China has lots of economic problems (even if the market has been surprisingly generous in the past 4 months and allowed Chinese stocks to surge despite any actual economic rebound or recovery), but this is a new one.

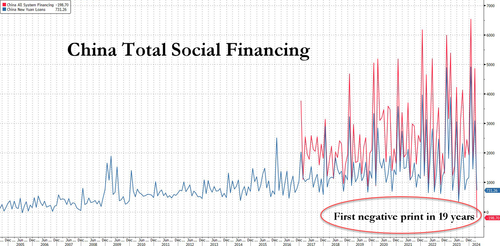

It is hardly a secret that for much of the past 15 years, and certainly in the aftermath of the Lehman collapse, it was China's unstoppable credit creation that lifted the world out of a deflationary shock time and again, and indeed it is a fact that as long as we can remember, China's broadest credit aggregate, Total Social Financing, was always positive, come rain, blizzard, or shina.

But in a stunning reversal, the latest credit data published over the weekend by the PBOC revealed that for the first time since late 2005 - nearly 20 years ago - China's Total Social Financing turned negative!

The drop was thanks to a combination of weak loan demand and slow pace of bond issuance, but whatever the reason, there is a bigger problem: China can't grow the economy without injecting billions (or trillions) of credit into it. Yet, without credit demand - at any interest rate or price - all the money that China does inject will go into various asset bubbles, which means we are back at square one.

Here are the details:

- New CNY loans: RMB 730bn in April (RMB loans to the real economy: RMB 331bn) vs. Bloomberg consensus: RMB 914bn

- Outstanding CNY loan growth: 9.6% yoy in April (+8.0% mom sa ann); March: 9.6% yoy (+8.7% mom sa ann).

- Total social financing (TSF flow, reported): RMB -199bn in April, vs. Bloomberg consensus: RMB 941bn.

- TSF stock growth: 8.3% yoy in April, vs. 8.7% in March. The implied month-on-month growth of TSF stock: 3.5% in April (seasonally adjusted annualized rate), vs. 8.2% in March.

- M2: 7.2% yoy in April (-1.6% mom sa ann estimated by GS) vs. Bloomberg consensus: 8.3% yoy, GS forecast: 8.0% yoy. March: 8.3% yoy (+6.4% mom sa ann).

According to Goldman, it wasn't just the negative print in TSF that conveyed weak credit demand: so did the composition of RMB loan data which showed household loans contracted in April, and corporate loans expanded mainly due to a surge in bill financing. As the bank further adds, the broad weakness in money and credit data likely reflects

- the focus of policymakers on optimizing the structure and effectiveness of loan extension;

- more stringent measures to tackle “idle money circulation” in the financial system (e.g., corporates’ borrowing for redeposits).

- deposit outflows from banks to financial markets (particularly the bond market).

Now a closer look at the narrative behnid the numbers:

- Total social financing (TSF) flows turned negative in April, the first time since October 2005, significantly below market expectations. The disappointing TSF data was driven by weak loan demand and slow pace of bond issuance. Bill financing surged as banks tried to fill in unused loan quota, which reduced the amount of undiscounted bankers’ acceptance bills. Shadow banking credit (undiscounted bankers’ acceptance bills, trust loans, entrusted loans) declined by RMB 246bn vs. an expansion of RMB 223bn in March. Bond net issuance fell sharply in April compared with March: Government bond net issuance moderated to RMB 159bn vs. RMB 478bn in March, while corporate bond net issuance was negative in April after seasonal adjustment (RMB -88bn vs. RMB 260bn in March). In year-over-year terms, TSF stock growth slowed to 8.3% from 8.7% in March. The sequential growth of TSF stock moderated to 3.5% mom sa annualized in April from 8.2% in March. For

- New CNY loans missed market expectations notably as well in April, and the sequential growth of RMB loans slowed to 8.0% mom sa annualized from 8.7% in March. That said, year-over-year growth of RMB loans was flat at 9.6% in April. The composition of new loans showed weak credit demand as household loans contracted and bill financing grew much faster than medium-to-long term corporate loans. After Goldman's seasonal adjustment, household loans contracted by -0.4% month-over-month annualized in April, vs +5.6% in March. Bill financing rose 70.4% month-over-month annualized in April (vs. -3.2% in March), while corporate medium-to-long term loans growth accelerated modestly to 11.8% month-over-month annualized in April (vs. 9.5% in March). The sizeable gap between “total new loans” (which was RMB 730bn in April) and the “new RMB loan under TSF” (which was RMB 331bn in April) was mainly due to the RMB 261bn expansion of loans to non-bank financial institutions.

- M2 growth slowed materially to 7.2% yoy in April (vs. 8.3% in March). On a sequential basis, M2 declined by 1.6% month-over-month annualized, vs +6.4% in March. Year-over-year growth of M1 turned negative in April, the first time since January 2022. The Financial News, a media outlet affiliated with PBOC, reported that the slowdown of M2 growth was driven by three factors: 1) deposit outflows from banks to non-bank financial institutions for higher returns of wealth management products, thanks to falling bond yields and lower deposit rates (more on this shortly); 2) more stringent measures to address “idle money circulation” (e.g., corporates’ borrowing for redeposits); 3) lower incentives for local governments to boost deposit/loan growth due to changes in accounting methods of value-added in financial sectors (in an effort by the central government to improve the GDP measurement).

