default risk, the rule allows cancellation for cancellation for those with an 80 percent likelihood of default, as determined by the Secretary. Importantly, over $150 billion of debt is currently in default (and loans in default generally have around a 70 percent recovery rate). We also estimate that a further 6 million borrowers are over 90 days delinquent on their loans, which is another predictor of a high likelihood of default and would further push up the number. The historically high rates of delinquency appear to be related to challenges around restarting student loan repayments last year.

While the default provision would be limited to the next two years under the most recent draft of the proposal, the hardship component has no time limit and thus opens a new venue for a future administration to cancel large amounts of student loan debt. An analysis by FREOPP argues that it could cover over 70 percent of college students.

In total, our $250 billion to $750 billion estimate for the total cost of the plan would be in line with the cost of the Administration’s $400 billion blanket debt cancellation, which was ruled illegal by the Supreme Court. It would be on top of more than $600 billion of debt cancellation already enacted through unilateral executive action. As we have shown before, these policies would put upward pressure on inflation and interest rates by supporting stronger demand, and much of the benefits would accrue to high-income and highly-educated Americans. In the coming weeks, we will produce further analysis of the Administration’s latest proposal and continue to refine our cost estimates as more data is made available. These analyses will be available at our student debt cancellation resources page.

Loading…