Authored by Simon White, Bloomberg macro strategist,

The risk of a structural rise in yields has heightened as bondholders begin to demand more compensation for inflation that is increasingly ingrained.

For all the opprobrium heaped on markets for being unruly and disobedient, they’ve been remarkably pliant in believing central banks will soon return inflation to 2%. The bond vigilantes (apart from a brief appearance during the UK’s LDI crisis) have been extraordinary only by their absence.

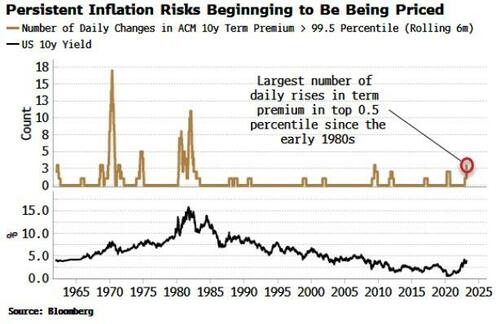

But that looks as if it is about to change. Term premium, essentially the extra yield long-term bond holders require for inflation risks, has been rising as data show the disinflation trend in the US running out of steam, helping push 10-year yields back over 4%.

In fact, over the last six months we have seen more extreme daily rises (i.e. those in the top 0.5% of all daily moves going back to 1960) in term premium than we have since the early 1980s, when Fed Governor Volcker was in the last throes of his conclusive battle with inflation.

Term premium captures several risks for holders of long-term bonds, but key is inflation.

The 10-year ACM term premium spent most of the 1970s above 1%, and peaked at 5% in 1984. Since then it has trended consistently lower, and has remained surprisingly contained over the last few years despite inflation hitting multi-decade highs.

The disconnect can be seen most clearly by looking at the precipitous rise in the volatility of inflation – which captures the extra uncertainty bond holders are facing – and still-subdued term premium.

The implications are considerable if bond holders are worrying inflation is becoming embedded. Most immediately, yields would be biased structurally higher, and would decline less when the Fed cuts rates, lowering the control the central bank has over longer-term borrowing costs.

This was the invidious position in which Volcker found himself in the early 1980s. The Fed at that point had “imperfect credibility”: when it hiked rates, the market did not believe it would keep them there. Instead, it was forced to cut them again when the ensuing recession hit. This meant inflation persisting, term premium rising, and the yield curve steepening – even as the Fed was hiking rates aggressively.

It was only when Volcker raised rates to 20% in 1981 - despite a deep recession - that the deadlock was finally broken and inflation began to fall. Nonetheless, term premium did not peak until three years later as the market remained wary the inflation beast had not been decisively floored. Once bond markets scent inflation, it takes years before they become desensitized to it.

Rising term premium also risks a self-reinforcing feedback loop. When it is increasing, the yield curve has a steepening bias, and steeper yield curves go hand-in-hand with higher rate volatility.

This is because longer-term forward yields must converge to shorter-term yields. The steeper the yield curve, the more paths yields can take to converge, which means higher yield volatility. Higher volatility means bond holders demand a higher yield to compensate, i.e. term premium rises.

Avoiding a rise in term premium is thus highly desirable. But the cat may already be out of the bag. Term premium looks to be catching up to the much higher level currently implied by forecasters.

There is no binding constraint that the forecasters’ view need be correct, but inflation is a social and behavioral phenomenon as much as an economic one. At some point, inflation expectations become self-fulfilling and drive inflation itself. An emerging narrative that inflation is becoming persistent adds to the likelihood that that is what we will soon see.

And inflation expectations are already rising at the fastest rate in decades. As the chart below shows, this adds further confidence to the notion that term premium will keep rising.

A structural, term-premium driven rise in yields could take years to reverse as hitherto dormant bond vigilantes become conditioned to a world where inflation is persistently elevated and prone to sudden flare-ups.

It would also mean an end to the uneasy alliance between central banks and markets fostered over the last four decades. Term premium thus bears watching very closely.

Authored by Simon White, Bloomberg macro strategist,

The risk of a structural rise in yields has heightened as bondholders begin to demand more compensation for inflation that is increasingly ingrained.

For all the opprobrium heaped on markets for being unruly and disobedient, they’ve been remarkably pliant in believing central banks will soon return inflation to 2%. The bond vigilantes (apart from a brief appearance during the UK’s LDI crisis) have been extraordinary only by their absence.

But that looks as if it is about to change. Term premium, essentially the extra yield long-term bond holders require for inflation risks, has been rising as data show the disinflation trend in the US running out of steam, helping push 10-year yields back over 4%.

In fact, over the last six months we have seen more extreme daily rises (i.e. those in the top 0.5% of all daily moves going back to 1960) in term premium than we have since the early 1980s, when Fed Governor Volcker was in the last throes of his conclusive battle with inflation.

Term premium captures several risks for holders of long-term bonds, but key is inflation.

The 10-year ACM term premium spent most of the 1970s above 1%, and peaked at 5% in 1984. Since then it has trended consistently lower, and has remained surprisingly contained over the last few years despite inflation hitting multi-decade highs.

The disconnect can be seen most clearly by looking at the precipitous rise in the volatility of inflation – which captures the extra uncertainty bond holders are facing – and still-subdued term premium.

The implications are considerable if bond holders are worrying inflation is becoming embedded. Most immediately, yields would be biased structurally higher, and would decline less when the Fed cuts rates, lowering the control the central bank has over longer-term borrowing costs.

This was the invidious position in which Volcker found himself in the early 1980s. The Fed at that point had “imperfect credibility”: when it hiked rates, the market did not believe it would keep them there. Instead, it was forced to cut them again when the ensuing recession hit. This meant inflation persisting, term premium rising, and the yield curve steepening – even as the Fed was hiking rates aggressively.

It was only when Volcker raised rates to 20% in 1981 – despite a deep recession – that the deadlock was finally broken and inflation began to fall. Nonetheless, term premium did not peak until three years later as the market remained wary the inflation beast had not been decisively floored. Once bond markets scent inflation, it takes years before they become desensitized to it.

Rising term premium also risks a self-reinforcing feedback loop. When it is increasing, the yield curve has a steepening bias, and steeper yield curves go hand-in-hand with higher rate volatility.

This is because longer-term forward yields must converge to shorter-term yields. The steeper the yield curve, the more paths yields can take to converge, which means higher yield volatility. Higher volatility means bond holders demand a higher yield to compensate, i.e. term premium rises.

Avoiding a rise in term premium is thus highly desirable. But the cat may already be out of the bag. Term premium looks to be catching up to the much higher level currently implied by forecasters.

There is no binding constraint that the forecasters’ view need be correct, but inflation is a social and behavioral phenomenon as much as an economic one. At some point, inflation expectations become self-fulfilling and drive inflation itself. An emerging narrative that inflation is becoming persistent adds to the likelihood that that is what we will soon see.

And inflation expectations are already rising at the fastest rate in decades. As the chart below shows, this adds further confidence to the notion that term premium will keep rising.

A structural, term-premium driven rise in yields could take years to reverse as hitherto dormant bond vigilantes become conditioned to a world where inflation is persistently elevated and prone to sudden flare-ups.

It would also mean an end to the uneasy alliance between central banks and markets fostered over the last four decades. Term premium thus bears watching very closely.

Loading…