Good morning and welcome to a global market meltdown, sparked by last week's catastrophic BOJ decision to hike rates by 0.15bps which in turn crushed the $20 trillion yen carry trade, sent the yen exploding higher and wiping out trillions in highly levered investments, leading to a cascade of selling and forced liquidations which has resulted a historic market crash in Japan and a rout everywhere else.

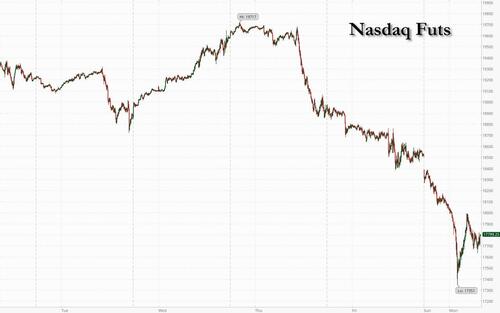

In the US, futures are sharply lower with tech plunging as the global AI/Semis trade - itself a byproduct of the carry trade - is sold and small-caps are re-shorted. The Nasdaq 100 is set for its biggest opening drop in more than four years, as investors bracing for days of volatility amid rising concerns over a slowing US economy and overheated gains in the tech sector. Nasdaq 100 futures fell as much as 6.5% before paring losses to about 4.5%. That puts the tech-heavy index on track for its worst open since the pandemic days of March 2020.

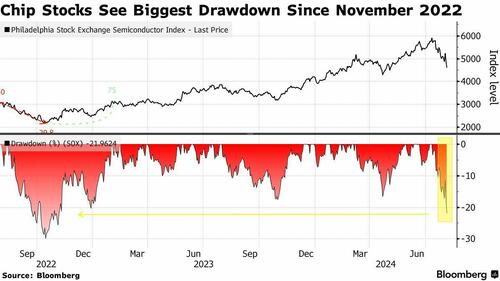

The Nasdaq dropped into a correction Friday as investors freaked out over elevated valuations and the high cash outlay for investments in artificial intelligence. The Philadelphia Semiconductor Index is already in a bear market, tumbling 22% from a peak, even before Monday’s open.

Meanwhile, S&P 500 futures were down 3.0% while those tracking the Dow Jones Industrial Average declined 1.6%.

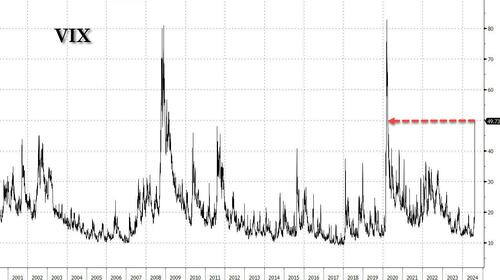

While both Nasdaq and Russell futures have pared their largest overnight losses, brace for more waves of selling as the VIX spikes above 62 and forces margin call after margin call, and volatility sellers are carted out...

... the highest print since the Covid crash when it peaked just over 80.

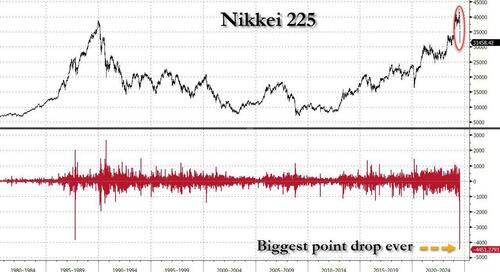

While US futures are a bloodbath, nobody had it as bad as Japan whose benchmark Nikkei 225 index recorded its worst-ever daily sell-off on Monday, losing 4,451.28 points from the previous day's closing amid panic selling triggered by fears of a possible U.S. recession and the yen's strength.

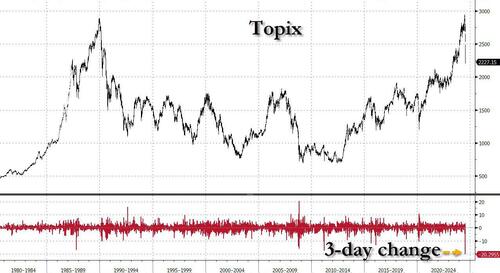

The sell-off was the largest ever in history and worse than in the Black Monday crash of October 1987, when it lost 3,836.48 points. The average closed down 12.4% to 31,458.42. On a percentage basis it wasn't much better, with the Nikkei's peer, Topix, tumbling -12.2%, its biggest one day drop since the 1987 stock market crash and the second worst day since data begins in 1949; the index is poised for its biggest three-day drop on record.

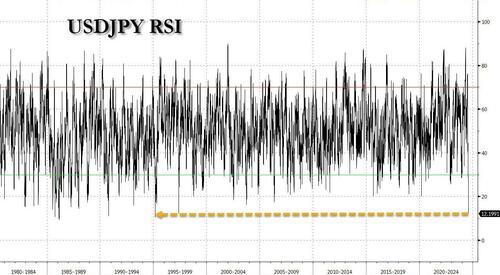

Turbulence in Japan, where the central bank started to raise interest rates as the Fed looks to cut in a historic mistake that has already wiped out trillions in value, is also having ripple effects across global markets of various asset classes. This is due to moves to reverse carry trades, in which investors had borrowed at lower rates in Japan to fund purchases of higher-yielding assets elsewhere, and nowhere has this been felt more than the yen: the USDJPY is down a record 20 big figures from 162 just a few weeks ago to 142 this morning, tumbling more than 3% since Friday.

The constant selling has pushed the USDJPY RSI to the most oversold level since 1995.

“With yen carry trades now being unwound quickly, not only has the Japanese currency notably broken its depreciation trend against all major units, but risk assets that those trades were financed with are also being sold off,” wrote Asymmetric Advisors strategist Amir Anvarzadeh, in a note to clients.

