Authored by Mark Jeftovic via BombThrower.com,

What we now call “The Cantillon Effect” was known far back as circa-1730, by at least one economist. It hasn’t been taken very seriously in modern times, especially here in the fiat age.

Named after its author, Richard Cantillon, in his “Essay on Economic Theory” (“Essai sur la Nature du Commerce en Général”) — it is his only surviving work and was published posthumously in 1755, more than 20 years after he was murdered by a former cook whom he had dismissed from his household. The disgruntled ex-employee, returned by night, robbed his home, then set it ablaze, with Cantillon — and the rest of his manuscripts, within.

The Essay On Economic Theory had been previously circulated in pamphlet form, which is why copies survived to be published to the world, and lays bare the dirty secret behind all fiat monetary schemes:

In a nutshell, when money is created or added to an economy, the people who receive it first, benefit, but they do so to the detriment of everybody else.

The early recipients of new money were able to spend it on accumulating more of the productive assets that society had to offer. But this also increased the money supply, which diluted the purchasing power of everybody else’s existing money.

The wealthy got to invest new money.

Everybody else had to spend more of their existing money.

So, while the rich got richer, it made it more expensive for the poor to stay alive.

The elites invariably believe the system works great. From inside their bubble it certainly seems that way. But it is unsustainable over the long haul. As the dynamic iterates, it accelerates, and it increases wealth disparity. If there was a nice, meaty middle-class in the economic bell curve, it wouldn’t last for long as the productive assets increasingly get hoovered up by a rentier class using new money.

Eventually wealth inequality hits a breaking point, and when that happens, all existing social contracts – real or implied – break down.

The French Revolution may be the first example of the Cantillon Effect’s consequences, after Cantillon himself detailed its underlying dynamics.

The distortions introduced from currency debasement are far reaching and take a long time to play out. But the tempo intensifies toward a “quickening” as it enters the end game, much like compound interest and bankruptcy (“gradually, then suddenly”). The rich become more imperious, the poor more resentful and then, finally, after generations of silent theft and economic repression, something sets off a phase shift — and then it’s show trials and guillotines.

In France’s case, the monetary missteps that set it on a course to Bastille Day went at least as far back as Louis XIV, the great-great-grandfather of the Sun King who would be left holding the bag (and his head in a bucket) nearly a century later.

In Guy Rowlands “The Financial Decline of a Great Power: War, Influence and Money in Louis XIV’s France“, we are told of “dimunitions” which devalued the coin of the realm by decree, (nevermind that it was gold and silver backed)…

The government would typically prepare an augmentation by decreeing diminutions—or abatements’—of the coins in circulation, a decision that did not require coins to be restamped or re-created. This was not primarily so the king could pull in more coins through taxation (denominated in Livres),” as any such gain would be cancelled out: a diminution would in fact also force the king to compensate his fisco-financiers and bankers for losses on their contracts and on the coins they held at the time. ‘

The main reason was so there could be huge leaps upward in the value of the coins to the level decreed by the subsequent augmentation, thus bringing in more seigniorage to the king. The government also hoped that a diminution, generating fear of further diminutions, would flush coin out into circulation, particularly for lending to the fisco-financiers.

That is why diminutions were announced in advance, with weeks or even months before the new, lower values would come into effect. This gave people a window in which to lend out their assets. There were indeed often several diminutions in a row: prior to the 1693 augmentation, the values of the coins were diminished four times; and prior to the great recoinage of 1709, diminutions were announced in March and November 1708 and on 16 March 1709.

The state never brought the coin values back down to the level they bad been before the previous augmentation, and this was important to ensure the public did not think the bottom of the valuation had been reached.”

Does any of this sound familiar?

Cantillon on steroids: The Fiat Era & Stakeholder Capitalism

“Let them eat brioche” — Marie Antoinette, 1789

“You will eat bugs, own nothing, and live in a pod” — The World Economic Forum, every day.

With the fiat era, starting in 1971, new money was no longer limited by the supply of gold, or whatever else was backing a currency. You could print the stuff right out of thin air now – which meant that instead of ostensibly enriching all members of society, with its “targeted inflation” for expanding the money supply, it would just accelerate the rate at which the underclass was being impoverished (which for a long time could be papered over with “hedonic adjustments” when reporting on it).

