By Donovan Choy of Bankless

Voyager Digital Goes Bankrupt

“The company is well capitalized and in a good position to weather this market cycle and protect customer assets.” — Voyager Digital press release, June 14th 2022.

That did not age well. CeFi firm Voyager Digital filed for bankruptcy this week.

The publicly traded crypto bank got caught up making huge uncollateralized loans of $660M to “too-big-to-fail” crypto hedge fund 3AC, which was in turn making its own leveraged risky trades all over the place.

Voyager customers were in effect lending to 3AC in a game of musical chairs, and the music came to a screeching default halt to the tune of 15250 BTC and 350M USDC.

Now, Voyager has a remaining $110M in assets on hand, plus $1.3B in assets.

The bankruptcy filing means that Voyager customers will likely not receive their assets back in full.

Here’s the company’s rough plan to make customers “whole”:

Voyager customers will receive a combination of some cryptoassets, a share of Voyager’s $660M claim against 3AC (now also bankrupt btw), a bunch of VGX “loyalty” tokens for “boosting rewards'' on crypto deposits, and VOYG shares — upon which trading has been halted on the Toronto Stock Exchange.

Something tells me Voyager users won’t be overly keen on receiving shares of a sunken ship.

Here’s how the rest of the pieces in the 3AC pandemic contagion puzzle lay:

- 3AC has filed for Chapter 15 bankruptcy in a New York court in a bid to protects its remaining assets from a legal grab

- Nexo is making moves to acquire the Coinbase-backed Vauld, another struggling crypto lender that halted withdrawals last week

- Facing $80M in losses from its 3AC loan, FTX acquires BlockFi this week for $240M. Its valuation at its peak was ~$4B+. (oof)

- Genesis Trading is facing hundreds of millions of dollars in losses from its exposure to 3AC.

- Finally, Celsius has completely paid down its WBTC loan on its Maker vault and gotten all its collateral ($440M) back.

The only lenders Celsius has paid back: @AaveAave @MakerDAO @compoundfinance

— Leighton (@lay2000lbs) July 7, 2022

Smart contracts have a higher liquidation preference than any paper agreement

DeFi protects you from Celsius https://t.co/lA68IAI4Bp

* * *

Aave proposes GHO stablecoin

Aave’s latest governance proposal is taking DeFi by storm. The DeFi giant is proposing GHO, an overcollateralized USD-pegged stablecoin that lenders can mint against supplied collateral — similar to Maker’s DAI.

Why GHO? The business strategy is to capture stablecoin market share through “organic adoption via L2s.” Aave V3 is currently deployed across six chains, including Polygon and Ethereum L2s Arbitrum and Optimism. GHO will also serve as a revenue generator for Aave, as 100% of interest paid on GHO loans by borrowers will be sent to the DAO.

Obviously, this is huge. Aave is the second largest DeFi protocol by TVL after Maker. An Aave stablecoin would place both protocols in direct competition. For every one GHO in Aave means one less DAI in Aave.

Aave’s massive lending market across multiple chains gives its stablecoin a big advantage in getting off the ground, thanks to its many existing stakeholders and deep liquidity. Aave is tapping well on both of these strengths.

For example: GHO is designed to be highly incentive-compatible with existing AAVE token holders. Aave Safety Module stakers (stkAAVE) can mint GHO at a discounted rate, and sell them on other DeFi protocols for arbitrage profits, driving utility to the AAVE token. This means AAVE holders have a significant interest in seeing GHO passed.

Anxious rumblings are already rumbling on the Maker forums. Aave leaders are doing their best to soothe concerns.

Voting hasn’t begun yet, but keep your eyes peeled for this one. Here are some other salient details:

- GHO is designed to have a fixed stable borrowing interest rate which “the DAO will be able to decide… and change over time through a governance process,” similar to how MKR holders decide on the mechanics (stability fee, debt ceiling, DAI savings rate) that govern DAI.

