In a central bank decision that was a far more uncertain nailbiter than the Fed's guaranteed 25bps hike, moments ago the BOJ revealed that in a unanimous vote it would keep rates at -0.1% and also keep the 10Y JGB yield target at 0%, but in an 8-1 vote (with Yakamura dissenting) said it would conduct yield curve control "with greater flexibility" (i.e. tweak it) by which it means that both the lower and upper bounds (but mostly upper) of yield control would be "references" not "rigid limits."

What does that mean? This is how the BOJ explained it in its statement:

The Bank will continue to allow 10-year JGB yields to fluctuate in the range of around plus and minus 0.5 percentage points from the target level, while it will conduct yield curve control with greater flexibility, regarding the upper and lower bounds of the range as references, not as rigid limits, in its market operations.

The Bank will offer to purchase 10-year JGBs at 1.0 percent every business day through fixed-rate purchase operations, unless it is highly likely that no bids will be submitted.

In order to encourage the formation of a yield curve that is consistent with the above guideline for market operations, the Bank will continue with large-scale JGB purchases and make nimble responses for each maturity by, for example, increasing the amount of JGB purchases and conducting fixed-rate purchase operations and the Funds-Supplying Operations against Pooled Collateral.

What is the punchline: while everything else remains the same, going forward the BOJ will offer to purchase 10Y at 1.0% yield instead of 0.50% - which is where the target for the 10Y JGB remains - which means that we are about to see a whole lot more volatility in the JGB market as bond traders test just how high the BOJ will allow yields to rise. And sure enough, at last check the 10Y was already yielding just south of 0.57% - or far above the previous YCC limit - ensuring that the BOJ has a lot of emergency bond buying ahead of it, just like in Dec/Jan when it tweaked YCC previously.

The rest of the statement was the usual compendium of excuses for why the BOJ will inevitably get everything wrong:

There are extremely high uncertainties for Japan's economic activity and prices, including developments in overseas economic activity and prices, developments in commodity prices, and domestic firms' wage- and price-setting behavior. Under these circumstances, it is necessary to pay due attention to developments in financial and foreign exchange markets and their impact on Japan's economic activity and prices.

Japan's recent inflation rates, as measured by the consumer price index (CPI), are higher than projected in the April 2023 Outlook Report, and wage growth has risen, partly on the back of this year's annual spring labor-management wage negotiations. Signs of change have been seen in firms' wage- and price-setting behavior, and inflation expectations have shown some upward movements again. If upward movements in prices continue, the effects of monetary easing will strengthen through a decline in real interest rates, while on the other hand, strictly capping long-term interest rates could affect the functioning of bond markets and the volatility in other financial markets. Such effects are expected to be mitigated by conducting yield curve control with greater flexibility.

Meanwhile, there are also significant downside risks to Japan's economic activity and prices, including the impact of a tightening of global financial conditions on overseas economies. If such downside risks materialize, the effects of monetary easing will be maintained through a decline in long-term interest rates under the framework of yield curve control.

Only 18% of the 50 economists polled by Bloomberg expected a YCC tweak at this meeting (in no small part due to Bloomberg's own reporting on the matter), though half foresaw such a move no later than October. In addition, there was a widespread view that any change to the program would have to come as a surprise, as any foreshadowing might trigger a massive bond sell-off, complicating the move. Instead, the bond selloff has just been delayed to, well, right now.

Eslewhere, while the BOJ did admit that inflation was higher than it expected in April, and it also did hike its 2023 core CPI forecast to 2.5% from 1.8% previously, the central bank bizarrely slashed its 2024 core CPI forecast from 2.0% to 1.9%, as inflation's effects "are expected to be mitigated by conducting yield curve control with greater flexibility." suggesting that no more "tweaking" or whatever it's now called will be required, and instead the current yield differentials for the world's carry currency of choice will remain for the foreseeable future.

To summarize the revised forecasts:

Real GDP

- Fiscal 2023 median forecast cut to 1.3% from 1.4%.

- Fiscal 2024 median forecast maintained at 1.2%.

- Fiscal 2025 median forecast maintained at 1.0%.

Core CPI

- Fiscal 2023 median forecast raised to 2.5% from 1.8%.

- Fiscal 2024 median forecast cut to 1.9% from 2.0%.

- Fiscal 2025 median forecast maintained at 1.6%.

The continuation of the main policy settings will likely enable Ueda to argue that the new guidance on the band was a technical move aimed at improving the sustainability of its stimulus, rather than a step toward imminent policy normalization.

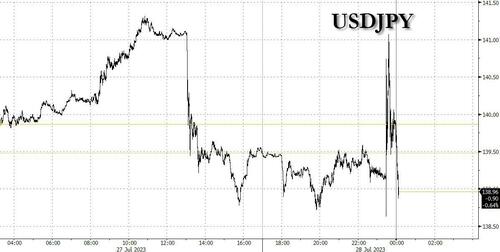

In kneejerk response to the half-pregnant YCC tweak, which will do nothing to reverse Japan's inflation problem but will do everything to spark another bond market crisis, the USDJPY first spiked by 200 pips before reversing the entire move...