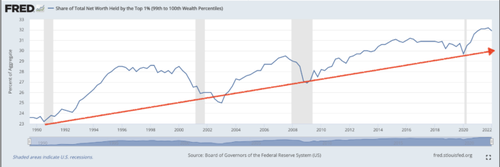

The Global Financial Crisis in 2008, followed by over a decade of ZIRP, NIRP, and QEternity, overclocked that process, and then Covid hit, when it went literally parabolic:

Via TradingEconomics

On its own, this may look like just another hockey stick graph. Most people don’t make the connection on exactly how this manifests in the real world (especially central bankers).

There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.

— John Maynard Keynes

(Even fewer people realize that Keynes was a Marxist and his economic prescriptions, which form the basis of conventional economic theory to this day, would bring lead to socialism. This was intentional. Especially once you understand what socialism really is.)

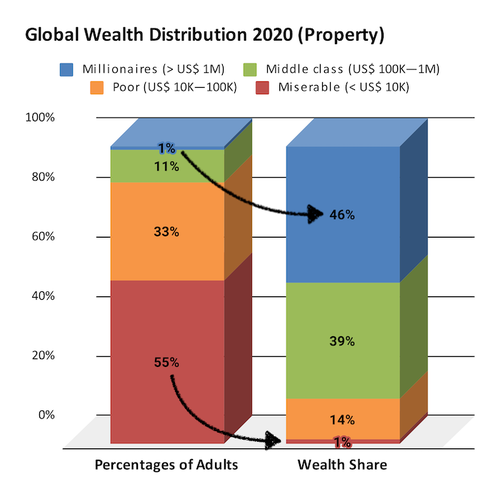

This graph is just real estate, and as of 2020. That was before COVID, before lockdowns, before small businesses got shut down by decree while big box stores and Amazon stayed open and the Fed bought their bonds.

Let’s look at a couple of inflection points:

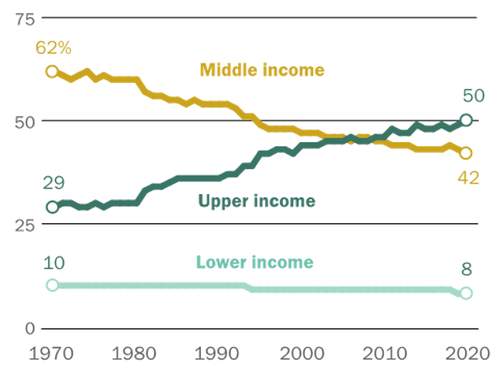

Via Pew Research

The graph above is from Pew Research. In 1971, the start of the Fiat Era, middle income households earned the bulk of the income pie at 62%. Along comes Nixon, who closed the gold window (“temporarily”), and it’s all downhill from there. All kinds of wealth inequality drivers can trace their genesis to that event in 1971.

Then when the bankers blew themselves up (again) in 2008, the bailouts happen (again) and we hit another inflection point: the era of ZIRP, NIRP and QEternity hits, and this is exactly where upper income households crossover the middle income earners. Again, this graph stops short of the Covid Era, at which point all of these trends accelerated.

Where does it leave things?

On the left: A tent city in BC Canada, on the right “Fentanyl zombies” roam downtown SF.

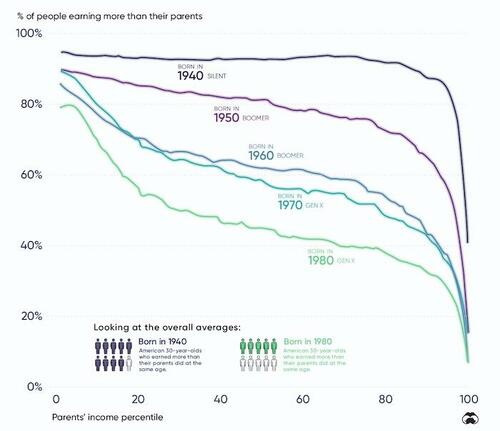

The bottom layers of the economic stratum are looking like a cross between Mad Max and a Zombie Apocalypse. Even worse, is that thanks to plunging income mobility, the underclass is growing. The middle class are falling into the poverty more often than ascending into wealth.

