Add the Chicago Fed's National Activity Index and Existing Home Sales to the list of disappointing macro data recently, and the soft-landing (or even goldilocks) narratives are starting to sound like a fairy tale...

Source: Bloomberg

Financial Conditions continue to loosen dramatically...

Source: Bloomberg

Treasury yields were mixed with a steepening bias (2Y -3bps, 30Y unch), which recoupled yesterday's flattening...

Source: Bloomberg

Stocks were lower, given back much of yesterday's gains with Small Caps the biggest loser (red on the week)...

Yesterday's squeezed-stocks reversed their gains today...

Source: Bloomberg

Mega-Cap tech erased much of yesterday's gains...

Source: Bloomberg

Banks gave back recent gains, back to one-week lows...

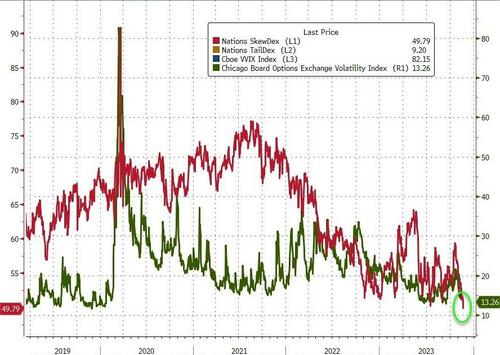

VIX continued to decline today (to 131.13) as Skew hit a record low. SDEX index (in red), measures the value of a 1-month at-the-money SPY put, vs a 1-month "one standard deviation out-of-the-money" put, reflects put prices are sliding markedly lower.

Source: Bloomberg

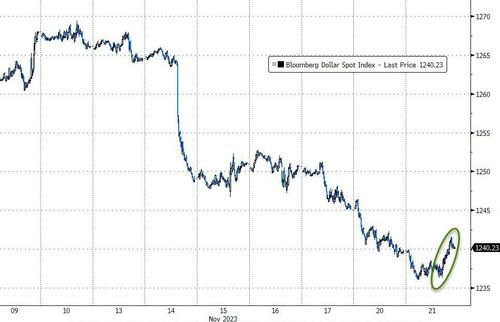

The dollar rebounded during the US session today to end marginally higher (after 6 down day in the last 7)...

Source: Bloomberg

It was a choppy day in crypto-land amid headline about DoJ freezing some Tether holdings and the Binance settlement. BTC tumbled to $36.300 before bouncing back up to $37,500 and settling around $37,000...

Source: Bloomberg

Spot Gold prices topped $2000 once again...

Source: Bloomberg

Oil prices were flat on the day, with WTI hovering around $78

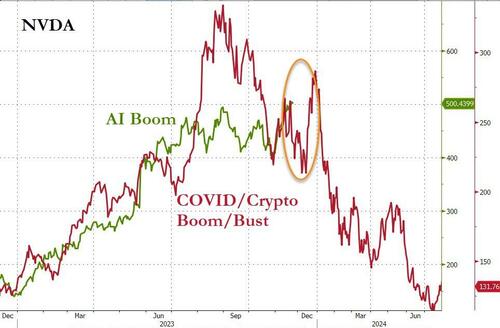

And finally, of course, NVDA reports tonight..

Source: Bloomberg

What happens next?

Add the Chicago Fed’s National Activity Index and Existing Home Sales to the list of disappointing macro data recently, and the soft-landing (or even goldilocks) narratives are starting to sound like a fairy tale…

Source: Bloomberg

Financial Conditions continue to loosen dramatically…

Source: Bloomberg

Treasury yields were mixed with a steepening bias (2Y -3bps, 30Y unch), which recoupled yesterday’s flattening…

Source: Bloomberg

Stocks were lower, given back much of yesterday’s gains with Small Caps the biggest loser (red on the week)…

Yesterday’s squeezed-stocks reversed their gains today…

Source: Bloomberg

Mega-Cap tech erased much of yesterday’s gains…

Source: Bloomberg

Banks gave back recent gains, back to one-week lows…

VIX continued to decline today (to 131.13) as Skew hit a record low. SDEX index (in red), measures the value of a 1-month at-the-money SPY put, vs a 1-month “one standard deviation out-of-the-money” put, reflects put prices are sliding markedly lower.

Source: Bloomberg

The dollar rebounded during the US session today to end marginally higher (after 6 down day in the last 7)…

Source: Bloomberg

It was a choppy day in crypto-land amid headline about DoJ freezing some Tether holdings and the Binance settlement. BTC tumbled to $36.300 before bouncing back up to $37,500 and settling around $37,000…

Source: Bloomberg

Spot Gold prices topped $2000 once again…

Source: Bloomberg

Oil prices were flat on the day, with WTI hovering around $78

And finally, of course, NVDA reports tonight..

Source: Bloomberg

What happens next?

Loading…