- Only intermediaries known as “facilitators” can mint and burn GHO. Who these facilitators will be, their minting limits, and types of collateral they can accept against minting (see chart) will be decided by the DAO.

- E-Mode is a stabilizing factor that ensures users access GHO with a 1:1 rate

- Portal will let users transfer GHO by simple message passing, thereby bypassing bridging risks.

* * *

Facebook and Reddit NFTs

We're launching NFTs on Facebook! Excited to share what I've been working on with the world. pic.twitter.com/TaV66zRanV

— Navdeep Singh (@navdeep_ua) June 29, 2022

Facebook announced this week that it was testing support for Ethereum and Polygon NFTs on its platform, with Solana and Flow to come. This comes about two months after its sister company Instagram did the same.

Reddit also announced the launch of its own limited edition collection of “Collectible Avatars” that users can display on their profile pictures, designed by artists that were carefully curated by Reddit. These aren’t quite NFTs in the traditional sense. Reddit lets you play dress-up with the way they look, but they are stored on the Polygon chain.

GM @0xPolygon Fam!@Reddit is launching its NFT Marketplace on @0xPolygon!

— Sandeep | Polygon 💜🔝3️⃣ (@sandeepnailwal) July 7, 2022

Goal : #Top3 by impact - BTC,ETH, Polygon; nothing less, nothing more.

Never stop building! WAGMI!https://t.co/VhSMEl2wJd

* * *

Crypto smartphones are here (again)

Layer-1 blockchains are coming for a slice of the smartphone market.

Solana announced last week Saga, an AndroidOS phone that comes with tools to securely store and trade digital assets. You can track even tracks its sales on-chain and it seems to have stagnated at 2.6K preorders for the $1000 device.

⚡️⚡️.@solana launch #web3-focused smartphone Saga to improve crypto-mobile relationship

— P2E Secret Hub (@P2E_SecretHub) July 4, 2022

“This is something that I fundamentally believe the industry needs to do,” Yakovenko said. “We didn’t see a single crypto feature at the Apple developer conference 13 years.#p2esecrethub pic.twitter.com/UxTKoNY1JL

While the demand for a crypto smartphone may not be overwhelming, Solana has played the move as the opening bell of a long arc of Web3 integration into mobile phone software and hardware.

Polygon is also launching its own “metaverse phone.” Unlike Solana though, this is in partnership with the Taiwanese tech juggernaut HTC.

Mass adoption of Web3 will happen on mobile and @0xPolygon is preparing for it.

— Mihailo Bjelic (@MihailoBjelic) July 4, 2022

Our strategy is not to make our own devices. Instead, we will integrate with existing manufacturers.

Today, we are proud to announce the first major integration.

Onwards. 🔥https://t.co/sGCfTm6v7P

These are not the first forays crypto has made into the smartphone sector. Most notably, Sirin Labs launched the Finney smartphone all the way back in 2019, but sales were low and the project ebbed thereafter. Let’s hope this generation of crypto smartphones fares better.

* * *

Web3 News Roundup

Aztec Connect launch

Aztec Connect is the “VPN for Ethereum,” according to creators Aztec. It’s a private roll-up that lets you execute DeFi transactions on Ethereum dapps with complete privacy. It drops this week and major protocols like Curve and Lido are already deployed.

Today we launched Aztec Connect, the VPN for Ethereum.

— jonwu.(🗽, 🍎) (@jonwu_) July 7, 2022

I just used it to get some $stETH on mainnet Curve for $1.50 in fees, with complete privacy.

Fully private DeFi, with huge cost savings.

Why I think our private rollup is ridiculously bullish for Ethereum: pic.twitter.com/v75YXt0glU

* * *

EU crypto regulation

This week saw the EU finalize MiCA (Markets-in-Crypto-Assets), a base legal framework to regulating crypto.

The good news: They’re leaving PoW mining alone, NFTs and DeFi are (mostly) out of the scope of MiCA.