Back to the US, looking at the premarket, it's a tech rout for understandable reasons: many of the best performing stocks were direct beneficiaries of the leverage afforded by the carry trade and sure enough, all the Mag 7 names are crashing: NVDA -9.3%, AAPL -8.6%, TSLA -7.4%, MSFT -4.5%, AMZN -3%, META -6%, GOOG -5% and Semis are under pressure. Here are all the most notable premarket movers:

- Nvidia falls 12% as megacap technology stocks are bearing the brunt of the selloff as investor brace for days of volatility amid rising concerns over a slowing US economy and overheated gains in the tech sector.

- Apple -7%, Meta Platforms -5% Microsoft Corp. -4%, Tesla -9%

- Nvidia shares are also down following a report that the company’s upcoming artificial intelligence chips will be delayed due to design flaws.

- Apple’s stock is also being hurt after Berkshire Hathaway reported on Saturday that it had slashed its stake in the company by almost 50% as part of a massive second-quarter selling spree

- Cryptocurrency-linked companies tumbled as Bitcoin added to a 13% drop last week that was the worst since the period when the FTX exchange imploded. The weakness in the digital token comes amid a broader selloff in global stock markets

- Coinbase Global -15%, Riot Platforms -14%, Marathon Digital -14%

- Kellanova rises 20% after Reuters reported Mars was exploring an acquisition of the snack maker, citing people familiar with the matter.

- Moderna drops 5% as RBC cut its rating to sector perform, noting an “increasingly uncertain outlook.”

“In these sorts of scenarios, investors need to be careful,” said Ben Barringer, an analyst at Quilter Cheviot. “When sentiment begins to sour, the falls become more extreme than perhaps they should be. The next few weeks is likely to be a volatile one for tech stocks as this new environment plays out.”

While the US may have just hit $35 trillion in debt for now that is of secondary concern amid a global flight to safety, and bond yields are lower with the yield curve bull steepening and 2s/10s ~4.5bps from being fully dis-inverted as the 10Y tumbles to 3.72%. Today’s macro focus is ISM-Srvcs (51.0 survey vs. 48.8 prior), Senior Loan Officer Survey, and 2x Fedspeakers.

“With the summer low liquidity, the still heavy trend plays that need unwinding and the VIX sky-high, this selloff move could go on for a few days,” said Florian Ielpo, head of macro research at Lombard Odier Asset Management. Still, “the macro picture itself is not as bad as the market seems to think.”

Concerns over health of the US economy took center stage after Friday’s data pointed to rising unemployment levels in July, triggering a closely watched recession indicator and stoking fears that the Federal Reserve hasn’t moved quickly enough to cut interest rates. Investors bid up haven assets such as the yen, while Cboe VIX August futures spiked.

“The key point is the current shift in narrative, from no landing to soft landing,” said Florian Ielpo, the head of macro research at Lombard Odier Asset Management. “That risk was poorly priced and investors shifting gears fast explains the extent of the move.”

Elsewhere, Treasuries climbed as traders boosted bets on aggressive monetary policy easing by the Federal Reserve this year, with odds of an emergency meeting rising to 25%. US two-year yields fall 11bps to 3.77%.

In FX, we already covered the main highlights: the yen soared 3.2% against the greenback, pulling USDJPY down to ~142.05. The Swiss franc also outperforms, rising 1%, while the euro adds 0.4%. Bitcoin slumps over 10%.

In rates, Treasuries retained about half of their steep, front-end-led gains during Asia session and European morning, with 2-year yields richer by 13bp at around 3.75% after falling nearly 27bp Friday. US yields remain richer by 13bp to 4bp across the curve in an aggressive bull-steepening move that has 2s10s spread wider by almost 8bp and approaching dis-inversion for the first time since July 2022. US 10-year yields trade around 3.75% after reaching lowest since June 2023. Investors continue to price in aggressive rate cuts by the Federal Reserve, with about 55bp of easing now priced in for September FOMC meeting, 100bp by November’s. In other words, there is about 20% odds of an emergency rate cut already priced in. Similar gains seen in core European rates, where 2-year German yields are lower by around 11bp on the day. US session includes ISM services data at 10am New York time.

In commodities, oil prices decline, with WTI falling 1.9% to trade near $72.10 a barrel. Spot gold falls $18 to around $2,425/oz.

US economic data slate includes July S&P Global US services PMI (9:45am) and ISM services index (10am), and Fed’s Senior Loan Officer Opinion survey (2pm). Scheduled Fed speaker slate includes Goolsbee (8:30am) and Daly (5pm).

Market Snapshot

- S&P 500 futures down 3.6% to 5,184

- STOXX Europe 600 down 2.3% to 486.40

- MXAP down 6.0% to 166.21

- MXAPJ down 4.1% to 530.79

- Nikkei down 12.4% to 31,458.42

- Topix down 12.2% to 2,227.15

- Hang Seng Index down 1.5% to 16,698.36

- Shanghai Composite down 1.5% to 2,860.70

- Sensex down 2.6% to 78,911.70

- Australia S&P/ASX 200 down 3.7% to 7,649.56

- Kospi down 8.8% to 2,441.55

- German 10Y yield -3 bps at 2.14%

- Euro up 0.5% to $1.0970

- Brent Futures down 1.0% to $76.06/bbl

- Gold spot down 0.7% to $2,425.51

- US Dollar Index down 0.72% to 102.46

Top Overnight News

- Japan’s Nikkei Stock Average closed down 12.4% in its biggest single-day percentage fall since 1987, a historic drop triggered by disappointing U.S. jobs data and a further rise in the yen. Highest turnover day ever for tpx >8trln YEN, 2nd largest drop index drop since 1987, tpx had 131 stocks close limit down, Nky had 20. Retail margin length is at highs. Mkt Underestimated CTA selling, overestimated Domestic support levels at 38, and 34…. maybe 25. WSJ / GS GBM

- China is successfully bypassing US export controls to obtain high-end AI chips. China’s gov’t reiterated its intent to bolster consumer spending (the government has been beating this drum for a VERY long time, but efforts thus far have failed to yield tangible results). NYT / BBG

