By Heather Burke, Bloomberg Markets Live analyst and reporter

Retail’s horrible 2022 is unlikely to get any better as the all-important holiday season unofficially kicks off this week amid an unprecedented cost-of-living crisis on both sides of the Atlantic.

Retail is one of the worst-performing S&P 500 GICS 2 sectors year-to-date, down more than 30% compared with the overall benchmark’s decline of about 17%. Some of that stems from the selloff in mega-tech: Amazon.com is approximately 45% of the gauge and responsible for about 75% of retail’s decline in terms of market cap.

But even minimizing Amazon with the equal-weight S&P Retail Select Industry Index (SPSIRE), down almost 30% year-to-date, underscores the sector’s underperformance.

US retail sales posted the biggest increase in eight months in October, but some discretionary categories like electronics declined, suggesting price cuts and weaker demand are weighing on the value of sales. Inflation, while slowing, remains firmly entrenched above pre-pandemic levels, meaning people are spending more on essentials like food and gas. Lower gasoline prices may help. But consumer sentiment is fragile amid rising borrowing costs. Some spending has also shifted from goods to experiences such as travel.

Retailers including Macy’s, Gap and Ross Stores rallied last week on strong earnings; for some, measures to clear inventory with big discounts paid off. But others said sales slowed in recent weeks and gave cautious outlooks. Ross said “we continue to expect a very promotional holiday selling season.” Target tumbled post-results as shoppers were hit by “inflation, rising interest rates and economic uncertainty,” the CEO said; discretionary categories have lagged.

And while Walmart boosted its forecast, part of that came from higher-income shoppers trading down, and a shift to groceries from general merchandise. Even Amazon is concerned, projecting the slowest holiday-quarter growth in its history.

The National Retail Federation forecasts sales rising by 6% to 8% in November and December, well below last year’s record 13.5% increase. Retailers may have to discount deeply to attract shoppers, threatening profitability at a peak period.

Black Friday, the informal start of the peak shopping season, comes this week amid the muted backdrop. A Goldman Sachs survey of 1,000 US consumers found that nearly half plan to spend less this holiday season than they did in 2021.

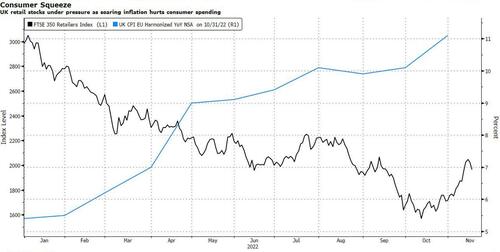

Retail stocks are also being battered in Europe and are among the most shorted. While the sector, like US peers, has benefited from the bear market rally, it’s still the second-worst performer in the Stoxx 600 year-to-date, with consumer confidence near a record low.

UK retail stocks have seen particular misery amid the sharpest drop in living standards. It’s one of the worst-performing FTSE 350 sectors so far this year. October’s retail sales were worse than expected.

Consumers face higher taxes and spending cuts as the government tries to tackle inflation and rein in the budget deficit. Disposable incomes will probably fall 7% in the next two years under last week’s measures set out by the Chancellor of the Exchequer.

Retail has become a bit of a recovery play in the recent bear market rally and US consumers have shown resilience by some measures such as credit. But with multiple retail gauges set for the worst year since the global financial crisis, it will take a remarkably strong holiday season to overcome 2022’s gloom -- and next year may not be much better.

By Heather Burke, Bloomberg Markets Live analyst and reporter

Retail’s horrible 2022 is unlikely to get any better as the all-important holiday season unofficially kicks off this week amid an unprecedented cost-of-living crisis on both sides of the Atlantic.

Retail is one of the worst-performing S&P 500 GICS 2 sectors year-to-date, down more than 30% compared with the overall benchmark’s decline of about 17%. Some of that stems from the selloff in mega-tech: Amazon.com is approximately 45% of the gauge and responsible for about 75% of retail’s decline in terms of market cap.

But even minimizing Amazon with the equal-weight S&P Retail Select Industry Index (SPSIRE), down almost 30% year-to-date, underscores the sector’s underperformance.

US retail sales posted the biggest increase in eight months in October, but some discretionary categories like electronics declined, suggesting price cuts and weaker demand are weighing on the value of sales. Inflation, while slowing, remains firmly entrenched above pre-pandemic levels, meaning people are spending more on essentials like food and gas. Lower gasoline prices may help. But consumer sentiment is fragile amid rising borrowing costs. Some spending has also shifted from goods to experiences such as travel.

Retailers including Macy’s, Gap and Ross Stores rallied last week on strong earnings; for some, measures to clear inventory with big discounts paid off. But others said sales slowed in recent weeks and gave cautious outlooks. Ross said “we continue to expect a very promotional holiday selling season.” Target tumbled post-results as shoppers were hit by “inflation, rising interest rates and economic uncertainty,” the CEO said; discretionary categories have lagged.

And while Walmart boosted its forecast, part of that came from higher-income shoppers trading down, and a shift to groceries from general merchandise. Even Amazon is concerned, projecting the slowest holiday-quarter growth in its history.

The National Retail Federation forecasts sales rising by 6% to 8% in November and December, well below last year’s record 13.5% increase. Retailers may have to discount deeply to attract shoppers, threatening profitability at a peak period.

Black Friday, the informal start of the peak shopping season, comes this week amid the muted backdrop. A Goldman Sachs survey of 1,000 US consumers found that nearly half plan to spend less this holiday season than they did in 2021.

Retail stocks are also being battered in Europe and are among the most shorted. While the sector, like US peers, has benefited from the bear market rally, it’s still the second-worst performer in the Stoxx 600 year-to-date, with consumer confidence near a record low.

UK retail stocks have seen particular misery amid the sharpest drop in living standards. It’s one of the worst-performing FTSE 350 sectors so far this year. October’s retail sales were worse than expected.

Consumers face higher taxes and spending cuts as the government tries to tackle inflation and rein in the budget deficit. Disposable incomes will probably fall 7% in the next two years under last week’s measures set out by the Chancellor of the Exchequer.

Retail has become a bit of a recovery play in the recent bear market rally and US consumers have shown resilience by some measures such as credit. But with multiple retail gauges set for the worst year since the global financial crisis, it will take a remarkably strong holiday season to overcome 2022’s gloom — and next year may not be much better.