Update (0720ET): Crypto exchange Binance has seen its proof-of-reserve audits removed from auditor Mazars’ website.

“Mazars has indicated that they will temporarily pause their work with all of their crypto clients globally, which include Crypto.com, KuCoin, and Binance. Unfortunately, this means that we will not be able to work with Mazars for the moment,” a spokesperson for the firm said in an emailed statement to Bloomberg News on Friday.

Binance CEO Changpeng “CZ” Zhao was quick to react to the news on Twitter with a retweet from a random commenter.

“Making a statement on why an auditing company decided to quit working with crypto? Ask them lol,” the tweet reads.

The news comes shortly after Mazars confirmed on Dec. 7 that Binance possessed control over 575,742 Bitcoin of its customers, worth around $9.7 billion at the time of writing.

The report has since been also removed from Mazars' website.

CZ appeared on CNBC yesterday to 'explain'...

Holy Sh*t!

— Neil Jacobs (@NeilJacobs) December 15, 2022

Get your bitcoin OFF Binance.#bitcoinpic.twitter.com/xSxNoyARXH

Bitcoin puked right as the Mazars headlines hit, dropping back to $17,000...

* * *

As Bitcoin Magazine Pro's Dylan LeClair and Sam Rule asked (and answered) earlier, is Binance facing FUD or legitimate questions?

Binance's bitcoin balance sees its largest one-day outflow ever. BUSD stablecoin experiences large redemptions and the price legitimacy for the exchange-native BNB token is called into question.

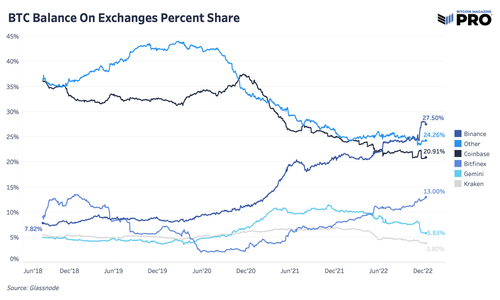

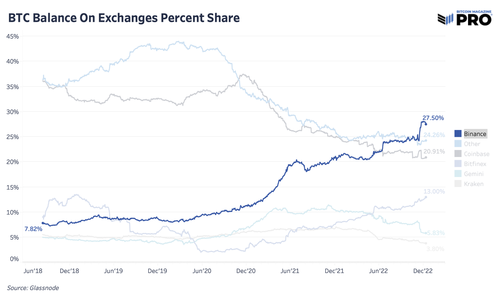

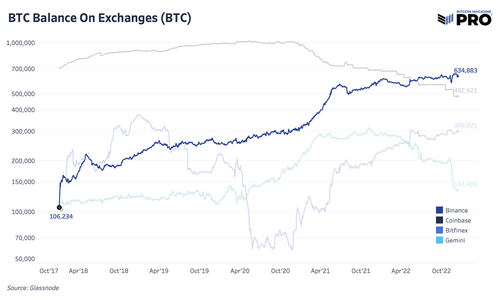

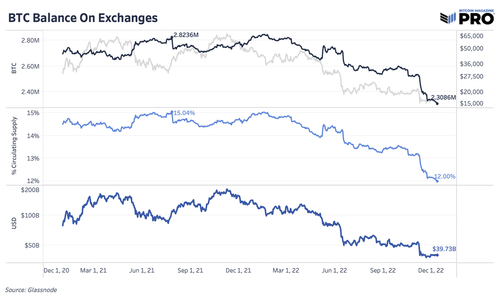

By far, one of the biggest winners in the aftermath of the FTX collapse has seemed — on the surface — to be Binance. After only having 7.82% market share of the bitcoin supply on exchanges in 2018, their share is now 27.50% despite a much broader trend of bitcoin supply leaving exchanges. The bitcoin balance on Binance now totals 595,864 BTC, which is 3.1% of outstanding supply, worth $10.58 billion. This bitcoin belongs to their customers and reflects a growing trend in market share over the last few years that has made Binance the largest bitcoin and cryptocurrency exchange in the world.