This Visual Capitalist chart looks at the number of people earning more than their parents by generational cohort. Remember, because of inflation everything is getting more expensive, but if each generation is earning less than their parents, they’re losing ground:

Unless you’re already wealthy – then everything is fine because your share of the pie is getting larger…

All Cantillon Schemes Require a Totalizing Ideology

As I mentioned recently in my article on how abandoning sound money perpetuates Forever Wars,

If there is a far-reaching, multi-generational global conspiracy – it is one that brainwashes the masses into trading their time, wealth and property for meaningless chits backed by nothing. Who needs global Communism?

In pre-Revolutionary France, it was By Divine Right. The king was chosen and appointed by God to govern the kingdom. This belief was used to justify the absolute power of the monarch and his authority over all aspects of French life. And the masses went along with it until the economics became so asymmetrical and unsustainable that the peasants revolted. They had no choice, the alternative was to starve to death.

Today’s totalizing ideology is a kind of euphemistically wrapped Technocratic Marxism. Klaus Schwab calls it “Stakeholder Capitalism”, George Gilder, perhaps more accurately, termed it Emergency Socialism in his latest book, Life After Capitalism.

It's called "Stakeholder Capitalism".

— Mark Jeftovic, The ₿itcoin Capitalist (@StuntPope) July 27, 2023

(...and you aren't a stakeholder 🤡 ) pic.twitter.com/pjyU37SL2o

Gilder only uses the phrase out once or twice in the book and never really expands on it.

Allow me.

Today’s Totalizing Ideology is that you, dear peasant, must ratchet your standard of living downwards. You will have to take up less space. You will have to consume less resources, pay more for everything and accept ever worsening living conditions because if you don’t, the world will end.

And nobody wants that, right?

In the meantime, your betters, the people who have it all under control and everything figured out, will continue to re-imagine your life, and the lives of your children, so that they can forestall the implosion of the global monetary system and finish hoovering up the remaining 5% of the global wealth that they don’t already own.

"The peasants have no bread". "Then let them eat bugs".

— Nick Griffin (@NickGriffinBU) September 22, 2023

Scene at Versailles as elitists who think you should own nothing, go nowhere & eat their processed crickets prepared to feast at taxpayers' expense.#vampireelite pic.twitter.com/zSeKw7KcqO

Which brings us to... Bitcoin.

If only there were some mechanism that was not only immune from dilution via inflation, but could actually reverse the Cantillon Effect.

Sure, there is gold – the age old monetary metal. I like gold and have been invested in it for nearly 30 years. Silver too. Everyone should have an allocation to gold and have some silver, including junk silver to have on-hand for sundries if (or when) your national currency collapses.

But Bitcoin, as distinct from other “cryptocurrencies”, is a very unique monetary asset, backed by energy, decentralized, hard-capped in supply, and largely impervious to capital controls in a way that is distinct from all other monetary assets.

To top it all off, Bitcoin exhibits a reverse Cantillon effect. Because Bitcoin is deflationary, it is becoming more valuable. It is increasing its purchasing power, as more wealth flows into the system and it does so for everybody hodling it. The difference between Bitcoin and Cantillonism is that the purchasing power isn’t declining as the currency units flow outward from the central spigot. It’s increasing for all units, at the same time.

Most people can’t wrap their head around this. Even the aforementioned George Gilder, concludes that Bitcoin can’t become the new global monetary standard because it is deflationary. And he did it in the chapter of his book called “Bitcoin Capitalism”. Heartbreaking.

But history has shown deflationary currencies not only work, economies thrive under them (see again, Sound Money Makes For Short Wars) – and Detlev S Schlichter wrote an entire book on why that’s the case.

“A monetary system with a money commodity of essentially fixed supply will experience secular deflation. A growing economy, with an entirely inflexible money supply will exhibit a tendency for prices to decline on trend, and for money’s purchasing [power] to steadily increase.