- Goldman increased its 12-month recession odds by 10pp to 25%. The bank continues to see recession risk as limited not only because the data look fine overall and does not see major financial imbalances, but also because—as Chair Powell emphasized last week—the Fed has 525bp of room to cut the funds rate and would surely be quick to support the economy if necessary. The bank changed its Fed forecast after the employment report to include an initial string of three consecutive 25bp rate cuts in September, November, and December (vs. quarterly cuts previously). GIR

- Berkshire Hathaway slashed its Apple stake by almost 50%, while its cash pile soared to a record $277 billion. Suppliers to the iPhone maker slumped amid the broader selloff even as some analysts said Warren Buffett may simply be taking profit. BBG

- Iran rejected U.S. and Arab efforts to temper its response to the killing in Tehran of Hamas’s top political leader, as authorities were investigating the security breaches that led to the attack. Iranian prosecutors said Saturday that they had opened a formal investigation into the killing of Ismail Haniyeh, which came hours after an Israeli strike killed a senior Hezbollah commander in Beirut. The two attacks, following a rocket strike on a soccer field in the Israeli-controlled Golan Heights, escalated a recent cycle of violence and threatened to push the region to the brink of war. WSJ

- The traditional playbook when it comes to extrapolating economic data may not be relevant in the post-COVID era (the creator of the “Sahm Rule” about how a 50bp increase in the unemployment rate signals a recession expressed skepticism about applying that benchmark in the present landscape). Barron's

- AI spending spree creating anxiety for tech investors as shareholders want more tangible proof that all the expenditures will drive profits in the future (but tech mgmt. teams suggest they won’t be dialing back anytime soon as they fear having inadequate capacity to capitalize on the AI opportunity). FT

- PE firms accelerate dealmaking activity as they prepare for the start of Fed easing (Ares, Apollo, Blackstone, and KKR deployed ~$160B in CQ2). FT

- GS PB on Friday’s flow: We saw broad-based net selling across all major regions, led by DM Asia (Japan saw the largest 1-day net selling since Mar ’20). While there was significant performance degradation on Friday as Marco pointed out, there was no further de-grossing by HFs per Prime data. Worth noting both Prime + franchise flows in the US were orderly and relatively modest on Friday. GSPB

A more detailed look at global markets courtesy of Newsquawk

APAC stocks mostly slumped following last Friday's continued sell-off on Wall St owing to disappointing jobs data which sparked recession concerns, while heightened tensions in the Middle East linger as markets await Iran's retaliation. ASX 200 declined with tech, financials and real estate leading the broad retreat seen across all sectors. Nikkei 225 continued its aggressive slide and dipped beneath the 33,000 level for the first time since early January, while the index entered into a bear market along with the Topix. Hang Seng and Shanghai Comp. showed early resilience with the mainland initially kept afloat after Caixin Services PMI topped forecasts, while China recently laid out its priorities to spur consumer spending and the State Council designated 20 key steps to expand basic consumption. However, the bourses later conformed to global losses. Nikkei 225 unofficially closes at 31458, -12.4%; closes with a record daily points fall, exceeding the drop on Black Monday in October 1987

Top Asian News

- China issued guidelines to promote high-quality development of service consumption, according to Bloomberg. China’s government on Saturday laid out its priorities to spur consumer spending as weak domestic demand continues to weigh on growth in which the State Council designated 20 key steps including exploring the potential to expand basic consumption in areas such as catering, home services and elderly care, according to a statement posted on the central government’s website.

- EU capitals are set to back tariffs on Chinese electric cars with member states likely to support the imposition of proposed tariffs on Chinese EVs in November, according to FT citing the bloc's trade commissioner Dombrovskis.

- BoJ Minutes from the June 13th-14th meeting stated that a few members said import prices are rising due to the recent yen fall, creating upside inflation risk, while a member said cost-push inflation could heighten underlying inflation if it leads to higher inflation expectations and wage increases. Furthermore, one member said the BoJ must raise rates at appropriate timing without delay although another member said a rate hike must be done only after inflation makes a clear rebound and data confirms heightening in inflation expectations, while members agreed recent weak yen pushes up inflation and warrants vigilance in guiding monetary policy.

- Japanese Finance Minister Suzuki says stock price is determined by the market; expects economy to gradually recover; Cooperating with BoJ and FSA and closely monitoring markets with a sense of urgency. Highly interested in the current stock market situation.

- Japan's Chief Cabinet Secretary Hayashi says they are monitoring financial situations both abroad and domestic with a sense of urgency, says it is important for the gov't to make a judgement on the market calmly.

- Thai Finance Minister says the stock market fall is being driven by external factors, should be supported by gov't measures

European bourses opened with marked downside, following the APAC pressure post-NFP with sentiment hit further by updates concerning Apple and Nvidia; since, benchmarks have lifted slightly off worst but remain under marked pressure, Euro Stoxx 50 -2.3%. In brief, APAC pressure was pronounced with circuit breakers triggered in Japan and South Korea while the Nikkei 225 closed with a record daily points fall. Sectors in the red, Energy lags as crude benchmarks come under renewed pressure with Tech hit on sentiment and AAPL/NVDA while Banks slump as yields fall and pricing for central bank easing lifts. Infineon opened as the DAX 40 laggard after missing forecasts, narrowing guidance and announcing layoffs.

Stateside, futures in the red given the above but have begun to consolidate just off worst levels with newsflow light and as we await ISM Services & Fed speak for direction; ES -2.4%, NQ -3.9%. Bloomberg headlines this morning suggested that traders are pricing a 60% chance that the Fed will cut rates by 25bps in the next week.

Top European News

- UK PM Starmer vowed that those responsible for the disorder and chaos that’s spreading across UK towns and cities will be punished for what he described as “far-right thuggery”, according to Bloomberg.

