Continued lockdowns in China aren't helping the country's ongoing, decade-long, production exodus, a new report from Caixin notes.

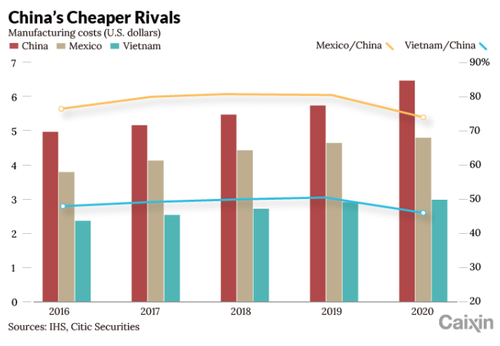

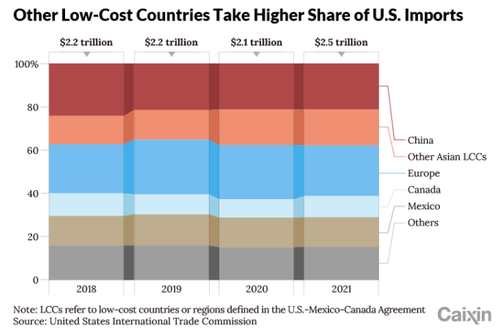

The accelerating exodus from Asian production powerhouse has been helped along by Covid policy disruptions, rising labor costs and worsening trade tensions between the U.S. and China, the report notes.

Southeast Asia and India are looking to take China's place thanks to low labor costs and rising domestic demand. This falls in line with India's political objectives, where Prime Minister Narendra Modi is pushing a “Made in India” campaign.

As an example, Apple said earlier this year that it had started making its iPhone 13 at a factory in India instead of Taiwanese contract manufacturer Foxconn. Like other smartphone makers, it has an incentive not only for exports, but for domestic sales, the report notes:

In India, Chinese smartphone makers set up factories aiming at the huge domestic market. With 1.4 billion people — almost as many as in China — and a high proportion of young people, India has attracted Chinese brands including Xiaomi, Meizu, Vivo and Oppo to build factories. Many Chinese phone part makers have also set up factories there. Now Chinese brands account for nearly two-thirds of India’s smartphone market.

But that doesn't mean China doesn't have advantages: it has an enormous domestic market and decades of manufacturing infrastructure and experience, the Caixin report notes. And while no major aftershocks have been felt in China's economy, the trend is heading in the wrong direction for the country.

Li Xingqian, director general of the Ministry of Commerce's Foreign Trade Department said the exodus from China was “in line with the law of economics.”

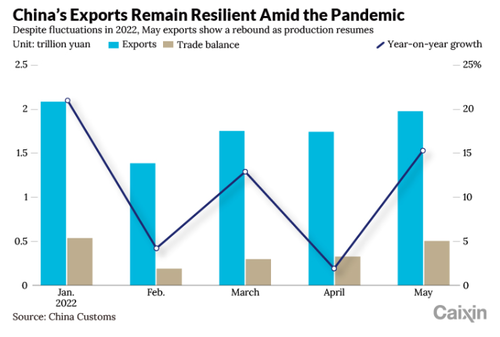

Exports in the country were up 16.9% in May, the report says, accelerating from April's 3.9%. The country's trade surplus was $78.76 billion in May.

However, thanks to weak demand in developed countries, "export orders for delivery in June and July, usually the peak season for booking goods for the back-to-school and holiday seasons, didn’t come in as expected," the report said. This weak demand was seen in falling shipping rates.

Americans may take until the end of this year to work through inventories that were pulled forward over the last year.

At the same time, President Joe Biden has said that he is considering lifting tariffs on $350 billion a year in Chinese goods. His administration, however, still seems to be divided on the matter and no decision is expected quickly.

The report noted clearly that, to this day, China remains "the world's factory", which is unlikely to change anytime soon:

Neither Southeast Asia nor India can replace China as the global manufacturing hub in the near future as they are mainly engaged in labor-intensive and low value-added manufacturing, several foreign trade participants told Caixin. They also face problems such as incomplete industrial chains and low labor efficiency to varying degrees, experts said.

