Perhaps all the cheer around record Black Friday online sales, fueled by 'Buy Now, Pay Later' options, may be unwarranted, as a new Bloomberg report suggests that this year's most important shopping day fell short of expectations for major retailers.

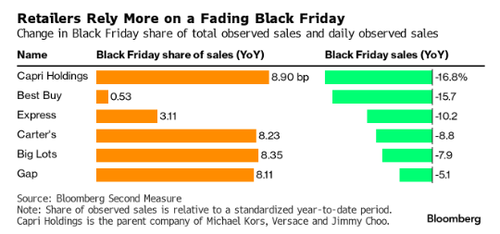

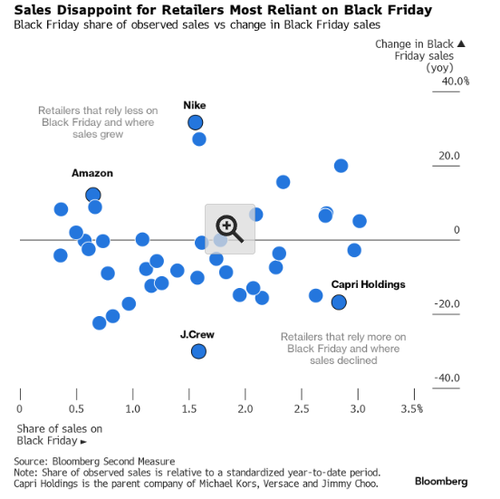

According to an analysis of Bloomberg Second Measure transaction data, the median decline in Black Friday sales was about 4% for a basket of 40 companies that have a higher percentage of year-to-date sales from the shopping holiday versus peers. The data showed that this year's drop was sharper than Black Friday 2022.

Data from Bloomberg Second Measure is derived from a sample of millions of US credit and debit card users. The retailers in focus heavily relied on Black Friday.

"Black Friday represented more than five times an average day's worth of observed US direct-to-consumer sales to date, according to the median estimate for the group. That's the highest level since 2019, meaning these retailers are relying more on this one shopping day even as the number of bargain hunters they're attracting dwindled," Bloomberg noted.

Despite Adobe Analytics data that showed Black Friday spending online jumped 7.5% compared to last year, the data from Bloomberg appears to show a shift in consumers who are gravitating away from traditional Black Friday retailers that Bloomberg tracks to discount retailers (trading down) and or spending more on experiences and travel purchases.

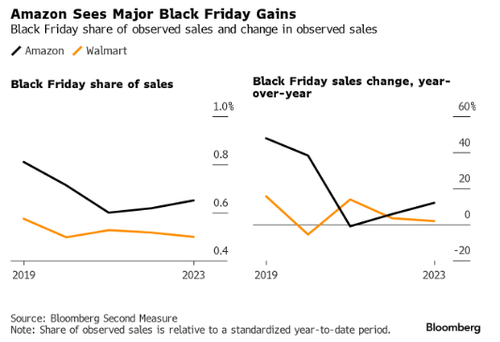

This might be why Bloomberg Second Measure data shows rising sales for discounters such as Walmart, TJ Maxx, and Marshalls. Even Amazon touted its 'record-breaking' sales to kick off the holiday season.

As for most other retailers that Bloomberg tracks, Black Friday actually fell by double digits in some cases.

Weeks ago, before the shopping holiday, corporate executives from Walmart to McDonald's were correct about consumers, calling them "choiceful" in third quarter earnings calls.

The biggest takeaway from this report is that consumers traded down from traditional retailers to discounting ones on Black Friday, as Bidenomics has been a complete and utter failure for the working poor. And if consumers are heavily relying on BNPL services at discount retailers, then this is a very ominous sign heading into 2024.

Perhaps all the cheer around record Black Friday online sales, fueled by ‘Buy Now, Pay Later‘ options, may be unwarranted, as a new Bloomberg report suggests that this year’s most important shopping day fell short of expectations for major retailers.

According to an analysis of Bloomberg Second Measure transaction data, the median decline in Black Friday sales was about 4% for a basket of 40 companies that have a higher percentage of year-to-date sales from the shopping holiday versus peers. The data showed that this year’s drop was sharper than Black Friday 2022.

Data from Bloomberg Second Measure is derived from a sample of millions of US credit and debit card users. The retailers in focus heavily relied on Black Friday.

“Black Friday represented more than five times an average day’s worth of observed US direct-to-consumer sales to date, according to the median estimate for the group. That’s the highest level since 2019, meaning these retailers are relying more on this one shopping day even as the number of bargain hunters they’re attracting dwindled,” Bloomberg noted.

Despite Adobe Analytics data that showed Black Friday spending online jumped 7.5% compared to last year, the data from Bloomberg appears to show a shift in consumers who are gravitating away from traditional Black Friday retailers that Bloomberg tracks to discount retailers (trading down) and or spending more on experiences and travel purchases.

This might be why Bloomberg Second Measure data shows rising sales for discounters such as Walmart, TJ Maxx, and Marshalls. Even Amazon touted its ‘record-breaking’ sales to kick off the holiday season.

As for most other retailers that Bloomberg tracks, Black Friday actually fell by double digits in some cases.

Weeks ago, before the shopping holiday, corporate executives from Walmart to McDonald’s were correct about consumers, calling them “choiceful” in third quarter earnings calls.

The biggest takeaway from this report is that consumers traded down from traditional retailers to discounting ones on Black Friday, as Bidenomics has been a complete and utter failure for the working poor. And if consumers are heavily relying on BNPL services at discount retailers, then this is a very ominous sign heading into 2024.

Loading…