Over the weekend, we quoted Goldman's head of hedge fund sales Tony Pasquariello who had some very choice words for China, saying its economy was so bad, "it’s simply eye-popping (witness the worst IP print on record)", and prompted Goldman's sellside research desk to cut its expectation for 2022 Chinese GDP growth to just 4%, which ex-2020 would be the slowest growth rate since 1990! For the sake of balance, Pasquariello noted that Shanghai was set to reopen on June 1st which could be a potential upside catalyst at a time when foreign investors have largely written away Chinese equities.

Fast forward to today when we find that Pasquariello's hedging was not necessary, because on Wednesday, China's Premier Li Keqiang held a teleconference this afternoon under the topic of "stabilizing economic growth" with provincial, city-level and county-level local government officials across the country in which he had some very dismal comments about the current state of China's economy.

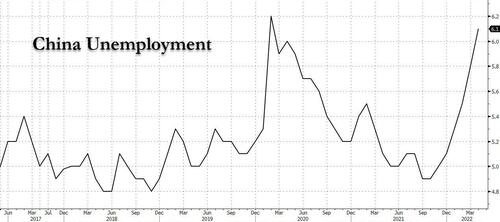

As Goldman notes, "while there are not many new measures being announced from this conference, the nature and scale of this conference is quite unusual. Chinese policymakers are in greater urgency to support the economy after the very weak activity growth in April, anemic recovery month-to-date in May, and continued increases in unemployment rates."

Specifically, premier Li said China’s economy is worse off to a “certain extent” than 2020 when the pandemic first emerged, urging efforts to reduce the unemployment rate which as we noted recently has soared to the highest level since the covid crash.

“Economic indicators in China have fallen significantly, and difficulties in some aspects and to a certain extent are greater than when the epidemic hit us severely in 2020,” Li said Wednesday following a meeting with local authorities, state-owned companies and financial firms to discuss how to stabilize the economy, Bloomberg reported.

China’s premier also said the world’s second-largest economy would struggle to record positive growth in the current quarter, urging officials to help companies resume production after Covid-19 lockdowns, according to the FT.

“We will try to make sure the economy grows in the second quarter,” Li said, according to a transcript that the Financial Times verified with three people briefed on the premier’s remarks. “This is not a high target and a far cry from our 5.5 per cent goal. But we have to do so.”

The last time China’s growth entered negative territory was when output plunged 6.9 per cent year on year in the first quarter of 2020 after the coronavirus pandemic ended an era of uninterrupted growth dating back more than 30 years.

The comments by Li Keqiang, to tens of thousands of officials on an internal videocast on Wednesday, underscore the difficulties President Xi Jinping’s administration will have in reaching its annual growth target of 5.5% while also battling Omicron outbreaks.

Concerned that the unemployment rate is approaching levels where the dreaded "social unrest" becomes a possibility, the premier urged officials to make sure the unemployment rate falls and the economy “operates in a reasonable range” in the second quarter of this year, state media cited him as saying. Earlier in May, Li warned of a “complicated and grave” employment situation after the nation’s surveyed jobless rate climbed to 6.1% in April, the highest since February 2020, and sent the yuan plunging to the lowest level since late 2020.

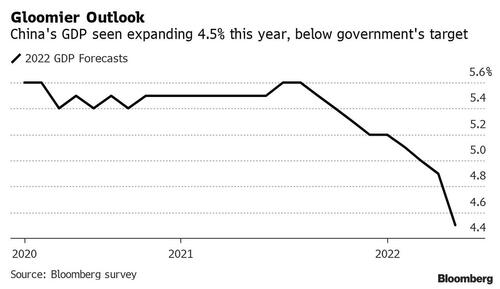

Today's meeting was the latest in a series of urgent calls by Li (who is quitting his job next March) to shore up the economy, which has come under enormous pressure from Covid outbreaks and lockdowns in recent months, threatening the government's growth target of about 5.5%. President Xi's stubborn commitment to Covid Zero means China is guaranteed to miss that goal this year: Economists now forecast gross domestic product growth will hit just 4.5%, according to a new Bloomberg survey, with Goldman predicting GDP will rise just 4.0% as noted above.

In hopes of offsetting some of the gloom and doom unleashed by Beijing's flawed covid policies, Li indicated that China will try to reduce the impact of its strict Zero-Covid policy on the economy. “At the same time as controlling the epidemic, we must complete the task of economic development,” he said.

Li also stressed implementation of current support policies, and said more detailed implementation measures would be issued by the end of this month. Somewhat bizarrely, he said that economic data for the second quarter would be released “accurately”, hinting that prior Chinese data was - gasp - inaccurate? Perish the thought.

As Bloomberg reported earlier this week, China's State Council outlined 33 support measures on Monday to help businesses struggling to cope with the lockdowns, including extra tax rebates, relief on social insurance payments and loans, and additional funding for aviation and rail construction. Local governments were told to spend most of the proceeds from special bonds -- used mainly for infrastructure -- by the end of August. Judging by the lack of market reaction, investors saw right through this latest mostly verbal attempt to prop up confidence in the country ahead of the 20th Party Congress later this year, where Xi's fate will be determine (amid some rumors that his political career may be cut short if China's economy does not stabilize).