The bad: Stablecoins get hit hard:

… MiCA will protect consumers by requesting stablecoins issuers to build up a sufficiently liquid reserve, with a 1/1 ratio and partly in the form of deposits. Every so-called “stablecoin” holder will be offered a claim at any time and free of charge by the issuer, and the rules governing the operation of the reserve will also provide for an adequate minimum liquidity…

The development of asset-referenced tokens (ARTs) based on a non-European currency, as a widely used means of payment, will be constrained to preserve our monetary sovereignty. Issuers of ARTs will need to have a registered office in the EU to ensure the proper supervision and monitoring of offers to the public of asset-referenced tokens.

* * *

Sepolia merge

The Ethereum Sepolia test network merged successfully. Two down (Ropsten, Sepolia), one to go (Goerli).

BREAKING - Ethereum completes another successful test of The Merge on Sepolia 🐼

— bankless.eth (@BanklessHQ) July 6, 2022

Goerli next.

Mainnet after.

Don't sleep. pic.twitter.com/YeQfghmm5O

* * *

Immutable X update

If you have ETH on an L2 that you’d like to spend in the real world, you’d babe to offramp it by sending ETH from L2 to a centralized exchange, requesting a withdrawal, and waiting few days before you could spend it.

Immutable X is streamlining this process in one step — with no gas fees!

Caveat: It’s only for ETH for now, and for the UK, EU and select US states.

1/ Major update! $ETH offramp is now available to any developer building an @Immutable X powered platform

— Immutable | $IMX ⓧ (@Immutable) July 5, 2022

Developers can enable their users to sell L2 $ETH and have the proceeds deposited directly to their bank accounts. https://t.co/DmiyWV8wYy

Continue below👇 pic.twitter.com/Uhm214oy2E

By Donovan Choy of Bankless

Voyager Digital Goes Bankrupt

“The company is well capitalized and in a good position to weather this market cycle and protect customer assets.” — Voyager Digital press release, June 14th 2022.

That did not age well. CeFi firm Voyager Digital filed for bankruptcy this week.

The publicly traded crypto bank got caught up making huge uncollateralized loans of $660M to “too-big-to-fail” crypto hedge fund 3AC, which was in turn making its own leveraged risky trades all over the place.

Voyager customers were in effect lending to 3AC in a game of musical chairs, and the music came to a screeching default halt to the tune of 15250 BTC and 350M USDC.

Now, Voyager has a remaining $110M in assets on hand, plus $1.3B in assets.

The bankruptcy filing means that Voyager customers will likely not receive their assets back in full.

Here’s the company’s rough plan to make customers “whole”:

Voyager customers will receive a combination of some cryptoassets, a share of Voyager’s $660M claim against 3AC (now also bankrupt btw), a bunch of VGX “loyalty” tokens for “boosting rewards” on crypto deposits, and VOYG shares — upon which trading has been halted on the Toronto Stock Exchange.

Something tells me Voyager users won’t be overly keen on receiving shares of a sunken ship.

Here’s how the rest of the pieces in the 3AC pandemic contagion puzzle lay:

- 3AC has filed for Chapter 15 bankruptcy in a New York court in a bid to protects its remaining assets from a legal grab

- Nexo is making moves to acquire the Coinbase-backed Vauld, another struggling crypto lender that halted withdrawals last week

- Facing $80M in losses from its 3AC loan, FTX acquires BlockFi this week for $240M. Its valuation at its peak was ~$4B+. (oof)

- Genesis Trading is facing hundreds of millions of dollars in losses from its exposure to 3AC.

- Finally, Celsius has completely paid down its WBTC loan on its Maker vault and gotten all its collateral ($440M) back.

The only lenders Celsius has paid back: @AaveAave @MakerDAO @compoundfinance

Smart contracts have a higher liquidation preference than any paper agreement

DeFi protects you from Celsius https://t.co/lA68IAI4Bp

— Leighton (@lay2000lbs) July 7, 2022

* * *

Aave proposes GHO stablecoin

Aave’s latest governance proposal is taking DeFi by storm. The DeFi giant is proposing GHO, an overcollateralized USD-pegged stablecoin that lenders can mint against supplied collateral — similar to Maker’s DAI.

