Last Friday's collapse of Silicon Valley Bank caused the second-largest bank failure in the history of the US, which led to a crash in regional bank stocks and a sharp drop in bond yields such as the US two-year Treasury yield, reminiscent of the Black Monday crash of 1987.

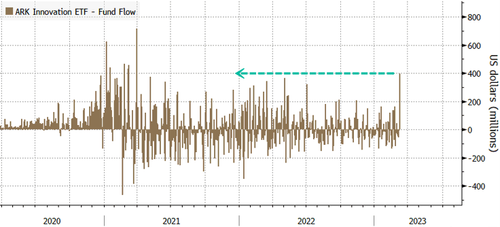

While trading flows pointed to a mad dash into safe-haven assets, some investors were doing quite the opposite: plowing money into Cathie Wood's ARK Innovation ETF (ticker ARKK) as their belief the regional banking crisis might be enough to persuade the Federal Reserve that the most aggressive interest rate hiking cycle in a generation would need to pause to restore confidence in financial markets.

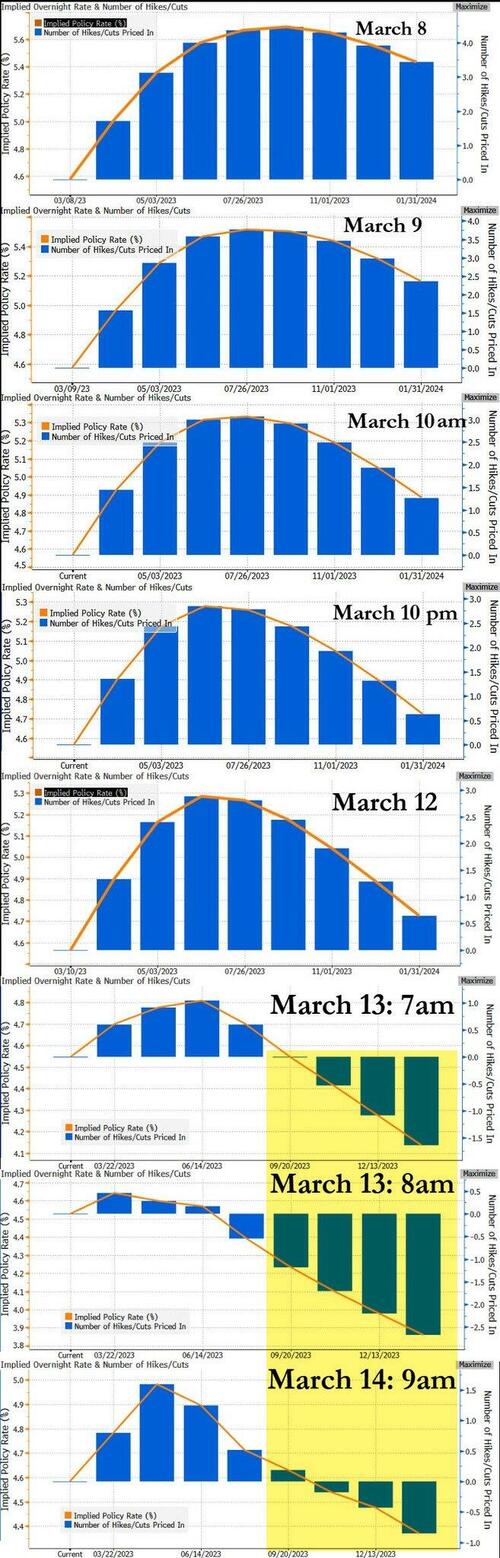

Those panic-buying ARKK on bets that profitless tech companies would surge in a possible shift in Fed policy weren't wrong. Take the overnight index swaps market. Traders have so far priced out a 50-basis-point hike for next week's FOMC (to a 75% chance of 25bps) - with the possibility of cuts in the back half of the year.

So just how big were ARKK's flows on Friday? Bloomberg data shows a whopping $397 million of inflows -- the largest in years.

Bloomberg noted:

That was the largest influx since April 2021 — a few weeks after the fund hit its all-time high in a year that saw investors pour in a whopping $9.6 billion in total.

The inflow came in the grip of the US banking turmoil that saw several lenders collapse, triggering a wider market panic. In a miserable week for equities, ARKK dropped 11% for its worst performance since September.

It's difficult to determine whether the collapse of SVB will result in a systemic event comparable to previous crises. Nevertheless, some investors have already made moves into the treasury market, rates market, or even in speculative tech, recognizing the possibility the Fed might offer a dovish present next week following the SVB meltdown.

Last Friday’s collapse of Silicon Valley Bank caused the second-largest bank failure in the history of the US, which led to a crash in regional bank stocks and a sharp drop in bond yields such as the US two-year Treasury yield, reminiscent of the Black Monday crash of 1987.

While trading flows pointed to a mad dash into safe-haven assets, some investors were doing quite the opposite: plowing money into Cathie Wood’s ARK Innovation ETF (ticker ARKK) as their belief the regional banking crisis might be enough to persuade the Federal Reserve that the most aggressive interest rate hiking cycle in a generation would need to pause to restore confidence in financial markets.

Those panic-buying ARKK on bets that profitless tech companies would surge in a possible shift in Fed policy weren’t wrong. Take the overnight index swaps market. Traders have so far priced out a 50-basis-point hike for next week’s FOMC (to a 75% chance of 25bps) – with the possibility of cuts in the back half of the year.

So just how big were ARKK’s flows on Friday? Bloomberg data shows a whopping $397 million of inflows — the largest in years.

Bloomberg noted:

That was the largest influx since April 2021 — a few weeks after the fund hit its all-time high in a year that saw investors pour in a whopping $9.6 billion in total.

The inflow came in the grip of the US banking turmoil that saw several lenders collapse, triggering a wider market panic. In a miserable week for equities, ARKK dropped 11% for its worst performance since September.

It’s difficult to determine whether the collapse of SVB will result in a systemic event comparable to previous crises. Nevertheless, some investors have already made moves into the treasury market, rates market, or even in speculative tech, recognizing the possibility the Fed might offer a dovish present next week following the SVB meltdown.

Loading…