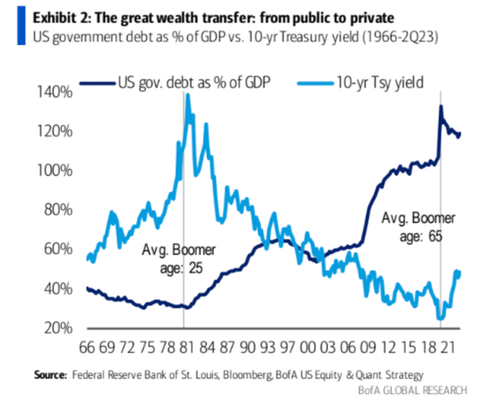

Since 1980, US government debt has exploded, soaring from a modest 31% to a staggering 120% of GDP. Meanwhile, 10-year Treasury yields have plummeted from 15% to 4.8%. This resulted in a massive wealth transfer from the public to the private sector, enriching Baby Boomers in the process.

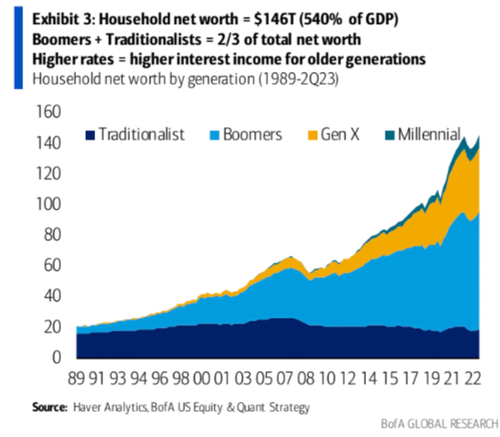

According to Bank of America Research strategists led by Ohsung Kwon, boomers were in their prime time during this wealth expansion over the last several decades and emerged as the primary beneficiaries. This generation, born between 1946-64, along with "Traditionalists" (or silent generation), hold a whopping two-thirds of total net worth, mostly in financial assets. Kwon said boomers have secured low-rate mortgages while millennials have been left out.

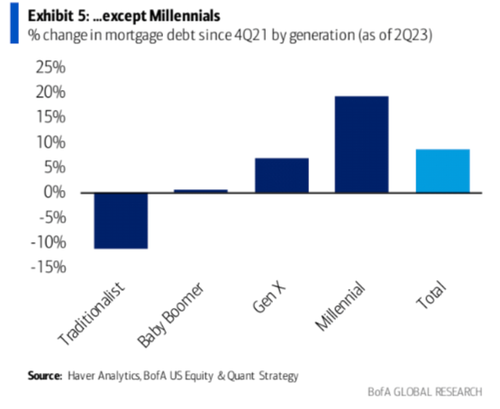

In contrast, millennials have been the largest generation to incur the most mortgage debt in the housing mania after 2021. These young folks sparked bidding wars nationwide while taking on new mortgage debt with homes at record-high prices.

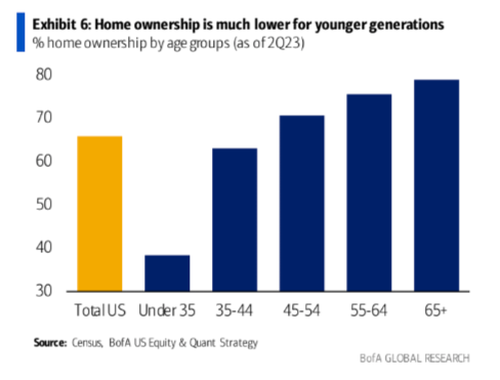

Younger generations have 'gotten the short end of the stick' regarding homeownership. These kids will have to get used to a life of renting.

Soaring interest rates and elevated home prices have sparked the worst housing affordability in generations. With that, so goes the 'American Dream'.

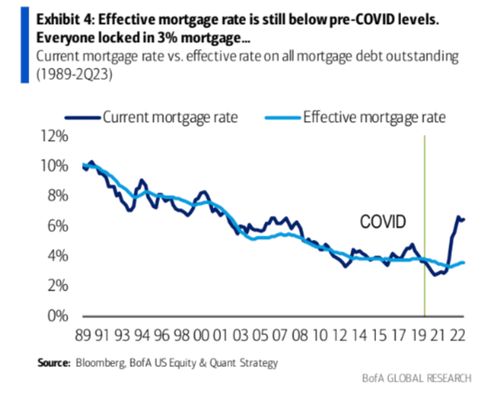

Interestingly, the analyst noted, "Boomers have yet, if ever, to feel the impact of higher rates, and many wealthy Boomers are actually benefiting," adding, "Everyone locked in 3% mortgage rates, except Millennials."