Why GHO? The business strategy is to capture stablecoin market share through “organic adoption via L2s.” Aave V3 is currently deployed across six chains, including Polygon and Ethereum L2s Arbitrum and Optimism. GHO will also serve as a revenue generator for Aave, as 100% of interest paid on GHO loans by borrowers will be sent to the DAO.

Obviously, this is huge. Aave is the second largest DeFi protocol by TVL after Maker. An Aave stablecoin would place both protocols in direct competition. For every one GHO in Aave means one less DAI in Aave.

Aave’s massive lending market across multiple chains gives its stablecoin a big advantage in getting off the ground, thanks to its many existing stakeholders and deep liquidity. Aave is tapping well on both of these strengths.

For example: GHO is designed to be highly incentive-compatible with existing AAVE token holders. Aave Safety Module stakers (stkAAVE) can mint GHO at a discounted rate, and sell them on other DeFi protocols for arbitrage profits, driving utility to the AAVE token. This means AAVE holders have a significant interest in seeing GHO passed.

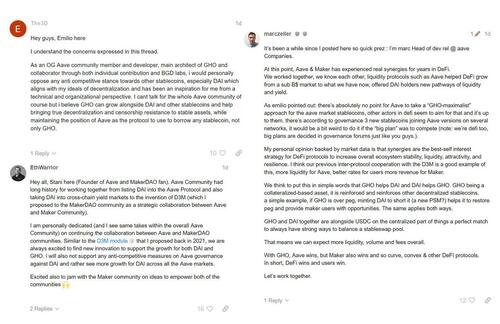

Anxious rumblings are already rumbling on the Maker forums. Aave leaders are doing their best to soothe concerns.

Voting hasn’t begun yet, but keep your eyes peeled for this one. Here are some other salient details:

- GHO is designed to have a fixed stable borrowing interest rate which “the DAO will be able to decide… and change over time through a governance process,” similar to how MKR holders decide on the mechanics (stability fee, debt ceiling, DAI savings rate) that govern DAI.

- Only intermediaries known as “facilitators” can mint and burn GHO. Who these facilitators will be, their minting limits, and types of collateral they can accept against minting (see chart) will be decided by the DAO.

- E-Mode is a stabilizing factor that ensures users access GHO with a 1:1 rate

- Portal will let users transfer GHO by simple message passing, thereby bypassing bridging risks.

* * *

Facebook and Reddit NFTs

We’re launching NFTs on Facebook! Excited to share what I’ve been working on with the world. pic.twitter.com/TaV66zRanV

— Navdeep Singh (@navdeep_ua) June 29, 2022

Facebook announced this week that it was testing support for Ethereum and Polygon NFTs on its platform, with Solana and Flow to come. This comes about two months after its sister company Instagram did the same.

Reddit also announced the launch of its own limited edition collection of “Collectible Avatars” that users can display on their profile pictures, designed by artists that were carefully curated by Reddit. These aren’t quite NFTs in the traditional sense. Reddit lets you play dress-up with the way they look, but they are stored on the Polygon chain.

GM @0xPolygon Fam!@Reddit is launching its NFT Marketplace on @0xPolygon!

Goal : #Top3 by impact – BTC,ETH, Polygon; nothing less, nothing more.

Never stop building! WAGMI!https://t.co/VhSMEl2wJd

— Sandeep | Polygon 💜🔝3️⃣ (@sandeepnailwal) July 7, 2022

* * *

Crypto smartphones are here (again)

Layer-1 blockchains are coming for a slice of the smartphone market.

Solana announced last week Saga, an AndroidOS phone that comes with tools to securely store and trade digital assets. You can track even tracks its sales on-chain and it seems to have stagnated at 2.6K preorders for the $1000 device.