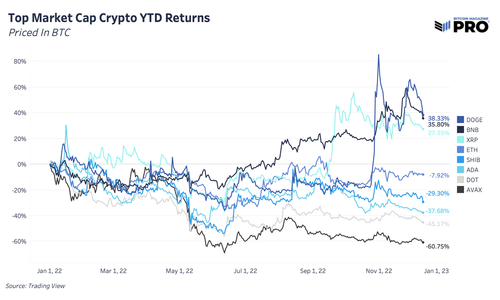

As highlighted previously in “The Exchange War: Binance Smells Blood As FTX/Alameda Rumors Mount,” Binance now controls approximately 60% of the spot and derivatives volume in the entire market as well. It’s hard to see how any exchange in the space can be a “winner” in the current market conditions, but one could make the case for Binance, with the exchange’s growing strength in a decimated industry. On top of that, Binance’s BNB token, the native currency of Binance’s own Ethereum-competing Layer 1 blockchain, is still one of the better performing tokens when valued in bitcoin terms this year.

Yet, is this recent “strength” everything that it seems or is it a facade? We’ve learned over the last month that no company is safe in this industry right now (especially exchanges) and questions are growing around Binance’s practices, solvency, BNB token value and the overall state of their business over the last few weeks. Is it FUD or legit? Let’s try to break some of it down, addressing the concerns through an objective and skeptical lens.

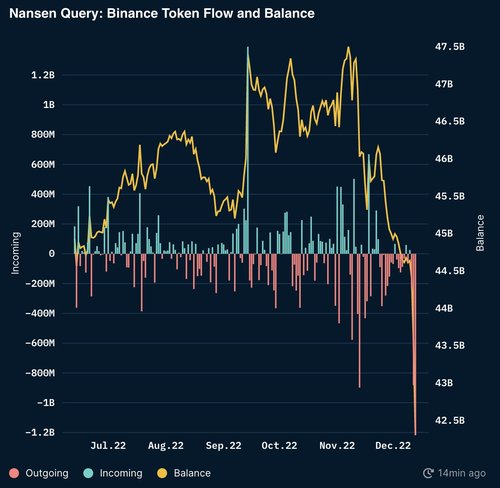

Binance Flows

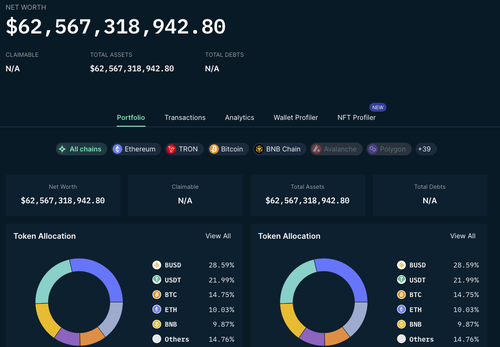

Over the last day, we’ve seen significant outflows from Binance across different various tokens and bitcoin when looking at both Nansen and Glassnode tracking. Across ETH and ERC20 tokens, Binance saw $3 billion leaving the exchange in its largest single-day outflow since June. Across Nansen total wallet tracking, all Binance balances are estimated at $62.5 billion with around 50% of those balances in stablecoins across BUSD and USDT.

Source: Nansen

Source: Nansen

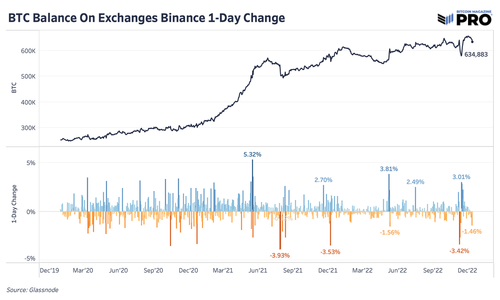

According to Glassnode, the total bitcoin exchange balance on Binance is down around 6-7% over the last day, after reaching a peak on December 1. Although balances remain above 500,000 bitcoin and Binance has shown a rising trend of bitcoin balances on the platform this year, this is a significant move for outflows in just 24 hours. The largest one-day change in bitcoin outflows was just shy of 4% back in July. As a general comparison, the trend of bitcoin exchange balances was a much different story for FTX, whose balance had been falling heavily since June.

