UK inflation measures unexpectedly re-surged across the board this morning after three straight months of deceleration, all much hotter than expected:

-

Headline CPI YoY (Feb): 10.4%; Cons: 9.9%; Previous (Jan): 10.1%

-

Core CPI YoY (Feb): 6.2%; Cons: 5.7%; Previous (Jan): 5.8%

-

RPI YoY (Feb): 13.8%; Cons: 13.3%; Previous (Jan): 13.4%

In context, these inflation rates are still near 40 year highs...

Source: Bloomberg

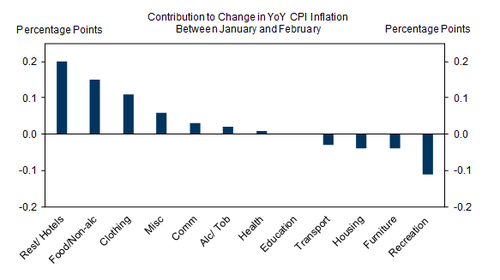

Goldman notes that the largest upward contributions to the increase in CPI inflation came from restaurant and hotels (+0.2pp) and food and non-alcoholic beverages (+0.15pp), where annual inflation rates at 12.1%yoy and 18.0%yoy, respectively, are at their highest since 1991. The largest offsetting downward contribution to the change in the annual rate came from recreation and culture (-0.11pp).

However, the breadth of the price increases was more shocking...

⚠️ This is pretty broad-based UK CPI print. Around 45% of the basket rose more than 1% MoM. Breadth was strong across goods and services. On this alone - I think the BoE tightening cycle is not done. 25bps hike is now likely tomorrow all things considered $GBP pic.twitter.com/FUHpTqi6DU

— Viraj Patel (@VPatelFX) March 22, 2023

Given the MPC's focus on domestic inflationary pressures, this print is especially notable since it showed the contribution from services to CPI inflation increasing to 3.1pp in February (from 2.8pp in January), above the BoE's projection of 2.9pp. At the same time, headline inflation at 10.4%yoy was also 0.5pp above the BoE's projection.

Goldman updated their UK inflation forecast and now expect core and headline inflation to be 4.0% yoy and 2.7% yoy, respectively, in December 2023.

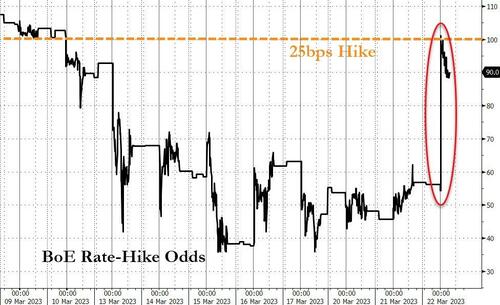

Given today's upside surprise, hopes for a 'pause' from the Bank of England tomorrow have been erased with a 25bps hike now fully priced-in...

Cable rallied on the print and gilt yields soared.

UK inflation measures unexpectedly re-surged across the board this morning after three straight months of deceleration, all much hotter than expected:

-

Headline CPI YoY (Feb): 10.4%; Cons: 9.9%; Previous (Jan): 10.1%

-

Core CPI YoY (Feb): 6.2%; Cons: 5.7%; Previous (Jan): 5.8%

-

RPI YoY (Feb): 13.8%; Cons: 13.3%; Previous (Jan): 13.4%

In context, these inflation rates are still near 40 year highs…

Source: Bloomberg

Goldman notes that the largest upward contributions to the increase in CPI inflation came from restaurant and hotels (+0.2pp) and food and non-alcoholic beverages (+0.15pp), where annual inflation rates at 12.1%yoy and 18.0%yoy, respectively, are at their highest since 1991. The largest offsetting downward contribution to the change in the annual rate came from recreation and culture (-0.11pp).

However, the breadth of the price increases was more shocking…

⚠️ This is pretty broad-based UK CPI print. Around 45% of the basket rose more than 1% MoM. Breadth was strong across goods and services. On this alone – I think the BoE tightening cycle is not done. 25bps hike is now likely tomorrow all things considered $GBP pic.twitter.com/FUHpTqi6DU

— Viraj Patel (@VPatelFX) March 22, 2023

Given the MPC’s focus on domestic inflationary pressures, this print is especially notable since it showed the contribution from services to CPI inflation increasing to 3.1pp in February (from 2.8pp in January), above the BoE’s projection of 2.9pp. At the same time, headline inflation at 10.4%yoy was also 0.5pp above the BoE’s projection.

Goldman updated their UK inflation forecast and now expect core and headline inflation to be 4.0% yoy and 2.7% yoy, respectively, in December 2023.

Given today’s upside surprise, hopes for a ‘pause’ from the Bank of England tomorrow have been erased with a 25bps hike now fully priced-in…

Cable rallied on the print and gilt yields soared.

Loading…