Boeing has identified a manufacturing problem in the aft pressure bulkhead on specific 737 Max jets, which helps maintain cabin pressure. The new issue could derail delivery targets for Boeing's cash-cow jet.

"During factory inspections, we identified fastener holes that did not conform to our specifications in the aft pressure bulkhead on certain 737 airplanes," Boeing told Bloomberg via email.

Boeing acknowledged the problem and announced they had finished a technical evaluation: "We understand the issue and required fix," it told publication The Air Current, stressing that they don't see it as an immediate threat to flight safety of operating 737 Max jets.

The production issue stems from supplier Spirit AeroSystems, which builds 70% of the narrowbody jet frames. It said, "Spirit uses multiple suppliers for the aft pressure bulkhead, only some units are affected. Spirit will continue to deliver units to Boeing."

The supplier added, "Spirit has implemented changes to its manufacturing process to address this issue."

The Air Current pointed out that "near-term delivery delays for some 737 Max aircraft" are likely, " making the latest quality issue another in an extended string of headaches that the plane maker and its most important supplier have endured as they work to find a stable production tempo."

Here's how Wall Street analysts reacted to the news (list courtesy of Bloomberg):

Jefferies (buy, PT $275)

Analyst Sheila Kahyaoglu says that while Boeing will continue to ramp up production of the Max to 38 per month, near-term delays are likely to prolong the time before it achieves that rate of output

Notes that Spirit flagged a quality issue involving certain 737 Max models; issue affects some Max-8 models, and Kahyaoglu estimates that each one-month delay of Max-8 deliveries could result in a $300 million free cash flow impact, at around $10 million per Max

Citi (buy, PT $285)

It's early days on both the near and long-term financial impacts of the issue, but it appears the fix is likely to take several weeks for completed aircraft, which likely puts pressure on Boeing's delivery forecast for the year, analyst Jason Gursky says

Notes that Spirit, the supplier that builds most of the jet frames, will technically be on the hook for the cost of the inspections and repairs of in-production aircraft as well as the installed fleet

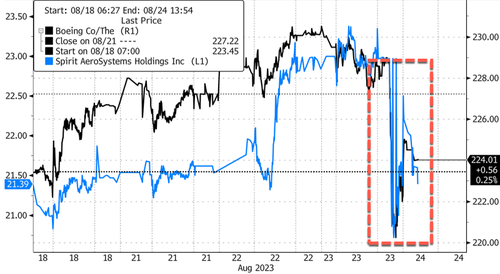

Shares of Boeing fell 2% in New York's premarket trading, while Spirit dropped 6.5%.

The latest issue might impact near-term deliveries and cause Boeing to miss annual delivery targets. Add this to the problems the jet has experienced over the years, including when it was grounded after deadly crashes in Indonesia and Ethiopia.

Boeing has identified a manufacturing problem in the aft pressure bulkhead on specific 737 Max jets, which helps maintain cabin pressure. The new issue could derail delivery targets for Boeing’s cash-cow jet.

“During factory inspections, we identified fastener holes that did not conform to our specifications in the aft pressure bulkhead on certain 737 airplanes,” Boeing told Bloomberg via email.

Boeing acknowledged the problem and announced they had finished a technical evaluation: “We understand the issue and required fix,” it told publication The Air Current, stressing that they don’t see it as an immediate threat to flight safety of operating 737 Max jets.

The production issue stems from supplier Spirit AeroSystems, which builds 70% of the narrowbody jet frames. It said, “Spirit uses multiple suppliers for the aft pressure bulkhead, only some units are affected. Spirit will continue to deliver units to Boeing.”

The supplier added, “Spirit has implemented changes to its manufacturing process to address this issue.”

The Air Current pointed out that “near-term delivery delays for some 737 Max aircraft” are likely, ” making the latest quality issue another in an extended string of headaches that the plane maker and its most important supplier have endured as they work to find a stable production tempo.”

Here’s how Wall Street analysts reacted to the news (list courtesy of Bloomberg):

Jefferies (buy, PT $275)

Analyst Sheila Kahyaoglu says that while Boeing will continue to ramp up production of the Max to 38 per month, near-term delays are likely to prolong the time before it achieves that rate of output

Notes that Spirit flagged a quality issue involving certain 737 Max models; issue affects some Max-8 models, and Kahyaoglu estimates that each one-month delay of Max-8 deliveries could result in a $300 million free cash flow impact, at around $10 million per Max

Citi (buy, PT $285)

It’s early days on both the near and long-term financial impacts of the issue, but it appears the fix is likely to take several weeks for completed aircraft, which likely puts pressure on Boeing’s delivery forecast for the year, analyst Jason Gursky says

Notes that Spirit, the supplier that builds most of the jet frames, will technically be on the hook for the cost of the inspections and repairs of in-production aircraft as well as the installed fleet

Shares of Boeing fell 2% in New York’s premarket trading, while Spirit dropped 6.5%.

The latest issue might impact near-term deliveries and cause Boeing to miss annual delivery targets. Add this to the problems the jet has experienced over the years, including when it was grounded after deadly crashes in Indonesia and Ethiopia.

Loading…