But the key question now, is why should this be a problem? We have already seen that historically secular deflation was rather minor and that it certainly never appeared to present any economic difficulties. No correlation between deflation or recession or stagnation is evident under commodity money systems. [T]here are no reasons on conceptual grounds to consider deflation to be a problem”

If there is any disparity, between time and value with Bitcoin, then it’s front loaded. People get into Bitcoin at the price they deserve, but there’s nothing stopping anybody from getting in whenever they want. With the Cantillion Effect, you have no control over new money creation, but yet you still have to live with the declining purchasing power instigated by other people.

With Bitcoin, even if you enter later, you are still on the escalator up, having your sats gain in purchasing power as more capital moves onto a Bitcoin Standard.

We may not have to fire up the guillotines in order to exit this particular episode of Cantillonism, (although we may fire them up for other reasons).

As more people exit the fiat system, the only people left to for the elites to dilute will be the remaining serfs who will get stuck inside the coming CBDC system.

More on that in a future post…

* * *

My forthcoming ebook The CBDC Survival Guide will give you the tools and the knowledge to navigate coming era of Monetary Apartheid. Bombthrower subscribers will get it free when it drops, sign up today.

The Bitcoin Capitalist: For Today’s Sovereign Individual provides actionable intelligence on the macro forces shaping Late Stage Globalism and a tactical toolkit for growing your wealth as it plays out. Try it today here.

Authored by Mark Jeftovic via BombThrower.com,

What we now call “The Cantillon Effect” was known far back as circa-1730, by at least one economist. It hasn’t been taken very seriously in modern times, especially here in the fiat age.

Named after its author, Richard Cantillon, in his “Essay on Economic Theory” (“Essai sur la Nature du Commerce en Général”) — it is his only surviving work and was published posthumously in 1755, more than 20 years after he was murdered by a former cook whom he had dismissed from his household. The disgruntled ex-employee, returned by night, robbed his home, then set it ablaze, with Cantillon — and the rest of his manuscripts, within.

The Essay On Economic Theory had been previously circulated in pamphlet form, which is why copies survived to be published to the world, and lays bare the dirty secret behind all fiat monetary schemes:

In a nutshell, when money is created or added to an economy, the people who receive it first, benefit, but they do so to the detriment of everybody else.

The early recipients of new money were able to spend it on accumulating more of the productive assets that society had to offer. But this also increased the money supply, which diluted the purchasing power of everybody else’s existing money.

The wealthy got to invest new money.

Everybody else had to spend more of their existing money.

So, while the rich got richer, it made it more expensive for the poor to stay alive.

The elites invariably believe the system works great. From inside their bubble it certainly seems that way. But it is unsustainable over the long haul. As the dynamic iterates, it accelerates, and it increases wealth disparity. If there was a nice, meaty middle-class in the economic bell curve, it wouldn’t last for long as the productive assets increasingly get hoovered up by a rentier class using new money.

Eventually wealth inequality hits a breaking point, and when that happens, all existing social contracts – real or implied – break down.

The French Revolution may be the first example of the Cantillon Effect’s consequences, after Cantillon himself detailed its underlying dynamics.

The distortions introduced from currency debasement are far reaching and take a long time to play out. But the tempo intensifies toward a “quickening” as it enters the end game, much like compound interest and bankruptcy (“gradually, then suddenly”). The rich become more imperious, the poor more resentful and then, finally, after generations of silent theft and economic repression, something sets off a phase shift — and then it’s show trials and guillotines.

In France’s case, the monetary missteps that set it on a course to Bastille Day went at least as far back as Louis XIV, the great-great-grandfather of the Sun King who would be left holding the bag (and his head in a bucket) nearly a century later.

In Guy Rowlands “The Financial Decline of a Great Power: War, Influence and Money in Louis XIV’s France“, we are told of “dimunitions” which devalued the coin of the realm by decree, (nevermind that it was gold and silver backed)…

The government would typically prepare an augmentation by decreeing diminutions—or abatements’—of the coins in circulation, a decision that did not require coins to be restamped or re-created. This was not primarily so the king could pull in more coins through taxation (denominated in Livres),” as any such gain would be cancelled out: a diminution would in fact also force the king to compensate his fisco-financiers and bankers for losses on their contracts and on the coins they held at the time. ‘

The main reason was so there could be huge leaps upward in the value of the coins to the level decreed by the subsequent augmentation, thus bringing in more seigniorage to the king. The government also hoped that a diminution, generating fear of further diminutions, would flush coin out into circulation, particularly for lending to the fisco-financiers.

