By Ye Xie, George Lei and Henry Ren, Bloomberg Markets Live reporter and strategists

Three things we learned in the past week:

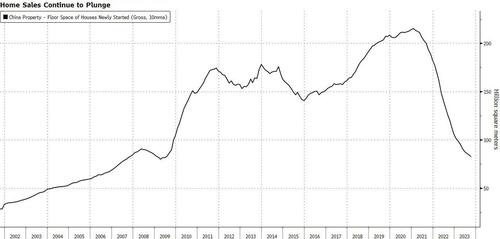

1. Beijing’s stepped-up support for the property market might not be enough to spur a turnaround. In a meeting Friday, regulators told banks to meet all “reasonable” funding needs from property developers. The call came after a report showed new home prices in major cities dropped the most in eight years in October.

Bloomberg also reported that Beijing plans to provide at least $137 billion of low-cost financing to the nation’s urban village renovation and affordable housing programs, potentially funded through the Pledged Supplemental Lending. The PSL, a controversial tool sometimes dubbed as China’s version of QE, helped end a housing downturn in 2015. But it’s also been criticized for inflating the property bubble in smaller cities further.

This time, its impact is likely to be more limited. Apart from a smaller size, a key difference now is that the renovation program targets bigger cities, which Nomura estimates only accounts for 20% of the nation’s new home sales.

“Most of the excess housing stock is really in smaller cities,” said Adam Wolfe, an economist at Absolute Strategy Research. “So this might not do as much to soak up developers’ excess inventories as the previous program due to its smaller size and narrower scope.” He added the growth outlook for next year is likely to worsen as consumers and local governments are tapped out.

2. China’s geopolitical predicaments saw improvement. The Biden-Xi summit turned out to be, by and large, a success. Meanwhile, Taiwan’s main opposition parties joined hands, raising hopes of a 2024 presidential victory that could ease tensions with Beijing. Political events could now “bolster sentiment more significantly” even as “investor concerns over Chinese growth loom large,” Singapore-based DBS Group said in a research report.

DBS sees scope for a return of US investments to Chinese assets, as the “geopolitical risk premium” declined. October data showed capital outflows waned, and global investors bought government bonds by the most in four months. The offshore yuan rallied 1.2% over the past week, posting the best returns in more than eight months.

3. Reports from China’s biggest internet companies gave investors little reason to cheer. Alibaba cut short an ill-fated plan to separate its cloud business, sending its US-listed shares to lowest levels in almost a year. The stunning reversal came just six months after the firm announced plans to distribute the cloud unit to shareholders as a stock dividend.

Alibaba’s core business of domestic e-commerce fell short of revenue expectations, and its peer JD.com’s retail arm saw no growth during the third quarter, underscoring the challenges that both companies face in an increasingly competitive industry. Tencent showed progress in new initiatives such as short-form videos, but underwhelming sales of games at home and abroad remain a concern.

By Ye Xie, George Lei and Henry Ren, Bloomberg Markets Live reporter and strategists

Three things we learned in the past week:

1. Beijing’s stepped-up support for the property market might not be enough to spur a turnaround. In a meeting Friday, regulators told banks to meet all “reasonable” funding needs from property developers. The call came after a report showed new home prices in major cities dropped the most in eight years in October.

Bloomberg also reported that Beijing plans to provide at least $137 billion of low-cost financing to the nation’s urban village renovation and affordable housing programs, potentially funded through the Pledged Supplemental Lending. The PSL, a controversial tool sometimes dubbed as China’s version of QE, helped end a housing downturn in 2015. But it’s also been criticized for inflating the property bubble in smaller cities further.

This time, its impact is likely to be more limited. Apart from a smaller size, a key difference now is that the renovation program targets bigger cities, which Nomura estimates only accounts for 20% of the nation’s new home sales.

“Most of the excess housing stock is really in smaller cities,” said Adam Wolfe, an economist at Absolute Strategy Research. “So this might not do as much to soak up developers’ excess inventories as the previous program due to its smaller size and narrower scope.” He added the growth outlook for next year is likely to worsen as consumers and local governments are tapped out.

2. China’s geopolitical predicaments saw improvement. The Biden-Xi summit turned out to be, by and large, a success. Meanwhile, Taiwan’s main opposition parties joined hands, raising hopes of a 2024 presidential victory that could ease tensions with Beijing. Political events could now “bolster sentiment more significantly” even as “investor concerns over Chinese growth loom large,” Singapore-based DBS Group said in a research report.

DBS sees scope for a return of US investments to Chinese assets, as the “geopolitical risk premium” declined. October data showed capital outflows waned, and global investors bought government bonds by the most in four months. The offshore yuan rallied 1.2% over the past week, posting the best returns in more than eight months.

3. Reports from China’s biggest internet companies gave investors little reason to cheer. Alibaba cut short an ill-fated plan to separate its cloud business, sending its US-listed shares to lowest levels in almost a year. The stunning reversal came just six months after the firm announced plans to distribute the cloud unit to shareholders as a stock dividend.

Alibaba’s core business of domestic e-commerce fell short of revenue expectations, and its peer JD.com’s retail arm saw no growth during the third quarter, underscoring the challenges that both companies face in an increasingly competitive industry. Tencent showed progress in new initiatives such as short-form videos, but underwhelming sales of games at home and abroad remain a concern.

Loading…