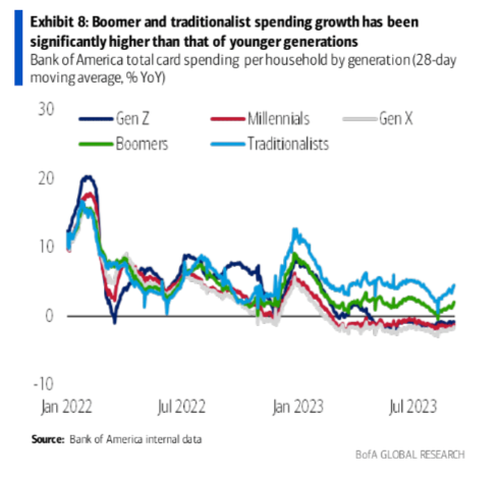

Internal spending data from the bank shows Boomers and Traditionalists continue to spend while younger generations (who are interest rate sensitive) dial back spending - perhaps due to a depletion of savings.

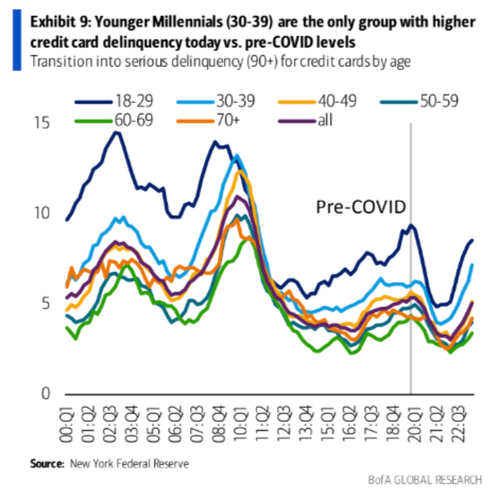

Spending data also shows millennials are the only group with exploding credit card delinquencies that have rocketed above pre-Covid levels. Seriously, guys, come on - you know the risks of a recession are mounting...

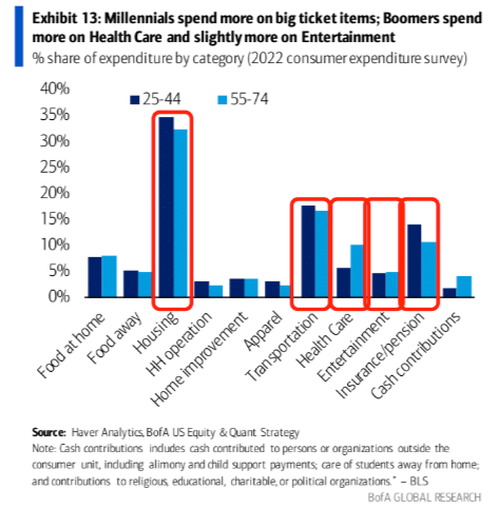

When it comes to big-ticket items, millennials are the biggest spenders, but boomers outpace other generations on health care and entertainment spending.

The financial health of the younger generation is very concerning. These folks need a bailout - but might not receive one from the government - instead, the 'bank of mom & dad' in the next great wealth transfer from old to young.

The analyst offers good news: the wealth transfer has already begun, "There also appears to be an increase in generational wealth transfer with parents helping their kids buy homes."

More in the full note available to pro subs.

Since 1980, US government debt has exploded, soaring from a modest 31% to a staggering 120% of GDP. Meanwhile, 10-year Treasury yields have plummeted from 15% to 4.8%. This resulted in a massive wealth transfer from the public to the private sector, enriching Baby Boomers in the process.

According to Bank of America Research strategists led by Ohsung Kwon, boomers were in their prime time during this wealth expansion over the last several decades and emerged as the primary beneficiaries. This generation, born between 1946-64, along with “Traditionalists” (or silent generation), hold a whopping two-thirds of total net worth, mostly in financial assets. Kwon said boomers have secured low-rate mortgages while millennials have been left out.

In contrast, millennials have been the largest generation to incur the most mortgage debt in the housing mania after 2021. These young folks sparked bidding wars nationwide while taking on new mortgage debt with homes at record-high prices.

Younger generations have ‘gotten the short end of the stick’ regarding homeownership. These kids will have to get used to a life of renting.

Soaring interest rates and elevated home prices have sparked the worst housing affordability in generations. With that, so goes the ‘American Dream’.

Interestingly, the analyst noted, “Boomers have yet, if ever, to feel the impact of higher rates, and many wealthy Boomers are actually benefiting,” adding, “Everyone locked in 3% mortgage rates, except Millennials.”

Internal spending data from the bank shows Boomers and Traditionalists continue to spend while younger generations (who are interest rate sensitive) dial back spending – perhaps due to a depletion of savings.

Spending data also shows millennials are the only group with exploding credit card delinquencies that have rocketed above pre-Covid levels. Seriously, guys, come on – you know the risks of a recession are mounting…

When it comes to big-ticket items, millennials are the biggest spenders, but boomers outpace other generations on health care and entertainment spending.

The financial health of the younger generation is very concerning. These folks need a bailout – but might not receive one from the government – instead, the ‘bank of mom & dad’ in the next great wealth transfer from old to young.

The analyst offers good news: the wealth transfer has already begun, “There also appears to be an increase in generational wealth transfer with parents helping their kids buy homes.”

More in the full note available to pro subs.

Loading…