With investors increasingly unwilling to express a bearish bias ahead of the coming recession via the stock market (at least until a six-sigma deleveraging event like last Monday's carry trade unwind forces them to do so), they are instead pilling into bearish bets in the commodity sector, and nowhere more so than energy, where bullish bets just hit a record low!

As John Kemp writes, investors cut their petroleum positions to the lowest level on record, part of a broad-based retreat from risk amid rising concerns over a global economic slowdown.

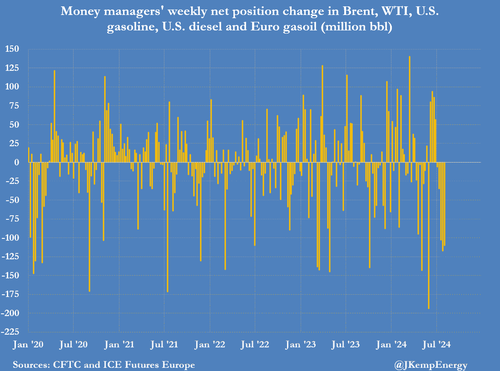

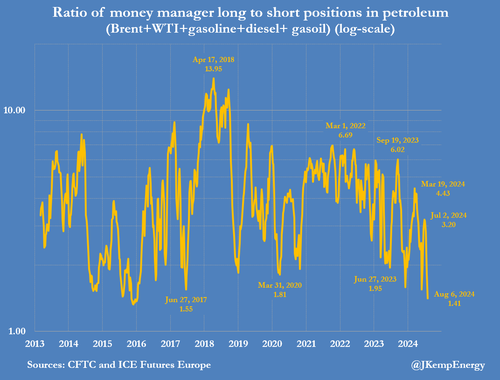

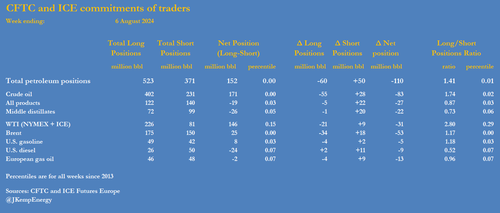

Hedge funds and other money managers sold the equivalent of 110 million barrels in the six most important petroleum futures and options contracts over the seven days ending on August 6, The most recent week saw sales across the board in Brent (-53 million barrels), NYMEX and ICE WTI (-31 million), European gas oil (-13 million), U.S. diesel (-9 million) and U.S. gasoline (-5 million).

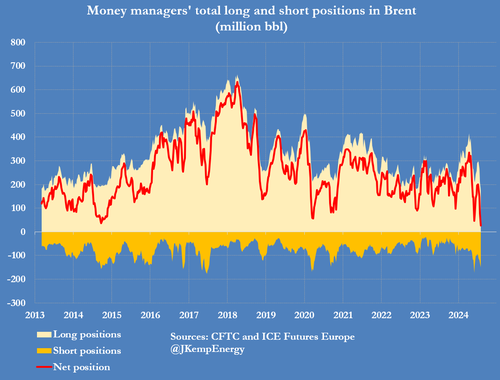

As the next chart from John Kemp Energy shows, fund managers had been net sellers in each of the five most recent weeks, reducing their combined position by a total of 372 million barrels since the start of July.

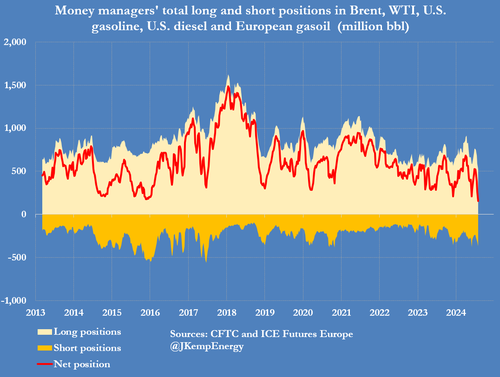

By August 6, the combined position had been slashed to 152 million barrels, the lowest in records dating back to 2013. Position changes were fairly evenly divided between the liquidation of former bullish long positions (-60 million) and initiation of fresh bearish shorts (+50 million).

