By John Kemp, senior energy analyst at Reuters

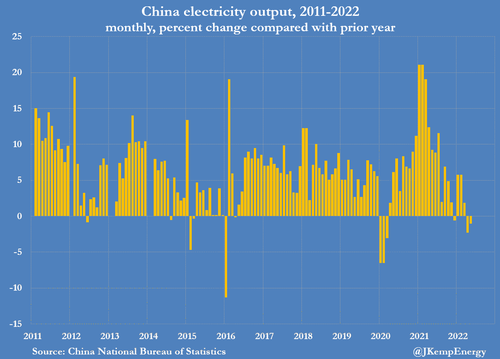

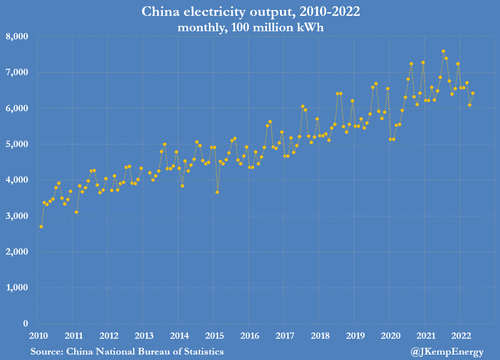

China’s electricity generation experienced rare declines in April and May compared with the same months a year earlier as lockdowns imposed to stop the spread of the coronavirus curbed consumption.

But slower consumption growth coupled with heavy rains across southern provinces, which has boosted hydro generation to a record high, has accelerated replenishment of coal inventories after shortages in 2021.

As a result, the coal supply situation is likely to be much more comfortable heading into the winter of 2022/23 than it was ahead of winter 2021/22. Generation from all sources was down 3%-4% in April and May compared with the same months in 2021, data from the National Bureau of Statistics (NBS) showed.

Generation has declined year-on-year in only 12 of the last 131 months; this was the first back-to-back decline since the first wave of the epidemic in 2020, illustrating the impact lockdowns have had on the economy.

Output in the first five months as a whole totalled 3,248 billion kilowatt-hours (kWh), an increase of just 71 billion kWh (2.2%) from the same period in 2021. Nearly all of the increase came from hydro-electric generators, which boosted output by 66 billion kWh compared with 2021.

There were also increases in generation from wind farms (+49 billion kWh), solar farms (+19 billion kWh) and nuclear units (+7 billion kWh). By contrast, output from thermal units, nearly all of which burn coal, declined by 71 billion kWh compared with the same period in 2021.

Southern Rainfall

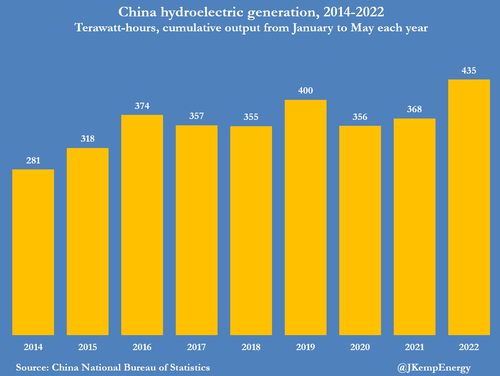

Hydro output in the first five months totalled 435 billion kWh, up from 368 billion kWh in 2021, surpassing the previous seasonal record of 400 billion kWh in 2019.

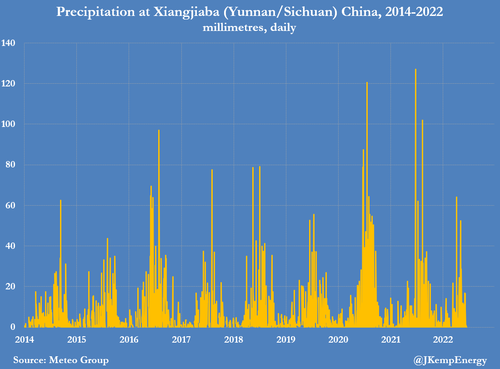

The surge in hydro generation has been driven by the unusually heavy rainfall which has lashed southern China since the start of the year.

In some parts of southern China, rainfall has been the heaviest for 60 years (“Southern China hit by severe rains, floods as ‘dragon boat water’ peaks”, Reuters, June 21).

The Ministry of Water Resources has issued flood alerts across most southern provinces since the start of June (“China launches level-IV emergency response for rain in southern areas”, MWR, June 13).

In response, top officials from the central government have been supervising massive releases from the upstream dams to manage flood risk in the region’s major river systems.