That is why diminutions were announced in advance, with weeks or even months before the new, lower values would come into effect. This gave people a window in which to lend out their assets. There were indeed often several diminutions in a row: prior to the 1693 augmentation, the values of the coins were diminished four times; and prior to the great recoinage of 1709, diminutions were announced in March and November 1708 and on 16 March 1709.

The state never brought the coin values back down to the level they bad been before the previous augmentation, and this was important to ensure the public did not think the bottom of the valuation had been reached.”

Does any of this sound familiar?

Cantillon on steroids: The Fiat Era & Stakeholder Capitalism

“Let them eat brioche” — Marie Antoinette, 1789

“You will eat bugs, own nothing, and live in a pod” — The World Economic Forum, every day.

With the fiat era, starting in 1971, new money was no longer limited by the supply of gold, or whatever else was backing a currency. You could print the stuff right out of thin air now – which meant that instead of ostensibly enriching all members of society, with its “targeted inflation” for expanding the money supply, it would just accelerate the rate at which the underclass was being impoverished (which for a long time could be papered over with “hedonic adjustments” when reporting on it).

The Global Financial Crisis in 2008, followed by over a decade of ZIRP, NIRP, and QEternity, overclocked that process, and then Covid hit, when it went literally parabolic:

Via TradingEconomics

On its own, this may look like just another hockey stick graph. Most people don’t make the connection on exactly how this manifests in the real world (especially central bankers).

There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.

— John Maynard Keynes

(Even fewer people realize that Keynes was a Marxist and his economic prescriptions, which form the basis of conventional economic theory to this day, would bring lead to socialism. This was intentional. Especially once you understand what socialism really is.)

This graph is just real estate, and as of 2020. That was before COVID, before lockdowns, before small businesses got shut down by decree while big box stores and Amazon stayed open and the Fed bought their bonds.

Let’s look at a couple of inflection points:

Via Pew Research

The graph above is from Pew Research. In 1971, the start of the Fiat Era, middle income households earned the bulk of the income pie at 62%. Along comes Nixon, who closed the gold window (“temporarily”), and it’s all downhill from there. All kinds of wealth inequality drivers can trace their genesis to that event in 1971.

Then when the bankers blew themselves up (again) in 2008, the bailouts happen (again) and we hit another inflection point: the era of ZIRP, NIRP and QEternity hits, and this is exactly where upper income households crossover the middle income earners. Again, this graph stops short of the Covid Era, at which point all of these trends accelerated.

Where does it leave things?

On the left: A tent city in BC Canada, on the right “Fentanyl zombies” roam downtown SF.

The bottom layers of the economic stratum are looking like a cross between Mad Max and a Zombie Apocalypse. Even worse, is that thanks to plunging income mobility, the underclass is growing. The middle class are falling into the poverty more often than ascending into wealth.

This Visual Capitalist chart looks at the number of people earning more than their parents by generational cohort. Remember, because of inflation everything is getting more expensive, but if each generation is earning less than their parents, they’re losing ground:

Unless you’re already wealthy – then everything is fine because your share of the pie is getting larger…

All Cantillon Schemes Require a Totalizing Ideology

As I mentioned recently in my article on how abandoning sound money perpetuates Forever Wars,

If there is a far-reaching, multi-generational global conspiracy – it is one that brainwashes the masses into trading their time, wealth and property for meaningless chits backed by nothing. Who needs global Communism?

In pre-Revolutionary France, it was By Divine Right. The king was chosen and appointed by God to govern the kingdom. This belief was used to justify the absolute power of the monarch and his authority over all aspects of French life. And the masses went along with it until the economics became so asymmetrical and unsustainable that the peasants revolted. They had no choice, the alternative was to starve to death.

Today’s totalizing ideology is a kind of euphemistically wrapped Technocratic Marxism. Klaus Schwab calls it “Stakeholder Capitalism”, George Gilder, perhaps more accurately, termed it Emergency Socialism in his latest book, Life After Capitalism.