... but a far more significant move was observed in 10Y JGBs whose yields were spiked as high as 0.57% - the highest level since 2014 - as the market prepares to test just how serious the BOJ's new resolve will be.

Knowing well it would kick the bond market hornets nest, the BOJ immediately announce it would widen its range for purchase of medium and long-term JGBs in Aug.

- Offers to buy 400b-750b yen of 3-5 year JGBs 4 times/month

- Offers to buy 450b-900b yen of 5-10 year JGBs 4 times/month

- Purchase amounts of other maturities unchanged

To summarize: all the BOJ has done is buy itself a few weeks of a stronger yen, until the 10Y yield rerates from 0.5% to 1.0% (still far below inflation), before yield differentials re-emerge as the dominant power in currency pairs. Meanwhile, the repricing of the entire JGB bond market, the 2nd largest in the world - will send shockwaves not only in Japan but across the globe. In fact, at last check, the 10Y TSY yield was at 4.03%, right at session highs.

Commenting on the BOJ's decision, former Bank of Japan assistant governor Kazuo Momma said that the central bank is making a little adjustment to the yield-curve control "because the exchange rate weakened before the meeting and there are risks it could decline further." In other words, instead of buying the yen outright, the central bank has decided to cripple the bond market as well.

“My sense is that the hidden motivation for the BOJ is the exchange rate,” Momma, who is currently an executive economist at Mizuho Research and Technologies said on Bloomberg Television. A strict YCC may invite an undesirable weakening of the yen going forward, he said correctly.

“This is not the first step toward monetary policy normalization. I would characterize this as a mini-technical tweak not a tweak” Momma said adding that “this is not the time for the BOJ to send a message that this is the first step to policy normalization."

Which is correct: the BOJ will never be able to normalize, instead the best it can hope for is to contain the collapse in the yen by keeping the market guessing, although after an initial period has passed, the selling in the yen will promptly resume.

Momma concluded that the press conference will be very important on how they convey the message on conducting YCC. "Changing the band would be sending a clearer message that they’re taking steps toward policy normalization but that’s the last thing they want."

The problem with the BOJ is that what they want, and what they get, are usually two very different things.

In a central bank decision that was a far more uncertain nailbiter than the Fed’s guaranteed 25bps hike, moments ago the BOJ revealed that in a unanimous vote it would keep rates at -0.1% and also keep the 10Y JGB yield target at 0%, but in an 8-1 vote (with Yakamura dissenting) said it would conduct yield curve control “with greater flexibility” (i.e. tweak it) by which it means that both the lower and upper bounds (but mostly upper) of yield control would be “references” not “rigid limits.”

What does that mean? This is how the BOJ explained it in its statement:

The Bank will continue to allow 10-year JGB yields to fluctuate in the range of around plus and minus 0.5 percentage points from the target level, while it will conduct yield curve control with greater flexibility, regarding the upper and lower bounds of the range as references, not as rigid limits, in its market operations.

The Bank will offer to purchase 10-year JGBs at 1.0 percent every business day through fixed-rate purchase operations, unless it is highly likely that no bids will be submitted.

In order to encourage the formation of a yield curve that is consistent with the above guideline for market operations, the Bank will continue with large-scale JGB purchases and make nimble responses for each maturity by, for example, increasing the amount of JGB purchases and conducting fixed-rate purchase operations and the Funds-Supplying Operations against Pooled Collateral.

What is the punchline: while everything else remains the same, going forward the BOJ will hard offer to purchase 10Y at 1.0% yield instead of 0.50% – which is where the target for the 10Y JGB remains – while leaving it to its discretion how much it will purchase at any one point between 0.5% and 1.0%.

Which means that we are about to see a whole lot more volatility in the JGB market as the market tests just how high the BOJ will allow yields to rise. And sure enough, at last check the 10Y was already yielding just north of 0.57% – or far above the previous YCC limit – ensuring that the BOJ has a lot of emergency bond buying ahead of it, just like in Dec/Jan when it tweaked YCC previously.

The rest of the statement was the usual compendium of excuses for why the BOJ will inevitably get everything wrong:

There are extremely high uncertainties for Japan’s economic activity and prices, including developments in overseas economic activity and prices, developments in commodity prices, and domestic firms’ wage- and price-setting behavior. Under these circumstances, it is necessary to pay due attention to developments in financial and foreign exchange markets and their impact on Japan’s economic activity and prices.

Japan’s recent inflation rates, as measured by the consumer price index (CPI), are higher than projected in the April 2023 Outlook Report, and wage growth has risen, partly on the back of this year’s annual spring labor-management wage negotiations. Signs of change have been seen in firms’ wage- and price-setting behavior, and inflation expectations have shown some upward movements again. If upward movements in prices continue, the effects of monetary easing will strengthen through a decline in real interest rates, while on the other hand, strictly capping long-term interest rates could affect the functioning of bond markets and the volatility in other financial markets. Such effects are expected to be mitigated by conducting yield curve control with greater flexibility.

