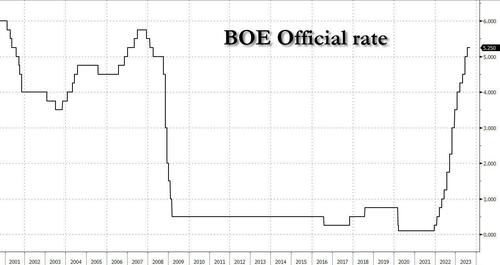

One day after the Fed kept rates unchanged in what multiple banks said cemented the end of the Fed's hiking cycle, and just a few hours after the Swiss franc tumbled when the SNB unexpectedly also kept rates unchanged at 1.75% against expectations of a rate hike to 2%, moments ago the Bank of England made it three for three, when it surprised markets by leaving the key policy rate unchanged at 5.25% after nearly two years of hikes, disappointing economists who were as looking for a 25bps rate hike to 5.50%, after a razor-edge vote that put an end to the most aggressive cycle of interest-rate rises in more than three decades amid falling inflation and mounting fears of recession.

The Monetary Policy Committee voted by a majority of 5-4 to maintain #BankRate at 5.25%. https://t.co/jfAstgGch5 pic.twitter.com/m2VuQTAu9N

— Bank of England (@bankofengland) September 21, 2023

Following weaker than expected inflation data in August, five members of the Monetary Policy Committee voted to leave rates unchanged and four wanted to raise them to 5.5%. Governor Andrew Bailey, who had the casting vote, chose to hold.

The decision to keep rates unchanged was the first pause after 14 consecutive rate rises since the tightening cycle started in December 2021.

The Committee indicated that it now wanted to leave interest rates at 5.25% for some time to ensure that it still brought inflation back down to the BoE’s 2 per cent target.

The BOE also stepped up the pace of quantitative tightening as it seeks to reduce the size of its balance sheet as quickly as possible to provide headroom for potential future financial stability interventions. Over the 12 months form October, it plans to reduce its gilt portfolio by £100 billion to £658 billion. Last year, it unwound £80 billion. That implies £50 billion of active gilt sales on top of the £50 billion of maturing assets. The gilt portfolio peaked in 2022 at £875 billion.

Here are the highlights from the BoE statement, courtesy of Newsquawk:

VOTE:

- 4 voted for hike (exp. 8). 5 voted for unchanged (exp. 1)

- Bailey, Broadbent. Dhingra, Ramsden, Pill voted to hold rates

- Cunliffe, Greene. Haskel, Mann voted to raise rates

MOTIVATION:

- Majority cited loosening labor market, August CPI data, falling business sentiment

- Minority saw persistent inflation pressure, and August fall in CPI likely to be short-lived

- One member sees growing risks falling output will require sharper rate cuts

INFLATION:

- Inflation has fallen a lot in recent months, will continue to do so

- Policy will be sufficiently restrictive to get inflation back to target

- Inflation seen falling significantly in near-term despite rising oil prices

- Services inflation set to remain elevated

ECONOMY:

- Says GDP growth is now seen at 0.1% in 03 (prev. saw *0.4%)

- Underlying growth in H2 likely weakened by more than forecast

GUIDANCE:

- Says further tightening would be needed if evidence of more persistent inflation pressures is seen.

BALANCE SHEET:

- The BOE would reduce the stock of gilts by GBP 100BN in 12-months starting October

- Will continue to sell Gilts evenly across short-, medium-, and long-buckets

- In Q4, will hold four Gilt auctions in each sector, at planned GBP 670mln size

According to UBS, the opening section of the Bank of England's Monetary Policy Statement is basically the same as Chief Economist, Huw Pill's South Africa speech he gave last month. Unchanged rates at 5.25% with inflation back to target by Q2 2025, then it is expected to fall below target as economic slack grows. In other words, the BoE has pivoted from its prior fears of an economy that's much too tight to one that's going to end up looking loose.

The BoE has almost dismissed the recent strong wage data, saying average weekly earnings growth was reported as 8.1% in July, but that was "difficult to reconcile with other indicators of pay growth. Most of these have tended to be more stable at rates of growth that are elevated but not quite as high as the average weekly earnings (AWE) series."