- Infineon (IFX GY) - Q3 (EUR): Revenue 3.7bln (exp. 3.8bln), Net 403mln (exp. 447mln), adj. Gross Margin 42.2% (exp. 40.3%), adj. EPS 0.43 (exp. 0.42). Further improvement to revenue and earnings seen in Q4, FY forecasts are well within the prior guided range. It is anticipated that revenue will increase in all four segments Q/Q. Q4 Guidance: Revenue 4bln (exp. 3.9bln). CEO says they are to cut around 1.4k jobs globally and will move an additional 1.4k. 3.6% weighting in the DAX 40

FX

- Hefty losses to begin the week for the USD with the DXY down to a 102.41 base as pricing for Fed easing ramps up considerably and as JPY strengthens significantly.

- USD/JPY down to a 141.70 base vs. a brief high-point of 146.56, action which comes as yields globally slump and differentials become more favourable following the BoJ's hike in addition to its typical haven status amid the broad sell off.

- EUR benefitting from the USD's pressure but with upside for the single currency capped/hampered by strength in the JPY and CHF; EUR/USD holding around 1.0950 just shy of the 1.0975 peak.

- Cable more contained and somewhat torn between USD pressure and EUR strength with yields not providing as much direction for GBP given the extent of last week's moves around the BoE.

- Antipodeans lag on the risk tone, AUD and NZD down to lows of 0.6350 and 0.5851 respectively.

Fixed Income

- Fixed benchmarks bid as the post-NFP sell-off reverberated into and was exacerbated during APAC trade. The odds of Fed easing have ramped up even more with a 50bp cut almost entirely priced for September and implied pricing for a 25bp cut in the next week at 60%.

- USTs at highs, yields lower across the curve with just the 20yr & 30yr remaining above 4.0% at lows of 4.08% and 4.01% respectively.

- EGBs and Gilts in-fitting, Bunds up to a 136.28 peak and on track for a 10th consecutive session of gains while Gilts are also at highs but slightly more modest after last week's action.

- No real move to the session's Final PMIs and EZ Sentix, though both PMIs and Sentix remain downbeat on Germany with the latter noting that “recession bells are ringing again in Germany”.

Commodities

- Crude is conforming to the broader risk aversion after the US jobs data on Friday stoked fears of a recession against the backdrop of sluggish Chinese demand; though, downside has at times been cushioned by ongoing geopolitical tensions.

- WTI and Brent at the low-points of session parameters, below USD 72.00/bbl and nearing USD 76.00/bbl respectively.

- Precious metals lower across the board as the USD managed to pick up slightly from worst levels and with XAU being outshone by marked JPY and Fixed bids; holding around USD 2430/oz after being as high as USD 2458/oz overnight.

- Base metals are lower across the board given the mentioned risk tone and despite better-than-expected Chinese Caixin Services PMI.

- Saudi Arabia raised its official selling price for Asia in September by 20 cents to USD 2.00/bbl above the Oman/Dubai average, while it set the OSP to NW Europe to + USD 1.25/bbl vs ICE Brent and to the US at + USD 4.10/bbl vs ASCI.

- NHC said Tropical Storm Debby is strengthening over the southeastern Gulf of Mexico, while it later stated Debby has strengthened to a hurricane and is expected to make landfall in the Florida Big Bend area on Monday which will bring a major flood threat to the southeastern United States.

Geopolitics: Middle East

- Israel conducted strikes targeting two schools sheltering the displaced near Gaza City which killed at least 25 Palestinians, while the Israeli military said the strikes on Gaza schools targeted militants operating there. Israel also conducted a strike in the West Bank which killed a Hamas commander.

- Israeli PM Netanyahu on Sunday warned "Iran's axis of evil" against attacking Israel amid expectations that Tehran and the militant groups it supports are readying retaliatory strikes, according to dpa.

- Iran-led retaliatory assaults are “expected imminently” and will likely be simultaneous, coming from Hezbollah in Lebanon, the Houthis in Yemen and Iran itself, according to Israeli officials cited by Bloomberg and Iran International.

- Iran’s Revolutionary Guards said the terrorist act of killing Hamas chief Haniyeh was designed and executed by Israel with the support of the criminal US government, while it added that the adventurous and terrorist Zionist regime will decisively receive the response to this crime. Furthermore, the IRGC said Tehran’s revenge will be severe and at the appropriate time, place and manner, according to Reuters.

- US Secretary of State Blinken told his G7 counterparts on a conference call on Sunday that an attack by Iran and Hezbollah against Israel could begin within 24 to 48 hours, according to Walla News.

- IRGC sources told iNews Britain that Iran's response to Israel could come no later than Tuesday or Wednesday.

- Egypt’s Foreign Minister held a call with Iran’s Foreign Minister and stressed that recent developments are unprecedented, very dangerous and threatening to the region’s stability.

- US President Biden will speak to Jordan's King on Monday and will convene the national security team on Monday in the situation room to discuss Middle East developments, according to the White House.

- US Secretary of State Blinken spoke with Iraqi PM Al-Sudani and emphasised the importance of all parties taking steps to calm regional tensions and avoid escalation, while Iraq’s PM told Blinken in the phone call that preventing regional tensions is tied to stopping Israeli aggression on Gaza. It was separately reported that Blinken told G7 ministers that Iran and Hezbollah may attack Israel within the next 24 hours, according to Axios

- White House’s Finer said the US is trying to prepare for any scenario in the Middle East by warning citizens to leave Lebanon and the US is moving an aircraft carrier to the Middle East purely for defensive reasons, while Finer said the overall goal is to turn the temperature down in the region, according to a CBS interview.

- UK Foreign Office said Britain temporarily withdrew the families of officials working at the British embassy in Beirut due to a highly volatile security situation in Lebanon.

- US Central Command forces said they successfully destroyed an Iranian-backed Houthi missile and launcher in the Houthi-controlled area of Yemen. It was separately reported that Yemen’s Houthis said they targeted MV Groton in the Gulf of Aden with ballistic missiles.

- Israel could reportedly pre-emptively strike Iran in the scenario that intelligence was to show that an attack was imminent, via Times of Israel.

