By Jan-Patrick Barnert, Bloomberg markets live reporter and analyst

As the summer equity rally runs out of steam, investor positioning suggests that defensives are back in favor, while some of the market’s recent drivers are fading.

Stocks extended their decline on Monday, with the Stoxx Europe 600 Index falling 1% as cyclicals such as autos, chemicals, banks, retail and industrials led the retreat. Health care, utilities, food stocks and consumer staples performed better.

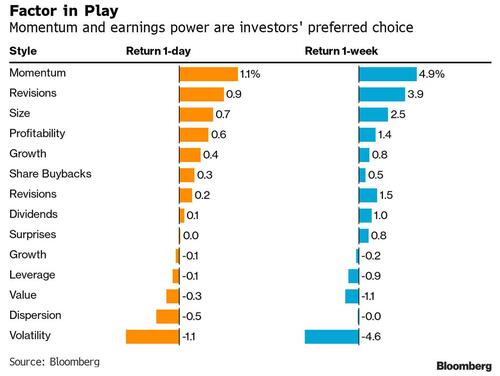

A similar picture emerges when looking at the factors guiding investor decisions as the trading week starts, with analyst conviction, momentum, share buybacks and EPS growth outperforming, while value, leverage and volatility are sold.

The surprise rally over the past two months has been “driven by a combination of better-than-feared earnings, extremely light positioning, and hope for a less hawkish Fed,” says Bantleon portfolio manager Oliver Scharping. “Just as investors return from the beach, these summertime support pillars are starting to crumble,” he says.

With the upswing in stocks in danger of faltering, even some of the more bullish market watchers are turning cautious when it comes to the riskier areas of the equities universe.

“While the recent rally in tech may be understandable, that doesn’t mean you should chase it,” writes UBS Global Wealth Management CIO Mark Haefele. He advises trimming overexposure and rebalancing portfolios toward segments that are better positioned than choppy tech.

Two positioning factors that helped push the market higher are also in decline: options and short covering.

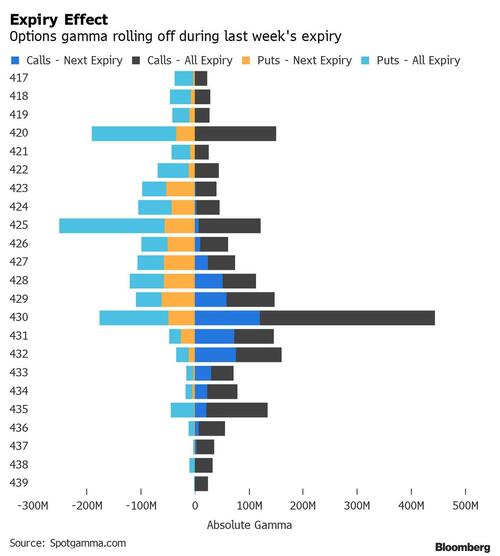

Some predicted that last Friday’s option expiry would trigger a resurgence in volatility, making equities less stable as a “pinning effect” in the options market was reduced by the rolling off in so-called gamma, an options sensitivity measure. So far, this prediction has proven correct, with volatility back above the 20 point handle, gaining more than four points -- or 22% -- since Aug. 18.

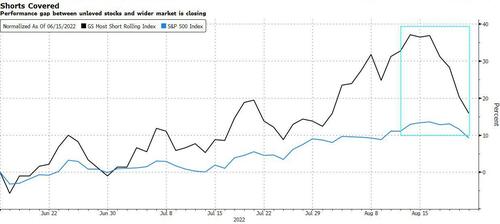

Short covering in stocks, meanwhile, seems to have run its course. The average short ratio measured against free float in the S&P 500 Index has dropped to 2% from 2.2%, while the performance gap between the most-shorted stocks and the wider market has narrowed significantly.

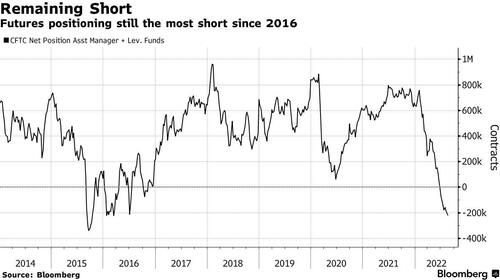

Meanwhile, short positions in equity futures contracts remain at their most pronounced levels in years. That suggests that while investors covered their shorts in single stocks, bets on declines intended as macro hedges for portfolios remain in place and have even been expanded slightly.

This week might also prove pivotal for stocks as Fed Chair Jerome Powell headlines the annual Jackson Hole central bankers meeting with a speech on the economic outlook Friday. He is expected to reinforce the Fed’s resolve to keep raising interest rates to subdue inflation, though he’ll probably stop short of signaling how big officials will go when they meet next month.

“We think it’s sensible to stay cautious going into the event and have been buyers of downside hedges recently,” says Bantleon’s Scharping.

By Jan-Patrick Barnert, Bloomberg markets live reporter and analyst

As the summer equity rally runs out of steam, investor positioning suggests that defensives are back in favor, while some of the market’s recent drivers are fading.

Stocks extended their decline on Monday, with the Stoxx Europe 600 Index falling 1% as cyclicals such as autos, chemicals, banks, retail and industrials led the retreat. Health care, utilities, food stocks and consumer staples performed better.

A similar picture emerges when looking at the factors guiding investor decisions as the trading week starts, with analyst conviction, momentum, share buybacks and EPS growth outperforming, while value, leverage and volatility are sold.

The surprise rally over the past two months has been “driven by a combination of better-than-feared earnings, extremely light positioning, and hope for a less hawkish Fed,” says Bantleon portfolio manager Oliver Scharping. “Just as investors return from the beach, these summertime support pillars are starting to crumble,” he says.

With the upswing in stocks in danger of faltering, even some of the more bullish market watchers are turning cautious when it comes to the riskier areas of the equities universe.

“While the recent rally in tech may be understandable, that doesn’t mean you should chase it,” writes UBS Global Wealth Management CIO Mark Haefele. He advises trimming overexposure and rebalancing portfolios toward segments that are better positioned than choppy tech.

Two positioning factors that helped push the market higher are also in decline: options and short covering.

Some predicted that last Friday’s option expiry would trigger a resurgence in volatility, making equities less stable as a “pinning effect” in the options market was reduced by the rolling off in so-called gamma, an options sensitivity measure. So far, this prediction has proven correct, with volatility back above the 20 point handle, gaining more than four points — or 22% — since Aug. 18.

Short covering in stocks, meanwhile, seems to have run its course. The average short ratio measured against free float in the S&P 500 Index has dropped to 2% from 2.2%, while the performance gap between the most-shorted stocks and the wider market has narrowed significantly.

Meanwhile, short positions in equity futures contracts remain at their most pronounced levels in years. That suggests that while investors covered their shorts in single stocks, bets on declines intended as macro hedges for portfolios remain in place and have even been expanded slightly.

This week might also prove pivotal for stocks as Fed Chair Jerome Powell headlines the annual Jackson Hole central bankers meeting with a speech on the economic outlook Friday. He is expected to reinforce the Fed’s resolve to keep raising interest rates to subdue inflation, though he’ll probably stop short of signaling how big officials will go when they meet next month.

“We think it’s sensible to stay cautious going into the event and have been buyers of downside hedges recently,” says Bantleon’s Scharping.