Authored by Mark Jeftovic via BombThrower.com,

The Oracle of Omaha’s second banana has pronounced judgement on crypto.

It was even more unhinged than previous attacks (“rat poison”), as Munger applauded communist China’s technocratic dictatorship as a sensible ideal we should be following here in the West.

“the communist government of China recently banned cryptocurrencies because it wisely concluded that they would provide more harm than benefit…What should the U.S. do after a ban of cryptocurrencies is in place? Well, one more action might make sense: Thank the Chinese communist leader for his splendid example of uncommon sense.”

The fact that Munger is able to aggrandize a communist police state that maintains concentration camps, engages in organ harvesting and forced labour with impunity is a testament to his insular position (not to mention the lopsidedness of our political zeitgeist).

Munger is a Cantillionaire – after Richard Cantillion who wrote one of the first economic treatise in the eighteenth century describing how proximity to the monetary inputs of a society confer special advantages at the expense of wider populus.

The Cantillon Effect

Munger’s crocodile tears for those who lose out in the economic game of life are ironic, given that Berkshire Hathaway’s mantra (and Westco, Munger’s sidecar conglomerate) for decades has been to buy often distressed businesses that are out of fashion but have a “durable competitive advantage ” or “moat”.

Those are euphemisms for monopolies, and both Buffet and Munger love owning them. They don’t seem to care if those monopolies draw rentier like returns on monetizing low income housing or opioid addiction.

Munger and Buffet’s dynastic wealth was built on the crest of three structural tailwinds:

If there is such thing as “structural inequality”, it has more to do with the way the monetary system is constructed to benefit people who are already super-wealthy than anything else. “Fix the money, fix the world”.

The first of these pillars below is more of a dynamic than a structure, and one that there’s nothing wrong with, actually.

But it seemed odd to hear Munger, a man who made his fortune exploiting valuation gaps in publicly traded companies, singing on the virtues of England’s “bann[ing of] all public trading in new common stocks and kee[ping] this ban in place for about 100 years.” .

That happened back in the 1700’s when Richard Cantillon was figuring out that the monetary system was structurally rigged, even then.

So while Buffett and Munger’s investing acumen is not in dispute, these three forces acted as the lubricant, if not steroids, for their astonishing returns over the decades:

1) Value investing

…is the foundation upon which Buffett (and Munger) built Berkshire. It is buying companies or assets below their perceived intrinsic value. The fact that other investors have lost money on it is a prerequisite, otherwise they wouldn’t be “value plays”. “All this wild and wooly capitalism” that Munger is ruminating about in his WSJ op-ed is what created the valuation asymmetries that Berkshire Hathaway has exploited ever since the duo took it over, in 1965.

2) Fiat currency debasement

The Cantillon Effect makes inflation acutely pernicious, widening wealth inequality as the asset values of the ultra-wealthy get higher, it drives up the cost of living for everybody else.

Buffett and Munger have been playing inflation like a fiddle for decades. They both know that all fiat currencies are headed for zero, so they gravitate toward “inflation proof” assets with “pricing power” and “moats” (…because inflation-proofing goes better with monopolies.)

Then when things run too hot, they can play the populists and urge government to raise taxes on the wealthy (suggesting tax structures which would barely impact themselves, if at all) and chide the central bank to “reign in inflation, even if it causes a recession”. Like nearly all super-wealthy elites, they love to make policy recommendations that impact everybody else, yet put them in a position capitalize on the second-order effects: Recessions cause unemployment, bankruptcies and a plethora of valuation asymmetries where they can reload on durable assets and businesses at discounted prices.

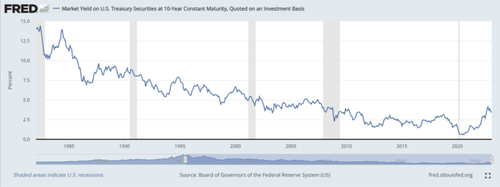

3) A 40-year decline in cost-of-capital

At the age of 52, Warren Buffett’s net worth was 0.3% of what it is today, and the correlation of Munger’s personal wealth to Buffett’s is basically 1.

That was 1982, which marked the beginning of a bond super-cycle that saw the cost of capital decline to zero by the end of it.

Real rates are still negative today, and all of this compounded with the fiat currency debasement that lifted Buffett and Munger’s boats and accentuated their returns for decades.