Note that in some of the charts below, exchange balances are using daily data from Glassnode instead of 10-minute or 1-hour intervals where we can see more of the latest bitcoin exchange outflows. The numbers above reference the latest 1-hour interval data. Exchange balance data, especially intraday, can change and data is typically more reliable on a longer time horizon, especially given that we have little insight into Glassnode’s classification and data science techniques that are used to label different wallets and addresses. Yet, however you cut the data, Binance outflows over the last 24 hours are a bit alarming and raise questions: Is this a one-off event and just business as usual or is this the start of something more?

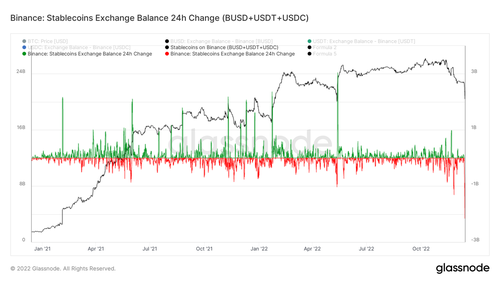

In absolute terms, the last 24 hours have brought about the largest ever flight away from Binance for both bitcoin and stablecoins — an extremely notable move.

In particular, in the case of BUSD, Binance’s native stablecoin that has its reserves custodied by U.S. financial firm Paxos, there has been a notable amount of redemptions as of late. Large holders of BUSD have been withdrawing from Binance and sending it to Paxos, redeeming the stablecoins for dollars. This shows up as BUSD being “burned” at the Paxos Treasury.

🔥 🔥 🔥 🔥 🔥 🔥 🔥 🔥 🔥 🔥 559,000,053 #BUSD (558,832,353 USD) burned at Paxos Treasuryhttps://t.co/y925vxE9sB

— Whale Alert (@whale_alert) December 13, 2022

🔥 🔥 🔥 🔥 🔥 🔥 🔥 🔥 🔥 🔥 700,000,000 #BUSD (700,350,000 USD) burned at Paxos Treasuryhttps://t.co/hXClXhREUK

— Whale Alert (@whale_alert) December 13, 2022

Readers can track the on-chain addresses provided by Binance for free here.

The main cause for concern is not whether Binance has any bitcoin/crypto or not. We can transparently see that the firm controls tens of billions worth of crypto assets. What isn’t exactly clear, similar to FTX, is whether the firm has commingled users funds or whether the firm has any outstanding liabilities against user assets.

Binance CEO Changpeng Zhao (CZ) has said that the firm has no liabilities with any other firms, but as recent months have shown, words don’t mean all that much. While we are not claiming that CZ is lying to the public about the state of Binance finances, we have no way to prove otherwise.

Will you be doing an independent audit on liabilities against those reserves and will other coins be audited also in due time?

— Willy Woo (@woonomic) December 7, 2022

yes, but liabilities are harder. We don't owe any loans to anyone. You can ask around.

— CZ 🔶 Binance (@cz_binance) December 7, 2022

CZ’s response as to whether the company was going to audit liabilities against user assets was, “Yes, but liabilities are harder. We don't owe any loans to anyone. You can ask around.”

Unfortunately, “ask around” isn’t a satisfactory enough answer for an ecosystem supposedly built around the ethos of don’t trust, verify.

Big red flag for me is that this seems to be more of an attempt at proving collateral rather than proving reserves. They even admit to be insolvent with regard to actual assets owed vs tokens controlled. The “collateral” accounting trick is exactly how FTX played solvent as well.