- US is reportedly willing to guarantee to Israel that it will be able to renew fighting against Hamas in Gaza after the first phase of a potential ceasefire and hostage deal, via Times of Israel.

Geopolitics: Other

- Ukrainian President Zelensky announced the arrival of F-16 fighter jets and said they are already in use in Ukraine’s skies, while he said Ukraine does not have enough F-16 pilots or jets and hopes training will be expanded. Furthermore, he plans to discuss at the Ukraine-NATO council the use of neighbouring countries’ aviation for air defence work.- Ukrainian military said it struck a Russian submarine and anti-aircraft system in Crimea, while it also struck Russia’s Morovosk airfield, as well as oil fields and fuel facilities in three Russian regions.

- Russian Defence Ministry said Russian forces captured a settlement in the Donetsk region.

- North Korean leader Kim said they will have a more improved level of nuclear readiness in the near future to respond to any challenges, while he added that stockpiling and improving nuclear weapons is the best way to counter the US, according to KCNA.

- Philippines and German Defence Ministers committed to concluding a broader defence agreement, while the Philippines Defence Minister said they invited German ships to participate in exercises.

US Event Calendar

- 09:45: July S&P Global US Services PMI, est. 56.0, prior 56.0

- 10:00: July ISM Services Index, est. 51.0, prior 48.8

- 14:00: Senior Loan Officer Opinion Survey on Bank Lending Practices

Good morning and welcome to a global market meltdown, sparked by last week’s catastrophic BOJ decision to hike rates by 0.15bps which in turn crushed the $20 trillion yen carry trade, sent the yen exploding higher and wiping out trillions in highly levered investments, leading to a cascade of selling and forced liquidations which has resulted a historic market crash in Japan and a rout everywhere else.

In the US, futures are sharply lower with tech plunging as the global AI/Semis trade – itself a byproduct of the carry trade – is sold and small-caps are re-shorted. The Nasdaq 100 is set for its biggest opening drop in more than four years, as investors bracing for days of volatility amid rising concerns over a slowing US economy and overheated gains in the tech sector. Nasdaq 100 futures fell as much as 6.5% before paring losses to about 4.5%. That puts the tech-heavy index on track for its worst open since the pandemic days of March 2020.

The Nasdaq dropped into a correction Friday as investors freaked out over elevated valuations and the high cash outlay for investments in artificial intelligence. The Philadelphia Semiconductor Index is already in a bear market, tumbling 22% from a peak, even before Monday’s open.

Meanwhile, S&P 500 futures were down 3.0% while those tracking the Dow Jones Industrial Average declined 1.6%.

While both Nasdaq and Russell futures have pared their largest overnight losses, brace for more waves of selling as the VIX spikes above 62 and forces margin call after margin call, and volatility sellers are carted out…

… the highest print since the Covid crash when it peaked just over 80.

While US futures are a bloodbath, nobody had it as bad as Japan whose benchmark Nikkei 225 index recorded its worst-ever daily sell-off on Monday, losing 4,451.28 points from the previous day’s closing amid panic selling triggered by fears of a possible U.S. recession and the yen’s strength.

The sell-off was the largest ever in history and worse than in the Black Monday crash of October 1987, when it lost 3,836.48 points. The average closed down 12.4% to 31,458.42. On a percentage basis it wasn’t much better, with the Nikkei’s peer, Topix, tumbling -12.2%, its biggest one day drop since the 1987 stock market crash and the second worst day since data begins in 1949; the index is poised for its biggest three-day drop on record.

Turbulence in Japan, where the central bank started to raise interest rates as the Fed looks to cut in a historic mistake that has already wiped out trillions in value, is also having ripple effects across global markets of various asset classes. This is due to moves to reverse carry trades, in which investors had borrowed at lower rates in Japan to fund purchases of higher-yielding assets elsewhere, and nowhere has this been felt more than the yen: the USDJPY is down a record 20 big figures from 162 just a few weeks ago to 142 this morning, tumbling more than 3% since Friday.

The constant selling has pushed the USDJPY RSI to the most oversold level since 1995.

“With yen carry trades now being unwound quickly, not only has the Japanese currency notably broken its depreciation trend against all major units, but risk assets that those trades were financed with are also being sold off,” wrote Asymmetric Advisors strategist Amir Anvarzadeh, in a note to clients.

Back to the US, looking at the premarket, it’s a tech rout for understandable reasons: many of the best performing stocks were direct beneficiaries of the leverage afforded by the carry trade and sure enough, all the Mag 7 names are crashing: NVDA -9.3%, AAPL -8.6%, TSLA -7.4%, MSFT -4.5%, AMZN -3%, META -6%, GOOG -5% and Semis are under pressure. Here are all the most notable premarket movers:

- Nvidia falls 12% as megacap technology stocks are bearing the brunt of the selloff as investor brace for days of volatility amid rising concerns over a slowing US economy and overheated gains in the tech sector.

- Apple -7%, Meta Platforms -5% Microsoft Corp. -4%, Tesla -9%

- Nvidia shares are also down following a report that the company’s upcoming artificial intelligence chips will be delayed due to design flaws.

- Apple’s stock is also being hurt after Berkshire Hathaway reported on Saturday that it had slashed its stake in the company by almost 50% as part of a massive second-quarter selling spree

- Cryptocurrency-linked companies tumbled as Bitcoin added to a 13% drop last week that was the worst since the period when the FTX exchange imploded. The weakness in the digital token comes amid a broader selloff in global stock markets

- Coinbase Global -15%, Riot Platforms -14%, Marathon Digital -14%

- Kellanova rises 20% after Reuters reported Mars was exploring an acquisition of the snack maker, citing people familiar with the matter.

- Moderna drops 5% as RBC cut its rating to sector perform, noting an “increasingly uncertain outlook.”

“In these sorts of scenarios, investors need to be careful,” said Ben Barringer, an analyst at Quilter Cheviot. “When sentiment begins to sour, the falls become more extreme than perhaps they should be. The next few weeks is likely to be a volatile one for tech stocks as this new environment plays out.”

