Nearly 33,000 unionized Boeing factory workers are entering the third week of strikes after negotiations between the union and the aerospace giant collapsed over the weekend.

On X, the International Association of Machinists and Aerospace Workers (IAM) wrote in a post late Friday that zero progress has been made on a new labor contract with Boeing.

"While conversations were direct, we did not make progress on the pension issue. The company remains adamant that it will not unfreeze the defined benefit plan. The company also would not engage substantively about other issues that the membership has made clear remain top priorities, like higher pay, quicker wage progression, and more PTO," IAM District 751 said.

The union said more bluntly, "Talks broke off, and we have no further dates scheduled at this time." Federal mediators led the talks on late Friday.

Day 15 - Strike Update

— IAM Union District 751 (@IAM751) September 28, 2024

September 27, 2024

Even the pups are Holding the Line!

Today, your Union Bargaining Committee went back to mediated talks with Boeing. With the support of Federal Mediation and Conciliation Services (FMCS), we had frank discussions about the needs of our… pic.twitter.com/J7gJQuYbZC

On Saturday morning, Boeing told AP News that it was "prepared to meet at any time" with IAM negotiators to bargain in good faith and reach a labor deal as soon as possible.

Early last week, Boeing submitted its "best and final offer" for a new labor contract with IAM.

The offer included:

-

A general pay bump of 30% over four years.

-

Reinstatement of the performance bonus.

-

Enhancement of retirement benefits.

-

Doublement of the ratification bonus to $6,000.

However, IAM leaders rejected the offer, explaining that "it missed the mark on many of the things our members said were important to them." The union's original demand is a 40% pay increase over three years.

Bloomberg notes, "Each day of strike has cost Boeing about $100 million by some estimates, forcing the company to embark on a broad savings push that includes worker furloughs, a hiring freeze and cutting back on corporate travel."

Multiple credit rating agencies, including Fitch and Moody's, warned in recent weeks that Boeing's credit rating was at risk of being downgraded from investment grade to junk bond status. Standard & Poor's had already warned that a downgrade would likely occur after the strike materialized.

The last time Boeing machinists went on strike was September 7, 2008. At the time, the strike was over job security, outsourcing, pay, and benefits. This caused a $1.2 billion hit to the company's net income. This time, it's likely the labor action will be more costly.

Let's not forget Boeing's supplier network is at risk of turmoil...

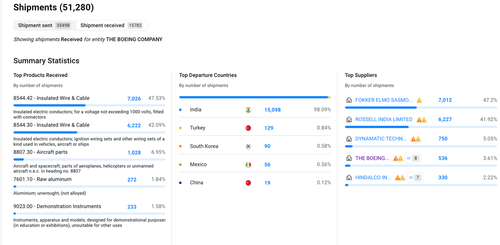

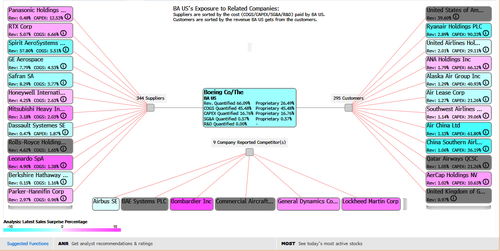

Boeing's top suppliers via Bloomberg data.

According to risk management firm Sayari Labs, the latest Boeing shipments primarily come from India, Turkey, South Korea, Mexico, and China. Suppliers in these regions are likely to be the most impacted.

In markets, Boeing shares in New York are down 40% on the year (as of Friday's close). Since peaking at $440 a share in 2019 (around the Max crashes), shares are 65% off the high, oscillating between $250 and $100 since the early 2020 crash.

What a mess.

Nearly 33,000 unionized Boeing factory workers are entering the third week of strikes after negotiations between the union and the aerospace giant collapsed over the weekend.

On X, the International Association of Machinists and Aerospace Workers (IAM) wrote in a post late Friday that zero progress has been made on a new labor contract with Boeing.

“While conversations were direct, we did not make progress on the pension issue. The company remains adamant that it will not unfreeze the defined benefit plan. The company also would not engage substantively about other issues that the membership has made clear remain top priorities, like higher pay, quicker wage progression, and more PTO,” IAM District 751 said.

The union said more bluntly, “Talks broke off, and we have no further dates scheduled at this time.” Federal mediators led the talks on late Friday.

Day 15 – Strike Update

September 27, 2024Even the pups are Holding the Line!

Today, your Union Bargaining Committee went back to mediated talks with Boeing. With the support of Federal Mediation and Conciliation Services (FMCS), we had frank discussions about the needs of our… pic.twitter.com/J7gJQuYbZC

— IAM Union District 751 (@IAM751) September 28, 2024

On Saturday morning, Boeing told AP News that it was “prepared to meet at any time” with IAM negotiators to bargain in good faith and reach a labor deal as soon as possible.

Early last week, Boeing submitted its “best and final offer” for a new labor contract with IAM.

The offer included:

-

A general pay bump of 30% over four years.

-

Reinstatement of the performance bonus.

-

Enhancement of retirement benefits.

-

Doublement of the ratification bonus to $6,000.

However, IAM leaders rejected the offer, explaining that “it missed the mark on many of the things our members said were important to them.” The union’s original demand is a 40% pay increase over three years.

Bloomberg notes, “Each day of strike has cost Boeing about $100 million by some estimates, forcing the company to embark on a broad savings push that includes worker furloughs, a hiring freeze and cutting back on corporate travel.”

Multiple credit rating agencies, including Fitch and Moody’s, warned in recent weeks that Boeing’s credit rating was at risk of being downgraded from investment grade to junk bond status. Standard & Poor’s had already warned that a downgrade would likely occur after the strike materialized.

The last time Boeing machinists went on strike was September 7, 2008. At the time, the strike was over job security, outsourcing, pay, and benefits. This caused a $1.2 billion hit to the company’s net income. This time, it’s likely the labor action will be more costly.

Let’s not forget Boeing’s supplier network is at risk of turmoil…

Boeing’s top suppliers via Bloomberg data.

According to risk management firm Sayari Labs, the latest Boeing shipments primarily come from India, Turkey, South Korea, Mexico, and China. Suppliers in these regions are likely to be the most impacted.

In markets, Boeing shares in New York are down 40% on the year (as of Friday’s close). Since peaking at $440 a share in 2019 (around the Max crashes), shares are 65% off the high, oscillating between $250 and $100 since the early 2020 crash.

What a mess.

Loading…