I’m not saying that currency debasement and secularly suppressed cost-of-capital are the sole factors for Berkshire Hathaway’s success.

But they were indisputably beneficiaries of the fiat system structure over decades. Also during periods of dislocation, like when it was weaponized against the plebes during lockdowns and the Fed started buying up Berkshire’s debt (along with every other billion and trillion dollar juggernaut) while lending rapidly devaluing dollars to small and independent businesses (that is, if they weren’t simply banned from operating).

Berkshire Hathaway was built atop a system that Bitcoin was created to destroy

Many years ago I found myself sitting in a Bay St. conference room at one of Canada’s “Big Four” banks. There was a representative there from three of those Big Four, plus an Entrepreneur-in-Residence from the Business Development Bank of Canada (BDC) who shall remain nameless, and had organized the meeting at the behest of another BDC contact.

We were there to talk Bitcoin.

He told me a story. More of a parable. Maybe it was just the facts of life.

He said, basically this (paraphrasing),

“when a new disruptive technology comes along, you want to be out front with big investment money behind you, you want to engage with government, the banks and policy makers right away, from the start – and you develop your relationships and your platform, all the while you are engaging with policy makers and the system incumbents to develop the rules.

When the government finally moves on regulating the new space, you are already there and you are on the right side of it, because you helped shape the policies.

Then the regulatory hurdles keep getting higher, and you’re always on the right side of it, while all the later entrants are playing catch up or falling behind.

In other words (and I remember this exactly, along the with the big, smug smile he had on his face when he said it):

"You get to turn around and pull the ladder up behind you!”

I left that meeting not sure what had just happened and nothing more ever came of it, at least with me.

But Bitcoin is more than a disruptive technology. It’s a decentralized counter-attack against a structurally unsustainable and predatory financial system.

Whenever I hear Buffett, Munger, Jamie Dimon, Larry Fink or any other High Priests of the Gerontocracy complaining about Bitcoin specifically, or crypto-currencies in general, I feel like that’s what I’m listening to: a bunch of super-rich Sith Lords frantically trying to pull up the ladder behind them.

Because the last thing they want or can fathom, is to wind up back on a level playing field.

* * *

Follow me on Nostr , Gettr, or Twitter. Sign up for The Bombthrower mailing list to get updates straight into your inbox and get a free copy of The Crypto Capitalist Manifesto while you’re at it.

Authored by Mark Jeftovic via BombThrower.com,

The Oracle of Omaha’s second banana has pronounced judgement on crypto.

It was even more unhinged than previous attacks (“rat poison”), as Munger applauded communist China’s technocratic dictatorship as a sensible ideal we should be following here in the West.

“the communist government of China recently banned cryptocurrencies because it wisely concluded that they would provide more harm than benefit…What should the U.S. do after a ban of cryptocurrencies is in place? Well, one more action might make sense: Thank the Chinese communist leader for his splendid example of uncommon sense.”

The fact that Munger is able to aggrandize a communist police state that maintains concentration camps, engages in organ harvesting and forced labour with impunity is a testament to his insular position (not to mention the lopsidedness of our political zeitgeist).

Munger is a Cantillionaire – after Richard Cantillion who wrote one of the first economic treatise in the eighteenth century describing how proximity to the monetary inputs of a society confer special advantages at the expense of wider populus.

The Cantillon Effect

Munger’s crocodile tears for those who lose out in the economic game of life are ironic, given that Berkshire Hathaway’s mantra (and Westco, Munger’s sidecar conglomerate) for decades has been to buy often distressed businesses that are out of fashion but have a “durable competitive advantage ” or “moat”.

Those are euphemisms for monopolies, and both Buffet and Munger love owning them. They don’t seem to care if those monopolies draw rentier like returns on monetizing low income housing or opioid addiction.

Munger and Buffet’s dynastic wealth was built on the crest of three structural tailwinds:

If there is such thing as “structural inequality”, it has more to do with the way the monetary system is constructed to benefit people who are already super-wealthy than anything else. “Fix the money, fix the world”.

The first of these pillars below is more of a dynamic than a structure, and one that there’s nothing wrong with, actually.

But it seemed odd to hear Munger, a man who made his fortune exploiting valuation gaps in publicly traded companies, singing on the virtues of England’s “bann[ing of] all public trading in new common stocks and kee[ping] this ban in place for about 100 years.” .