While the US may have just hit $35 trillion in debt for now that is of secondary concern amid a global flight to safety, and bond yields are lower with the yield curve bull steepening and 2s/10s ~4.5bps from being fully dis-inverted as the 10Y tumbles to 3.72%. Today’s macro focus is ISM-Srvcs (51.0 survey vs. 48.8 prior), Senior Loan Officer Survey, and 2x Fedspeakers.

“With the summer low liquidity, the still heavy trend plays that need unwinding and the VIX sky-high, this selloff move could go on for a few days,” said Florian Ielpo, head of macro research at Lombard Odier Asset Management. Still, “the macro picture itself is not as bad as the market seems to think.”

Concerns over health of the US economy took center stage after Friday’s data pointed to rising unemployment levels in July, triggering a closely watched recession indicator and stoking fears that the Federal Reserve hasn’t moved quickly enough to cut interest rates. Investors bid up haven assets such as the yen, while Cboe VIX August futures spiked.

“The key point is the current shift in narrative, from no landing to soft landing,” said Florian Ielpo, the head of macro research at Lombard Odier Asset Management. “That risk was poorly priced and investors shifting gears fast explains the extent of the move.”

Elsewhere, Treasuries climbed as traders boosted bets on aggressive monetary policy easing by the Federal Reserve this year, with odds of an emergency meeting rising to 25%. US two-year yields fall 11bps to 3.77%.

In FX, we already covered the main highlights: the yen soared 3.2% against the greenback, pulling USDJPY down to ~142.05. The Swiss franc also outperforms, rising 1%, while the euro adds 0.4%. Bitcoin slumps over 10%.

In rates, Treasuries retained about half of their steep, front-end-led gains during Asia session and European morning, with 2-year yields richer by 13bp at around 3.75% after falling nearly 27bp Friday. US yields remain richer by 13bp to 4bp across the curve in an aggressive bull-steepening move that has 2s10s spread wider by almost 8bp and approaching dis-inversion for the first time since July 2022. US 10-year yields trade around 3.75% after reaching lowest since June 2023. Investors continue to price in aggressive rate cuts by the Federal Reserve, with about 55bp of easing now priced in for September FOMC meeting, 100bp by November’s. In other words, there is about 20% odds of an emergency rate cut already priced in. Similar gains seen in core European rates, where 2-year German yields are lower by around 11bp on the day. US session includes ISM services data at 10am New York time.

In commodities, oil prices decline, with WTI falling 1.9% to trade near $72.10 a barrel. Spot gold falls $18 to around $2,425/oz.

US economic data slate includes July S&P Global US services PMI (9:45am) and ISM services index (10am), and Fed’s Senior Loan Officer Opinion survey (2pm). Scheduled Fed speaker slate includes Goolsbee (8:30am) and Daly (5pm).

Market Snapshot

- S&P 500 futures down 3.6% to 5,184

- STOXX Europe 600 down 2.3% to 486.40

- MXAP down 6.0% to 166.21

- MXAPJ down 4.1% to 530.79

- Nikkei down 12.4% to 31,458.42

- Topix down 12.2% to 2,227.15

- Hang Seng Index down 1.5% to 16,698.36

- Shanghai Composite down 1.5% to 2,860.70

- Sensex down 2.6% to 78,911.70

- Australia S&P/ASX 200 down 3.7% to 7,649.56

- Kospi down 8.8% to 2,441.55

- German 10Y yield -3 bps at 2.14%

- Euro up 0.5% to $1.0970

- Brent Futures down 1.0% to $76.06/bbl

- Gold spot down 0.7% to $2,425.51

- US Dollar Index down 0.72% to 102.46

Top Overnight News

- Japan’s Nikkei Stock Average closed down 12.4% in its biggest single-day percentage fall since 1987, a historic drop triggered by disappointing U.S. jobs data and a further rise in the yen. Highest turnover day ever for tpx >8trln YEN, 2nd largest drop index drop since 1987, tpx had 131 stocks close limit down, Nky had 20. Retail margin length is at highs. Mkt Underestimated CTA selling, overestimated Domestic support levels at 38, and 34…. maybe 25. WSJ / GS GBM

- China is successfully bypassing US export controls to obtain high-end AI chips. China’s gov’t reiterated its intent to bolster consumer spending (the government has been beating this drum for a VERY long time, but efforts thus far have failed to yield tangible results). NYT / BBG

- Goldman increased its 12-month recession odds by 10pp to 25%. The bank continues to see recession risk as limited not only because the data look fine overall and does not see major financial imbalances, but also because—as Chair Powell emphasized last week—the Fed has 525bp of room to cut the funds rate and would surely be quick to support the economy if necessary. The bank changed its Fed forecast after the employment report to include an initial string of three consecutive 25bp rate cuts in September, November, and December (vs. quarterly cuts previously). GIR

- Berkshire Hathaway slashed its Apple stake by almost 50%, while its cash pile soared to a record $277 billion. Suppliers to the iPhone maker slumped amid the broader selloff even as some analysts said Warren Buffett may simply be taking profit. BBG

- Iran rejected U.S. and Arab efforts to temper its response to the killing in Tehran of Hamas’s top political leader, as authorities were investigating the security breaches that led to the attack. Iranian prosecutors said Saturday that they had opened a formal investigation into the killing of Ismail Haniyeh, which came hours after an Israeli strike killed a senior Hezbollah commander in Beirut. The two attacks, following a rocket strike on a soccer field in the Israeli-controlled Golan Heights, escalated a recent cycle of violence and threatened to push the region to the brink of war. WSJ

- The traditional playbook when it comes to extrapolating economic data may not be relevant in the post-COVID era (the creator of the “Sahm Rule” about how a 50bp increase in the unemployment rate signals a recession expressed skepticism about applying that benchmark in the present landscape). Barron’s