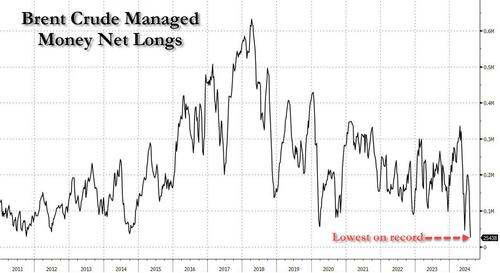

The sell-off was the fastest since January and February 2020, when traders were bracing for the spread of the coronavirus epidemic from China to the rest of the world. As a result, fund managers held a record low position in Brent...

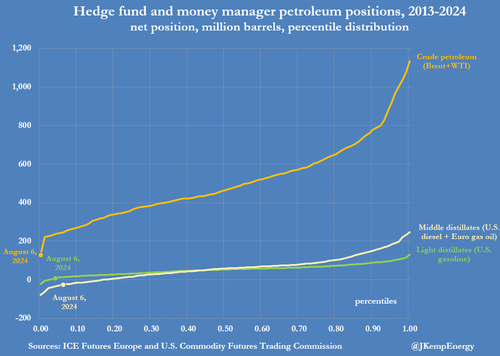

... and near-record low positions in the rest of the petroleum complex.

The speed, scale and breadth of selling was consistent with a broad risk-off move across asset markets as well as concerns about a slowdown in the major economies and deterioration in the outlook for oil consumption.

In recent weeks, oil traders have focused more on the future consumption threat rather than the slow depletion of global inventories.

But the extremely bearish positioning in Brent and other contracts has created a potentially attractive entry point for new bullish long positions – provided a slowdown is averted, or a geopolitical shock emerges sparking a furious short squeeze.

Front-month Brent futures prices have bounced back above $80 per barrel from a low of just $75 per barrel at one point on August 5.

With positions now extremely bearish, the recession-on trade in the oil market has become crowded and vulnerable to reversal. The recent price bounce is also consistent with fund managers repurchasing some short positions to take profits and perhaps establishing some fresh bullish long positions to anticipate the short-covering rally and a fading recession risk.

Natural Gas

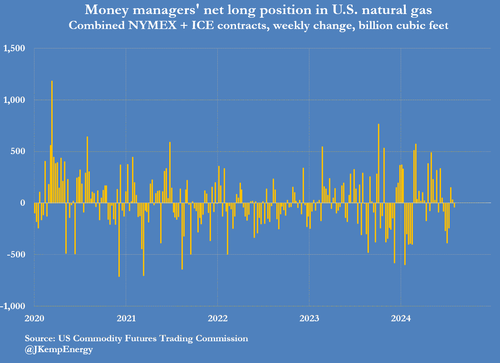

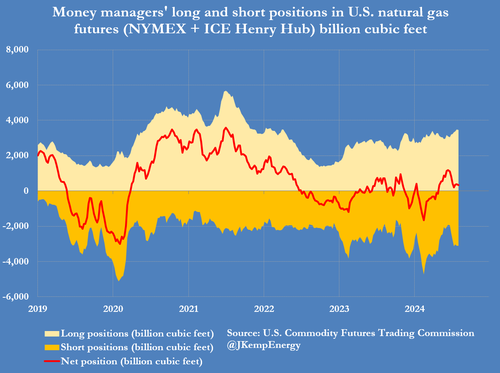

Portfolio managers made few changes to their broadly neutral position in U.S. natural gas as inventories continued to deplete slowly despite ultra-low prices encouraging maximum summer consumption by power generators.

Hedge funds and other money managers sold the equivalent of 40 billion cubic feet (bcf) of futures and options linked to the price of gas at Henry Hub in Louisiana, reversing purchases of 30 bcf the week before.

The net position was basically unchanged at a net long of 332 bcf, in the 41st percentile for all weeks since 2010, best characterised as neutral verging on moderately bearish.

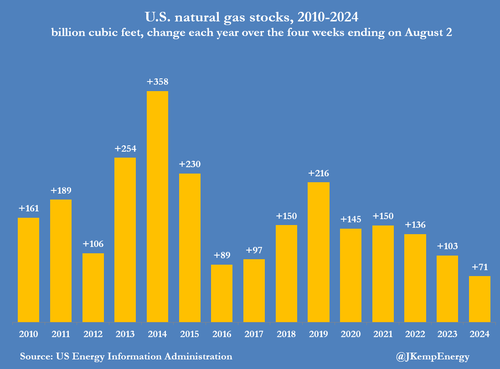

Working gas inventories accumulated by just 71 bcf over the four weeks ending on August 2, the smallest seasonal increase in data going back to 2010, as generators continued to binge on cheap gas.

