2021 was a record-breaking year for the European merger and acquisitions industry. On the other hand, 2022 dealmaking has underwhelmed due to volatile and fragile markets because of the invasion of Ukraine in late February, the energy crisis, increasing risks of recession, and central banks tightening financial conditions to rein in elevated inflation.

All these factors contributed to a dismal year for dealmaking for the German multinational investment bank, Berenberg Bank. As a return, Bloomberg said the bank told staff to expect poor bonuses at the end of the year.

"Due to weaker markets, in particular the much weaker activity in equity issuance, bonuses are likely to be limited and targeted," European Equities head Laura Janssens told Bloomberg in a response on Friday.

Last year, the German investment bank recorded the best year since its founding more than four centuries ago. This year's freezing of the European M&A market has forced it to trim costs to survive market volatility, an increasing interest rate environment, and a low investor appetite for new issues.

Bloomberg pointed out the bonus cuts announcement comes three months after Berenberg reduced its investment banker workforce in London by 5%, or slashing 30 jobs. Over the summer, it cut 50 jobs in the US as the IPO market has also frozen across the Atlantic.

"Due to the more challenging environment, we have moved early to right size our cost base and are confident about our prospects heading into 2023 and beyond," Janssens said Friday.

Dealmaking conditions in the US are equally as bad.

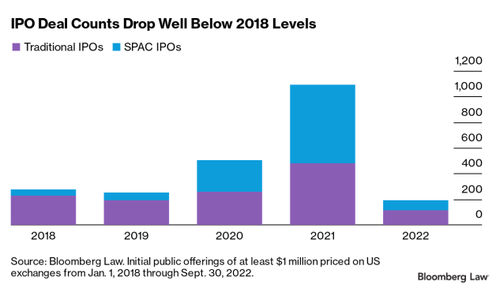

In the recently completed quarter, US IPOs were down 87.5%, and raised nearly 98% less capital compared to the first quarter of 2021, when new issues peaked. Only 52 companies went public in the US in Q3, raising $2.8 billion. -- Bloomberg

Reuters cited New York State Comptroller Thomas DiNapoli, who said Wall Street bonuses in 2022 are set to plunge 22% from last year's figure. DiNapoli blamed challenging macroeconomic conditions that choked off demand for new issues.

"The last two years of profits and bonuses fueled in part by the extraordinary federal response to the pandemic were not sustainable. "As the sector slows down in 2022, leading firms are reviewing staffing and office space needs and a prolonged downturn could negatively impact state and city coffers," DiNapoli said.

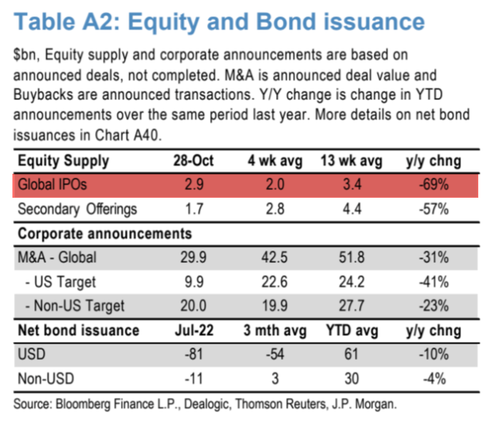

JPMorgan's latest "Flows & Liquidity" report sheds light on global dealmaking cratering this year.

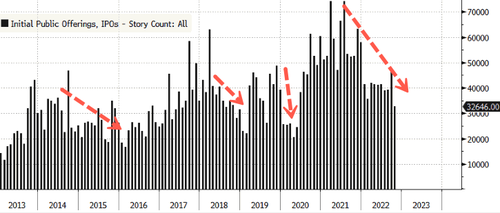

Also, IPO mentions in news stories across the web have dramatically fallen since the stock market frenzy during the Covid era

Global M&A trends point to further downside through early next year. A reversal for the industry will come when central banks pivot.

2021 was a record-breaking year for the European merger and acquisitions industry. On the other hand, 2022 dealmaking has underwhelmed due to volatile and fragile markets because of the invasion of Ukraine in late February, the energy crisis, increasing risks of recession, and central banks tightening financial conditions to rein in elevated inflation.

All these factors contributed to a dismal year for dealmaking for the German multinational investment bank, Berenberg Bank. As a return, Bloomberg said the bank told staff to expect poor bonuses at the end of the year.

“Due to weaker markets, in particular the much weaker activity in equity issuance, bonuses are likely to be limited and targeted,” European Equities head Laura Janssens told Bloomberg in a response on Friday.

Last year, the German investment bank recorded the best year since its founding more than four centuries ago. This year’s freezing of the European M&A market has forced it to trim costs to survive market volatility, an increasing interest rate environment, and a low investor appetite for new issues.

Bloomberg pointed out the bonus cuts announcement comes three months after Berenberg reduced its investment banker workforce in London by 5%, or slashing 30 jobs. Over the summer, it cut 50 jobs in the US as the IPO market has also frozen across the Atlantic.

“Due to the more challenging environment, we have moved early to right size our cost base and are confident about our prospects heading into 2023 and beyond,” Janssens said Friday.

Dealmaking conditions in the US are equally as bad.

In the recently completed quarter, US IPOs were down 87.5%, and raised nearly 98% less capital compared to the first quarter of 2021, when new issues peaked. Only 52 companies went public in the US in Q3, raising $2.8 billion. — Bloomberg

Reuters cited New York State Comptroller Thomas DiNapoli, who said Wall Street bonuses in 2022 are set to plunge 22% from last year’s figure. DiNapoli blamed challenging macroeconomic conditions that choked off demand for new issues.

“The last two years of profits and bonuses fueled in part by the extraordinary federal response to the pandemic were not sustainable. “As the sector slows down in 2022, leading firms are reviewing staffing and office space needs and a prolonged downturn could negatively impact state and city coffers,” DiNapoli said.

JPMorgan’s latest “Flows & Liquidity” report sheds light on global dealmaking cratering this year.

Also, IPO mentions in news stories across the web have dramatically fallen since the stock market frenzy during the Covid era

Global M&A trends point to further downside through early next year. A reversal for the industry will come when central banks pivot.