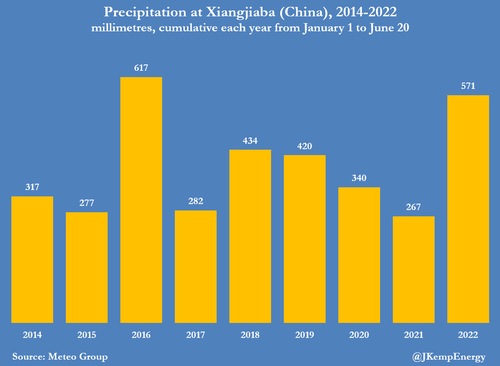

For example, total precipitation at Xiangjiaba on Jinsha River, at the border of Yunnan and Sichuan provinces, and the site of one of the country’s mega-dams, has been more than 50% higher than the average in 2014-2021.

Cumulative precipitation at Xiangjiaba so far this year has been 571 millimetres, up from 267 at the same point in 2021, and the highest since 2016.

Xiangjiaba’s massive generating station has installed capacity of more than 6 Gigawatts and sends power through a high-voltage transmission link to Shanghai.

Torrential rainfall has allowed hydro-electric generators across southern China to ramp up output earlier this year and should enable them to sustain it at a higher level for longer, saving coal.

More output from hydro plus wind, solar and nuclear is in turn relieving pressure on thermal generators and should allow them to accumulate coal stocks faster ahead of next winter.

Since the start of the year, the central government has pressed both coal mining companies and power generators to increase stocks at power plants to prevent a re-run of last year’s shortages.

The slowdown in electricity consumption and boost in hydro and other alternatives has made that policy far more effective and should reduce the risk of power rationing later in the year.

By John Kemp, senior energy analyst at Reuters

China’s electricity generation experienced rare declines in April and May compared with the same months a year earlier as lockdowns imposed to stop the spread of the coronavirus curbed consumption.

But slower consumption growth coupled with heavy rains across southern provinces, which has boosted hydro generation to a record high, has accelerated replenishment of coal inventories after shortages in 2021.

As a result, the coal supply situation is likely to be much more comfortable heading into the winter of 2022/23 than it was ahead of winter 2021/22. Generation from all sources was down 3%-4% in April and May compared with the same months in 2021, data from the National Bureau of Statistics (NBS) showed.

Generation has declined year-on-year in only 12 of the last 131 months; this was the first back-to-back decline since the first wave of the epidemic in 2020, illustrating the impact lockdowns have had on the economy.

Output in the first five months as a whole totalled 3,248 billion kilowatt-hours (kWh), an increase of just 71 billion kWh (2.2%) from the same period in 2021. Nearly all of the increase came from hydro-electric generators, which boosted output by 66 billion kWh compared with 2021.

There were also increases in generation from wind farms (+49 billion kWh), solar farms (+19 billion kWh) and nuclear units (+7 billion kWh). By contrast, output from thermal units, nearly all of which burn coal, declined by 71 billion kWh compared with the same period in 2021.

Southern Rainfall

Hydro output in the first five months totalled 435 billion kWh, up from 368 billion kWh in 2021, surpassing the previous seasonal record of 400 billion kWh in 2019.

The surge in hydro generation has been driven by the unusually heavy rainfall which has lashed southern China since the start of the year.

In some parts of southern China, rainfall has been the heaviest for 60 years (“Southern China hit by severe rains, floods as ‘dragon boat water’ peaks”, Reuters, June 21).

The Ministry of Water Resources has issued flood alerts across most southern provinces since the start of June (“China launches level-IV emergency response for rain in southern areas”, MWR, June 13).

In response, top officials from the central government have been supervising massive releases from the upstream dams to manage flood risk in the region’s major river systems.

For example, total precipitation at Xiangjiaba on Jinsha River, at the border of Yunnan and Sichuan provinces, and the site of one of the country’s mega-dams, has been more than 50% higher than the average in 2014-2021.

Cumulative precipitation at Xiangjiaba so far this year has been 571 millimetres, up from 267 at the same point in 2021, and the highest since 2016.

Xiangjiaba’s massive generating station has installed capacity of more than 6 Gigawatts and sends power through a high-voltage transmission link to Shanghai.

Torrential rainfall has allowed hydro-electric generators across southern China to ramp up output earlier this year and should enable them to sustain it at a higher level for longer, saving coal.

More output from hydro plus wind, solar and nuclear is in turn relieving pressure on thermal generators and should allow them to accumulate coal stocks faster ahead of next winter.

Since the start of the year, the central government has pressed both coal mining companies and power generators to increase stocks at power plants to prevent a re-run of last year’s shortages.

The slowdown in electricity consumption and boost in hydro and other alternatives has made that policy far more effective and should reduce the risk of power rationing later in the year.