Last September, we told readers that the US national debt was skyrocketing at a staggering $1 trillion every three months—roughly every 100 days.

Total US Debt surpasses $33 trillion for the first time.

— zerohedge (@zerohedge) September 18, 2023

For those keeping tabs, the US added $1 trillion in debt in three (3) months. pic.twitter.com/9eJVnX1YnZ

Since then, the debt spending has gotten worse.

And we're off: US debt rises by $89BN on the last day of February, to $34.471 trillion, a new record high

— zerohedge (@zerohedge) March 2, 2024

Debt has increased by $280BN in February and by $470BN in the first two months of the year.

At this pace debt will hit $37 trillion by year-end and $40 trillion by the end… https://t.co/eETiO355MG pic.twitter.com/GFbkzkY7oE

Lesson 1: how to increase total debt by $1 trillion every 100 days pic.twitter.com/rzANo8e7Ro

— zerohedge (@zerohedge) April 8, 2024

And by "strong economic performance" you mean $1 trillion in debt every 100 days https://t.co/HamDPdS7tx

— zerohedge (@zerohedge) May 23, 2024

Out-of-control spending has delayed the US economy's day of reckoning in this year's presidential election cycle. But it has become very evident an economic crisis looms in the years ahead.

One River Asset Management CIO, Eric Peters, recently said, "I have a growing conviction that in the coming 2-5 years, we're going to face a US debt sustainability crisis, sparking a major global market event."

BofA CIO Michael Hartnett recently noted what we said previously about the unsustainable debt explosion...

And now, fresh comments from Andrey Kostin, CEO of Russia's second-largest bank, have emerged—comments that Western mainstream media dare not share with their audiences. Why is that? ... Well, the Washington censorship blob wouldn't allow it.

Russian state-owned news agency TASS cited Kostin's interview with the Fontanka publication, who warned if it wasn't for the dollar's status as the world's reserve currency, a sovereign debt crisis would've already been underway in the US. No matter what, he warned the US economy is on the verge of an economic crisis.

"I am thoroughly convinced that America is inevitably headed for a serious economic crisis. The amount of debt currently held by the US today has reached inconceivable, astronomical levels. And the dollar's monopoly on the global stage is the only thing enabling the Americans to maintain such a level of debt. If the Chinese or the Arabs took their money out of the US, a complete collapse would ensue for the financial sector and the government," he said.

Kostin added:

"If the West fails to revise its policy I think that the move toward the collapse of the colonial system will only accelerate."

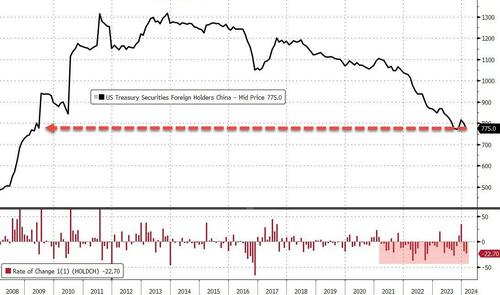

Kostin noted that China has been disposing of US government debt. Last month, we asked: "Is China's 'Dumping' Driving US Treasury Yields Higher?"

China's Treasury holdings are back to levels not seen since June 2009.

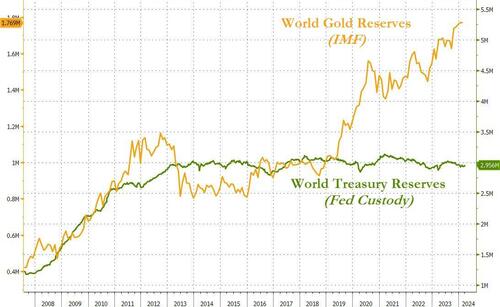

It's not just China. Treasury holdings are 'relatively' flat (based on Fed custody data), while according to The IMF, the world's sovereign nations have been panic-buying gold.

It's not just Kostin sounding the alarm about a looming US debt crisis — Wall Street analysts have echoed the same dire warnings.

Here's a question: What ever happened to the economic collapse of Russia via endless Western sanctions?

Last September, we told readers that the US national debt was skyrocketing at a staggering $1 trillion every three months—roughly every 100 days.

Total US Debt surpasses $33 trillion for the first time.

For those keeping tabs, the US added $1 trillion in debt in three (3) months. pic.twitter.com/9eJVnX1YnZ

— zerohedge (@zerohedge) September 18, 2023

Since then, the debt spending has gotten worse.

And we’re off: US debt rises by $89BN on the last day of February, to $34.471 trillion, a new record high

Debt has increased by $280BN in February and by $470BN in the first two months of the year.

At this pace debt will hit $37 trillion by year-end and $40 trillion by the end… https://t.co/eETiO355MG pic.twitter.com/GFbkzkY7oE

— zerohedge (@zerohedge) March 2, 2024

Lesson 1: how to increase total debt by $1 trillion every 100 days pic.twitter.com/rzANo8e7Ro

— zerohedge (@zerohedge) April 8, 2024

And by “strong economic performance” you mean $1 trillion in debt every 100 days https://t.co/HamDPdS7tx

— zerohedge (@zerohedge) May 23, 2024

Out-of-control spending has delayed the US economy’s day of reckoning in this year’s presidential election cycle. But it has become very evident an economic crisis looms in the years ahead.

One River Asset Management CIO, Eric Peters, recently said, “I have a growing conviction that in the coming 2-5 years, we’re going to face a US debt sustainability crisis, sparking a major global market event.”

BofA CIO Michael Hartnett recently noted what we said previously about the unsustainable debt explosion…

And now, fresh comments from Andrey Kostin, CEO of Russia’s second-largest bank, have emerged—comments that Western mainstream media dare not share with their audiences. Why is that? … Well, the Washington censorship blob wouldn’t allow it.

Russian state-owned news agency TASS cited Kostin’s interview with the Fontanka publication, who warned if it wasn’t for the dollar’s status as the world’s reserve currency, a sovereign debt crisis would’ve already been underway in the US. No matter what, he warned the US economy is on the verge of an economic crisis.

“I am thoroughly convinced that America is inevitably headed for a serious economic crisis. The amount of debt currently held by the US today has reached inconceivable, astronomical levels. And the dollar’s monopoly on the global stage is the only thing enabling the Americans to maintain such a level of debt. If the Chinese or the Arabs took their money out of the US, a complete collapse would ensue for the financial sector and the government,” he said.

Kostin added:

“If the West fails to revise its policy I think that the move toward the collapse of the colonial system will only accelerate.”

Kostin noted that China has been disposing of US government debt. Last month, we asked: “Is China’s ‘Dumping’ Driving US Treasury Yields Higher?”

China’s Treasury holdings are back to levels not seen since June 2009.

It’s not just China. Treasury holdings are ‘relatively’ flat (based on Fed custody data), while according to The IMF, the world’s sovereign nations have been panic-buying gold.

It’s not just Kostin sounding the alarm about a looming US debt crisis — Wall Street analysts have echoed the same dire warnings.

Here’s a question: What ever happened to the economic collapse of Russia via endless Western sanctions?

Loading…