- AI spending spree creating anxiety for tech investors as shareholders want more tangible proof that all the expenditures will drive profits in the future (but tech mgmt. teams suggest they won’t be dialing back anytime soon as they fear having inadequate capacity to capitalize on the AI opportunity). FT

- PE firms accelerate dealmaking activity as they prepare for the start of Fed easing (Ares, Apollo, Blackstone, and KKR deployed ~$160B in CQ2). FT

- GS PB on Friday’s flow: We saw broad-based net selling across all major regions, led by DM Asia (Japan saw the largest 1-day net selling since Mar ’20). While there was significant performance degradation on Friday as Marco pointed out, there was no further de-grossing by HFs per Prime data. Worth noting both Prime + franchise flows in the US were orderly and relatively modest on Friday. GSPB

A more detailed look at global markets courtesy of Newsquawk

APAC stocks mostly slumped following last Friday’s continued sell-off on Wall St owing to disappointing jobs data which sparked recession concerns, while heightened tensions in the Middle East linger as markets await Iran’s retaliation. ASX 200 declined with tech, financials and real estate leading the broad retreat seen across all sectors. Nikkei 225 continued its aggressive slide and dipped beneath the 33,000 level for the first time since early January, while the index entered into a bear market along with the Topix. Hang Seng and Shanghai Comp. showed early resilience with the mainland initially kept afloat after Caixin Services PMI topped forecasts, while China recently laid out its priorities to spur consumer spending and the State Council designated 20 key steps to expand basic consumption. However, the bourses later conformed to global losses. Nikkei 225 unofficially closes at 31458, -12.4%; closes with a record daily points fall, exceeding the drop on Black Monday in October 1987

Top Asian News

- China issued guidelines to promote high-quality development of service consumption, according to Bloomberg. China’s government on Saturday laid out its priorities to spur consumer spending as weak domestic demand continues to weigh on growth in which the State Council designated 20 key steps including exploring the potential to expand basic consumption in areas such as catering, home services and elderly care, according to a statement posted on the central government’s website.

- EU capitals are set to back tariffs on Chinese electric cars with member states likely to support the imposition of proposed tariffs on Chinese EVs in November, according to FT citing the bloc’s trade commissioner Dombrovskis.

- BoJ Minutes from the June 13th-14th meeting stated that a few members said import prices are rising due to the recent yen fall, creating upside inflation risk, while a member said cost-push inflation could heighten underlying inflation if it leads to higher inflation expectations and wage increases. Furthermore, one member said the BoJ must raise rates at appropriate timing without delay although another member said a rate hike must be done only after inflation makes a clear rebound and data confirms heightening in inflation expectations, while members agreed recent weak yen pushes up inflation and warrants vigilance in guiding monetary policy.

- Japanese Finance Minister Suzuki says stock price is determined by the market; expects economy to gradually recover; Cooperating with BoJ and FSA and closely monitoring markets with a sense of urgency. Highly interested in the current stock market situation.

- Japan’s Chief Cabinet Secretary Hayashi says they are monitoring financial situations both abroad and domestic with a sense of urgency, says it is important for the gov’t to make a judgement on the market calmly.

- Thai Finance Minister says the stock market fall is being driven by external factors, should be supported by gov’t measures

European bourses opened with marked downside, following the APAC pressure post-NFP with sentiment hit further by updates concerning Apple and Nvidia; since, benchmarks have lifted slightly off worst but remain under marked pressure, Euro Stoxx 50 -2.3%. In brief, APAC pressure was pronounced with circuit breakers triggered in Japan and South Korea while the Nikkei 225 closed with a record daily points fall. Sectors in the red, Energy lags as crude benchmarks come under renewed pressure with Tech hit on sentiment and AAPL/NVDA while Banks slump as yields fall and pricing for central bank easing lifts. Infineon opened as the DAX 40 laggard after missing forecasts, narrowing guidance and announcing layoffs.

Stateside, futures in the red given the above but have begun to consolidate just off worst levels with newsflow light and as we await ISM Services & Fed speak for direction; ES -2.4%, NQ -3.9%. Bloomberg headlines this morning suggested that traders are pricing a 60% chance that the Fed will cut rates by 25bps in the next week.

Top European News

- UK PM Starmer vowed that those responsible for the disorder and chaos that’s spreading across UK towns and cities will be punished for what he described as “far-right thuggery”, according to Bloomberg.

- Infineon (IFX GY) – Q3 (EUR): Revenue 3.7bln (exp. 3.8bln), Net 403mln (exp. 447mln), adj. Gross Margin 42.2% (exp. 40.3%), adj. EPS 0.43 (exp. 0.42). Further improvement to revenue and earnings seen in Q4, FY forecasts are well within the prior guided range. It is anticipated that revenue will increase in all four segments Q/Q. Q4 Guidance: Revenue 4bln (exp. 3.9bln). CEO says they are to cut around 1.4k jobs globally and will move an additional 1.4k. 3.6% weighting in the DAX 40

FX

- Hefty losses to begin the week for the USD with the DXY down to a 102.41 base as pricing for Fed easing ramps up considerably and as JPY strengthens significantly.

- USD/JPY down to a 141.70 base vs. a brief high-point of 146.56, action which comes as yields globally slump and differentials become more favourable following the BoJ’s hike in addition to its typical haven status amid the broad sell off.

- EUR benefitting from the USD’s pressure but with upside for the single currency capped/hampered by strength in the JPY and CHF; EUR/USD holding around 1.0950 just shy of the 1.0975 peak.

- Cable more contained and somewhat torn between USD pressure and EUR strength with yields not providing as much direction for GBP given the extent of last week’s moves around the BoE.

- Antipodeans lag on the risk tone, AUD and NZD down to lows of 0.6350 and 0.5851 respectively.

Fixed Income

- Fixed benchmarks bid as the post-NFP sell-off reverberated into and was exacerbated during APAC trade. The odds of Fed easing have ramped up even more with a 50bp cut almost entirely priced for September and implied pricing for a 25bp cut in the next week at 60%.