- 4. April’s credit and money data consistently pointed to weak credit demand. Recent policy communications suggest that the PBOC continued to focus on enhancing monetary policy transmission and improving the efficiency of loan usage. Looking ahead, the growth of new CNY loans and M2 may gradually slow down further, as the PBOC highlighted weakening relationship between economic growth and credit expansion. Taken together with soft year-to-date growth of TSF stock, we revise down our TSF stock growth forecast to 9.5% for 2024 (vs. 10.0% previously). In light of upcoming acceleration of government bond issuance, we continue to expect two more RRR cuts and one policy rate cut through the remainder of this year.

Looking ahead, Goldman expects government bond issuance to pick up in late Q2, and the PBOC to facilitate the government bond issuance by increasing interbank liquidity. We continue to forecast one 25bp RRR cut in Q2.

While economists are trying to goal seek this latest disappointment out of China, the market has already priced it in, and overnight Chinese government bonds gained, as the poor credit data fueled expectation of more monetary policy easing and allowed traders to shrug off debt supply concerns. The offshore yuan touched its weakest level in over a week.

Bonds. And with credit demand plunging 10Y yields are dumping just fast; here are some more from Bloomberg:

- China plans to start selling the first batch of its 1 trillion yuan ($138 billion) of ultra-long special central government bonds on Friday.

- Weakness in credit print “adds to the possibility of another RRR cut" coming before end-2Q, likely coinciding with the special bond issuance and a step-up of local government bond issuance for the remainder of 2Q,” Becky Liu, head of China macro strategy at Stanchard Chartered Bank said

10-year bond yields fell to 2.29% versus previous close at 2.34% on Saturday; the domestic interbank bond market was open on May 11 due to holiday adjustment

Finally, China’s credit in April shrank for the first time as government bond sales slowed, while loan expansion was worse than expected in a sign of weak demand.

Bottom line: the yuan is dumping, credit is not only stalling but outright contracting, and while stocks are modestly higher as traders hope thay finally bottom-ticked the rebound, the collapsing Chinese yields signal that much more deflation is coming unless Beijing can arrest it. In either case, China is now facing a toxic cocktail of two equally bad choices: i) devalue the currency in hopes of kickstarting exports (since nothing else works), or ii) do nothing and watch as the economy spontaneously collapses in on itself and leads to a global economic shockwave that forces all developed central banks to quickly turn on the money printer.

China has lots of economic problems (even if the market has been surprisingly generous in the past 4 months and allowed Chinese stocks to surge despite any actual economic rebound or recovery), but this is a new one.

It is hardly a secret that for much of the past 15 years, and certainly in the aftermath of the Lehman collapse, it was China’s unstoppable credit creation that lifted the world out of a deflationary shock time and again, and indeed it is a fact that as long as we can remember, China’s broadest credit aggregate, Total Social Financing, was always positive, come rain, blizzard, or shina.

But in a stunning reversal, the latest credit data published over the weekend by the PBOC revealed that for the first time since late 2005 – nearly 20 years ago – China’s Total Social Financing turned negative!

The drop was thanks to a combination of weak loan demand and slow pace of bond issuance, but whatever the reason, there is a bigger problem: China can’t grow the economy without injecting billions (or trillions) of credit into it. Yet, without credit demand – at any interest rate or price – all the money that China does inject will go into various asset bubbles, which means we are back at square one.

Here are the details:

- New CNY loans: RMB 730bn in April (RMB loans to the real economy: RMB 331bn) vs. Bloomberg consensus: RMB 914bn

- Outstanding CNY loan growth: 9.6% yoy in April (+8.0% mom sa ann); March: 9.6% yoy (+8.7% mom sa ann).

- Total social financing (TSF flow, reported): RMB -199bn in April, vs. Bloomberg consensus: RMB 941bn.

- TSF stock growth: 8.3% yoy in April, vs. 8.7% in March. The implied month-on-month growth of TSF stock: 3.5% in April (seasonally adjusted annualized rate), vs. 8.2% in March.

- M2: 7.2% yoy in April (-1.6% mom sa ann estimated by GS) vs. Bloomberg consensus: 8.3% yoy, GS forecast: 8.0% yoy. March: 8.3% yoy (+6.4% mom sa ann).

According to Goldman, it wasn’t just the negative print in TSF that conveyed weak credit demand: so did the composition of RMB loan data which showed household loans contracted in April, and corporate loans expanded mainly due to a surge in bill financing. As the bank further adds, the broad weakness in money and credit data likely reflects

- the focus of policymakers on optimizing the structure and effectiveness of loan extension;

- more stringent measures to tackle “idle money circulation” in the financial system (e.g., corporates’ borrowing for redeposits).

