Blackstone Mortgage Trust, a real estate finance company that originates senior loans collateralized by commercial real estate across North America, Europe, and Australia, reported its second-quarter earnings on Tuesday. The report revealed a near-quarter reduction in its dividend due to rising defaults and increasing challenges with borrowers in making payments or refinancing office tower loans amid a worsening CRE downturn.

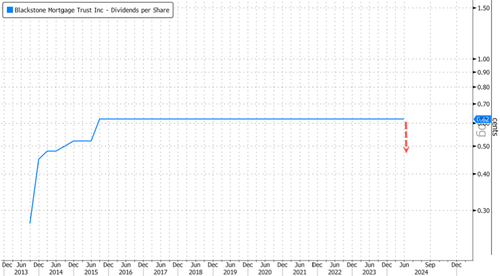

Bloomberg was the first to report that the $3.4 billion real estate investment trust BXMT slashed its dividend to 47 cents from 62 cents. BXMT has been distributing the 62-cent dividend to shareholders since late 2015.

Shares of BXMT were down 6% in premarket trading in New York. If losses in premarket hold through the cash session, this would be the largest intraday decline in seven months.

"Cutting the dividend will save about $100 million a year that can be reallocated to new loans or other investments," Bloomberg noted.

BXMT Chief Executive Officer Katie Keenan wrote in a statement:

"We believe stockholder return is well served by balancing current return with optimization of book value and long-term earnings potential through our strategic capital allocation decisions.

We assess the dividend with the Board each quarter, prudently considering a variety of factors, and our Board has declared a third quarter dividend of $0.47 per share, which we believe reflects a sustainable level relative to long-term earnings power.

With strong liquidity, accelerating repayments, and an emerging investment pipeline, BXMT is well positioned to deploy capital accretively in this environment and continue its forward trajectory through the cycle."

Most of the distress comes from BXMT's office portfolio, which makes up about 25% of its outstanding loans. Recent data from the Green Street Commercial Property Price Index shows US office tower values have plunged 37% from early 2022 peaks. Towers have been the worst hit in the CRE downturn. The rest of the commercial sector has slumped only 20%.

In recent quarters, short seller Carson Block has been vocal about his bearish BXMT bet.

"This kind of reminds me of 2007," the Muddy Waters founder told Bloomberg TV in mid-March, adding there was a period after the failure of Bear Stearns that the general market sentiment was that "'there's been deleveraging, everything's OK.' And it turned out not to be."

In recent weeks, Block was back on Bloomberg TV, warning:

"We got a hold of CLO data. So CLO loan data, which there's - that's apparently emblematic of BXMT's CLOs and what's on BXMT's balance sheet. So, a lot of these loans are in trouble. BXMT has not true them up in terms of the risk ratings. So we believe that as more and more of these loans are allowed to pick up in kind, in the second half of this year, BXMT is going to have to cut the dividend."

Well, Block was correct. He first unveiled the short thesis on BXMT in December and warned of a liquidity crisis.

In a note from analysts at Keefe Bruyette & Woods last week, BXMT modified three loans in California and Texas in June to provide extensions.

There are rumblings under the surface in the CRE world. Moody's recently offered a grim outlook that the CRE downturn is nowhere near the bottom and warned that hybrid working trends could result in around 24% of all US office towers standing vacant within the next two years.

Blackstone Mortgage Trust, a real estate finance company that originates senior loans collateralized by commercial real estate across North America, Europe, and Australia, reported its second-quarter earnings on Tuesday. The report revealed a near-quarter reduction in its dividend due to rising defaults and increasing challenges with borrowers in making payments or refinancing office tower loans amid a worsening CRE downturn.

Bloomberg was the first to report that the $3.4 billion real estate investment trust BXMT slashed its dividend to 47 cents from 62 cents. BXMT has been distributing the 62-cent dividend to shareholders since late 2015.

Shares of BXMT were down 6% in premarket trading in New York. If losses in premarket hold through the cash session, this would be the largest intraday decline in seven months.

“Cutting the dividend will save about $100 million a year that can be reallocated to new loans or other investments,” Bloomberg noted.

BXMT Chief Executive Officer Katie Keenan wrote in a statement:

“We believe stockholder return is well served by balancing current return with optimization of book value and long-term earnings potential through our strategic capital allocation decisions.

We assess the dividend with the Board each quarter, prudently considering a variety of factors, and our Board has declared a third quarter dividend of $0.47 per share, which we believe reflects a sustainable level relative to long-term earnings power.

With strong liquidity, accelerating repayments, and an emerging investment pipeline, BXMT is well positioned to deploy capital accretively in this environment and continue its forward trajectory through the cycle.”

Most of the distress comes from BXMT’s office portfolio, which makes up about 25% of its outstanding loans. Recent data from the Green Street Commercial Property Price Index shows US office tower values have plunged 37% from early 2022 peaks. Towers have been the worst hit in the CRE downturn. The rest of the commercial sector has slumped only 20%.

In recent quarters, short seller Carson Block has been vocal about his bearish BXMT bet.

“This kind of reminds me of 2007,” the Muddy Waters founder told Bloomberg TV in mid-March, adding there was a period after the failure of Bear Stearns that the general market sentiment was that “‘there’s been deleveraging, everything’s OK.’ And it turned out not to be.”

In recent weeks, Block was back on Bloomberg TV, warning:

“We got a hold of CLO data. So CLO loan data, which there’s – that’s apparently emblematic of BXMT’s CLOs and what’s on BXMT’s balance sheet. So, a lot of these loans are in trouble. BXMT has not true them up in terms of the risk ratings. So we believe that as more and more of these loans are allowed to pick up in kind, in the second half of this year, BXMT is going to have to cut the dividend.”

[embedded content]

Well, Block was correct. He first unveiled the short thesis on BXMT in December and warned of a liquidity crisis.

In a note from analysts at Keefe Bruyette & Woods last week, BXMT modified three loans in California and Texas in June to provide extensions.

There are rumblings under the surface in the CRE world. Moody’s recently offered a grim outlook that the CRE downturn is nowhere near the bottom and warned that hybrid working trends could result in around 24% of all US office towers standing vacant within the next two years.

Loading…