Normally central banks place a very great weight on wage growth as a forward indicator, but in the UK's case, the bank is mistrustful of the data it's being supplied. It's not often that a central bank will openly and publicly question the accuracy of official data, but in the case of wages, the BoE has done so. It noted that official data for average weekly earnings pointed to wage growth around 8%, but its own agents surveys were around 6 to 6.5%. Indeed it also said the official ONS data couldn't be reconciled with what the HMRC payrolls data showed. Wage growth remains elevated, but the BoE is willing to accept survey evidence that it is slowing.

As Bloomberg notes, the decision will come as a relief to millions of households facing the threat of even higher mortgage costs and indebted businesses. It will also be welcomed by Prime Minister Rishi Sunak, who has promised to ease the inflation crisis and improve living standards ahead of an election expected next year.

The BOE, however, signaled that policy was only on pause and it would respond if inflation, which remains more than three times above the 2% target, doesn’t fall as expected. The MPC forecasts consumer-price inflation to hit the target in the second quarter of 2025.

“Inflation has fallen a lot in recent months and we think it will continue to do so,” Bailey said in a written statement. “That’s welcome news. But there is no room for complacency. We need to be sure inflation returns to normal and we will continue to take the decisions necessary to do just that.”

Ahead of the decision, Chancellor of the Exchequer Jeremy Hunt told Bailey in a letter than the MPC has his full support. “The tough action taken by the MPC to squeeze inflation out of the system is working,” Hunt said, adding that the government needed to show fiscal discipline to bolster the bank’s actions.

Repeating its former guidance, the committee said rates would be “sufficiently restrictive for sufficiently long” and “further tightening in monetary policy would be required if there were evidence of more persistent pressures.” Like other major central banks, the implication is that rates would remain high for longer.

“Today’s decision to keep the base rate unchanged will be welcomed by companies already struggling to meet interest obligations,” said Nils Kuhlwein, partner at management consulting firm Kearney. “Successive base rate jumps over recent years have turned the screw on these companies.”

The MPC has been laying the ground to pause policy as the UK’s economic outlook darkened in recent weeks. Bailey said this month that rates were “much nearer now to the top of the cycle” and Deputy Governor Jon Cunliffe said the bank was close to a turning point.

The MPC expressed concerns that the economy was stalling after output in July contracted 0.5%, a sharper fall than expected, and official figures showed unemployment rising and job vacancies dropping. The committee also noted that business activity data is contracting, while raising questions about official measures that show wage growth is accelerating.

The BOE cut its GDP growth forecast for the third quarter to 0.1% from 0.4%, the minutes showed. Underlying growth in the second half of 2023 is also likely to be weaker than the 0.25% expected in August.

The bank said past rate hikes were having an impact: “There are increasing signs of some impact of tighter monetary policy on the labor market and on momentum in the real economy more general.”

As the economy slows, inflation was expected to drop below 2% “in the medium term.” In the short term, the bank expects a “significant” fall in inflation “despite the renewed upward pressure from oil prices” due to declining energy and goods inflation.

Higher rates have been punishing homeowners, who face a £15 billion repayment crunch, according to the Resolution Foundation, much of which has yet to come through. Several MPC members have been warning that policy lags mean the BOE was already at risk of overtightening.

Swati Dhingra, an external member has been voting to hold since December last year. She was joined by Bailey, Deputy Governors Ben Broadbent and Dave Ramsden and Chief Economist Huw Pill. Cunliffe and external members Megan Greene, Catherine Mann and Jonathan Haskel voted to raise rates by a quarter point to 5.5%.

Other central banks are signalling that cycle is over, too. The ECB raised rates to 4% last week and said “sufficient contributions” had been made to return inflation to target. The US Federal Reserve on Wednesday held rates in the 5.25%-5.5% range, but did suggest further increases were on the cards and ruled out any imminent rate cuts.

Markets were split before the vote, betting on a roughly 50% chance of a vote to hold, after a surprise fall in August inflation to 6.7% this week. Investors still expect one more quarter-point increase although Goldman Sachs and Nomura reckon rates have now peaked.