— Jesse Powell (@jespow) December 11, 2022

While there is no doubt that Binance is an industry giant in the crypto derivatives industry, how do we know the firm isn’t doing similar things as past actors in regards to trading against clients using user funds and/or proprietary data. Things like the former Chief Legal Officer of Coinbase departing Binance U.S. last summer after just three months as the CEO leaves one with many questions.

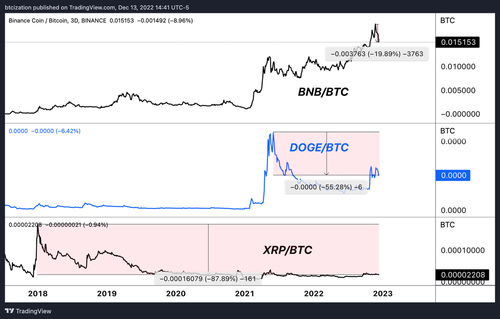

To add to our skepticism, the price of the Binance exchange token BNB is near all-time highs in bitcoin terms, appreciating an astounding 828% against bitcoin in the last 785 calendar days.

Is BNB, a more centralized cousin to Ethereum, really worth approximately 14% of all bitcoin that will ever exist? BNB is not equity in the Binance company. BNB is a crypto token spun up from nothing in 2017.

BNB is one of the few cryptocurrencies that is up year-to-date in bitcoin terms, with the others being illiquid alts well below their BTC-denominated all-time highs.

The only other two outperformers during 2022 have been the “meme” DOGE, which is 55% below its all time high in bitcoin terms, and quasi-security XRP, which has been delisted by major exchanges and is 87% below its all-time highs in bitcoin terms.

Why is the outperformance so notable? Why are we hammering this point so hard? Because financial markets aren’t magical machines tied to a fantasy-land reality. Financial markets — while appearing to be disconnected from reality at times — always come crashing down to reality, exposing those that were possibly perceived as giants once before.

For the most part, the crypto industry is an attempt at modern alchemy, and exchange tokens minted from nothing with centrally engineered “tokenomics” are no different.

In fact, they are part of the problem.

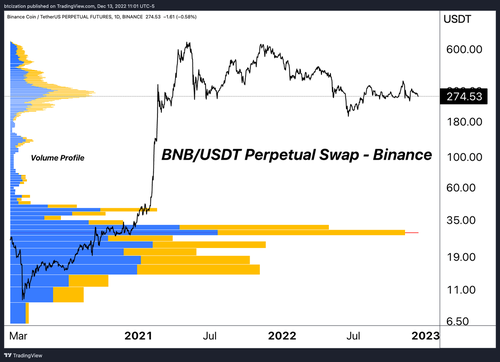

It could be possible that BNB was pushed up with the internal help of Binance or its unofficial affiliates during the bull run. Just look at the volume profile of where coins changed hands on its native exchange. While it would be a leap of faith to say this took place directly using customer funds à la FTX, the revenue of the company has been used to buy back the token, similar to a stock buyback.

Label me a pessimist, but all I see is a whole lot of hot air.

— Dylan LeClair 🟠 (@DylanLeClair_) November 29, 2022

9x in two months during the bull run with barely a retrace? 10x against BTC since 2021?

Must be a "new paradigm".$BNB pic.twitter.com/ysJ04lXPPZ

While it remains to be seen whether the firm is levered against its own token in any sort of way, it would certainly be no surprise to us if the company supported the ascent of the token/chain, similarly to many other exchanges with token that outperformed bitcoin during the bull run. BNB is a “blockchain” that can be arbitrarily halted by the Binance team. It is not even attempting to be a decentralized application set.

An exploit on a cross-chain bridge, BSC Token Hub, resulted in extra BNB. We have asked all validators to temporarily suspend BSC. The issue is contained now. Your funds are safe. We apologize for the inconvenience and will provide further updates accordingly.

