One week ago, we reported that China had found itself "On The Verge" of collapse as its "Welfare State Crumbles, Explosion In Social Unrest As Youth Unemployment Soars, Strikes Surge." All of this was the result of Beijing's very deliberate - and extremely risky - decision to not engage in a massive stimulus this time, unlike every previous occasion of sharp economist slowdown, and risk social unrest at best, or a full-blown revolution as an unthinkable worst case.

Here is the silver lining: all those revolutionaries will have brand new empty offices at their disposal when they finally take over. That's because as the FT reports, offices in China’s biggest cities are emptier than they were during stringent Covid-19 lockdowns in what is the latest clear sign of how the country’s economic slowdown has crushed business confidence.

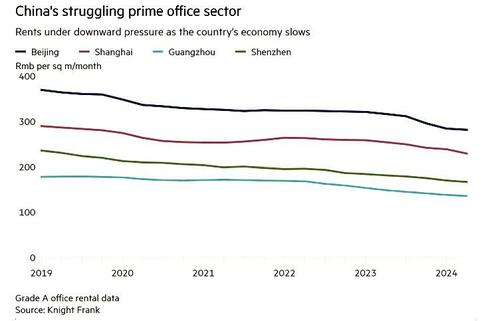

At least a fifth of high-end office space was vacant in the tech hub of Shenzhen in June, according to data from three real estate agencies, while office vacancy rates in Beijing, Guangzhou and Shanghai were also higher than in June 2022. Naturally, with demand collapsing, rents are at least 10% lower than they were two years ago and in many cases much lower.

While a rise of flexible working has made it hard for developers to fill office space in cities such as London and San Francisco, and led to an unprecedented commercial real estate crisis, in Chinese cities - where far fewer people work from home - analysts said there is a much simpler cause for explosion in office vacancies: the collapsing economy.... which is amusing considering the centrally-planned central government has set a full-year economic growth target of about 5%. The reality is that China's economy is shrinking at that rate, if not much faster.

"The biggest challenge is still the significant reduction in market demand due to the weakening of China’s economic growth expectations,” said Lucia Leung, greater China research and consultancy director at Knight Frank.

In Shenzhen, Colliers put its prime office vacancy rate at 27% in June, up from 20% in June 2022. Monthly rental prices at premium offices in the southern Chinese city are now about Rmb163 ($22) per sq metres, down 15% year on year, and expected to keep declining at this pace for the foreseeable future. This matches the trend seen by Knight Frank and JLL.

The three agencies have recorded similar vacancy rises in other cities. Shanghai had a vacancy rate of nearly 21% for its high-end offices as of June, up from 14% in June two years ago, according to Knight Frank. Rental prices have slipped 13% year on year, the agency’s data showed. JLL puts manufacturing hub Guangzhou’s prime office vacancy at 21% as of June and 12% for Beijing, up from 16 and 10% in 2022, respectively.

Companies are trying to reduce costs, and this has “led them to be more prudent in their office leasing decisions”, Leung said, citing rental reductions in lease renewals. This environment remains “challenging” in China, Leung added, with the overall vacancy rate expected to continue to rise this year and rents forecast to fall by 8 to 10 per cent year on year.

Said otherwise, absent massive, constant stimulus China - like the US - simply can not function in its current parameters, and the result will be constant overcapacity-driven deflation across every sector until the government finally capitulates and injects the next several trillion in stimmies.

Part of the problem is new supply, said John Lam, head of China property research at UBS. According to Colliers, in Shanghai alone there were almost 1.6mn sq metres of new prime office space will be completed this year, this is the highest level of new supply in the past five years.

While foreign companies including many US law firms have downsized or vacated their offices in Shanghai or Beijing over the past two years, the office rental market is largely driven by domestic companies. And the office rental market will only get worse as ever more Chinese companies move to cheaper office buildings to cuts costs, Lam said, while state-owned enterprises are also looking to cut costs.

One lawyer at a major Chinese firm said they recently cut half of their space in an office building in Beijing’s central business area due to “downsizing and cost-saving”.

Zhang, a leasing manager at an office building in Beijing’s Lido area, told the FT that some smaller clients “cannot hold on any longer”, and most tenants want to renegotiate rent. He said the prime office market environment was still “poor”. “Clients are downsizing,” added Zhang. “Those who used to occupy an entire floor might now use only half a floor, and those who had two continuous floors might also downsize.”

Hong Kong-based Hang Lung Properties’ office leasing revenue in mainland China fell 4 per cent year on year to Rmb556mn on “weakened demand” in the six months to the end of June, it said. The vacancy level in its flagship office building in Shanghai jumped from 2 per cent in June last year to 12 per cent in June this year.

“There will be downward pressure ahead,” chief executive Weber Lo told reporters last month. “What we hope to do now is to be able to keep our existing tenants.”