- USTs at highs, yields lower across the curve with just the 20yr & 30yr remaining above 4.0% at lows of 4.08% and 4.01% respectively.

- EGBs and Gilts in-fitting, Bunds up to a 136.28 peak and on track for a 10th consecutive session of gains while Gilts are also at highs but slightly more modest after last week’s action.

- No real move to the session’s Final PMIs and EZ Sentix, though both PMIs and Sentix remain downbeat on Germany with the latter noting that “recession bells are ringing again in Germany”.

Commodities

- Crude is conforming to the broader risk aversion after the US jobs data on Friday stoked fears of a recession against the backdrop of sluggish Chinese demand; though, downside has at times been cushioned by ongoing geopolitical tensions.

- WTI and Brent at the low-points of session parameters, below USD 72.00/bbl and nearing USD 76.00/bbl respectively.

- Precious metals lower across the board as the USD managed to pick up slightly from worst levels and with XAU being outshone by marked JPY and Fixed bids; holding around USD 2430/oz after being as high as USD 2458/oz overnight.

- Base metals are lower across the board given the mentioned risk tone and despite better-than-expected Chinese Caixin Services PMI.

- Saudi Arabia raised its official selling price for Asia in September by 20 cents to USD 2.00/bbl above the Oman/Dubai average, while it set the OSP to NW Europe to + USD 1.25/bbl vs ICE Brent and to the US at + USD 4.10/bbl vs ASCI.

- NHC said Tropical Storm Debby is strengthening over the southeastern Gulf of Mexico, while it later stated Debby has strengthened to a hurricane and is expected to make landfall in the Florida Big Bend area on Monday which will bring a major flood threat to the southeastern United States.

Geopolitics: Middle East

- Israel conducted strikes targeting two schools sheltering the displaced near Gaza City which killed at least 25 Palestinians, while the Israeli military said the strikes on Gaza schools targeted militants operating there. Israel also conducted a strike in the West Bank which killed a Hamas commander.

- Israeli PM Netanyahu on Sunday warned “Iran’s axis of evil” against attacking Israel amid expectations that Tehran and the militant groups it supports are readying retaliatory strikes, according to dpa.

- Iran-led retaliatory assaults are “expected imminently” and will likely be simultaneous, coming from Hezbollah in Lebanon, the Houthis in Yemen and Iran itself, according to Israeli officials cited by Bloomberg and Iran International.

- Iran’s Revolutionary Guards said the terrorist act of killing Hamas chief Haniyeh was designed and executed by Israel with the support of the criminal US government, while it added that the adventurous and terrorist Zionist regime will decisively receive the response to this crime. Furthermore, the IRGC said Tehran’s revenge will be severe and at the appropriate time, place and manner, according to Reuters.

- US Secretary of State Blinken told his G7 counterparts on a conference call on Sunday that an attack by Iran and Hezbollah against Israel could begin within 24 to 48 hours, according to Walla News.

- IRGC sources told iNews Britain that Iran’s response to Israel could come no later than Tuesday or Wednesday.

- Egypt’s Foreign Minister held a call with Iran’s Foreign Minister and stressed that recent developments are unprecedented, very dangerous and threatening to the region’s stability.

- US President Biden will speak to Jordan’s King on Monday and will convene the national security team on Monday in the situation room to discuss Middle East developments, according to the White House.

- US Secretary of State Blinken spoke with Iraqi PM Al-Sudani and emphasised the importance of all parties taking steps to calm regional tensions and avoid escalation, while Iraq’s PM told Blinken in the phone call that preventing regional tensions is tied to stopping Israeli aggression on Gaza. It was separately reported that Blinken told G7 ministers that Iran and Hezbollah may attack Israel within the next 24 hours, according to Axios

- White House’s Finer said the US is trying to prepare for any scenario in the Middle East by warning citizens to leave Lebanon and the US is moving an aircraft carrier to the Middle East purely for defensive reasons, while Finer said the overall goal is to turn the temperature down in the region, according to a CBS interview.

- UK Foreign Office said Britain temporarily withdrew the families of officials working at the British embassy in Beirut due to a highly volatile security situation in Lebanon.

- US Central Command forces said they successfully destroyed an Iranian-backed Houthi missile and launcher in the Houthi-controlled area of Yemen. It was separately reported that Yemen’s Houthis said they targeted MV Groton in the Gulf of Aden with ballistic missiles.

- Israel could reportedly pre-emptively strike Iran in the scenario that intelligence was to show that an attack was imminent, via Times of Israel.

- US is reportedly willing to guarantee to Israel that it will be able to renew fighting against Hamas in Gaza after the first phase of a potential ceasefire and hostage deal, via Times of Israel.

Geopolitics: Other

- Ukrainian President Zelensky announced the arrival of F-16 fighter jets and said they are already in use in Ukraine’s skies, while he said Ukraine does not have enough F-16 pilots or jets and hopes training will be expanded. Furthermore, he plans to discuss at the Ukraine-NATO council the use of neighbouring countries’ aviation for air defence work.- Ukrainian military said it struck a Russian submarine and anti-aircraft system in Crimea, while it also struck Russia’s Morovosk airfield, as well as oil fields and fuel facilities in three Russian regions.

- Russian Defence Ministry said Russian forces captured a settlement in the Donetsk region.

- North Korean leader Kim said they will have a more improved level of nuclear readiness in the near future to respond to any challenges, while he added that stockpiling and improving nuclear weapons is the best way to counter the US, according to KCNA.

- Philippines and German Defence Ministers committed to concluding a broader defence agreement, while the Philippines Defence Minister said they invited German ships to participate in exercises.

US Event Calendar

- 09:45: July S&P Global US Services PMI, est. 56.0, prior 56.0

- 10:00: July ISM Services Index, est. 51.0, prior 48.8

- 14:00: Senior Loan Officer Opinion Survey on Bank Lending Practices

Loading…