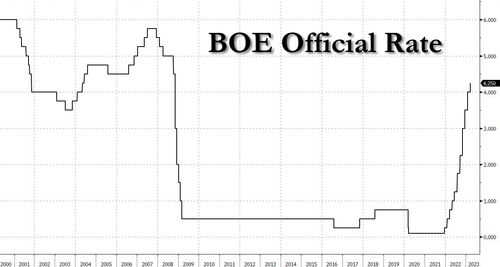

Following yesterday's disappointingly hot inflation prints, it was not a big surprise to markets that The Bank of England (BoE) hiked rates by 25bps this morning to 4.25%, the highest since 2008, and left the door open to further increases if inflation persists.

The 25bps hike is the smallest increase in rates since June.

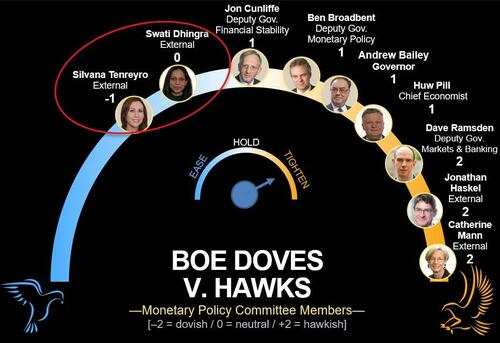

Policy makers voted 7-2 for the hike - Tenreyro and Dhingra voted to keep rates unchanged.

Key remarks in the statement suggest a shift the market's perspective that BoE was ready to 'pause'.

“If there were to be evidence of more persistent pressures, then further tightening in monetary policy would be required,” minutes of the meeting released Thursday said, a guidance that’s in step with what the BOE said in February.

However, while inflation has “surprised significantly on the upside,” it still expects price growth to cool sharply in the coming months.

“The stronger domestic and global outlook for demand was also being driven by factors over and above the weaker path of energy prices,” minutes of the meeting said.

Cable is very modestly higher on the day with little to no reaction post-statement, Gilt yields are drifting modestly lower.

Following yesterday’s disappointingly hot inflation prints, it was not a big surprise to markets that The Bank of England (BoE) hiked rates by 25bps this morning to 4.25%, the highest since 2008, and left the door open to further increases if inflation persists.

The 25bps hike is the smallest increase in rates since June.

Policy makers voted 7-2 for the hike – Tenreyro and Dhingra voted to keep rates unchanged.

Key remarks in the statement suggest a shift the market’s perspective that BoE was ready to ‘pause’.

“If there were to be evidence of more persistent pressures, then further tightening in monetary policy would be required,” minutes of the meeting released Thursday said, a guidance that’s in step with what the BOE said in February.

However, while inflation has “surprised significantly on the upside,” it still expects price growth to cool sharply in the coming months.

“The stronger domestic and global outlook for demand was also being driven by factors over and above the weaker path of energy prices,” minutes of the meeting said.

Cable is very modestly higher on the day with little to no reaction post-statement, Gilt yields are drifting modestly lower.

Loading…