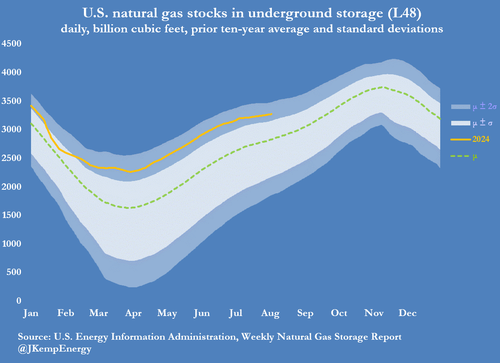

The unusually small accumulation of inventories this summer has helped narrow the record surplus inherited from winter 2023/24.

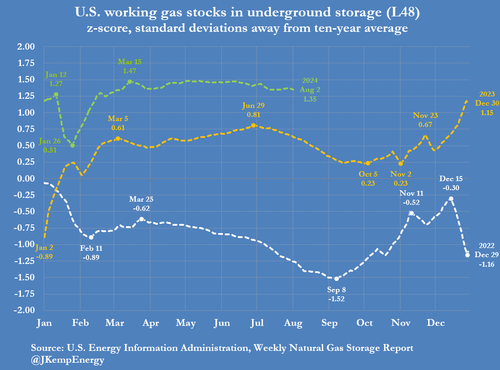

Inventories are 441 bcf (+16% or +1.35 standard deviations) above the prior ten-year seasonal average, down from a surplus of 664 bcf (+40% or +1.47 standard deviations) on March 15.

Even so, with the airconditioning season more than half over, it is virtually certain inventories will still be above average when the 2024/25 winter heating season starts on November 1.

After multiple frustrated attempts over the last year to build a bullish position anticipating a normalization of inventories, the persistence of plentiful stocks is enforcing a more cautious approach for the time being.

* * *

Going back to oil, the recent bounce in the price makes the complex susceptible to a short squeeze. As Goldman analyst Yulia Grigsby writes (note available to pro subs), the Brent crude price rebounded by 6% from a week ago as broader macro markets continued to recover, as solid US activity data shifted energy investors' focus from recession fears back to geopolitics. At the same time, market expectations of Iran's potential retaliation triggered a rise in Brent call options implied volatility skew to the highest level since April, while a production halt in Libya's largest oil field also fueled concerns about sudden supply disruptions.

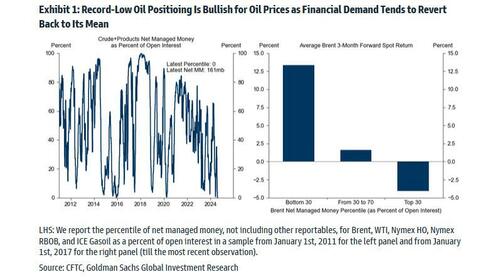

Looking ahead, Goldman expects Brent prices to continue to recover further to the mid-80s as "financial demand for oil rebounds from its record low (although CFTC's latest report only captures positioning up till last Tuesday), with low positioning historically often foreshadowing solid returns in the next 3 months" as Goldman shows in the chart below.

Besides the record low in oil positioning, further bullish signals according to Goldman are the following:

- Canada total liquids production nowcast edged down by 0.1mb/d last week as the effect of July Firebag's production curtailment filtered into the regional data.

- Tracking of global oil commercial stocks pivoted to modest draws.

- Global visible stocks count decreased by 22mb last week on larger draws on water and EM crude.

- Tighter physical markets triggered a jump in the average crude basis last week.

- Brent call options implied volatility skew jumped last week to its highest level since April as Iran reiterated its intentions to retaliate against Israel's last month attack and amid Ukraine's incursion into Western Russia.