— CZ 🔶 Binance (@cz_binance) October 6, 2022

$600 million hack of BNB, and Binance has decided to halt BSC (Binance Smart Chain).

— Dylan LeClair 🟠 (@DylanLeClair_) October 6, 2022

[De]Centralized finance.

That’s fine, but we remain extremely skeptical that its relative valuation against bitcoin — what we believe to be humanity’s best bet as decentralized digital cash — is tethered to reality.

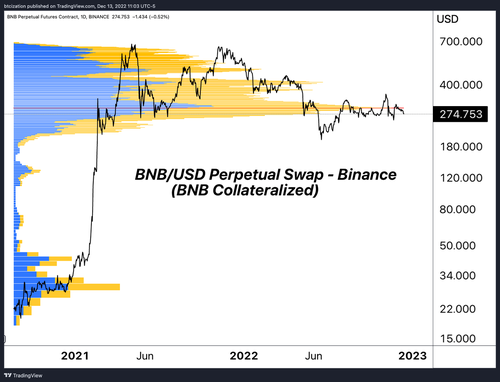

$BNB can be used as collateral on Binance, and they also subsidize the rate:https://t.co/BzHnJ4II1t

— Dylan LeClair 🟠 (@DylanLeClair_) December 12, 2022

If it's used as collateral, explain how it trades with 2x the volatility of $BTC during the bull, but no excess vol in the bear...

Last 758 days: BNB/BTC +898%, BTC/USD +0% pic.twitter.com/Crtao4x0UQ

How does something that traded with double the realized volatility of bitcoin during the bull market now have the same implied volatility in the bear market after it has appreciated by over an order of magnitude with a strong relative outperformance throughout 2022?

The entire “industry” is cross-collateralized, and all of the altcoins are merely riding on the beta of bitcoin with far less liquidity, thus having greater volatility and potential (fleeting) upside.

We think this attempt at modern alchemy is destined to fail, at worst. At best, the asset likely drastically underperforms global neutral money through its adoption phase. Said differently, the worst-case, paranoid-style take would be that the exchange rate of BNB is tied to the solvency status of Binance the exchange. We don’t think that there is an overly strong probability of this outcome per say, but it is certainly non-zero.

The coming weeks will be full of headlines around the state of global crypto regulation in a post-FTX world. In a 48-hour period, Reuters published news stating that the U.S. Justice Dept is split over charging Binance, Binance withdrawals for bitcoin and aggregate stablecoin pairs have hit all-time highs and the BNB exchange token has fallen 10% relative to bitcoin.

Out of an abundance of caution, we will continue to urge readers operating on any centralized exchange — of which Binance is most definitely included — to look into self custody solutions. There have been far too many instances of incompetence and/or misconduct from exchanges.

It’s not that we don’t trust CZ or Binance, it's the fact that we don’t trust anyone.

The whole point of bitcoin is we now have an asset that is truly the liability of no one. Verify the ownership of an open distributed network with cryptography; don’t trust permissioned IOUs. With the mix of regulatory concerns about the global crypto derivatives industry, a questionable exchange token with unbelievable relative performance over the last two years and a shaky proof-of-reserves attestation — that was incorrectly claimed to be an audit and had industry CEOs raising eyebrows — we find the need to urge our readers to evaluate their counterparty risk.

We will update readers as the situation developers.

* * *

Relevant Past Articles:

Update (0720ET): Crypto exchange Binance has seen its proof-of-reserve audits removed from auditor Mazars’ website.

“Mazars has indicated that they will temporarily pause their work with all of their crypto clients globally, which include Crypto.com, KuCoin, and Binance. Unfortunately, this means that we will not be able to work with Mazars for the moment,” a spokesperson for the firm said in an emailed statement to Bloomberg News on Friday.

Binance CEO Changpeng “CZ” Zhao was quick to react to the news on Twitter with a retweet from a random commenter.