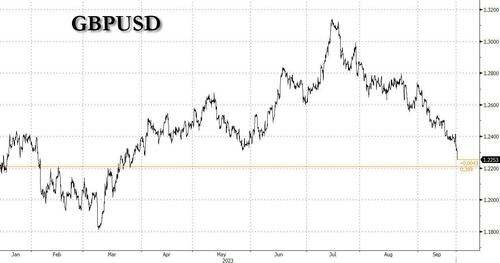

The pound extended losses to the lowest since March as traders trimmed bets on further interest-rate hikes.

The market is pricing in around 18 basis points of more tightening compared to a full quarter-point before the decision.

One day after the Fed kept rates unchanged in what multiple banks said cemented the end of the Fed’s hiking cycle, and just a few hours after the Swiss franc tumbled when the SNB unexpectedly also kept rates unchanged at 1.75% against expectations of a rate hike to 2%, moments ago the Bank of England made it three for three, when it surprised markets by leaving the key policy rate unchanged at 5.25% after nearly two years of hikes, disappointing economists who were as looking for a 25bps rate hike to 5.50%, after a razor-edge vote that put an end to the most aggressive cycle of interest-rate rises in more than three decades amid falling inflation and mounting fears of recession.

The Monetary Policy Committee voted by a majority of 5-4 to maintain #BankRate at 5.25%. https://t.co/jfAstgGch5 pic.twitter.com/m2VuQTAu9N

— Bank of England (@bankofengland) September 21, 2023

Following weaker than expected inflation data in August, five members of the Monetary Policy Committee voted to leave rates unchanged and four wanted to raise them to 5.5%. Governor Andrew Bailey, who had the casting vote, chose to hold.

The decision to keep rates unchanged was the first pause after 14 consecutive rate rises since the tightening cycle started in December 2021.

The Committee indicated that it now wanted to leave interest rates at 5.25% for some time to ensure that it still brought inflation back down to the BoE’s 2 per cent target.

The BOE also stepped up the pace of quantitative tightening as it seeks to reduce the size of its balance sheet as quickly as possible to provide headroom for potential future financial stability interventions. Over the 12 months form October, it plans to reduce its gilt portfolio by £100 billion to £658 billion. Last year, it unwound £80 billion. That implies £50 billion of active gilt sales on top of the £50 billion of maturing assets. The gilt portfolio peaked in 2022 at £875 billion.

Here are the highlights from the BoE statement, courtesy of Newsquawk:

VOTE:

- 4 voted for hike (exp. 8). 5 voted for unchanged (exp. 1)

- Bailey, Broadbent. Dhingra, Ramsden, Pill voted to hold rates

- Cunliffe, Greene. Haskel, Mann voted to raise rates

MOTIVATION:

- Majority cited loosening labor market, August CPI data, falling business sentiment

- Minority saw persistent inflation pressure, and August fall in CPI likely to be short-lived

- One member sees growing risks falling output will require sharper rate cuts

INFLATION:

- Inflation has fallen a lot in recent months, will continue to do so

- Policy will be sufficiently restrictive to get inflation back to target

- Inflation seen falling significantly in near-term despite rising oil prices

- Services inflation set to remain elevated

ECONOMY:

- Says GDP growth is now seen at 0.1% in 03 (prev. saw *0.4%)

- Underlying growth in H2 likely weakened by more than forecast

GUIDANCE:

- Says further tightening would be needed if evidence of more persistent inflation pressures is seen.

BALANCE SHEET:

- The BOE would reduce the stock of gilts by GBP 100BN in 12-months starting October

- Will continue to sell Gilts evenly across short-, medium-, and long-buckets

- In Q4, will hold four Gilt auctions in each sector, at planned GBP 670mln size

According to UBS, the opening section of the Bank of England’s Monetary Policy Statement is basically the same as Chief Economist, Huw Pill’s South Africa speech he gave last month. Unchanged rates at 5.25% with inflation back to target by Q2 2025, then it is expected to fall below target as economic slack grows. In other words, the BoE has pivoted from its prior fears of an economy that’s much too tight to one that’s going to end up looking loose.

The BoE has almost dismissed the recent strong wage data, saying average weekly earnings growth was reported as 8.1% in July, but that was “difficult to reconcile with other indicators of pay growth. Most of these have tended to be more stable at rates of growth that are elevated but not quite as high as the average weekly earnings (AWE) series.”