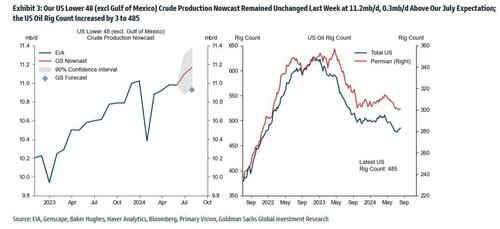

That said, several notable bearish features persist, among them that Goldman's US Lower 48 crude production nowcast remains 0.3mb/d above the bank's July expectations, while the US oil rig count increased by 3 last week.

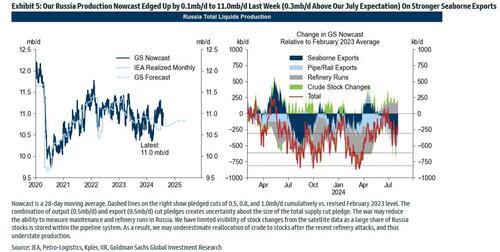

At the same time, the Russia production nowcast edged up by 0.1mb/d last week on higher seaborne exports. While Russia crude production edged down in July according to OPEC secondary sources, the nowcast remained modestly above its pledged target (and our expectations); furthermore early industry data suggest strong refinery runs in the first week of August as well.

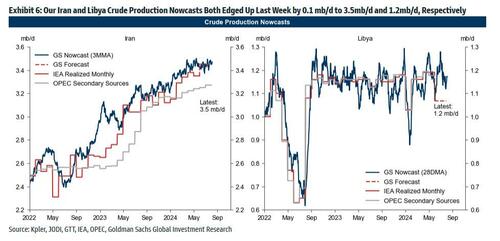

Elsewhere, Goldman's Iran crude production nowcast edged up by 0.1mb/d last week, while the Libya production nowcast remained solid, with most of the negative effect from Sharara production halt yet to come in August exports data.

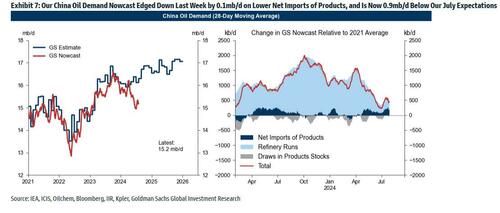

Finally, the bank's China demand nowcast slipped again last week on lower net imports of products.

However, countering the persistent disappointment out of China demand, accelerating draws in Goldman's EM visible stocks counter are consistent with still solid EM demand, with apparent India oil demand jumping in July by 7% yoy.

More in the full Goldman note available to pro subscribers.

With investors increasingly unwilling to express a bearish bias ahead of the coming recession via the stock market (at least until a six-sigma deleveraging event like last Monday’s carry trade unwind forces them to do so), they are instead pilling into bearish bets in the commodity sector, and nowhere more so than energy, where bullish bets just hit a record low!

As John Kemp writes, investors cut their petroleum positions to the lowest level on record, part of a broad-based retreat from risk amid rising concerns over a global economic slowdown.

Hedge funds and other money managers sold the equivalent of 110 million barrels in the six most important petroleum futures and options contracts over the seven days ending on August 6, The most recent week saw sales across the board in Brent (-53 million barrels), NYMEX and ICE WTI (-31 million), European gas oil (-13 million), U.S. diesel (-9 million) and U.S. gasoline (-5 million).

As the next chart from John Kemp Energy shows, fund managers had been net sellers in each of the five most recent weeks, reducing their combined position by a total of 372 million barrels since the start of July.

By August 6, the combined position had been slashed to 152 million barrels, the lowest in records dating back to 2013. Position changes were fairly evenly divided between the liquidation of former bullish long positions (-60 million) and initiation of fresh bearish shorts (+50 million).

The sell-off was the fastest since January and February 2020, when traders were bracing for the spread of the coronavirus epidemic from China to the rest of the world. As a result, fund managers held a record low position in Brent…

… and near-record low positions in the rest of the petroleum complex.

The speed, scale and breadth of selling was consistent with a broad risk-off move across asset markets as well as concerns about a slowdown in the major economies and deterioration in the outlook for oil consumption.

In recent weeks, oil traders have focused more on the future consumption threat rather than the slow depletion of global inventories.