“Making a statement on why an auditing company decided to quit working with crypto? Ask them lol,” the tweet reads.

The news comes shortly after Mazars confirmed on Dec. 7 that Binance possessed control over 575,742 Bitcoin of its customers, worth around $9.7 billion at the time of writing.

The report has since been also removed from Mazars’ website.

CZ appeared on CNBC yesterday to ‘explain’…

Holy Sh*t!

Get your bitcoin OFF Binance.#bitcoinpic.twitter.com/xSxNoyARXH

— Neil Jacobs (@NeilJacobs) December 15, 2022

Bitcoin puked right as the Mazars headlines hit, dropping back to $17,000…

* * *

As Bitcoin Magazine Pro’s Dylan LeClair and Sam Rule asked (and answered) earlier, is Binance facing FUD or legitimate questions?

Binance’s bitcoin balance sees its largest one-day outflow ever. BUSD stablecoin experiences large redemptions and the price legitimacy for the exchange-native BNB token is called into question.

By far, one of the biggest winners in the aftermath of the FTX collapse has seemed — on the surface — to be Binance. After only having 7.82% market share of the bitcoin supply on exchanges in 2018, their share is now 27.50% despite a much broader trend of bitcoin supply leaving exchanges. The bitcoin balance on Binance now totals 595,864 BTC, which is 3.1% of outstanding supply, worth $10.58 billion. This bitcoin belongs to their customers and reflects a growing trend in market share over the last few years that has made Binance the largest bitcoin and cryptocurrency exchange in the world.

As highlighted previously in “The Exchange War: Binance Smells Blood As FTX/Alameda Rumors Mount,” Binance now controls approximately 60% of the spot and derivatives volume in the entire market as well. It’s hard to see how any exchange in the space can be a “winner” in the current market conditions, but one could make the case for Binance, with the exchange’s growing strength in a decimated industry. On top of that, Binance’s BNB token, the native currency of Binance’s own Ethereum-competing Layer 1 blockchain, is still one of the better performing tokens when valued in bitcoin terms this year.

Yet, is this recent “strength” everything that it seems or is it a facade? We’ve learned over the last month that no company is safe in this industry right now (especially exchanges) and questions are growing around Binance’s practices, solvency, BNB token value and the overall state of their business over the last few weeks. Is it FUD or legit? Let’s try to break some of it down, addressing the concerns through an objective and skeptical lens.

Binance Flows

Over the last day, we’ve seen significant outflows from Binance across different various tokens and bitcoin when looking at both Nansen and Glassnode tracking. Across ETH and ERC20 tokens, Binance saw $3 billion leaving the exchange in its largest single-day outflow since June. Across Nansen total wallet tracking, all Binance balances are estimated at $62.5 billion with around 50% of those balances in stablecoins across BUSD and USDT.

Source: Nansen

Source: Nansen

According to Glassnode, the total bitcoin exchange balance on Binance is down around 6-7% over the last day, after reaching a peak on December 1. Although balances remain above 500,000 bitcoin and Binance has shown a rising trend of bitcoin balances on the platform this year, this is a significant move for outflows in just 24 hours. The largest one-day change in bitcoin outflows was just shy of 4% back in July. As a general comparison, the trend of bitcoin exchange balances was a much different story for FTX, whose balance had been falling heavily since June.

Note that in some of the charts below, exchange balances are using daily data from Glassnode instead of 10-minute or 1-hour intervals where we can see more of the latest bitcoin exchange outflows. The numbers above reference the latest 1-hour interval data. Exchange balance data, especially intraday, can change and data is typically more reliable on a longer time horizon, especially given that we have little insight into Glassnode’s classification and data science techniques that are used to label different wallets and addresses. Yet, however you cut the data, Binance outflows over the last 24 hours are a bit alarming and raise questions: Is this a one-off event and just business as usual or is this the start of something more?

In absolute terms, the last 24 hours have brought about the largest ever flight away from Binance for both bitcoin and stablecoins — an extremely notable move.