To foreign companies, China is not only a manufacturing base but also a huge market, said He Xiaoqing, president of consulting firm Kearney Greater China. In 2020, global companies had $1.4 trillion of domestic sales, far more than their exports of $900 billion, showing the attractiveness of China’s local market, He said.

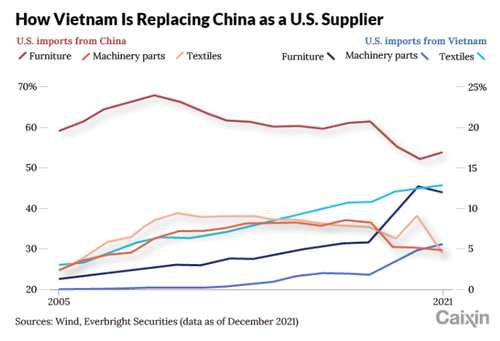

In addition to India, Vietnam has also been a beneficiary of factories leaving China. Imports for the country were up 16.7% for the first five months of this year, data shows.

Most of the production moving to Southeast Asia involves textiles, furniture and low-end assembly of consumer electronics, the report said.

Continued lockdowns in China aren’t helping the country’s ongoing, decade-long, production exodus, a new report from Caixin notes.

The accelerating exodus from Asian production powerhouse has been helped along by Covid policy disruptions, rising labor costs and worsening trade tensions between the U.S. and China, the report notes.

Southeast Asia and India are looking to take China’s place thanks to low labor costs and rising domestic demand. This falls in line with India’s political objectives, where Prime Minister Narendra Modi is pushing a “Made in India” campaign.

As an example, Apple said earlier this year that it had started making its iPhone 13 at a factory in India instead of Taiwanese contract manufacturer Foxconn. Like other smartphone makers, it has an incentive not only for exports, but for domestic sales, the report notes:

In India, Chinese smartphone makers set up factories aiming at the huge domestic market. With 1.4 billion people — almost as many as in China — and a high proportion of young people, India has attracted Chinese brands including Xiaomi, Meizu, Vivo and Oppo to build factories. Many Chinese phone part makers have also set up factories there. Now Chinese brands account for nearly two-thirds of India’s smartphone market.

But that doesn’t mean China doesn’t have advantages: it has an enormous domestic market and decades of manufacturing infrastructure and experience, the Caixin report notes. And while no major aftershocks have been felt in China’s economy, the trend is heading in the wrong direction for the country.

Li Xingqian, director general of the Ministry of Commerce’s Foreign Trade Department said the exodus from China was “in line with the law of economics.”

Exports in the country were up 16.9% in May, the report says, accelerating from April’s 3.9%. The country’s trade surplus was $78.76 billion in May.

However, thanks to weak demand in developed countries, “export orders for delivery in June and July, usually the peak season for booking goods for the back-to-school and holiday seasons, didn’t come in as expected,” the report said. This weak demand was seen in falling shipping rates.

Americans may take until the end of this year to work through inventories that were pulled forward over the last year.

At the same time, President Joe Biden has said that he is considering lifting tariffs on $350 billion a year in Chinese goods. His administration, however, still seems to be divided on the matter and no decision is expected quickly.

The report noted clearly that, to this day, China remains “the world’s factory”, which is unlikely to change anytime soon:

Neither Southeast Asia nor India can replace China as the global manufacturing hub in the near future as they are mainly engaged in labor-intensive and low value-added manufacturing, several foreign trade participants told Caixin. They also face problems such as incomplete industrial chains and low labor efficiency to varying degrees, experts said.

To foreign companies, China is not only a manufacturing base but also a huge market, said He Xiaoqing, president of consulting firm Kearney Greater China. In 2020, global companies had $1.4 trillion of domestic sales, far more than their exports of $900 billion, showing the attractiveness of China’s local market, He said.

In addition to India, Vietnam has also been a beneficiary of factories leaving China. Imports for the country were up 16.7% for the first five months of this year, data shows.

Most of the production moving to Southeast Asia involves textiles, furniture and low-end assembly of consumer electronics, the report said.