US chocolate maker Hershey slashed its sales and earnings outlook on Thursday, citing higher cocoa prices that have resulted in demand destruction among cash-strapped consumers. This development spooked cocoa futures, sliding to a five-month low at the end of the week.

Cocoa futures in New York fell as much as 6% to $6,574 a ton, hitting their lowest level since early March following the dismal earnings report from Hershey. Prices, which peaked at $12,000 a ton in mid-April, have nearly halved and have been oscillating within a triangle formation ever since.

Bloomberg noted, "Market watchers are closely monitoring company earnings for signs that consumers are buying less as costs rise." It added, "Many expect volatility to continue as uncertainty also lingers on the supply side."

On Thursday, Hershey CEO Michele Buck told investors that current cocoa prices are not sustainable. She noted, "We believe that the future prices will be higher levels than we've seen before this kind of recent historic pricing cycle."

Bloomberg cited a weather forecast from Maxar that shows improved crop conditions across West Africa over the weekend, especially for the Ivory Coast and Cameroon. This area is the mecca of cocoa farming. Despite improving crop conditions, many analysts are still concerned about dwindling global supplies.

"Even though the futures are down, wide swings are the norm these days because nobody in the market is sure about the future output," said Michael McDougall, managing director at Paragon Global Markets.

McDougall said, "The market appears undecided as to which direction it wants to take." And hence, for the triangle formation - and usually out of technical patterns - comes direction.

Buck also warned investors that "consumers are pulling back on discretionary spending."

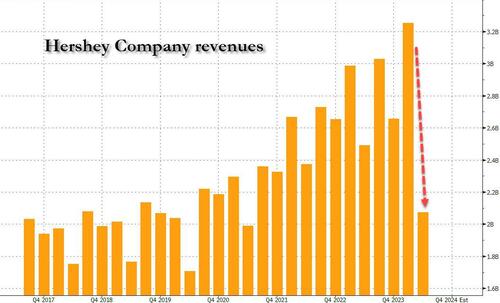

Demand destruction by consumers weighed on Hershey's second-quarter financial results and outlook.

Despite these price swings, oil trader Pierre Andurand remains bullish on the view that the stocks-to-grinding ratio for the world at the end of the year will be at its lowest ever "and potentially run out of inventories late in the year."

US chocolate maker Hershey slashed its sales and earnings outlook on Thursday, citing higher cocoa prices that have resulted in demand destruction among cash-strapped consumers. This development spooked cocoa futures, sliding to a five-month low at the end of the week.

Cocoa futures in New York fell as much as 6% to $6,574 a ton, hitting their lowest level since early March following the dismal earnings report from Hershey. Prices, which peaked at $12,000 a ton in mid-April, have nearly halved and have been oscillating within a triangle formation ever since.

Bloomberg noted, “Market watchers are closely monitoring company earnings for signs that consumers are buying less as costs rise.” It added, “Many expect volatility to continue as uncertainty also lingers on the supply side.”

On Thursday, Hershey CEO Michele Buck told investors that current cocoa prices are not sustainable. She noted, “We believe that the future prices will be higher levels than we’ve seen before this kind of recent historic pricing cycle.”

Bloomberg cited a weather forecast from Maxar that shows improved crop conditions across West Africa over the weekend, especially for the Ivory Coast and Cameroon. This area is the mecca of cocoa farming. Despite improving crop conditions, many analysts are still concerned about dwindling global supplies.

“Even though the futures are down, wide swings are the norm these days because nobody in the market is sure about the future output,” said Michael McDougall, managing director at Paragon Global Markets.

McDougall said, “The market appears undecided as to which direction it wants to take.” And hence, for the triangle formation – and usually out of technical patterns – comes direction.

Buck also warned investors that “consumers are pulling back on discretionary spending.”

Demand destruction by consumers weighed on Hershey’s second-quarter financial results and outlook.

Despite these price swings, oil trader Pierre Andurand remains bullish on the view that the stocks-to-grinding ratio for the world at the end of the year will be at its lowest ever “and potentially run out of inventories late in the year.”

Loading…