Normally central banks place a very great weight on wage growth as a forward indicator, but in the UK’s case, the bank is mistrustful of the data it’s being supplied. It’s not often that a central bank will openly and publicly question the accuracy of official data, but in the case of wages, the BoE has done so. It noted that official data for average weekly earnings pointed to wage growth around 8%, but its own agents surveys were around 6 to 6.5%. Indeed it also said the official ONS data couldn’t be reconciled with what the HMRC payrolls data showed. Wage growth remains elevated, but the BoE is willing to accept survey evidence that it is slowing.

As Bloomberg notes, the decision will come as a relief to millions of households facing the threat of even higher mortgage costs and indebted businesses. It will also be welcomed by Prime Minister Rishi Sunak, who has promised to ease the inflation crisis and improve living standards ahead of an election expected next year.

The BOE, however, signaled that policy was only on pause and it would respond if inflation, which remains more than three times above the 2% target, doesn’t fall as expected. The MPC forecasts consumer-price inflation to hit the target in the second quarter of 2025.

“Inflation has fallen a lot in recent months and we think it will continue to do so,” Bailey said in a written statement. “That’s welcome news. But there is no room for complacency. We need to be sure inflation returns to normal and we will continue to take the decisions necessary to do just that.”

Ahead of the decision, Chancellor of the Exchequer Jeremy Hunt told Bailey in a letter than the MPC has his full support. “The tough action taken by the MPC to squeeze inflation out of the system is working,” Hunt said, adding that the government needed to show fiscal discipline to bolster the bank’s actions.

Repeating its former guidance, the committee said rates would be “sufficiently restrictive for sufficiently long” and “further tightening in monetary policy would be required if there were evidence of more persistent pressures.” Like other major central banks, the implication is that rates would remain high for longer.

“Today’s decision to keep the base rate unchanged will be welcomed by companies already struggling to meet interest obligations,” said Nils Kuhlwein, partner at management consulting firm Kearney. “Successive base rate jumps over recent years have turned the screw on these companies.”

The MPC has been laying the ground to pause policy as the UK’s economic outlook darkened in recent weeks. Bailey said this month that rates were “much nearer now to the top of the cycle” and Deputy Governor Jon Cunliffe said the bank was close to a turning point.

The MPC expressed concerns that the economy was stalling after output in July contracted 0.5%, a sharper fall than expected, and official figures showed unemployment rising and job vacancies dropping. The committee also noted that business activity data is contracting, while raising questions about official measures that show wage growth is accelerating.

The BOE cut its GDP growth forecast for the third quarter to 0.1% from 0.4%, the minutes showed. Underlying growth in the second half of 2023 is also likely to be weaker than the 0.25% expected in August.

The bank said past rate hikes were having an impact: “There are increasing signs of some impact of tighter monetary policy on the labor market and on momentum in the real economy more general.”

As the economy slows, inflation was expected to drop below 2% “in the medium term.” In the short term, the bank expects a “significant” fall in inflation “despite the renewed upward pressure from oil prices” due to declining energy and goods inflation.

Higher rates have been punishing homeowners, who face a £15 billion repayment crunch, according to the Resolution Foundation, much of which has yet to come through. Several MPC members have been warning that policy lags mean the BOE was already at risk of overtightening.

Swati Dhingra, an external member has been voting to hold since December last year. She was joined by Bailey, Deputy Governors Ben Broadbent and Dave Ramsden and Chief Economist Huw Pill. Cunliffe and external members Megan Greene, Catherine Mann and Jonathan Haskel voted to raise rates by a quarter point to 5.5%.

Other central banks are signalling that cycle is over, too. The ECB raised rates to 4% last week and said “sufficient contributions” had been made to return inflation to target. The US Federal Reserve on Wednesday held rates in the 5.25%-5.5% range, but did suggest further increases were on the cards and ruled out any imminent rate cuts.

Markets were split before the vote, betting on a roughly 50% chance of a vote to hold, after a surprise fall in August inflation to 6.7% this week. Investors still expect one more quarter-point increase although Goldman Sachs and Nomura reckon rates have now peaked.

The pound extended losses to the lowest since March as traders trimmed bets on further interest-rate hikes.

The market is pricing in around 18 basis points of more tightening compared to a full quarter-point before the decision.

Loading…