The central bank and banking regulator also held a meeting with major financial institutions on Monday to urge them to boost loans.

Li met with local authorities in April, when Shanghai was in the middle of a lockdown, telling them to “add a sense of urgency” as they rolled out policy. During a trip to Yunnan province last week, he said they should “act decisively” to support growth. Of course, when banks artificially inject loans into an economy where there is no loan demand, what you end up getting is just another bubble.

Over the weekend, we quoted Goldman’s head of hedge fund sales Tony Pasquariello who had some very choice words for China, saying its economy was so bad, “it’s simply eye-popping (witness the worst IP print on record)”, and prompted Goldman’s sellside research desk to cut its expectation for 2022 Chinese GDP growth to just 4%, which ex-2020 would be the slowest growth rate since 1990! For the sake of balance, Pasquariello noted that Shanghai was set to reopen on June 1st which could be a potential upside catalyst at a time when foreign investors have largely written away Chinese equities.

Fast forward to today when we find that Pasquariello’s hedging was not necessary, because on Wednesday, China’s Premier Li Keqiang held a teleconference this afternoon under the topic of “stabilizing economic growth” with provincial, city-level and county-level local government officials across the country in which he had some very dismal comments about the current state of China’s economy.

As Goldman notes, “while there are not many new measures being announced from this conference, the nature and scale of this conference is quite unusual. Chinese policymakers are in greater urgency to support the economy after the very weak activity growth in April, anemic recovery month-to-date in May, and continued increases in unemployment rates.”

Specifically, premier Li said China’s economy is worse off to a “certain extent” than 2020 when the pandemic first emerged, urging efforts to reduce the unemployment rate which as we noted recently has soared to the highest level since the covid crash.

“Economic indicators in China have fallen significantly, and difficulties in some aspects and to a certain extent are greater than when the epidemic hit us severely in 2020,” Li said Wednesday following a meeting with local authorities, state-owned companies and financial firms to discuss how to stabilize the economy, Bloomberg reported.

China’s premier also said the world’s second-largest economy would struggle to record positive growth in the current quarter, urging officials to help companies resume production after Covid-19 lockdowns, according to the FT.

“We will try to make sure the economy grows in the second quarter,” Li said, according to a transcript that the Financial Times verified with three people briefed on the premier’s remarks. “This is not a high target and a far cry from our 5.5 per cent goal. But we have to do so.”

The last time China’s growth entered negative territory was when output plunged 6.9 per cent year on year in the first quarter of 2020 after the coronavirus pandemic ended an era of uninterrupted growth dating back more than 30 years.

The comments by Li Keqiang, to tens of thousands of officials on an internal videocast on Wednesday, underscore the difficulties President Xi Jinping’s administration will have in reaching its annual growth target of 5.5% while also battling Omicron outbreaks.

Concerned that the unemployment rate is approaching levels where the dreaded “social unrest” becomes a possibility, the premier urged officials to make sure the unemployment rate falls and the economy “operates in a reasonable range” in the second quarter of this year, state media cited him as saying. Earlier in May, Li warned of a “complicated and grave” employment situation after the nation’s surveyed jobless rate climbed to 6.1% in April, the highest since February 2020, and sent the yuan plunging to the lowest level since late 2020.

Today’s meeting was the latest in a series of urgent calls by Li (who is quitting his job next March) to shore up the economy, which has come under enormous pressure from Covid outbreaks and lockdowns in recent months, threatening the government’s growth target of about 5.5%. President Xi’s stubborn commitment to Covid Zero means China is guaranteed to miss that goal this year: Economists now forecast gross domestic product growth will hit just 4.5%, according to a new Bloomberg survey, with Goldman predicting GDP will rise just 4.0% as noted above.

In hopes of offsetting some of the gloom and doom unleashed by Beijing’s flawed covid policies, Li indicated that China will try to reduce the impact of its strict Zero-Covid policy on the economy. “At the same time as controlling the epidemic, we must complete the task of economic development,” he said.

Li also stressed implementation of current support policies, and said more detailed implementation measures would be issued by the end of this month. Somewhat bizarrely, he said that economic data for the second quarter would be released “accurately”, hinting that prior Chinese data was – gasp – inaccurate? Perish the thought.

As Bloomberg reported earlier this week, China’s State Council outlined 33 support measures on Monday to help businesses struggling to cope with the lockdowns, including extra tax rebates, relief on social insurance payments and loans, and additional funding for aviation and rail construction. Local governments were told to spend most of the proceeds from special bonds — used mainly for infrastructure — by the end of August. Judging by the lack of market reaction, investors saw right through this latest mostly verbal attempt to prop up confidence in the country ahead of the 20th Party Congress later this year, where Xi’s fate will be determine (amid some rumors that his political career may be cut short if China’s economy does not stabilize).

The central bank and banking regulator also held a meeting with major financial institutions on Monday to urge them to boost loans.

Li met with local authorities in April, when Shanghai was in the middle of a lockdown, telling them to “add a sense of urgency” as they rolled out policy. During a trip to Yunnan province last week, he said they should “act decisively” to support growth. Of course, when banks artificially inject loans into an economy where there is no loan demand, what you end up getting is just another bubble.