Authored by Simon White, Bloomberg macro strategist,

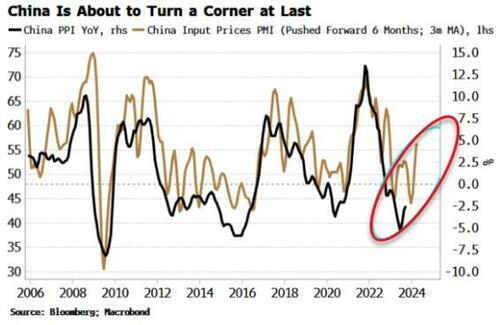

China has slipped under the radar somewhat, but that’s a good thing for its stocks: when sentiment is negative and attention is focused elsewhere, markets often quietly bottom.

I noted late last month that the Chinese stock market was closing in on capitulation levels, since then the FTSE China A50 Index is up ~3.5%. Breadth still remains poor but is improving, and volume has been solid. There has been no single moment of maximum exhaustion, but after months of deteriorating sentiment and disappointment, it’s possible China’s stocks have bottomed.

That’s underscored by the improvement in some leading indicators. Negative producer prices have been a signature data-series of China’s malaise, but it has finally started to rise.

What’s more, the input prices component from the PMI has been turning up strongly, suggesting increased economic activity is creating price pressures, catalyzed by an improvement in economic activity.

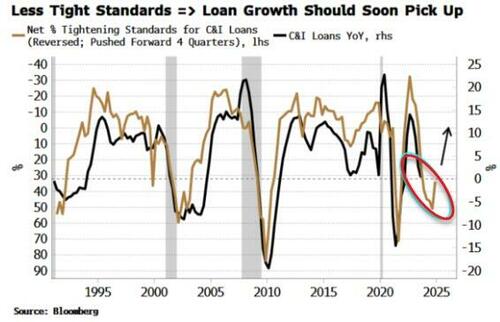

Also more positive, in the US this time, was the improvement in some of the key parts of the Federal Reserve’s Senior Loan Officer survey, released Monday.

Banks tightening lending standards for commercial and industrial loans is one of the most leading parts of the report. The survey leads demand for C&I loans by six months, and growth of loans itself by a year.

C&I loans tend to have the most stringent standards thus they are a good barometer of overall loan demand.

Loan standards and demand for C&I loans both turned up notably in the last quarter, which suggests loan-growth’s negative track should soon change direction.

The market would likely have agitated for more rate cuts sooner if there had been a significant further deterioration.

As it stands, the Fed can keep the flame alive (just) that another rate hike may be in the offing. The primary aim of this is to keep the market from getting too trigger-happy pricing in rate cuts, blunting the efficacy of the Fed’s policy rate.

The UK is seeing such a dynamic. The BOE’s Chief Economist, Huw Pill, suggested today that the market was not “unreasonable” to predict a rate cut next summer.

The latter parts of the Sonia futures curve (e.g. SFIH4 vs SFIH5) are likely to keep flattening, with two additional quarter-point cuts priced in by the end of next year having been priced in over the last three weeks.

Authored by Simon White, Bloomberg macro strategist,

China has slipped under the radar somewhat, but that’s a good thing for its stocks: when sentiment is negative and attention is focused elsewhere, markets often quietly bottom.

I noted late last month that the Chinese stock market was closing in on capitulation levels, since then the FTSE China A50 Index is up ~3.5%. Breadth still remains poor but is improving, and volume has been solid. There has been no single moment of maximum exhaustion, but after months of deteriorating sentiment and disappointment, it’s possible China’s stocks have bottomed.

That’s underscored by the improvement in some leading indicators. Negative producer prices have been a signature data-series of China’s malaise, but it has finally started to rise.

What’s more, the input prices component from the PMI has been turning up strongly, suggesting increased economic activity is creating price pressures, catalyzed by an improvement in economic activity.

Also more positive, in the US this time, was the improvement in some of the key parts of the Federal Reserve’s Senior Loan Officer survey, released Monday.

Banks tightening lending standards for commercial and industrial loans is one of the most leading parts of the report. The survey leads demand for C&I loans by six months, and growth of loans itself by a year.

C&I loans tend to have the most stringent standards thus they are a good barometer of overall loan demand.

Loan standards and demand for C&I loans both turned up notably in the last quarter, which suggests loan-growth’s negative track should soon change direction.

The market would likely have agitated for more rate cuts sooner if there had been a significant further deterioration.

As it stands, the Fed can keep the flame alive (just) that another rate hike may be in the offing. The primary aim of this is to keep the market from getting too trigger-happy pricing in rate cuts, blunting the efficacy of the Fed’s policy rate.

The UK is seeing such a dynamic. The BOE’s Chief Economist, Huw Pill, suggested today that the market was not “unreasonable” to predict a rate cut next summer.

The latter parts of the Sonia futures curve (e.g. SFIH4 vs SFIH5) are likely to keep flattening, with two additional quarter-point cuts priced in by the end of next year having been priced in over the last three weeks.

Loading…