Meanwhile, there are also significant downside risks to Japan’s economic activity and prices, including the impact of a tightening of global financial conditions on overseas economies. If such downside risks materialize, the effects of monetary easing will be maintained through a decline in long-term interest rates under the framework of yield curve control.

Only 18% of the 50 economists polled by Bloomberg expected a YCC tweak at this meeting (in no small part due to Bloomberg’s own reporting on the matter), though half foresaw such a move no later than October. In addition, there was a widespread view that any change to the program would have to come as a surprise, as any foreshadowing might trigger a massive bond sell-off, complicating the move. Instead, the bond selloff has just been delayed to, well, right now.

Eslewhere, while the BOJ did admit that inflation was higher than it expected in April, and it also did hike its 2023 core CPI forecast to 2.5% from 1.8% previously, the central bank bizarrely slashed its 2024 core CPI forecast from 2.0% to 1.9%, as inflation’s effects “are expected to be mitigated by conducting yield curve control with greater flexibility.” suggesting that no more “tweaking” or whatever it’s now called will be required, and instead the current yield differentials for the world’s carry currency of choice will remain for the foreseeable future.

To summarize the revised forecasts:

Real GDP

- Fiscal 2023 median forecast cut to 1.3% from 1.4%.

- Fiscal 2024 median forecast maintained at 1.2%.

- Fiscal 2025 median forecast maintained at 1.0%.

Core CPI

- Fiscal 2023 median forecast raised to 2.5% from 1.8%.

- Fiscal 2024 median forecast cut to 1.9% from 2.0%.

- Fiscal 2025 median forecast maintained at 1.6%.

The continuation of the main policy settings will likely enable Ueda to argue that the new guidance on the band was a technical move aimed at improving the sustainability of its stimulus, rather than a step toward imminent policy normalization.

In kneejerk response to the half-pregnant YCC tweak, which will do nothing to reverse Japan’s inflation problem but will do everything to spark another bond market crisis, the USDJPY first spiked by 200 pips before reversing the entire move…

… but a far more significant move was observed in 10Y JGBs whose yields were spiked as high as 0.57% – the highest level since 2014 – as the market prepares to test just how serious the BOJ’s new resolve will be.

Knowing well it would kick the bond market hornets nest, the BOJ immediately announce it would widen its range for purchase of medium and long-term JGBs in Aug.

- Offers to buy 400b-750b yen of 3-5 year JGBs 4 times/month

- Offers to buy 450b-900b yen of 5-10 year JGBs 4 times/month

- Purchase amounts of other maturities unchanged

To summarize: with today’s “less hawkish than expected” YCC tweak (see below) all the BOJ has done is buy itself a few weeks of a stronger yen, until the 10Y yield rerates from 0.5% to 1.0% (still far below inflation), before yield differentials re-emerge as the dominant power in currency pairs. Meanwhile, as part of its half-assed attempt to control both the currency and rates, the repricing of the entire JGB bond market, the 2nd largest in the world, will send shockwaves not only in Japan but across the globe. In fact, at last check, the 10Y TSY yield was at 4.03%, right at session highs.

* * *

Commenting on the BOJ’s decision, Khoon Goh head of Asia research at Australia & New Zealand Banking Group said that the Bank of Japan’s decision to tweak their yield curve control was in line with what the market had anticipated, but probably not as hawkish as previously feared.

“The range that the 10-year JGB yield is allowed to fluctuate remains unchanged, but greater flexibility has been introduced at the upper and lower bounds of the range.”

“How far yields will be allowed to trade beyond those limits is uncertain, and something which the market will no doubt try to test”, and indeed the relentless selling in 10Y JGB has confirmed just that.

“But there is a hard limit of 1% as the BOJ will offer to purchase 10-year JGBs at that level every business day through fixed-rate purchase operations (up from 0.5% previously)” he said, adding that “market reaction has been very choppy as it is not a straightforward decision to digest. The yen is still gyrating, but risk assets have risen, as the tweak was not as bad as initially feared”

A somewhat more formal take came from former Bank of Japan assistant governor Kazuo Momma, who said that the central bank is making a little adjustment to the yield-curve control “because the exchange rate weakened before the meeting and there are risks it could decline further.” In other words, instead of buying the yen outright, the central bank has decided to cripple the bond market as well.

“My sense is that the hidden motivation for the BOJ is the exchange rate,” Momma, who is currently an executive economist at Mizuho Research and Technologies said on Bloomberg Television. A strict YCC may invite an undesirable weakening of the yen going forward, he said correctly.

“This is not the first step toward monetary policy normalization. I would characterize this as a mini-technical tweak not a tweak” Momma said adding that “this is not the time for the BOJ to send a message that this is the first step to policy normalization.”

Which is correct: the BOJ will never be able to normalize, instead the best it can hope for is to contain the collapse in the yen by keeping the market guessing, although after an initial period has passed, the selling in the yen will promptly resume.

Momma concluded that the press conference will be very important on how they convey the message on conducting YCC. “Changing the band would be sending a clearer message that they’re taking steps toward policy normalization but that’s the last thing they want.“

The problem with the BOJ is that what they want, and what they get, are usually two very different things.

Loading…