That happened back in the 1700’s when Richard Cantillon was figuring out that the monetary system was structurally rigged, even then.

So while Buffett and Munger’s investing acumen is not in dispute, these three forces acted as the lubricant, if not steroids, for their astonishing returns over the decades:

1) Value investing

…is the foundation upon which Buffett (and Munger) built Berkshire. It is buying companies or assets below their perceived intrinsic value. The fact that other investors have lost money on it is a prerequisite, otherwise they wouldn’t be “value plays”. “All this wild and wooly capitalism” that Munger is ruminating about in his WSJ op-ed is what created the valuation asymmetries that Berkshire Hathaway has exploited ever since the duo took it over, in 1965.

2) Fiat currency debasement

The Cantillon Effect makes inflation acutely pernicious, widening wealth inequality as the asset values of the ultra-wealthy get higher, it drives up the cost of living for everybody else.

Buffett and Munger have been playing inflation like a fiddle for decades. They both know that all fiat currencies are headed for zero, so they gravitate toward “inflation proof” assets with “pricing power” and “moats” (…because inflation-proofing goes better with monopolies.)

Then when things run too hot, they can play the populists and urge government to raise taxes on the wealthy (suggesting tax structures which would barely impact themselves, if at all) and chide the central bank to “reign in inflation, even if it causes a recession”. Like nearly all super-wealthy elites, they love to make policy recommendations that impact everybody else, yet put them in a position capitalize on the second-order effects: Recessions cause unemployment, bankruptcies and a plethora of valuation asymmetries where they can reload on durable assets and businesses at discounted prices.

3) A 40-year decline in cost-of-capital

At the age of 52, Warren Buffett’s net worth was 0.3% of what it is today, and the correlation of Munger’s personal wealth to Buffett’s is basically 1.

That was 1982, which marked the beginning of a bond super-cycle that saw the cost of capital decline to zero by the end of it.

Real rates are still negative today, and all of this compounded with the fiat currency debasement that lifted Buffett and Munger’s boats and accentuated their returns for decades.

I’m not saying that currency debasement and secularly suppressed cost-of-capital are the sole factors for Berkshire Hathaway’s success.

But they were indisputably beneficiaries of the fiat system structure over decades. Also during periods of dislocation, like when it was weaponized against the plebes during lockdowns and the Fed started buying up Berkshire’s debt (along with every other billion and trillion dollar juggernaut) while lending rapidly devaluing dollars to small and independent businesses (that is, if they weren’t simply banned from operating).

Berkshire Hathaway was built atop a system that Bitcoin was created to destroy

Many years ago I found myself sitting in a Bay St. conference room at one of Canada’s “Big Four” banks. There was a representative there from three of those Big Four, plus an Entrepreneur-in-Residence from the Business Development Bank of Canada (BDC) who shall remain nameless, and had organized the meeting at the behest of another BDC contact.

We were there to talk Bitcoin.

He told me a story. More of a parable. Maybe it was just the facts of life.

He said, basically this (paraphrasing),

“when a new disruptive technology comes along, you want to be out front with big investment money behind you, you want to engage with government, the banks and policy makers right away, from the start – and you develop your relationships and your platform, all the while you are engaging with policy makers and the system incumbents to develop the rules.

When the government finally moves on regulating the new space, you are already there and you are on the right side of it, because you helped shape the policies.

Then the regulatory hurdles keep getting higher, and you’re always on the right side of it, while all the later entrants are playing catch up or falling behind.

In other words (and I remember this exactly, along the with the big, smug smile he had on his face when he said it):

“You get to turn around and pull the ladder up behind you!”

I left that meeting not sure what had just happened and nothing more ever came of it, at least with me.

But Bitcoin is more than a disruptive technology. It’s a decentralized counter-attack against a structurally unsustainable and predatory financial system.

Whenever I hear Buffett, Munger, Jamie Dimon, Larry Fink or any other High Priests of the Gerontocracy complaining about Bitcoin specifically, or crypto-currencies in general, I feel like that’s what I’m listening to: a bunch of super-rich Sith Lords frantically trying to pull up the ladder behind them.

Because the last thing they want or can fathom, is to wind up back on a level playing field.

* * *

Follow me on Nostr , Gettr, or Twitter. Sign up for The Bombthrower mailing list to get updates straight into your inbox and get a free copy of The Crypto Capitalist Manifesto while you’re at it.

Loading…