Over the last few weeks we have reported about billions being pulled from ESG funds, hedge funds losing ESG ratings, and companies and banks scrambling to cover up their ESG appeal in pitch decks, all after "woke" ESG name Silicon Valley Bank went under, forcing the market to focus a bit more on things that matter (i.e. solvency, cash generation) instead of the unicorn and rainbow ESG fairy tale it has been obsessed with over the last 5 years.

But, the more things change, the more they stay the same.

Bloomberg reported this week that with ESG out of favor for all of about five minutes, there's already a new "buzzword" on the street that we're certain will drum up the same interest in "green" names: biodiversity.

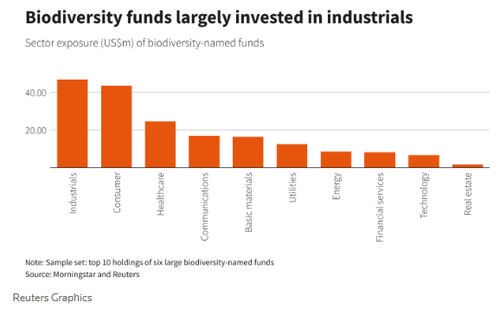

The term has helped some fund managers expand their asset base by 15% in two months, the report says. This comes after a "150% surge in the number of funds offering such strategies last year", it continues. While the $2.9 billion in combined assets for the buzzword pales in comparison to ESG, it feels like it could just be the beginning of more herd mentality virtue signaling FOMO like we saw in ESG.

Ingrid Kukuljan, head of impact and sustainable investing and international lead portfolio manager at Federated Hermes, cemented those thoughts, telling Bloomberg: “The move in biodiversity that we have seen is 10 times the speed of what we have seen with carbon. And rightly so, because this is the biggest systemic threat that we face.”

Bloomberg points out the genesis of making biodiversity a key issue:

Since a landmark agreement was struck at the COP15 summit in December, the finance industry has been forced to pay attention to biodiversity. The Global Biodiversity Framework, signed by almost 200 nations, envisages a central role for banks, insurers and asset managers in reaching the stated goal of mobilizing at least $200 billion each year to protect the natural world.

But the report also notes that there's a lack of reliable biodiversity data, calling some of the calculations a "black box". Kind of like Silicon Valley Bank's balance sheet.

Wijnand Broer, program manager at the Partnership for Biodiversity Accounting Financials and partner at CREM, a Netherlands-based consultancy, concluded: “You see more and more data providers entering the market providing biodiversity data, but it’s not always clear what the underlying assumptions are.”

"Biodiversity" is the next big ESG investing buzzword. Likely gonna see bunch of new ETFs with that word in the name.. "The move in bidioversity that we have seen is 10 times the speed of what we've seen in carbon" https://t.co/vxBS9N9opZ via @business

— Eric Balchunas (@EricBalchunas) March 28, 2023

Over the last few weeks we have reported about billions being pulled from ESG funds, hedge funds losing ESG ratings, and companies and banks scrambling to cover up their ESG appeal in pitch decks, all after “woke” ESG name Silicon Valley Bank went under, forcing the market to focus a bit more on things that matter (i.e. solvency, cash generation) instead of the unicorn and rainbow ESG fairy tale it has been obsessed with over the last 5 years.

But, the more things change, the more they stay the same.

Bloomberg reported this week that with ESG out of favor for all of about five minutes, there’s already a new “buzzword” on the street that we’re certain will drum up the same interest in “green” names: biodiversity.

The term has helped some fund managers expand their asset base by 15% in two months, the report says. This comes after a “150% surge in the number of funds offering such strategies last year”, it continues. While the $2.9 billion in combined assets for the buzzword pales in comparison to ESG, it feels like it could just be the beginning of more herd mentality virtue signaling FOMO like we saw in ESG.

Ingrid Kukuljan, head of impact and sustainable investing and international lead portfolio manager at Federated Hermes, cemented those thoughts, telling Bloomberg: “The move in biodiversity that we have seen is 10 times the speed of what we have seen with carbon. And rightly so, because this is the biggest systemic threat that we face.”

Bloomberg points out the genesis of making biodiversity a key issue:

Since a landmark agreement was struck at the COP15 summit in December, the finance industry has been forced to pay attention to biodiversity. The Global Biodiversity Framework, signed by almost 200 nations, envisages a central role for banks, insurers and asset managers in reaching the stated goal of mobilizing at least $200 billion each year to protect the natural world.

But the report also notes that there’s a lack of reliable biodiversity data, calling some of the calculations a “black box”. Kind of like Silicon Valley Bank’s balance sheet.

Wijnand Broer, program manager at the Partnership for Biodiversity Accounting Financials and partner at CREM, a Netherlands-based consultancy, concluded: “You see more and more data providers entering the market providing biodiversity data, but it’s not always clear what the underlying assumptions are.”

“Biodiversity” is the next big ESG investing buzzword. Likely gonna see bunch of new ETFs with that word in the name.. “The move in bidioversity that we have seen is 10 times the speed of what we’ve seen in carbon” https://t.co/vxBS9N9opZ via @business

— Eric Balchunas (@EricBalchunas) March 28, 2023

Loading…