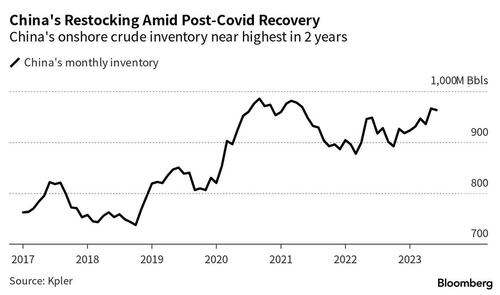

In the latest hurdle to Saudi ambitions to boost oil prices, China’s onshore crude oil stockpiles hit a two-year high in May as demand fell short of expectations amid a disappointing economic recovery, Bloomberg reports overnight.

According to Kpler, Chinese crude oil inventories climbed to 966 million barrels, before easing back to 963 million barrels in June. That compares to a five-year average of 858 million barrels, and is almost 3x more than the US has in its strategic petroleum reserve.

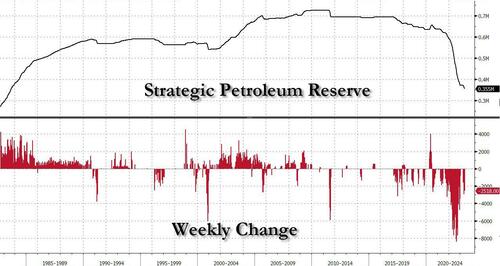

Meanwhile, the drain of the US strategic reserve continues apace, and with just 355 million barrels, the US had the lowest inventory in 40 years, since Sept of 1983.

Chinese refiners have been on a post-Covid buying spree, betting that oil demand would quickly rebound after China reopened its economy. But that hasn’t been the case and consumption has stagnated at the same time as processors have idled facilities for spring maintenance.

Additionally, lackluster industrial activity has curbed diesel consumption, while the recovery in travel demand for items like jet fuel has yet to fully take off. And, as Bloomberg notes, petrochemical products such as styrene are feeling the pinch from China’s sagging property market. Meanwhile, a customs probe on bitumen mix is delaying some cargoes from clearing onshore tanks.

A customs probe in Shandong has also kept oil from clearing storage, said Emma Li, an analyst at Vortexa Ltd., which puts onshore inventory at 960 million barrels, its highest since December 2020.

China could draw 20 million barrels from its stockpiles between June and August as crude imports show a seasonal decline, before purchases strengthen again in September, Energy Aspects Ltd. said earlier this month.

New refining capacity and storage facilities are also expanding the amount of oil that China can stockpile. Inventory capacity grew to 1.63 billion barrels in June, compared to 1.55 billion barrels a year ago, according to Kpler.

In the latest hurdle to Saudi ambitions to boost oil prices, China’s onshore crude oil stockpiles hit a two-year high in May as demand fell short of expectations amid a disappointing economic recovery, Bloomberg reports overnight.

According to Kpler, Chinese crude oil inventories climbed to 966 million barrels, before easing back to 963 million barrels in June. That compares to a five-year average of 858 million barrels, and is almost 3x more than the US has in its strategic petroleum reserve.

Meanwhile, the drain of the US strategic reserve continues apace, and with just 355 million barrels, the US had the lowest inventory in 40 years, since Sept of 1983.

Chinese refiners have been on a post-Covid buying spree, betting that oil demand would quickly rebound after China reopened its economy. But that hasn’t been the case and consumption has stagnated at the same time as processors have idled facilities for spring maintenance.

Additionally, lackluster industrial activity has curbed diesel consumption, while the recovery in travel demand for items like jet fuel has yet to fully take off. And, as Bloomberg notes, petrochemical products such as styrene are feeling the pinch from China’s sagging property market. Meanwhile, a customs probe on bitumen mix is delaying some cargoes from clearing onshore tanks.

A customs probe in Shandong has also kept oil from clearing storage, said Emma Li, an analyst at Vortexa Ltd., which puts onshore inventory at 960 million barrels, its highest since December 2020.

China could draw 20 million barrels from its stockpiles between June and August as crude imports show a seasonal decline, before purchases strengthen again in September, Energy Aspects Ltd. said earlier this month.

New refining capacity and storage facilities are also expanding the amount of oil that China can stockpile. Inventory capacity grew to 1.63 billion barrels in June, compared to 1.55 billion barrels a year ago, according to Kpler.

Loading…