And as more tenants flee, more renters will be forced to shutdown and liquidate, forcing even more economic pain, even more economic contraction, as the Chinese feedback loop eventually forces the government to step in and short circuit China's deflationary vortex.

One week ago, we reported that China had found itself “On The Verge” of collapse as its “Welfare State Crumbles, Explosion In Social Unrest As Youth Unemployment Soars, Strikes Surge.” All of this was the result of Beijing’s very deliberate – and extremely risky – decision to not engage in a massive stimulus this time, unlike every previous occasion of sharp economist slowdown, and risk social unrest at best, or a full-blown revolution as an unthinkable worst case.

Here is the silver lining: all those revolutionaries will have brand new empty offices at their disposal when they finally take over. That’s because as the FT reports, offices in China’s biggest cities are emptier than they were during stringent Covid-19 lockdowns in what is the latest clear sign of how the country’s economic slowdown has crushed business confidence.

At least a fifth of high-end office space was vacant in the tech hub of Shenzhen in June, according to data from three real estate agencies, while office vacancy rates in Beijing, Guangzhou and Shanghai were also higher than in June 2022. Naturally, with demand collapsing, rents are at least 10% lower than they were two years ago and in many cases much lower.

While a rise of flexible working has made it hard for developers to fill office space in cities such as London and San Francisco, and led to an unprecedented commercial real estate crisis, in Chinese cities – where far fewer people work from home – analysts said there is a much simpler cause for explosion in office vacancies: the collapsing economy…. which is amusing considering the centrally-planned central government has set a full-year economic growth target of about 5%. The reality is that China’s economy is shrinking at that rate, if not much faster.

“The biggest challenge is still the significant reduction in market demand due to the weakening of China’s economic growth expectations,” said Lucia Leung, greater China research and consultancy director at Knight Frank.

In Shenzhen, Colliers put its prime office vacancy rate at 27% in June, up from 20% in June 2022. Monthly rental prices at premium offices in the southern Chinese city are now about Rmb163 ($22) per sq metres, down 15% year on year, and expected to keep declining at this pace for the foreseeable future. This matches the trend seen by Knight Frank and JLL.

The three agencies have recorded similar vacancy rises in other cities. Shanghai had a vacancy rate of nearly 21% for its high-end offices as of June, up from 14% in June two years ago, according to Knight Frank. Rental prices have slipped 13% year on year, the agency’s data showed. JLL puts manufacturing hub Guangzhou’s prime office vacancy at 21% as of June and 12% for Beijing, up from 16 and 10% in 2022, respectively.

Companies are trying to reduce costs, and this has “led them to be more prudent in their office leasing decisions”, Leung said, citing rental reductions in lease renewals. This environment remains “challenging” in China, Leung added, with the overall vacancy rate expected to continue to rise this year and rents forecast to fall by 8 to 10 per cent year on year.

Said otherwise, absent massive, constant stimulus China – like the US – simply can not function in its current parameters, and the result will be constant overcapacity-driven deflation across every sector until the government finally capitulates and injects the next several trillion in stimmies.

Part of the problem is new supply, said John Lam, head of China property research at UBS. According to Colliers, in Shanghai alone there were almost 1.6mn sq metres of new prime office space will be completed this year, this is the highest level of new supply in the past five years.

While foreign companies including many US law firms have downsized or vacated their offices in Shanghai or Beijing over the past two years, the office rental market is largely driven by domestic companies. And the office rental market will only get worse as ever more Chinese companies move to cheaper office buildings to cuts costs, Lam said, while state-owned enterprises are also looking to cut costs.

One lawyer at a major Chinese firm said they recently cut half of their space in an office building in Beijing’s central business area due to “downsizing and cost-saving”.

Zhang, a leasing manager at an office building in Beijing’s Lido area, told the FT that some smaller clients “cannot hold on any longer”, and most tenants want to renegotiate rent. He said the prime office market environment was still “poor”. “Clients are downsizing,” added Zhang. “Those who used to occupy an entire floor might now use only half a floor, and those who had two continuous floors might also downsize.”

Hong Kong-based Hang Lung Properties’ office leasing revenue in mainland China fell 4 per cent year on year to Rmb556mn on “weakened demand” in the six months to the end of June, it said. The vacancy level in its flagship office building in Shanghai jumped from 2 per cent in June last year to 12 per cent in June this year.

“There will be downward pressure ahead,” chief executive Weber Lo told reporters last month. “What we hope to do now is to be able to keep our existing tenants.”

And as more tenants flee, more renters will be forced to shutdown and liquidate, forcing even more economic pain, even more economic contraction, as the Chinese feedback loop eventually forces the government to step in and short circuit China’s deflationary vortex.

Loading…