⚡️⚡️.@solana launch #web3-focused smartphone Saga to improve crypto-mobile relationship

“This is something that I fundamentally believe the industry needs to do,” Yakovenko said. “We didn’t see a single crypto feature at the Apple developer conference 13 years.#p2esecrethub pic.twitter.com/UxTKoNY1JL

— P2E Secret Hub (@P2E_SecretHub) July 4, 2022

While the demand for a crypto smartphone may not be overwhelming, Solana has played the move as the opening bell of a long arc of Web3 integration into mobile phone software and hardware.

Polygon is also launching its own “metaverse phone.” Unlike Solana though, this is in partnership with the Taiwanese tech juggernaut HTC.

Mass adoption of Web3 will happen on mobile and @0xPolygon is preparing for it.

Our strategy is not to make our own devices. Instead, we will integrate with existing manufacturers.

Today, we are proud to announce the first major integration.

Onwards. 🔥https://t.co/sGCfTm6v7P

— Mihailo Bjelic (@MihailoBjelic) July 4, 2022

These are not the first forays crypto has made into the smartphone sector. Most notably, Sirin Labs launched the Finney smartphone all the way back in 2019, but sales were low and the project ebbed thereafter. Let’s hope this generation of crypto smartphones fares better.

* * *

Web3 News Roundup

Aztec Connect launch

Aztec Connect is the “VPN for Ethereum,” according to creators Aztec. It’s a private roll-up that lets you execute DeFi transactions on Ethereum dapps with complete privacy. It drops this week and major protocols like Curve and Lido are already deployed.

Today we launched Aztec Connect, the VPN for Ethereum.

I just used it to get some $stETH on mainnet Curve for $1.50 in fees, with complete privacy.

Fully private DeFi, with huge cost savings.

Why I think our private rollup is ridiculously bullish for Ethereum: pic.twitter.com/v75YXt0glU

— jonwu.(🗽, 🍎) (@jonwu_) July 7, 2022

* * *

EU crypto regulation

This week saw the EU finalize MiCA (Markets-in-Crypto-Assets), a base legal framework to regulating crypto.

The good news: They’re leaving PoW mining alone, NFTs and DeFi are (mostly) out of the scope of MiCA.

The bad: Stablecoins get hit hard:

… MiCA will protect consumers by requesting stablecoins issuers to build up a sufficiently liquid reserve, with a 1/1 ratio and partly in the form of deposits. Every so-called “stablecoin” holder will be offered a claim at any time and free of charge by the issuer, and the rules governing the operation of the reserve will also provide for an adequate minimum liquidity…

The development of asset-referenced tokens (ARTs) based on a non-European currency, as a widely used means of payment, will be constrained to preserve our monetary sovereignty. Issuers of ARTs will need to have a registered office in the EU to ensure the proper supervision and monitoring of offers to the public of asset-referenced tokens.

* * *

Sepolia merge

The Ethereum Sepolia test network merged successfully. Two down (Ropsten, Sepolia), one to go (Goerli).

BREAKING – Ethereum completes another successful test of The Merge on Sepolia 🐼

Goerli next.

Mainnet after.

Don’t sleep. pic.twitter.com/YeQfghmm5O

— bankless.eth (@BanklessHQ) July 6, 2022

* * *

Immutable X update

If you have ETH on an L2 that you’d like to spend in the real world, you’d babe to offramp it by sending ETH from L2 to a centralized exchange, requesting a withdrawal, and waiting few days before you could spend it.

Immutable X is streamlining this process in one step — with no gas fees!

Caveat: It’s only for ETH for now, and for the UK, EU and select US states.

1/ Major update! $ETH offramp is now available to any developer building an @Immutable X powered platform

Developers can enable their users to sell L2 $ETH and have the proceeds deposited directly to their bank accounts. https://t.co/DmiyWV8wYy

Continue below👇 pic.twitter.com/Uhm214oy2E

— Immutable | $IMX ⓧ (@Immutable) July 5, 2022