But the extremely bearish positioning in Brent and other contracts has created a potentially attractive entry point for new bullish long positions – provided a slowdown is averted, or a geopolitical shock emerges sparking a furious short squeeze.

Front-month Brent futures prices have bounced back above $80 per barrel from a low of just $75 per barrel at one point on August 5.

With positions now extremely bearish, the recession-on trade in the oil market has become crowded and vulnerable to reversal. The recent price bounce is also consistent with fund managers repurchasing some short positions to take profits and perhaps establishing some fresh bullish long positions to anticipate the short-covering rally and a fading recession risk.

Natural Gas

Portfolio managers made few changes to their broadly neutral position in U.S. natural gas as inventories continued to deplete slowly despite ultra-low prices encouraging maximum summer consumption by power generators.

Hedge funds and other money managers sold the equivalent of 40 billion cubic feet (bcf) of futures and options linked to the price of gas at Henry Hub in Louisiana, reversing purchases of 30 bcf the week before.

The net position was basically unchanged at a net long of 332 bcf, in the 41st percentile for all weeks since 2010, best characterised as neutral verging on moderately bearish.

Working gas inventories accumulated by just 71 bcf over the four weeks ending on August 2, the smallest seasonal increase in data going back to 2010, as generators continued to binge on cheap gas.

The unusually small accumulation of inventories this summer has helped narrow the record surplus inherited from winter 2023/24.

Inventories are 441 bcf (+16% or +1.35 standard deviations) above the prior ten-year seasonal average, down from a surplus of 664 bcf (+40% or +1.47 standard deviations) on March 15.

Even so, with the airconditioning season more than half over, it is virtually certain inventories will still be above average when the 2024/25 winter heating season starts on November 1.

After multiple frustrated attempts over the last year to build a bullish position anticipating a normalization of inventories, the persistence of plentiful stocks is enforcing a more cautious approach for the time being.

* * *

Going back to oil, the recent bounce in the price makes the complex susceptible to a short squeeze. As Goldman analyst Yulia Grigsby writes (note available to pro subs), the Brent crude price rebounded by 6% from a week ago as broader macro markets continued to recover, as solid US activity data shifted energy investors’ focus from recession fears back to geopolitics. At the same time, market expectations of Iran’s potential retaliation triggered a rise in Brent call options implied volatility skew to the highest level since April, while a production halt in Libya’s largest oil field also fueled concerns about sudden supply disruptions.

Looking ahead, Goldman expects Brent prices to continue to recover further to the mid-80s as “financial demand for oil rebounds from its record low (although CFTC’s latest report only captures positioning up till last Tuesday), with low positioning historically often foreshadowing solid returns in the next 3 months” as Goldman shows in the chart below.

Besides the record low in oil positioning, further bullish signals according to Goldman are the following:

- Canada total liquids production nowcast edged down by 0.1mb/d last week as the effect of July Firebag’s production curtailment filtered into the regional data.

- Tracking of global oil commercial stocks pivoted to modest draws.

- Global visible stocks count decreased by 22mb last week on larger draws on water and EM crude.

- Tighter physical markets triggered a jump in the average crude basis last week.

- Brent call options implied volatility skew jumped last week to its highest level since April as Iran reiterated its intentions to retaliate against Israel’s last month attack and amid Ukraine’s incursion into Western Russia.

That said, several notable bearish features persist, among them that Goldman’s US Lower 48 crude production nowcast remains 0.3mb/d above the bank’s July expectations, while the US oil rig count increased by 3 last week.

At the same time, the Russia production nowcast edged up by 0.1mb/d last week on higher seaborne exports. While Russia crude production edged down in July according to OPEC secondary sources, the nowcast remained modestly above its pledged target (and our expectations); furthermore early industry data suggest strong refinery runs in the first week of August as well.

Elsewhere, Goldman’s Iran crude production nowcast edged up by 0.1mb/d last week, while the Libya production nowcast remained solid, with most of the negative effect from Sharara production halt yet to come in August exports data.

Finally, the bank’s China demand nowcast slipped again last week on lower net imports of products.

However, countering the persistent disappointment out of China demand, accelerating draws in Goldman’s EM visible stocks counter are consistent with still solid EM demand, with apparent India oil demand jumping in July by 7% yoy.

More in the full Goldman note available to pro subscribers.

Loading…