In particular, in the case of BUSD, Binance’s native stablecoin that has its reserves custodied by U.S. financial firm Paxos, there has been a notable amount of redemptions as of late. Large holders of BUSD have been withdrawing from Binance and sending it to Paxos, redeeming the stablecoins for dollars. This shows up as BUSD being “burned” at the Paxos Treasury.

🔥 🔥 🔥 🔥 🔥 🔥 🔥 🔥 🔥 🔥 559,000,053 #BUSD (558,832,353 USD) burned at Paxos Treasuryhttps://t.co/y925vxE9sB

— Whale Alert (@whale_alert) December 13, 2022

🔥 🔥 🔥 🔥 🔥 🔥 🔥 🔥 🔥 🔥 700,000,000 #BUSD (700,350,000 USD) burned at Paxos Treasuryhttps://t.co/hXClXhREUK

— Whale Alert (@whale_alert) December 13, 2022

Readers can track the on-chain addresses provided by Binance for free here.

The main cause for concern is not whether Binance has any bitcoin/crypto or not. We can transparently see that the firm controls tens of billions worth of crypto assets. What isn’t exactly clear, similar to FTX, is whether the firm has commingled users funds or whether the firm has any outstanding liabilities against user assets.

Binance CEO Changpeng Zhao (CZ) has said that the firm has no liabilities with any other firms, but as recent months have shown, words don’t mean all that much. While we are not claiming that CZ is lying to the public about the state of Binance finances, we have no way to prove otherwise.

Will you be doing an independent audit on liabilities against those reserves and will other coins be audited also in due time?

— Willy Woo (@woonomic) December 7, 2022

yes, but liabilities are harder. We don’t owe any loans to anyone. You can ask around.

— CZ 🔶 Binance (@cz_binance) December 7, 2022

CZ’s response as to whether the company was going to audit liabilities against user assets was, “Yes, but liabilities are harder. We don’t owe any loans to anyone. You can ask around.”

Unfortunately, “ask around” isn’t a satisfactory enough answer for an ecosystem supposedly built around the ethos of don’t trust, verify.

Big red flag for me is that this seems to be more of an attempt at proving collateral rather than proving reserves. They even admit to be insolvent with regard to actual assets owed vs tokens controlled. The “collateral” accounting trick is exactly how FTX played solvent as well.

— Jesse Powell (@jespow) December 11, 2022

While there is no doubt that Binance is an industry giant in the crypto derivatives industry, how do we know the firm isn’t doing similar things as past actors in regards to trading against clients using user funds and/or proprietary data. Things like the former Chief Legal Officer of Coinbase departing Binance U.S. last summer after just three months as the CEO leaves one with many questions.

To add to our skepticism, the price of the Binance exchange token BNB is near all-time highs in bitcoin terms, appreciating an astounding 828% against bitcoin in the last 785 calendar days.

Is BNB, a more centralized cousin to Ethereum, really worth approximately 14% of all bitcoin that will ever exist? BNB is not equity in the Binance company. BNB is a crypto token spun up from nothing in 2017.

BNB is one of the few cryptocurrencies that is up year-to-date in bitcoin terms, with the others being illiquid alts well below their BTC-denominated all-time highs.

The only other two outperformers during 2022 have been the “meme” DOGE, which is 55% below its all time high in bitcoin terms, and quasi-security XRP, which has been delisted by major exchanges and is 87% below its all-time highs in bitcoin terms.

Why is the outperformance so notable? Why are we hammering this point so hard? Because financial markets aren’t magical machines tied to a fantasy-land reality. Financial markets — while appearing to be disconnected from reality at times — always come crashing down to reality, exposing those that were possibly perceived as giants once before.

For the most part, the crypto industry is an attempt at modern alchemy, and exchange tokens minted from nothing with centrally engineered “tokenomics” are no different.

In fact, they are part of the problem.

