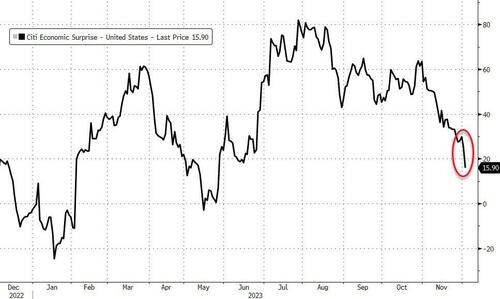

Another day, another set of shitty data dragged US macro surprise index down to lowest since May...

Source: Bloomberg

And before today's surge in the dollar and bond yields, financial conditions had dramatically eased to their loosest since early August...

Source: Bloomberg

But - the big story of the day was bitcoin and bullion.

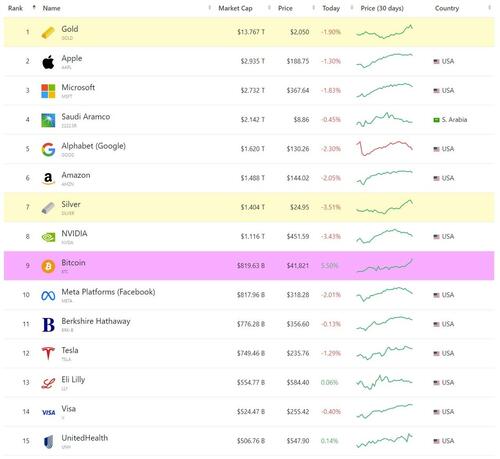

Bitcoin ripped back above $42,000 for the first time since April 2022 - erasing all the TerraUSD/3AC crisis losses from last year...

Source: Bloomberg

That pushed Bitcoin's market cap above that of Berkshire Hathaway (as Munger turns over in his grave)...

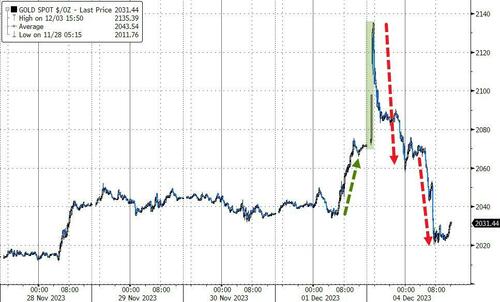

Gold hit a new (nominal) record high overnight at $2135...

Source: Bloomberg

...but shortly after that the selling began as Benoit was called in...

It's 830pm in Basel and he is still in the office.

— zerohedge (@zerohedge) December 4, 2023

They are not happy with what happened. pic.twitter.com/zeUHmoWd6a

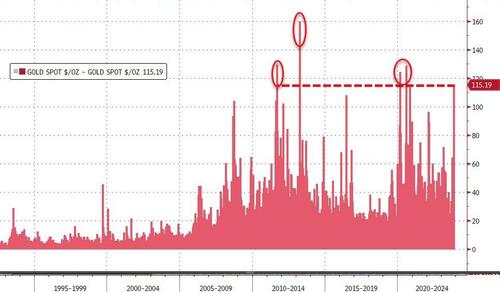

...within the next 8 hours, spot gold prices had dropped $115 from its intraday highs...

Source: Bloomberg

...that is the 6th biggest absolute $ intraday drop in the history of spot gold trading (9/23/11 & 9/26/11 (SNB intervention as gold soared near $2,000), 04/15/13 (taper tantrum), 3/16/20 (COVID lockdowns), 08/11/20 (vaccines))...

Source: Bloomberg

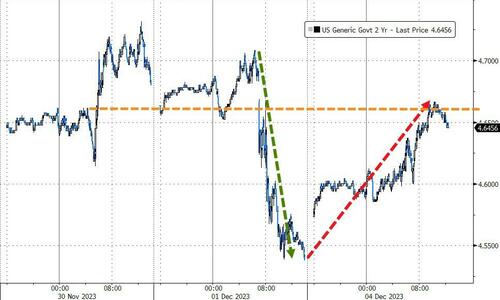

Bonds dumped most of Friday's pump with yields up across the curve. The short-end underperformed on the day(2Y +11bps, 30Y +4bps)...

Source: Bloomberg

2Y yields are up around 14bps off Friday's lows...

Source: Bloomberg

Huge divergences in equity-land as long-duration (tech) underperformed as yields rose but Small Caps soared (short-squeeze) with The Dow scarmbling to unch on the day and S&P weak...

Unprofitable Tech stocks continue to outperform the Magnificent 7, with the latter now back at support levels seen in the early summer relative to the unprofitable names...

Source: Bloomberg

The dollar ripped higher today (no manipulation of gold of course) for its best day in almost two months...

Source: Bloomberg

Oil prices were lower on the day (as the dollar soared) with WTI finding support around $73 and chopping around there all day...

Finally, after spending July thru Oct starting to recouple with liquidity's reality, US equities exploded divergently in November...

Source: Bloomberg

What happens first - major central bank liquidity expansion... or a crash in stocks?

Another day, another set of shitty data dragged US macro surprise index down to lowest since May…

Source: Bloomberg

And before today’s surge in the dollar and bond yields, financial conditions had dramatically eased to their loosest since early August…

Source: Bloomberg

But – the big story of the day was bitcoin and bullion.

Bitcoin ripped back above $42,000 for the first time since April 2022 – erasing all the TerraUSD/3AC crisis losses from last year…

Source: Bloomberg

That pushed Bitcoin’s market cap above that of Berkshire Hathaway (as Munger turns over in his grave)…

Gold hit a new (nominal) record high overnight at $2135…

Source: Bloomberg

…but shortly after that the selling began as Benoit was called in…

It’s 830pm in Basel and he is still in the office.

They are not happy with what happened. pic.twitter.com/zeUHmoWd6a

— zerohedge (@zerohedge) December 4, 2023

…within the next 8 hours, spot gold prices had dropped $115 from its intraday highs…

Source: Bloomberg

…that is the 6th biggest absolute $ intraday drop in the history of spot gold trading (9/23/11 & 9/26/11 (SNB intervention as gold soared near $2,000), 04/15/13 (taper tantrum), 3/16/20 (COVID lockdowns), 08/11/20 (vaccines))…

Source: Bloomberg

Despite the weak data, yields were higher today.

Bonds dumped most of Friday’s pump with yields up across the curve. The short-end underperformed on the day(2Y +11bps, 30Y +4bps)…

Source: Bloomberg

2Y yields are up around 14bps off Friday’s lows…

Source: Bloomberg

Huge divergences in equity-land as long-duration (tech) underperformed as yields rose but Small Caps soared (short-squeeze) with The Dow scarmbling to unch on the day and S&P weak…

Unprofitable Tech stocks continue to outperform the Magnificent 7, with the latter now back at support levels seen in the early summer relative to the unprofitable names…

Source: Bloomberg

The dollar ripped higher today (no manipulation of gold of course) for its best day in almost two months…

Source: Bloomberg

Oil prices were lower on the day (as the dollar soared) with WTI finding support around $73 and chopping around there all day…

Finally, after spending July thru Oct starting to recouple with liquidity’s reality, US equities exploded divergently in November…

Source: Bloomberg

What happens first – major central bank liquidity expansion… or a crash in stocks?

Loading…