Blackstone has limited investor redemption requests from its $64 billion commercial real estate trust for high-net wealth investors for the thirteenth consecutive month. However, the good news: the "backlog is easing," according to Bloomberg.

According to a shareholder letter, Blackstone Real Estate Income Trust (BREIT) recorded investor outflows of $1.8 billion in November. The fund fulfilled 67% of its requests, and demand redemptions fell to the lowest since September 2022.

BREIT limits redemptions to 2% of net asset value monthly and 5% quarterly to curb sudden runs. This process of gating investors has been ongoing for 13 months due to surging fears of high interest rates and deteriorating conditions for commercial real estate markets.

Recall:

The fund is heavily invested in housing, such as multi-family and student housing, as well as industrial properties and data centers.

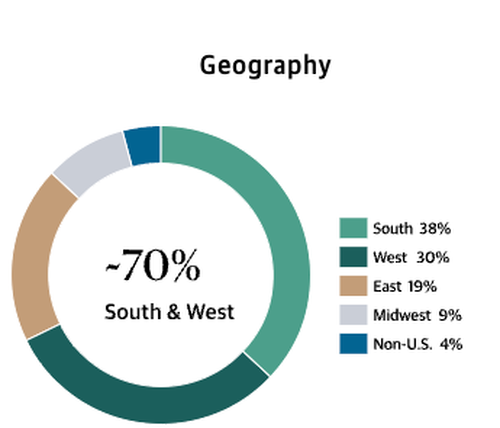

Most of the properties are located in the southern and western portions of the US.

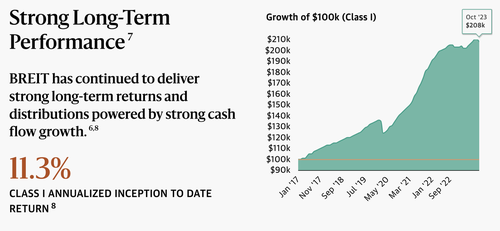

Fund performance has been dampened by deteriorating macroeconomic conditions, only delivering 2.3% this year through October for high-net wealth investors. Last year, it delivered 8.4% in 2022. And since its inception, it has routinely delivered 11.3% annual returns.

The good news, as explained by a Blackstone spokesperson: Investors who requested to pull their money out of the fund two months ago have received "nearly all" their money back.

Blackstone has limited investor redemption requests from its $64 billion commercial real estate trust for high-net wealth investors for the thirteenth consecutive month. However, the good news: the “backlog is easing,” according to Bloomberg.

According to a shareholder letter, Blackstone Real Estate Income Trust (BREIT) recorded investor outflows of $1.8 billion in November. The fund fulfilled 67% of its requests, and demand redemptions fell to the lowest since September 2022.

BREIT limits redemptions to 2% of net asset value monthly and 5% quarterly to curb sudden runs. This process of gating investors has been ongoing for 13 months due to surging fears of high interest rates and deteriorating conditions for commercial real estate markets.

Recall:

The fund is heavily invested in housing, such as multi-family and student housing, as well as industrial properties and data centers.

Most of the properties are located in the southern and western portions of the US.

Fund performance has been dampened by deteriorating macroeconomic conditions, only delivering 2.3% this year through October for high-net wealth investors. Last year, it delivered 8.4% in 2022. And since its inception, it has routinely delivered 11.3% annual returns.

The good news, as explained by a Blackstone spokesperson: Investors who requested to pull their money out of the fund two months ago have received “nearly all” their money back.

Loading…