It could be possible that BNB was pushed up with the internal help of Binance or its unofficial affiliates during the bull run. Just look at the volume profile of where coins changed hands on its native exchange. While it would be a leap of faith to say this took place directly using customer funds à la FTX, the revenue of the company has been used to buy back the token, similar to a stock buyback.

Label me a pessimist, but all I see is a whole lot of hot air.

9x in two months during the bull run with barely a retrace? 10x against BTC since 2021?

Must be a “new paradigm”.$BNB pic.twitter.com/ysJ04lXPPZ

— Dylan LeClair 🟠 (@DylanLeClair_) November 29, 2022

While it remains to be seen whether the firm is levered against its own token in any sort of way, it would certainly be no surprise to us if the company supported the ascent of the token/chain, similarly to many other exchanges with token that outperformed bitcoin during the bull run. BNB is a “blockchain” that can be arbitrarily halted by the Binance team. It is not even attempting to be a decentralized application set.

An exploit on a cross-chain bridge, BSC Token Hub, resulted in extra BNB. We have asked all validators to temporarily suspend BSC. The issue is contained now. Your funds are safe. We apologize for the inconvenience and will provide further updates accordingly.

— CZ 🔶 Binance (@cz_binance) October 6, 2022

$600 million hack of BNB, and Binance has decided to halt BSC (Binance Smart Chain).

[De]Centralized finance.

— Dylan LeClair 🟠 (@DylanLeClair_) October 6, 2022

That’s fine, but we remain extremely skeptical that its relative valuation against bitcoin — what we believe to be humanity’s best bet as decentralized digital cash — is tethered to reality.

$BNB can be used as collateral on Binance, and they also subsidize the rate:https://t.co/BzHnJ4II1t

If it’s used as collateral, explain how it trades with 2x the volatility of $BTC during the bull, but no excess vol in the bear…

Last 758 days: BNB/BTC +898%, BTC/USD +0% pic.twitter.com/Crtao4x0UQ

— Dylan LeClair 🟠 (@DylanLeClair_) December 12, 2022

How does something that traded with double the realized volatility of bitcoin during the bull market now have the same implied volatility in the bear market after it has appreciated by over an order of magnitude with a strong relative outperformance throughout 2022?

The entire “industry” is cross-collateralized, and all of the altcoins are merely riding on the beta of bitcoin with far less liquidity, thus having greater volatility and potential (fleeting) upside.

We think this attempt at modern alchemy is destined to fail, at worst. At best, the asset likely drastically underperforms global neutral money through its adoption phase. Said differently, the worst-case, paranoid-style take would be that the exchange rate of BNB is tied to the solvency status of Binance the exchange. We don’t think that there is an overly strong probability of this outcome per say, but it is certainly non-zero.

The coming weeks will be full of headlines around the state of global crypto regulation in a post-FTX world. In a 48-hour period, Reuters published news stating that the U.S. Justice Dept is split over charging Binance, Binance withdrawals for bitcoin and aggregate stablecoin pairs have hit all-time highs and the BNB exchange token has fallen 10% relative to bitcoin.

Out of an abundance of caution, we will continue to urge readers operating on any centralized exchange — of which Binance is most definitely included — to look into self custody solutions. There have been far too many instances of incompetence and/or misconduct from exchanges.

It’s not that we don’t trust CZ or Binance, it’s the fact that we don’t trust anyone.

The whole point of bitcoin is we now have an asset that is truly the liability of no one. Verify the ownership of an open distributed network with cryptography; don’t trust permissioned IOUs. With the mix of regulatory concerns about the global crypto derivatives industry, a questionable exchange token with unbelievable relative performance over the last two years and a shaky proof-of-reserves attestation — that was incorrectly claimed to be an audit and had industry CEOs raising eyebrows — we find the need to urge our readers to evaluate their counterparty risk.

We will update readers as the situation developers.

* * *

Relevant Past Articles:

Loading…