It’s called “Stakeholder Capitalism”.

(…and you aren’t a stakeholder 🤡 ) pic.twitter.com/pjyU37SL2o— Mark Jeftovic, The ₿itcoin Capitalist (@StuntPope) July 27, 2023

Gilder only uses the phrase out once or twice in the book and never really expands on it.

Allow me.

Today’s Totalizing Ideology is that you, dear peasant, must ratchet your standard of living downwards. You will have to take up less space. You will have to consume less resources, pay more for everything and accept ever worsening living conditions because if you don’t, the world will end.

And nobody wants that, right?

In the meantime, your betters, the people who have it all under control and everything figured out, will continue to re-imagine your life, and the lives of your children, so that they can forestall the implosion of the global monetary system and finish hoovering up the remaining 5% of the global wealth that they don’t already own.

“The peasants have no bread”. “Then let them eat bugs”.

Scene at Versailles as elitists who think you should own nothing, go nowhere & eat their processed crickets prepared to feast at taxpayers’ expense.#vampireelite pic.twitter.com/zSeKw7KcqO

— Nick Griffin (@NickGriffinBU) September 22, 2023

Which brings us to… Bitcoin.

If only there were some mechanism that was not only immune from dilution via inflation, but could actually reverse the Cantillon Effect.

Sure, there is gold – the age old monetary metal. I like gold and have been invested in it for nearly 30 years. Silver too. Everyone should have an allocation to gold and have some silver, including junk silver to have on-hand for sundries if (or when) your national currency collapses.

But Bitcoin, as distinct from other “cryptocurrencies”, is a very unique monetary asset, backed by energy, decentralized, hard-capped in supply, and largely impervious to capital controls in a way that is distinct from all other monetary assets.

To top it all off, Bitcoin exhibits a reverse Cantillon effect. Because Bitcoin is deflationary, it is becoming more valuable. It is increasing its purchasing power, as more wealth flows into the system and it does so for everybody hodling it. The difference between Bitcoin and Cantillonism is that the purchasing power isn’t declining as the currency units flow outward from the central spigot. It’s increasing for all units, at the same time.

Most people can’t wrap their head around this. Even the aforementioned George Gilder, concludes that Bitcoin can’t become the new global monetary standard because it is deflationary. And he did it in the chapter of his book called “Bitcoin Capitalism”. Heartbreaking.

But history has shown deflationary currencies not only work, economies thrive under them (see again, Sound Money Makes For Short Wars) – and Detlev S Schlichter wrote an entire book on why that’s the case.

“A monetary system with a money commodity of essentially fixed supply will experience secular deflation. A growing economy, with an entirely inflexible money supply will exhibit a tendency for prices to decline on trend, and for money’s purchasing [power] to steadily increase.

But the key question now, is why should this be a problem? We have already seen that historically secular deflation was rather minor and that it certainly never appeared to present any economic difficulties. No correlation between deflation or recession or stagnation is evident under commodity money systems. [T]here are no reasons on conceptual grounds to consider deflation to be a problem”

If there is any disparity, between time and value with Bitcoin, then it’s front loaded. People get into Bitcoin at the price they deserve, but there’s nothing stopping anybody from getting in whenever they want. With the Cantillion Effect, you have no control over new money creation, but yet you still have to live with the declining purchasing power instigated by other people.

With Bitcoin, even if you enter later, you are still on the escalator up, having your sats gain in purchasing power as more capital moves onto a Bitcoin Standard.

We may not have to fire up the guillotines in order to exit this particular episode of Cantillonism, (although we may fire them up for other reasons).

As more people exit the fiat system, the only people left to for the elites to dilute will be the remaining serfs who will get stuck inside the coming CBDC system.

More on that in a future post…

* * *

My forthcoming ebook The CBDC Survival Guide will give you the tools and the knowledge to navigate coming era of Monetary Apartheid. Bombthrower subscribers will get it free when it drops, sign up today.

The Bitcoin Capitalist: For Today’s Sovereign Individual provides actionable intelligence on the macro forces shaping Late Stage Globalism and a tactical toolkit for growing your wealth as it plays out. Try it today here.

Loading…