- deposit outflows from banks to financial markets (particularly the bond market).

Now a closer look at the narrative behnid the numbers:

- Total social financing (TSF) flows turned negative in April, the first time since October 2005, significantly below market expectations. The disappointing TSF data was driven by weak loan demand and slow pace of bond issuance. Bill financing surged as banks tried to fill in unused loan quota, which reduced the amount of undiscounted bankers’ acceptance bills. Shadow banking credit (undiscounted bankers’ acceptance bills, trust loans, entrusted loans) declined by RMB 246bn vs. an expansion of RMB 223bn in March. Bond net issuance fell sharply in April compared with March: Government bond net issuance moderated to RMB 159bn vs. RMB 478bn in March, while corporate bond net issuance was negative in April after seasonal adjustment (RMB -88bn vs. RMB 260bn in March). In year-over-year terms, TSF stock growth slowed to 8.3% from 8.7% in March. The sequential growth of TSF stock moderated to 3.5% mom sa annualized in April from 8.2% in March. For

- New CNY loans missed market expectations notably as well in April, and the sequential growth of RMB loans slowed to 8.0% mom sa annualized from 8.7% in March. That said, year-over-year growth of RMB loans was flat at 9.6% in April. The composition of new loans showed weak credit demand as household loans contracted and bill financing grew much faster than medium-to-long term corporate loans. After Goldman’s seasonal adjustment, household loans contracted by -0.4% month-over-month annualized in April, vs +5.6% in March. Bill financing rose 70.4% month-over-month annualized in April (vs. -3.2% in March), while corporate medium-to-long term loans growth accelerated modestly to 11.8% month-over-month annualized in April (vs. 9.5% in March). The sizeable gap between “total new loans” (which was RMB 730bn in April) and the “new RMB loan under TSF” (which was RMB 331bn in April) was mainly due to the RMB 261bn expansion of loans to non-bank financial institutions.

- M2 growth slowed materially to 7.2% yoy in April (vs. 8.3% in March). On a sequential basis, M2 declined by 1.6% month-over-month annualized, vs +6.4% in March. Year-over-year growth of M1 turned negative in April, the first time since January 2022. The Financial News, a media outlet affiliated with PBOC, reported that the slowdown of M2 growth was driven by three factors: 1) deposit outflows from banks to non-bank financial institutions for higher returns of wealth management products, thanks to falling bond yields and lower deposit rates (more on this shortly); 2) more stringent measures to address “idle money circulation” (e.g., corporates’ borrowing for redeposits); 3) lower incentives for local governments to boost deposit/loan growth due to changes in accounting methods of value-added in financial sectors (in an effort by the central government to improve the GDP measurement).

- 4. April’s credit and money data consistently pointed to weak credit demand. Recent policy communications suggest that the PBOC continued to focus on enhancing monetary policy transmission and improving the efficiency of loan usage. Looking ahead, the growth of new CNY loans and M2 may gradually slow down further, as the PBOC highlighted weakening relationship between economic growth and credit expansion. Taken together with soft year-to-date growth of TSF stock, we revise down our TSF stock growth forecast to 9.5% for 2024 (vs. 10.0% previously). In light of upcoming acceleration of government bond issuance, we continue to expect two more RRR cuts and one policy rate cut through the remainder of this year.

Looking ahead, Goldman expects government bond issuance to pick up in late Q2, and the PBOC to facilitate the government bond issuance by increasing interbank liquidity. We continue to forecast one 25bp RRR cut in Q2.

While economists are trying to goal seek this latest disappointment out of China, the market has already priced it in, and overnight Chinese government bonds gained, as the poor credit data fueled expectation of more monetary policy easing and allowed traders to shrug off debt supply concerns. The offshore yuan touched its weakest level in over a week.

Bonds. And with credit demand plunging 10Y yields are dumping just fast; here are some more from Bloomberg:

- China plans to start selling the first batch of its 1 trillion yuan ($138 billion) of ultra-long special central government bonds on Friday.

- Weakness in credit print “adds to the possibility of another RRR cut” coming before end-2Q, likely coinciding with the special bond issuance and a step-up of local government bond issuance for the remainder of 2Q,” Becky Liu, head of China macro strategy at Stanchard Chartered Bank said

10-year bond yields fell to 2.29% versus previous close at 2.34% on Saturday; the domestic interbank bond market was open on May 11 due to holiday adjustment

Finally, China’s credit in April shrank for the first time as government bond sales slowed, while loan expansion was worse than expected in a sign of weak demand.

Bottom line: the yuan is dumping, credit is not only stalling but outright contracting, and while stocks are modestly higher as traders hope thay finally bottom-ticked the rebound, the collapsing Chinese yields signal that much more deflation is coming unless Beijing can arrest it. In either case, China is now facing a toxic cocktail of two equally bad choices: i) devalue the currency in hopes of kickstarting exports (since nothing else works), or ii) do nothing and watch as the economy spontaneously collapses in on itself and leads to a global economic shockwave that forces all developed central banks to quickly turn on the money printer.

Loading…